LIFO Tax Incentive Opportunities Abound

LIFO is the most valuable inventory-related tax incentive for companies with inflation. LIFOPro publishes our top LIFO candidates blog annually at the end of the year to help CPA firms & companies considering electing LIFO both identify if they’re a good LIFO candidate and if the current inflation environment favors making a LIFO election for the next year end. The timing is key when considering electing LIFO, so it’s important to attempt to forecast the year end inflation environment in order to quantify the current year tax savings that LIFO may provide. Using both industry & commodity pricing data published by the Producer Price Index (PPI) division of the Bureau Labor of Statistics, LIFOPro has performed extensive analysis to identify the best prospects for LIFO.

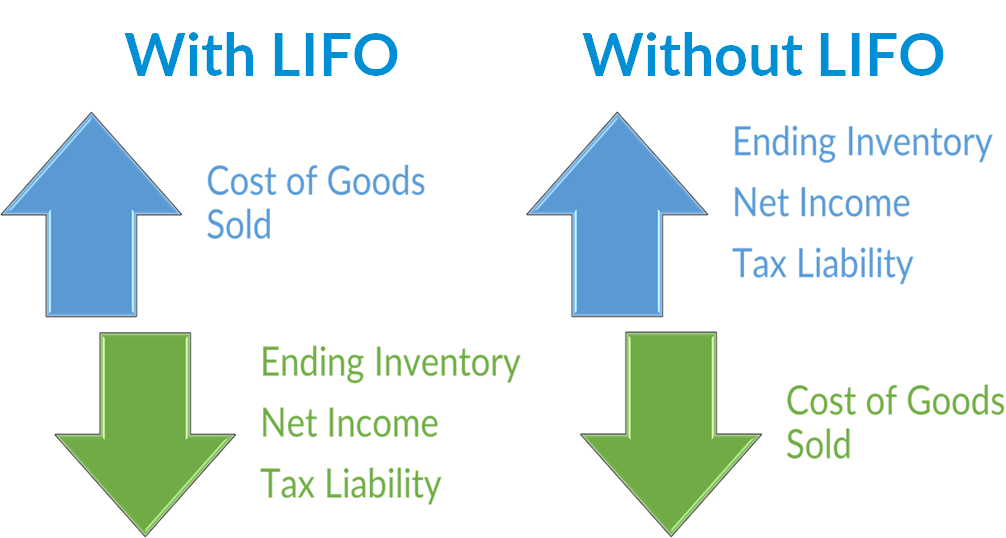

Effect of Inflation on the Balance Sheet & Income Statement

How LIFO Creates Real After Tax Cash Savings

- More accurately reflects income by matching current costs against current revenues

- Eliminates artificial profits from earnings resulting from inflationary increases in inventory costs

- Transfers artificially inflated ending inventory values from the balance sheet to the income statement

- Increases cost of goods sold & reduces ending inventory balances in periods of inflation

- Reduces taxable income in periods of inflation & creates material long-term after-tax cash savings

- Inventories maintained at same costs historically used & annual side calculation made to adjust inventories at cost (i.e. FIFO or average cost) to LIFO cost using contra inventory account called LIFO reserve

- Subsequent period’s LIFO benefits build upon those of the prior period (change in CY vs. PY LIFO reserve called LIFO expense (income); expense means CY vs. PY LIFO reserve increased. Income means reserve decreased.)

- Benefits grow in perpetuity & only decreases when there’s deflation or substantial inventory liquidation

Quick LIFO Tax Savings Formula

- CY Taxable Income Reduction From LIFO (i.e. CY LIFO expense): CY inflation rate * PY ending inventory balance @ cost (i.e. FIFO, average cost)

- CY After Tax Cash Savings From LIFO: CY LIFO expense * tax rate

LIFO Tax Savings Example

- Inputs

- CY inflation rate: 2.5%

- Prior year end inventory balance at FIFO cost: $10M

- Tax rate: 30%

- Outputs

- CY LIFO expense: 2.5% * $10M = $250K

- CY After Tax Cash Savings: $250K * 30% = $75K

2020 Top LIFO Candidates

LIFOPro’s top LIFO candidates are organized into the following two groupings:

- Industry-based: IRS primary business activities or PBAs & their corresponding BLS PPI Table 11 industry-based indexes (126 total inventory-based PBAs)

- Commodity-based: BLS PPI Table 9 commodity-based indexes (approximately 3,700 total commodity based indexes). Separated into the following two groups:

- Major Commodity Group: 2-digit top-level groupings of the BLS PPI Table 9 commodity-based hierarchy (15 commodity-based 2-digit Table 9 PPI major commodity groups)

- More-detailed Commodity Group: 3+ digit lower-level groupings of the BLS Table 9 commodity-based hierarchy. Includes:

- 3-digit subgroups

- 4-digit product classes

- 5 & 6-digit subproduct classes

- 7-digit item groupings

- 8+ digits: individual items

2020 Top LIFO Candidate Criteria

LIFOPro requires for the following criteria to be met to make our 2020 list:

- Must have year to date inflation of greater than 1% (YTD = 9 months ended September ’20 or Sep. ’20 ÷ Dec. ’19 PPI)

- Must be considered a good LIFO candidate in general, which takes into account the following factors:

- 50% or more of the historical 3, 5, 10 or 20 year average annual inflation rate must be inflationary: Using the compound inflation formula, LIFOPro calculates the 3,5,10 & 20 year average annual inflation rates for all industries & commodities tracked by the BLS.

- Historical average annual inflation rate of 1% or greater: This will be the historical 3, 5, 10, or 20 year average annual inflation rate that spans the longest period of time for any given industry or commodity (will be the 20 year average annual inflation rate for most, but some will be the 3, 5 or 10 year average as certain industries/commodities were not published by the BLS until more recently)

- Overall inflation frequency of 50% or more: Using 12 months ended December BLS price indexes published for each of the past 20 year, LIFOPro measures how many of those periods resulted in inflation for any given industry or commodity

- Inflation frequency rate of greater than 50% (11 or more of 20 periods from 2000 – 2019)

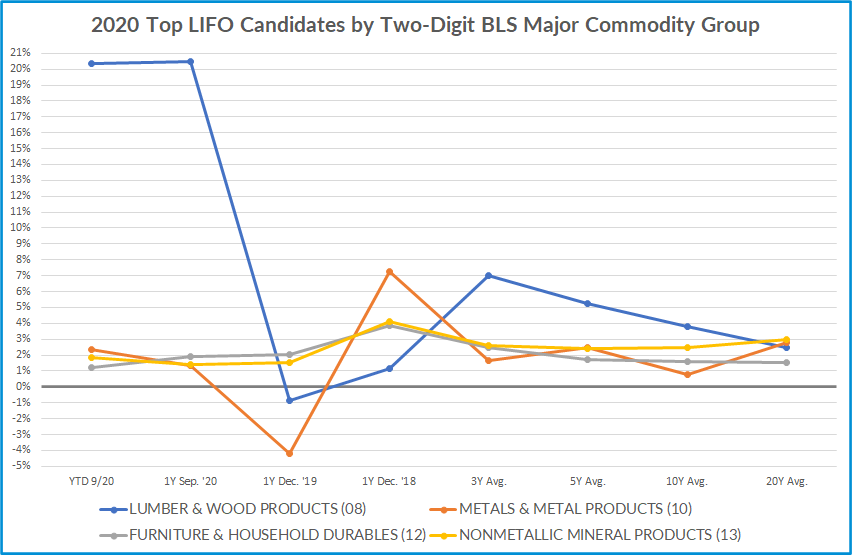

2020 Top LIFO Candidates by Commodity Chart: Two-digit Major Commodity Group

2021 Top LIFO Candidates by Commodity Table: Three-digit Subgroup

2021 Top LIFO Candidates by Commodity Table: All Groupings

Get a Complimentary LIFO Election Benefit Analysis Today!

- How it works & what’s Included:

- In-depth study performed by LIFOPro to quantify the estimated tax savings of LIFO. Includes the following:

- 20 year pro forma LIFO calculation

- Historical average annual inflation rate

- Historical inflation frequency

- Cumulative tax savings that would have occurred if LIFO was elected 20 years ago

- Summary of findings & recommendations

- If good LIFO candidate criteria was met based on pro forma calculation results

- Estimated current year taxable income reduction from LIFO (if applicable)

- Recommendation regarding if LIFO should be adopted for the current year end (if applicable)

- How LIFO Works Appendix

- Separate proposal with estimated costs to outsource calculation to LIFOPro or license our software delivered with report

- 20 year pro forma LIFO calculation

- In-depth study performed by LIFOPro to quantify the estimated tax savings of LIFO. Includes the following:

- Documentation Requirements

- High-level analysis: Performed prior to LIFO Election Benefit Analysis to confirm company could be a good LIFO candidate (optional)

- Only requires basic information, such as

- Industry

- Company name and/or URL

- Only requires basic information, such as

- Mid-level analysis:

-

- Basic information required for high-level analysis

- Current & prior year end inventory balances

-

- Low-level analysis:

- Information required for mid-level analysis

- Current & prior year end inventory item detail report(s)

- Provides more accurate:

- Estimated LIFO benefits

- Estimated LIFOPro turnkey outsourcing solutions & software license cost

- High-level analysis: Performed prior to LIFO Election Benefit Analysis to confirm company could be a good LIFO candidate (optional)

LIFOPro's 2020 Top LIFO Candidate GuideLIFO Candidate ID List for CPA FirmsCPA Firm Offerings

Good LIFO CandidatesHow LIFO WorksFAQs

Industry-based Index Source: Bureau of Labor Statistics Table 11 Producer Price Indexes

Commodity-based Index Source: Bureau of Labor Statistics Table 9 Producer Price Indexes

YTD 9M 9/20 inflation rates shown above use 9 months PPI inflation ended September ’20 (September ’20 ÷ December ’19 PPI)

1Y inflation rates use 12 months PPI inflation (i.e. 1Y Sep. ’20 = Sep. ’20 ÷ Sep. ’19 PPI)

3/5/10/20 Year Averages are the average annual inflation rates using compound inflation formula (not simple average inflation rates; 3Y average = ((Sep. ‘20 ÷ Dec. ‘17 PPI)^(1/3)-1))

# Periods figures & percentages is for each of the 12M periods ended December for the past 20 years between 2000 – 2019

# Periods with Inflation counts any of the 12M periods for the past 20 years between 2000 – 2019 that measured an inflation index of greater than zero