Tariffs & LIFO Series: Part One

Inflation is now top of mind following the White House’s announcement of tariffs ranging from 10% to 125%. Retailers and wholesalers reselling imported goods will incur increased costs, and manufacturers purchasing raw materials from foreign sources will also face higher input prices. As a result, elevated goods inflation and reduced profits for companies buying and/or reselling imported commodities now appear to be inevitable for 2025.

LIFOPro’s three-part series on tariffs will provide high-level overviews as well as deep dives into how the LIFO method could be the silver lining from a tax perspective during a period that’s almost certainly expected to bring higher costs and shrinking margins for companies with exposure to imported goods. The first of the three-part series on tariffs seeks to establish the basics of the LIFO method, and why it could provide unprecedented tax benefits during exceptionally high inflationary periods.

Inventory Valuation Method Alternatives

Companies with inventory are required to utilize one of the available cost flow assumptions to determine the cost of goods sold and the value of inventories. The most predominant are as follows:

- First-in, first-out (FIFO): Oldest goods are assumed to be sold first, and the most recently purchased goods are assumed to be the ones remaining on hand

- Last-in, first-out (LIFO): Newest goods are assumed to be sold first, and the oldest goods are assumed to be the ones remaining on hand

- Moving-average cost: Recalculates the average cost of inventory each time new stock is purchased. It provides a weighted average unit cost for items in inventory.

- Specific identification: Uses item-level cost tracking where each good retains its actual purchase price (only method that calculates an exact cost of goods; all other methods are estimates)

Why Use LIFO?

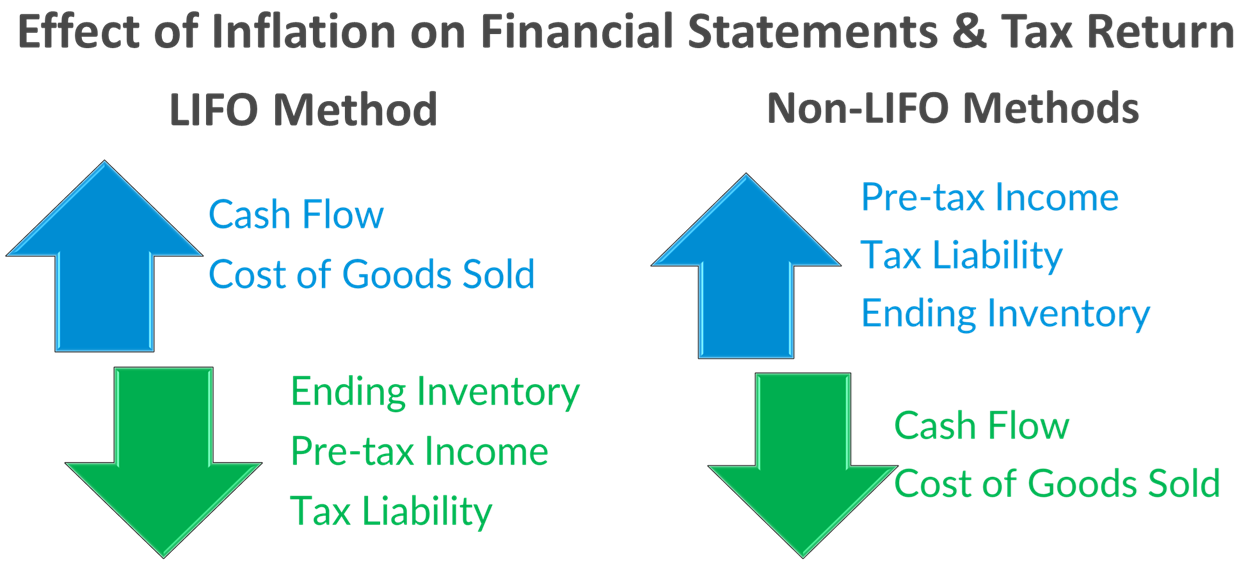

The objective of LIFO is to transfer artificial profits that occur solely due to inflation from the income statement to the balance sheet. Under a last-in, first-out cost flow assumption, this is accomplished by charging the most recently purchased products to cost of goods sold while retaining the older goods on hand in ending inventory. Under the LIFO method, the inflationary component of the most recently purchased, higher-priced goods are transferred from ending inventory (balance sheet) to the cost of goods sold (income statement), which in turn decreases pre-tax income, reduces the federal/state tax liability and increases cash flow. The figure below illustrates the relationship between inflation and the inventory valuation method alternatives.

The LIFO method is used by companies of all sizes, industry type and legal/tax structures. The primary motivation for using the LIFO method is to create a tax benefit by increasing the cost of goods sold, decreasing taxable income and reducing federal and state income tax liability (the primary benefit of LIFO is the federal income tax liability, but it also reduces the state income tax liability). Additionally, from a conceptual perspective, the LIFO method most closely matches revenues with costs during periods of inflation, so it’s the most conservative accounting method and most clearly reflective of income.

Although LIFO is considered an unfavorable adjustment to net income on the financial statement, during periods of rising costs, LIFO provides the most favorable results within the statement of cash flows because it reduces income taxes and increases cash flows from operating activities when compared to the alternative methods. Additionally, since most companies carry debt, many companies use their LIFO tax benefit to pay off liabilities to creditors, which in turn reduces interest expense.

Is LIFO Merely a Timing Difference, or Does it Represent a Permanent Benefit?

Within a company’s financial statements, LIFO is considered a deferred tax liability. Furthermore, from a conceptual point of view, some consider LIFO to be a temporary benefit that will inevitably have to be paid back at some point. In reality, there are only three specific instances where all of your LIFO reserve must be recaptured, which are as follows:

- Business is sold in the form of an asset purchase: 100% of the LIFO reserve is recaptured by the owner/seller (LIFO reserve often carry over to buyer when a business sale occurs in the form of a stock purchase or one that’s structured as a non-taxable transaction).

- C to S corporation conversion: 100% of the LIFO reserve is ratably recaptured over a four year period beginning on the first tax return filed as a subchapter S corporation.

- Optional termination of LIFO election is made: When this occurs, companies are required to ratably recapture their LIFO reserve into income over a four year period beginning with the period that the use of the LIFO method was discontinued. Companies can terminate their LIFO election as soon as the first year proceeding the initial LIFO election by filing an IRS Form 3115 under automatic change procedures (meaning there’s no IRS User’s fee associated with the change, and the deadline for filing this change is the extended return deadline).

Outside of the above three scenarios, the LIFO method can be used for an indefinite period of time, and it can grow to be as big as one could possibly imagine. The only other time that a portion of the LIFO reserve can be recaptured is when deflation occurs. In many industries, deflation rarely if ever happens. In other industries, deflation occasionally occurs, but much less often than inflation occurs. In most cases, when deflation does occur, the LIFO recapture created from deflation is a small percentage of the cumulative tax benefit. For example, if you had 10% inflation in the year you elect LIFO and had 2% deflation in your second year on LIFO, you would still have 80% of your original LIFO reserve remaining going into your third year on LIFO.

The long-term benefits of LIFO will continue to compound more often since inflation occurs more often than deflation, any subsequent recapture that occurs in a single period due to decreasing costs are usually immaterial in comparison to LIFO’s cumulative benefits. Based on our experience, most of our clients have been on LIFO for decades, and some have been on LIFO for more than 70 years! As a result, many companies consider LIFO to be a perpetual benefit as opposed to just a timing difference.

If you consider LIFO to merely create a temporary deferral of income taxes, one must still acknowledge that an interest-free loan from the government was obtained during the time that LIFO was used. Furthermore, cash flow was improved from the decrease in taxes paid during the time that LIFO was used. In many cases, the time value of money that was available as a result of LIFO to either reinvest and grow a business or strengthen a company’s financial position that would have otherwise been used to pay taxes also represents meaningful value. Those who take a longer-term view on the use of LIFO often consider it to be a tax savings annuity that will continue to grow as long as their business meets the going concern assumption.

Key Takeaways

- LIFO creates a tax benefit whenever there’s inflation

- Since inflation is an inevitable feature of most commodities/goods in the U.S. economy in, there are far more industries that would benefit from using LIFO than there those that would not

- Since LIFO is applied prospectively for tax purposes and the amount of tax benefits obtained in the first year is dependent on the level of inflation measured at that time, the timing of the LIFO election is key, and the most significant tax benefits will occur during exceptionally high inflationary periods created by events such as tariffs

- Most industries that are good or great LIFO candidates will obtain meaningful tax benefits from electing LIFO for the 2025 year end since tariffs will cause inflation to be exponentially higher than the historical norms

Actionable Items

- Follow part two and three of our series on tariffs & LIFO

- Learn more about LIFO by scheduling a discovery call with the LIFOPro team

- Explore a LIFO election by obtaining a complimentary LIFO election benefit analysis from LIFOPro