The IRS may terminate a taxpayer’s LIFO election if the taxpayer fails to comply with any of the requirements listed above. See Rev. Proc. 79-23, Sec. 3.01.

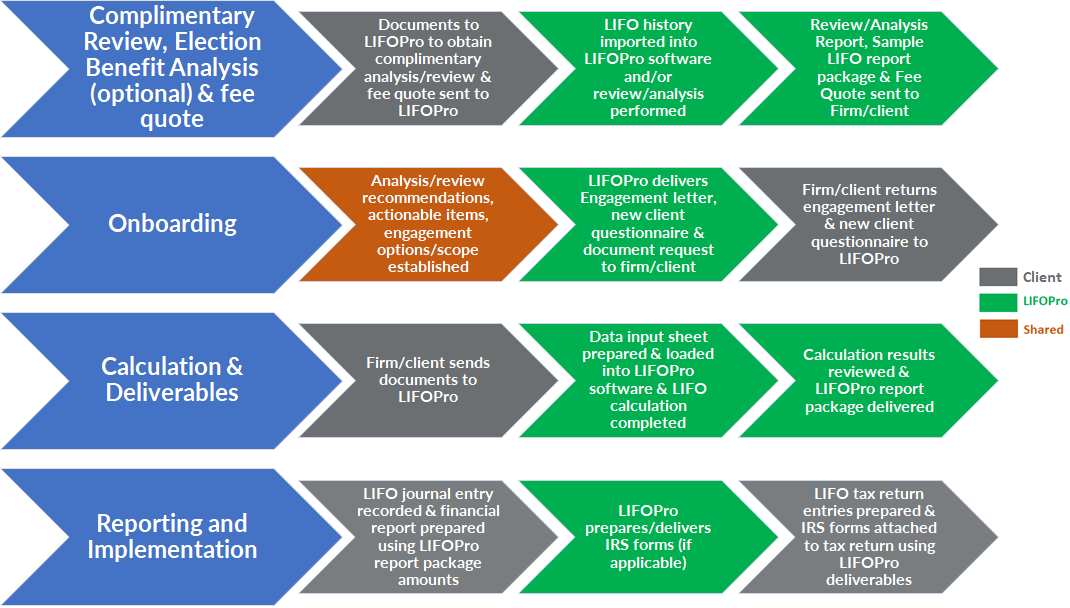

Note: Best LIFO Practices & Review is an optional complimentary offering. It does not have to be performed to obtain a turnkey outsourcing solutions fee quote and/or engage LIFOPro for outsourcing solutions

Outsourcing Engagement Process Flow: Recurring Annual Engagements

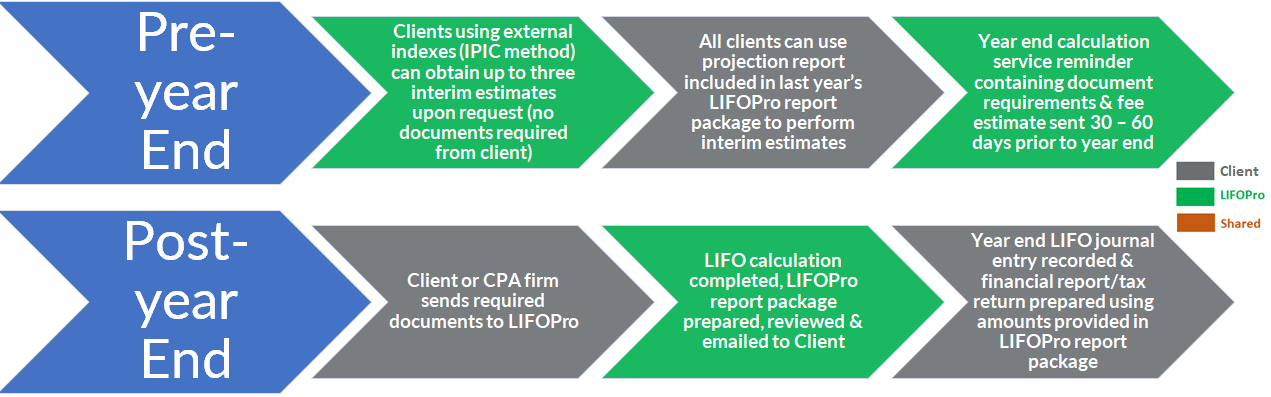

Recurring annual calculation services

First Year Only (if applicable)

Standard LIFOPro report package includes a next year LIFO reserve change schedule (LIFO Projection Report) that includes all amounts required to perform an interim estimate for the next year to be closed without the need to furnish additional documents to LIFOPro.

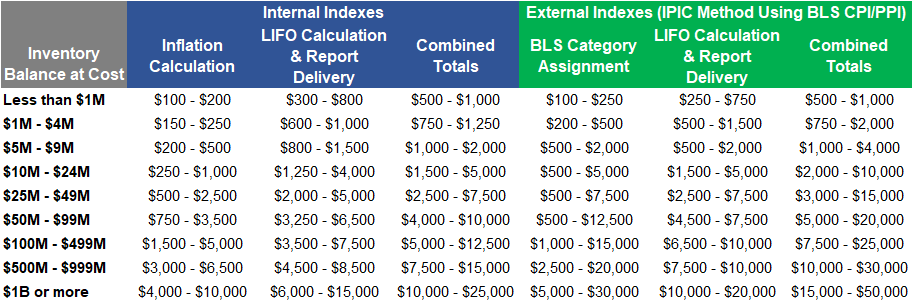

LIFOPro strives to provide the highest quality of services at the most competitive prices, and we promise to provide an outsourcing solution that fits your budget. Fees listed below are general estimates.

Note: See Auto Dealer Outsourcing page for auto dealer fee schedule.

Recurring

First year only

Onboarding: The following steps are included in the onboarding process for first-time clients:

Engagement commencement & Service performance

Steps listed below are suggestions, but can occur in your desired order and all steps do not have to be followed

Have a call or Teams meeting with LIFOPro to get started today or learn more about our offerings. Schedule online using our easy-to use booking tool.

Schedule Call or DemoGet a complimentary analysis for companies considering using LIFO. Get a complimentary review for companies on LIFO. Request an outsourcing or LIFOPro software fee quote. Use our simple form to submit your request.

Get startedUse our online request tool to receive a Non-disclosure Agreement electronically. Avoid the hassle of sending NDAs back and forth and having to scan documents with our quick & easy online NDA request form!

Non-Disclosure Agreement RequestWould you like to determine the potential LIFO tax deferral benefit for your company or client?

Sign up today to receive industry news & promotional offers from LIFO-PRO