Updated 1/30/2025 with December 2024 Inflation Rates

View/Download the PDF report version of this guide or our 2024 Top LIFO Candidates List Excel file by clicking the buttons below!

LIFOPro's 2024 LIFO Opportunities & Strategies Guide PDF Report

LIFOPro's Top 2024 LIFO Election Candidates List Excel File

2024 Top LIFO Tax Savings Opportunities Abound

Although inflation has returned to a more normalized level, there are many industries with inflation at or above the historical levels & will be good LIFO election candidates for the 2024 year end. The best opportunities will be in the following areas:

- Processed foods & beverages – 4% inflation

- Meats, poultry & fish – 10% inflation

- Dairy products – 5% inflation

- Canned fruits & juices – 4% inflation

- Frozen fruits, juices & ades – 19% inflation

- Sugar & confectionery – 15% inflation

- Refined sugar – 11% inflation

- Confectionery materials – 49% inflation

- Confectionery end products (candy & snacks) – 8% inflation

- Beverages & beverage materials – 4% inflation

- Soft drinks – 7% inflation

- Packaged beverage materials (including coffee & tea) – 12% inflation

- Paper & paper products – 3% inflation

- Converted paper & paperboard products – 3% inflation

- Publications, printed matter & printing material – 3% inflation

- Machinery & equipment – 3% inflation

- General purpose machinery & equipment – 3% inflation

- Pumps, compressors & equipment – 5% inflation

- Material handling equipment – 4% inflation

- Fluid power equipment – 6% inflation

- Motors & generators – 7% inflation

- Switchgear, switchboard, industrial controls equipment – 7% inflation

- Instruments (including environmental controls and process control instruments) – 4% inflation

- Nonmetallic materials & products – 4% inflation

- Concrete ingredients & related products – 7% inflation

- Construction sand, gravel & crushed stone – 8% inflation

- Insulation materials 8% inflation

- Transportation equipment (including PPIs used by auto dealers)

- Motor vehicles (including cars, crossovers, trucks, SUVs & minivans) – 2% inflation

- Motor homes – 2% inflation

- Aircraft & aircraft equipment (including parts) – 4% inflation

- Miscellaneous products – 6% inflation

- Sporting goods & athletic goods – 4% inflation

- Small arms & ammunition – 3% inflation

- Tobacco – 12% inflation

- Personal & industrial safety equipment & clothing – 4% inflation

LIFOPro’s list of 2024 top LIFO election candidates are shown further below, and instructions for quickly identifying , and the Top LIFO election candidates tables are shown below the instructions. Alternatively, view/download LIFOPro’s 2024 Top LIFO Election Candidate List Excel file by clicking this link: LIFOPro’s 2024 Top LIFO Election Candidates List Excel File

Why Use LIFO?

The LIFO method (last-in, first-out) is the most beneficial inventory-based tax savings strategy because it uses inflation to create material long-term benefits (LIFO creates a tax benefit when there’s inflation), and tens of thousands of companies use LIFO because of this (most companies use LIFO in perpetuity after an election is made since the tax benefits become bigger for every subsequent inflationary period). Since the LIFO tax benefit amount is primarily tied to the amount of inflation measured in a given period (for example, a 5x bigger LIFO tax benefit will occur in a period with 10% inflation compared to a period with 2% inflation), thousands of companies have elected LIFO because of the unprecedented inflation that’s occurred over the last few years. When there’s inflation, LIFO creates a tax benefit by lowering the inventory value and increasing cost of goods sold, which in turn reduces taxable income.

Quick LIFO Tax Benefit Formula

- Current year taxable income reduction from LIFO (also known as LIFO expense): Prior year inventory balance * Current year inflation rate

- Current year tax liability reduction from LIFO (aka tax deferral or after-tax savings from LIFO): Current year LIFO expense * Current year combined federal and state tax rate

LIFO Tax Benefit Example

- Inputs

- Prior year end inventory balance: $10M

- Current year inflation rate: 5%

- Current year combined federal & state tax rate: 30%

- Outputs

- Current year LIFO expense: $10M * 5% = $500K

- Current year after-tax cash savings from LIFO: $500K * 30% = $150K

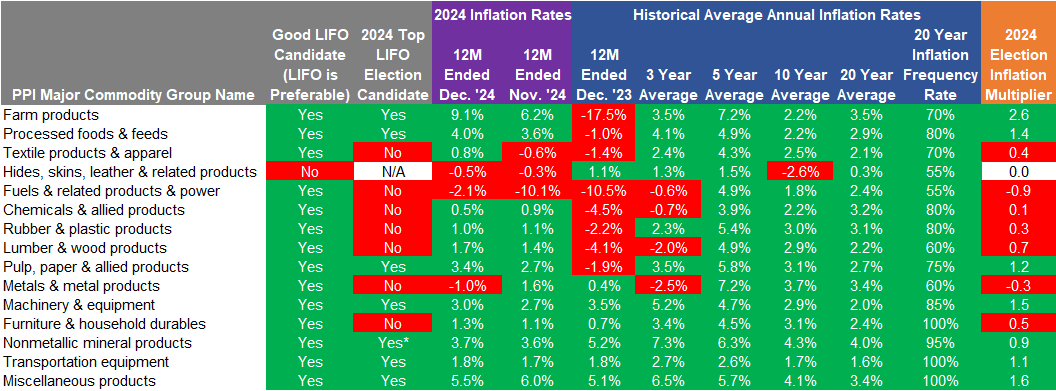

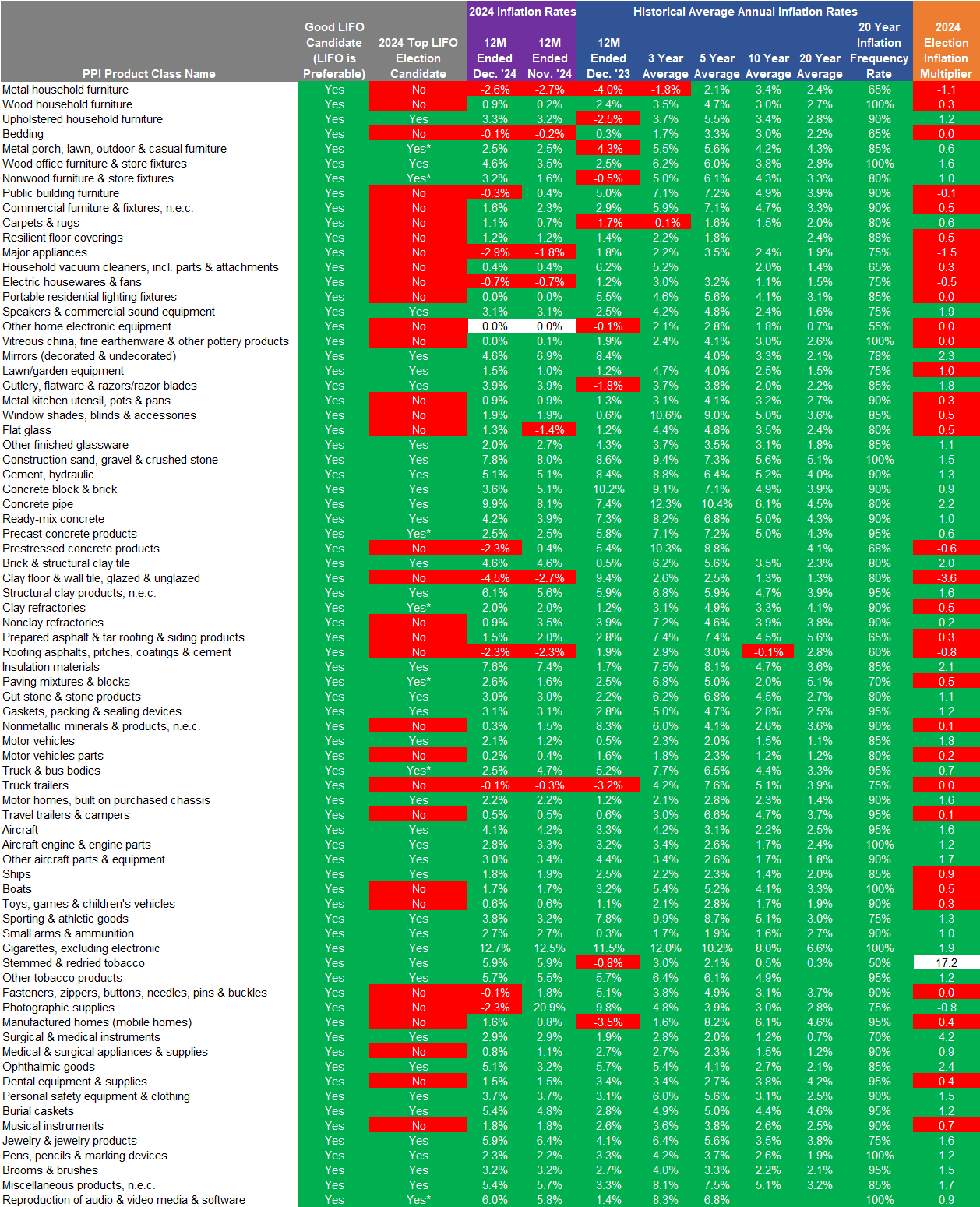

Table 1. Top 2024 LIFO Election Candidates by BLS PPI Major Commodity Group

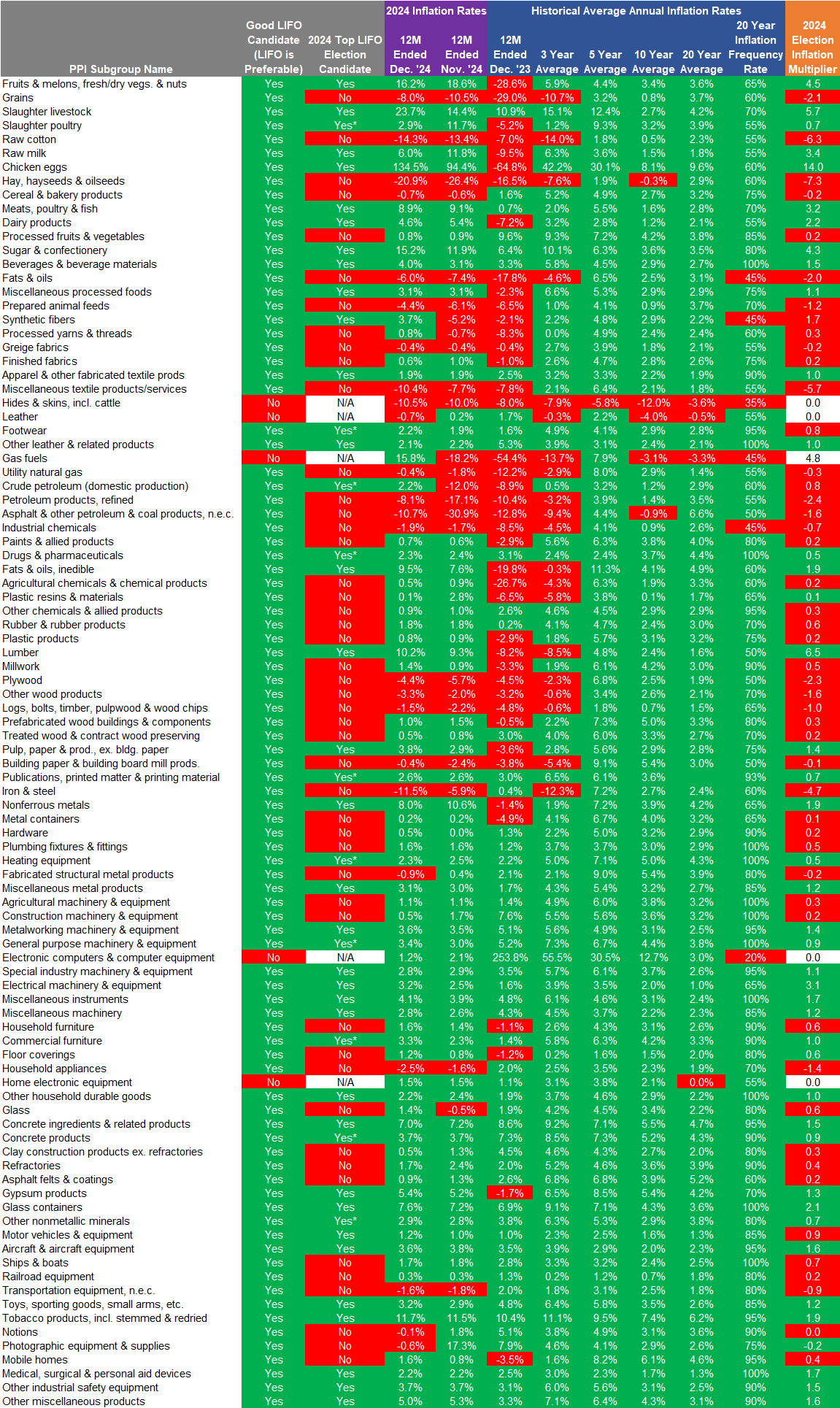

Table 2. Top 2024 LIFO Election Candidates by BLS PPI Subgroup

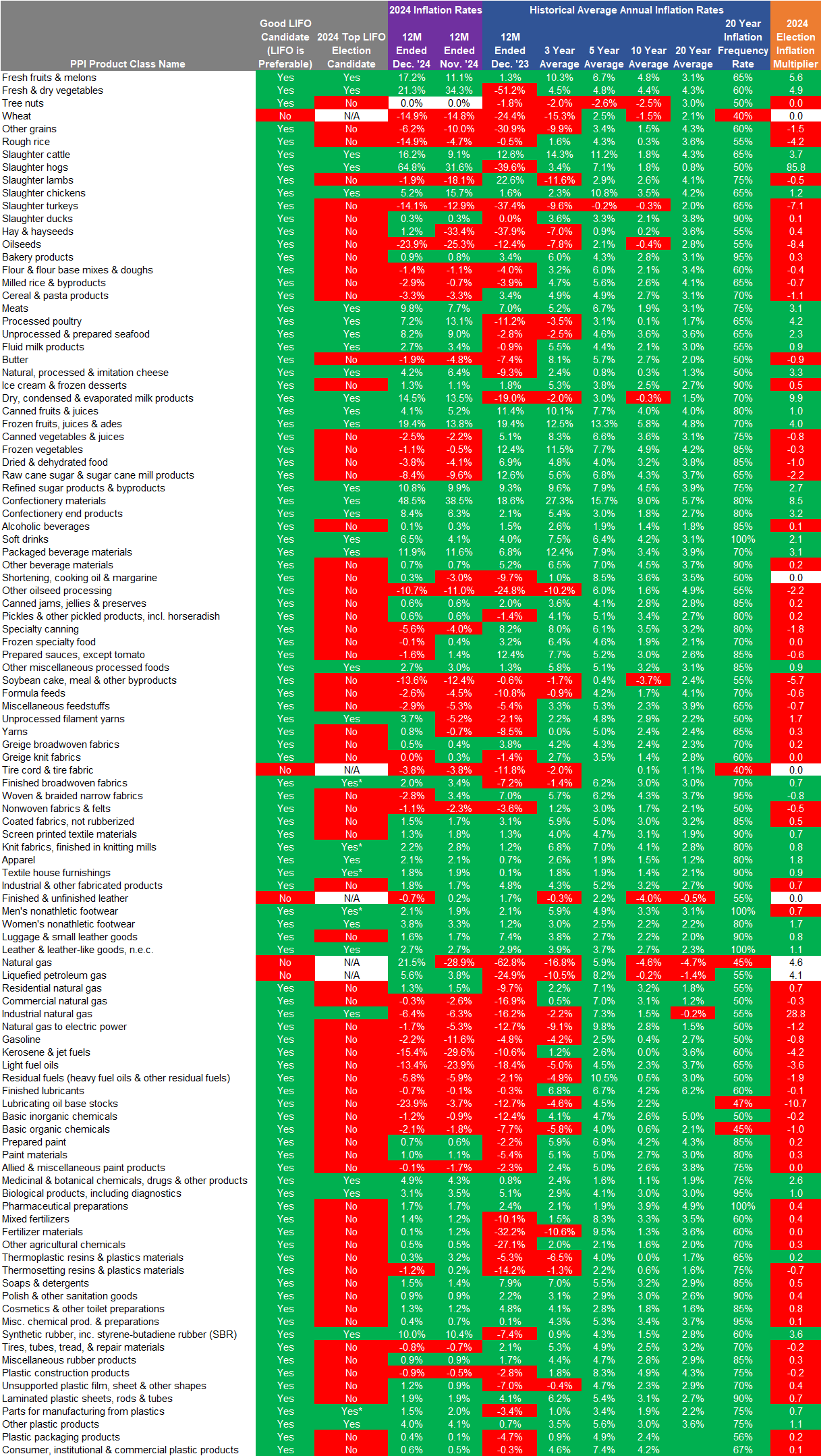

Table 3.1 Top 2024 LIFO Election Candidates by BLS PPI Product Class

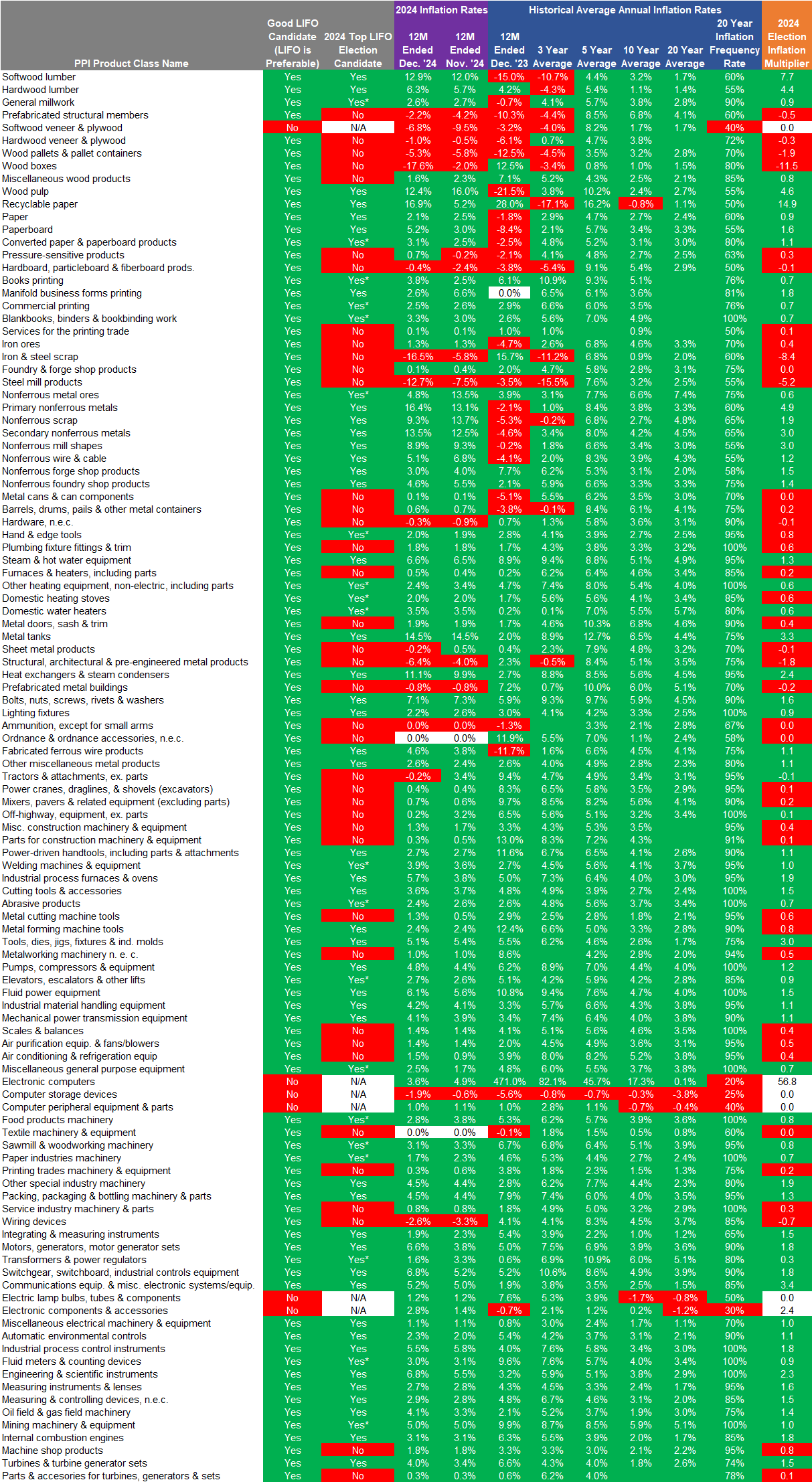

Table 3.2 Top 2024 LIFO Election Candidates by BLS PPI Product Class

Table 3.3 Top 2024 LIFO Election Candidates by BLS PPI Product Class

Does the Chosen Inventory Valuation Method Need to Match the Physical Flow of Goods?

The actual flow or physical movement of goods does not need to match the inventory costing method used to value inventory (aka cost flow assumption). The most two most predominant inventory valuation methods can be simplified as follows:

- LIFO:

- Matches current costs with current revenues, thereby reducing income & providing a better measure of current earnings

- Commonly called the income statement approach as it provides the clearest reflection of income & costs of goods sold (removes inflation component from income)

- FIFO (first-in, first out):

- Ending inventory most closely matches the current costs since it consists of most recent purchases

- Commonly called the balance sheet approach because it most closely matches physical flow of goods

- Charges oldest costs against more current revenue, and creates artificial inventory profits

Are Unit Costs Required to be Tracked on a LIFO Basis in Accounting Systems Incident & Subsequent to Adoption?

Because of the advantages of the dollar-value method & disadvantages of the unit LIFO method, almost all companies using LIFO track and value inventories in their accounting system on a FIFO, average cost or standard cost basis for the following reasons:

- They use the dollar-value method which requires for unit costs to be tracked and valued on a non-LIFO basis

- Most accounting systems are designed to track and value inventories using FIFO, average cost or standard cost

- Companies often base their pricing decisions on a FIFO, average cost or standard cost assumption

- Recordkeeping on a non-LIFO basis is easier since LIFO does usually not approximate the physical flow of goods

- Profit-sharing & other bonus arrangements often depend on a non-LIFO cost flow assumption

One of the biggest misconceptions is item/unit costs must be tracked and valued on a last-in, first out basis once LIFO is adopted. Although this is not true, it’s a misnomer that causes many companies to not to use LIFO. The reality is there are two methods or options how goods are to be tracked and valued on a LIFO basis, which are as follows:

- Dollar-value method: The dollar-value method measures inflation in terms of the total dollar value of the inventories at a FIFO, average cost or standard cost basis, not by the physical quantity & unit cost on a LIFO basis. Under this method, inventories continue being tracked and valued on a non-LIFO basis in perpetuity even incident & subsequent to adopting LIFO. When the dollar-value method is used, a top-side adjustment is recorded to account for the difference between the inventory value at cost (FIFO, average cost etc.) & the LIFO inventory value. When using the dollar-value LIFO method, item/unit costs are never “LIFO-ized”. What instead occurs is that goods continue to be tracked and valued under a company’s existing method, and at the end of the year, an inventory report showing the quantities and item/unit costs on a non-LIFO basis is generated and exported out of the accounting system in order to calculate inflation & perform the total LIFO inventory value. Once this occurs, inflation is calculated outside of the accounting system, layer at base year cost and LIFO cost are determined, the total LIFO inventory value is determined, the change between the current & prior period’s LIFO reserve is computed, and a top-side journal entry is recorded to adjust cost of goods sold and LIFO reserve (many companies outsource this work to LIFOPro or license our software to automate their in-house dollar-value LIFO calculation). Simply put, the dollar-value method avoids LIFO’s most undesirable characteristics by allowing companies to maintain their existing accounting systems on a non-LIFO basis, and only requiring for a top-side journal entry to be made annually. Because of this, the vast majority of companies on LIFO use the dollar-value method.

- Specific goods method (aka unit LIFO): The unit LIFO method is most often illustrated in tutorials and taught in college accounting courses because the underlying concept is simpler to illustrate than the dollar-value LIFO method. In reality, integrating the unit LIFO method in a perpetual accounting information system is extremely burdensome & sometimes to costly to implement. Under this method, item costs are tracked on a LIFO basis, and the accounting system must be set up in a manner to assume a last-in, first out basis cost flow assumption, meaning the sales of goods must be set up in a manner where the newest goods are sold first and the oldest items remain in stock. Said another way, each item’s unit cost must be LIFO-ized & the total inventory value on a LIFO basis is determined by taking the sum of the extended LIFO cost of all items. Under this method, companies often maintain two separate cost flow assumptions within their accounting information system: 1. Costing method used in the existing accounting system 2. unit LIFO method. One additional shortfall of the unit LIFO method is that it creates a materially lower tax benefit over a long period of time when compared to the dollar-value LIFO method. This is due to the fact that when new items enter into inventory and other items are no longer stocked (due to being discontinued or new items replacing them), the LIFO reserve associated with the items no longer stocked is recaptured under the unit LIFO method, but is retained under the dollar-value LIFO method as long as the total dollar value of the new or replacement goods is greater than or equal to the total value of the goods no longer carried. Because of this, very few companies use the unit LIFO method.

Establishing LIFO as a Preferable Method

The costing method used to value inventory is considered an accounting method or principle. Since there are multiple inventory valuation methods available, preferability must be established when changing to the LIFO method from a non-LIFO method. Because of this, companies issuing GAAP financial statements must establish that LIFO is preferable to the existing method.

No authoritative body has established criteria for determining the preferability among alternative inventory valuation methods, but the Securities & Exchange Commission’s Staff Accounting Bulletin Topic 6.G.2b states the following:

- In such cases, where objective criteria for determining the preferability among alternative accounting principles have not been established by authoritative bodies, the determination of preferability should be based on the particular circumstances described by and discussed with the registrant.

- In the case of changes for which objective criteria for determining preferability have not been established by authoritative bodies, business judgment and business planning often are major considerations in determining that the change is to a preferable method because the change results in improved financial reporting.

Furthermore, most companies use LIFO in perpetuity, and because of this, the LIFO reserve will often grow and become a materially large amount. For these reasons, companies and CPA firms should obtain or perform meticulous analysis prior to adopting LIFO for the following reasons:

- Establish that LIFO truly is preferrable over the existing method (preferability)

- Forecast/model LIFO’s short and long-term financial reporting and tax implications (quantify LIFO’s current & future estimated tax benefits)

- Ensure the most favorable tax submethods are chosen (including assessing IRS audit risk amongst the available submethods)

- Assess risks vs. rewards (cost-benefit analysis)

Such analysis should include historical calculations, current period estimates, exploring all available submethods & preparing comparisons amongst the available submethods (such as valuing all or only certain goods using LIFO, using an internal vs. external inflation measurement source, pooling methods & determining whether the same or different book & tax LIFO submethods will be used). Additional considerations should include comparing the administrative burden and risks, outsourcing costs, and considering licensing software to automate the calculation if managed in-house.

LIFO Election Requirements & Disclaimers

- Election Requirements

- LIFO Conformity Rule: Must value inventory using LIFO on financial statements beginning with the same period LIFO is elected & reported on the tax return (although financial statements must show inventory & income reported under LIFO, disclosures can be made in notes to financial statements to present amounts such as ending inventory and income using non-LIFO method for comparative purposes)

- Election scope or the goods to be valued under LIFO for tax purposes cannot be greater than inventories valued under LIFO for financial reporting (can have more goods on LIFO for book than for tax, but not vice versa)

- Must take Non-LIFO reserves into income over 4-year period beginning with year of election, such as:

- Lower of cost or market reserve

- Slow-moving/obsolete reserve

- Arbitrary write-downs other than shrink

- Disclaimers

- Portions or all of LIFO reserve may be taken back into income if the following occurs:

- Portion of LIFO reserve may be taken back into income in periods where one or both of the following occurs (also known as LIFO recapture):

- Deflation

- Material inventory liquidations (for example, a 50% decrease in the current vs. prior year’s ending inventory balance at cost)

- All of LIFO reserve will be taken back into income when either of the following occurs:

- C to S Corp conversions

- Business asset sales

- Terminating LIFO:

- Automatic approval to terminate LIFO election at any point in time

- IRS Form 3115 must be filed to switch from LIFO to a non-LIFO method

- LIFO reserve must be ratably recaptured into income over a 4 year period starting in termination year

- Portion of LIFO reserve may be taken back into income in periods where one or both of the following occurs (also known as LIFO recapture):

- Portions or all of LIFO reserve may be taken back into income if the following occurs:

LIFO Financial Reporting Disclosure Requirements & Alternatives

IRS Regs. §1.472-2(e) requires income to be reported and inventories to be valued on a LIFO basis on the face of the income statement and balance sheet beginning in the same year that LIFO is adopted for tax purposes. This is commonly referred to as the LIFO conformity rule. An overview of the LIFO financial reporting disclosure rules and alternatives are listed below.

- LIFO Disclosures

- Face of the annual or year end income statement must present income, profit or loss using the LIFO method beginning no later than the year that LIFO is adopted for tax purposes

- Once LIFO has been elected for tax purposes, income, profit or loss must be computed using LIFO on the face of all subsequent annual financial statements (unless LIFO is terminated for tax purposes)

- Non-LIFO Disclosures: The following non-LIFO disclosures and information are allowed within financial statements while also maintaining LIFO conformity compliance (see IRS Regs. §1.472-2(e)):

- Supplemental and explanatory information using a non-LIFO method – Includes anything other than the primary presentation of the income statement, which includes the following:

- Notes to the income statement

- Appendices & supplements to the income statement

- Other reports included in the financial reports, such as:

- Management’s discussion and analysis

- Statement of changes in financial position

- Letters to shareholders, partners or other stakeholders

- Summary of key figures

- Inventory asset value disclosures

- Supplemental and explanatory information using a non-LIFO method – Includes anything other than the primary presentation of the income statement, which includes the following:

- Internal Management & Interim Reports

- Internal Management Reports – The use of a non-LIFO method is allowed on all portions of internal management reports as long as the reports will not be issued or released to parties outside of the organization. Examples include earnings projections, budgets, and sales forecasts.

- Interim reports – If issued in accordance with GAAP, same LIFO disclosure rules described above apply. If not issued in accordance with GAAP, then interim reports are not required to be presented on a LIFO basis (exception – series of interim reports that can be used to ascertain income, profit & loss by combining those reports)

Interim LIFO Estimate Best Practices

- Companies that don’t issue interim financial reports are not required to perform interim LIFO estimates

- Companies that issue non-GAAP interim reports are also not required to perform interim LIFO estimates

- Companies perform interim LIFO estimates for a wide array of reasons, including:

- Financial reporting compliance – Under Generally Accepted Accounting Principles, an estimate for the interim cost of sales is required for interim reporting purposes. Because of this, companies issuing GAAP financial statements include an estimated LIFO adjustment in their interim reports.

- Tax – Although tax law defines LIFO as an annual calculation, many companies perform interim estimates in order to incorporate the LIFO effect into their quarterly estimated tax payments

- Forecasting and planning – Many companies perform at least one interim LIFO estimate in order to properly forecast and plan the estimated LIFO effect on their bottom line. An added benefit of doing so is to smooth out the effect of the estimated LIFO reserve change over the course of the year as opposed to booking a single LIFO adjustment at year end. An added benefit of forecasting & planning is that one can avoid material or unexpected surprises from LIFO at year end.

- Maximize the LIFO reserve increase (or minimize the decrease) –When there’s inflation, a minimum “Current-year cost” balance is required to avoid what is known as layer erosion effect LIFO income (Current-year cost can be thought of as inventory at cost i.e., FIFO or average cost). If the Current-year cost balance is below the minimum required amount, layer erosion effect LIFO income can erode or completely wipe out the LIFO expense created by inflation for that period (or in some cases, a net LIFO reserve decrease can occur from substantial layer erosion income). Because of this, some companies will plan their year end purchases to achieve the most desirable LIFO results to minimize the effects of layer-erosion LIFO income.

LIFOPro’s 2024 Top LIFO Election Candidates List

LIFOPro’s 2024 top LIFO election candidates list provides you with the ability to quickly determine or accomplish the following:

- If a specific company or industry is a good LIFO candidate

- If a specific company or industry is a top LIFO election candidate for the 2024 year end

- Estimate election year & long-term LIFO tax benefits for a specific company or industry

- Perform LIFO risk assessment for a specific company or industry

- Record a LIFO adjustment, present upcoming year end financial statements on a LIFO basis & ensure IRS LIFO conformity

LIFOPro’s 2024 Top LIFO Election List Tables

- Major commodity group (Table 1)

- BLS PPI major commodity groups are the least-granular or broadest BLS groupings, and there are a total of 15 major commodity groups. For example, the Processed foods & feeds major commodity group includes the most goods most predominantly carried by a food wholesaler/retailer.

- The major commodity group table is best suited for the following situations:

- CPA firms seeking to identify the 2024 top LIFO election candidates at an industry level that will be used to create a list of clients that will be targeted to explore a LIFO election (will likely be the most suitable table to use since your clients can be more easily organized into the broadest groupings)

- The major commodity group may be most suitable for certain companies that carry a broad range of products. For example, the major commodity group table would be most suitable for a food wholesaler/retailer for the following reasons:

- The Processed foods & feeds PPI major commodity group is the only applicable major commodity group for food wholesaler/retailers, it includes all goods carried by the food wholesaler & it excludes goods that aren’t carried by most food wholesaler/retailers

- There are multiple PPI subgroups and product classes applicable to a food wholesaler/retailers, meaning a single subgroup or product class can not be chosen for a food wholesaler

- Subgroups (Table 2)

- There are a total of 96 subgroups which break out goods into more granular groupings than the 15 major commodity groups. For example, there are nine BLS PPI subgroups that fall within the Processed foods & feeds major commodity group.

- The Subgroup table is best suited for the type of company or industry that may carry a more specific or narrow range/type of products than a company or industry such as a food wholesaler/retailer. For example, a dairy wholesaler would find the Subgroup table to be the most suitable table for the following reasons:

- The Dairy products PPI subgroup is the only applicable subgroup for dairy wholesalers, it includes all goods carried by the dairy wholesaler, and excludes goods that aren’t carried by dairy wholesalers

- The major commodity group table options are broader than the subgroup options for a dairy wholesaler because the most applicable major commodity group (Processed foods & feeds) includes price surveys for goods not carried by a dairy wholesaler

- Multiple product classes exist for a dairy wholesaler, meaning a single product class can not be chosen for a dairy wholesaler

- Product classes (Table 3)

- There are a total of 301 product classes which break out goods into more granular groupings than the 15 major commodity groups and 96 subgroups. For example, there are 37 product classes that fall within the Processed foods & feeds major commodity group.

- The product class table is best suited for an industry or company with a narrower range of products than a food wholesaler/retailer or dairy wholesaler. For example, a wholesaler of non-alcoholic beverages would find the product class table to be most suitable for the following reasons:

- The soft drinks PPI product class is the only applicable subgroup for a non-alcoholic beverage wholesaler, it includes all goods carried by the beverage wholesaler & excludes goods that aren’t carried by a beverage wholesaler

- The major commodity group and subgroup table options are broader than the subgroup options for a dairy wholesaler because the most applicable major commodity group (Processed foods & feeds) includes price surveys for goods not carried by a dairy wholesaler

How to Use LIFOPro’s 2024 Top LIFO Election Candidates List

LIFOPro uses Bureau of Labor Statistics Producer Price Indexes (BLS PPI) to measure inflation metrics & identify the best LIFO election candidates each year. LIFOPro releases the first version of our Top LIFO Election Candidates list beginning with the release of the September BLS indexes.

The single company instructions are designed for CPA firms seeking to determine if one client is a top LIFO election candidate. The multi-company instructions are designed for CPA firms who’re seeking to prepare a client target list of potential LIFO election candidates. Download LIFOPro’s Top LIFO Election Candidates List & Tool Excel file to use the multi-company client identification tool.

LIFOPro's Top 2024 LIFO Election Candidates List Excel File

Single Company Top 2024 LIFO Election Candidate Identification Instructions

- Step 1:

- Scroll down to Tables 1 – 3 below, locate a single BLS group/subgroup/product class that most closely matches your company/client’s product mix or industry & proceed to Step 3

- If multiple BLS PPIs were identified that matches your company/client’s product mix/industry, proceed to step 2

- Step 2: If multiple PPIs match your company’s or client’s industry or product mix, take one the following steps:

- Use one of the less-detailed BLS tables – For example, if multiple product classes were found that include a portion of but not all of your company or client’s product mix or industry (but no product class was found that included 100% of your goods), review the subgroup table to determine if there is a single subgroup that contains all goods & excludes most or all goods not carried. If no such subgroup can be found, review the major commodity group table and perform the same steps.

- Use the most predominant group/subgroup/product class in your company/client’s industry or product mix – For example, if your product mix includes 70% of one product class, 20% of another product class & 10% of third product class, select the product class that represents the largest proportion of the total inventory balance.

- Step 3: Locate the Good LIFO Candidate field entry for the selected PPI & take the following steps:

- If the Good LIFO Candidate entry is “Yes” – Your company is a goods LIFO candidate. Proceed to Step 4 and/or contact LIFOPro to obtain a free LIFO election benefit analysis.

- If the Good LIFO Candidate entry is “No” – Your client or company is not a good LIFO candidate & LIFOPro recommends not using LIFO (or contact LIFOPro to obtain confirmation of this)

- Step 4: Locate the Top 2024 Election Candidate field entry for the selected PPI & take the following steps:

- If the Top 2024 Election Candidate entry is “Yes” – LIFOPro recommends exploring a 2024 LIFO election and obtaining a complimentary benefit analysis from LIFOPro ASAP. Proceed to Step 5.

- If the Top 2024 Election Candidate entry is “No” – Although your company/client is a good LIFO candidate, it is likely that current year LIFO election should be deferred to a future period in time. Consider obtaining a free election benefit analysis from LIFOPro this year, or defer doing so until next year.

- Step 5: Take any of the following steps to further explore electing LIFO:

- Estimate 2024 LIFO tax benefit:

- 2024 taxable income reduction from LIFO (2024 LIFO expense/reserve): Multiply the higher of the two inflation rates shown in the 2024 inflation rate fields by last year’s inventory balance

- 2024 LIFO tax benefit (2024 LIFO after-tax savings): Multiply the 2024 LIFO expense by your combined federal & state tax rate

- Contact your client & inform them of the following:

- High likelihood that LIFO will create meaningful tax benefit for the upcoming year end

- They can attend a free LIFO discovery call to learn more about LIFO, how to get a free benefit analysis & learn about our turnkey outsourcing solutions which makes being on LIFO as simple as possible

- They can obtain a free, comprehensive benefit analysis to obtain a more accurate estimate and essential information on how LIFO works, election requirements and method alternatives

- Schedule a free LIFO discovery call to learn more about LIFO, how to obtain a free election benefit analysis & LIFOPro’s outsourcing solutions:

- Email or call Jamie Pentagulio at jamie@lifopro.com or 531-999-3147

- Use our online scheduling tool: https://live.vcita.com/site/smleud97dkmgnkd9/online-scheduling

- Estimate 2024 LIFO tax benefit:

How is a Good LIFO Candidate & Top LIFO Election Candidate Determined?

LIFOPro uses proprietary inflation metrics and a standard grading system to establish whether or not LIFO is a preferable method for a company or given industry. From this grading system, a determination can be made regarding if a company is a good LIFO candidate, and subsequent recommendations are also provided regarding the proper timing of when to elect LIFO. Our grading system & scoring criteria is organized as follows:

- Historical Preferability (Good LIFO candidate criteria): These criteria use past pricing metrics sourced from the Bureau of Labor Statistics Consumer/Producer Price Indexes (BLS CPI/PPI) to establish preferability as of the time of exploring a LIFO election. These are also called our “good LIFO candidate” criteria, which are as follows:

- Inflation level – How much inflation has there been historically?

- The inflation level is the most fundamental metric used to establish LIFO as a preferable method because higher the historical inflation level, the higher the likelihood that LIFO will create a material tax benefit and be more clearly reflective of income than other non-LIFO methods in the future.

- LIFOPro’s inflation level requirement is to have a long-term average annual inflation rate of 1% or more. Auto dealers and supermarkets (predominant users of LIFO) have 20 year average annual inflation rates of around 1% – 2%, which is more than sufficient to establish preferability because over a 20 year period, there will have been 20% – 40% cumulative inflation, and in most cases, inflation at this level will yield material long-term LIFO tax benefits.

- Inflation frequency – How often has inflation occurred historically?

- Inflation frequency is another key metric used to establish LIFO as a preferable method because the more often there has been inflation in the past, the higher the likelihood that LIFO will be most clearly reflective of income & create a tax benefit in the future

- Inflation frequency is a key LIFO risk assessment metric because there is an inverse relationship between the amount of LIFO risk and inflation frequency rate. More specifically, the lower the inflation frequency rate, the higher amount of LIFO risk. Conversely, the higher inflation frequency rate, the lower the risk. Certain industries have 20 year inflation frequency rates of 100% (inflation measured in all of the last 20 years), meaning there is little or no LIFO risk in these areas.

- LIFOPro’s inflation frequency requirement is to have a rate of greater than or equal to 50% over the last 20 years (inflation measured in 10 or more of the last 20 years)

- Both historical preferability criteria must be met for LIFO to be a preferable method and for a company/industry to be a good LIFO candidate. LIFO is not a preferable method and a company/industry is not a good LIFO candidate if neither or only one of the two historical preferability criteria is met.

- Inflation level – How much inflation has there been historically?

- Present Preferability (Current year LIFO election candidate): These criteria provide the basis of recommending either a current year LIFO election, or deferring the LIFO election to a later period, which are as follows:

- Both historical preferability criteria met

- Current year vs. Historical average inflation multiplier – Is the current period inflation rate greater/less than or equal to the historical average inflation rate?

- Inflation multiplier is calculated by taking the quotient of the Current year inflation rate and the Historical average annual inflation rate

- Current year inflation rate uses the higher of the following two options:

- Year to date inflation: For a December year end, the year to date inflation rate at the time of this publication is 9 months ended September 2024 PPI (Sep. ’24 ÷ Dec. ’23) since the last BLS release was September PPI.

- 1 Year inflation: For a December year end, the 1 year inflation at the time of this publication is 12M ended September 2024 PPI since the last BLS release was September PPI

- Historical average annual inflation rate computed using the BLS PPI 20 year average annual inflation rate as of September 2024 (if available; 3/5/10 year average annual inflation rates used for BLS PPIs that have existed for less than 20 years)

- LIFOPro’s inflation multiplier requirement is to have an inflation multiplier of greater than or equal to 1. For example, if there’s 5% inflation in 2024 & a 20 year average annual inflation rate of 2%, the inflation multiplier would be 2.5, and a current year LIFO election would be recommended.

- Both present preferability criteria must be met for a current period LIFO election to be recommended. If the inflation multiplier is less than 1, a LIFO election recommendation is deferred to the next period where the inflation multiplier is greater than or equal to 1.

Does the Timing of the LIFO Election Matter?

Although LIFO can create meaningful short and long term tax benefits, there are many considerations that should be made prior to and during the implementation process. Most importantly, the timing of adopting LIFO is key for the following reasons:

- For tax purposes, LIFO must be applied prospectively (beginning in year LIFO is adopted), and the tax benefits are directly tied to the amount of inflation measured in the year of adoption (high inflation that recently occurred in a prior period can’t be applied in the LIFO election period)

- The size of the first year tax benefit is primarily dependent on the amount of inflation measured in the year the LIFO election is made, so the higher the inflation measured in the election year, the bigger the LIFO tax benefit will be

- Higher tax benefits are being forfeited when electing during a low inflation period instead of doing so during a period where inflation was greater than or equal to historical levels

Make Electing LIFO Easy!

Electing LIFO can be a lot easier than you think with the help of the experts at LIFOPro. Our complimentary benefit analysis lowers the barriers to LIFO entry. We do all the heavy lifting required to perform comprehensive analysis. We take the guesswork out of determining who is or is not a good LIFO candidate, when the LIFO election should be made, and which submethods should be used. Best of all, we serve as a LIFO subject matter expert for both companies and CPA firms, meaning all parties can count on us for all their LIFO needs! Schedule a call today with the LIFOPro team to learn more about LIFO & our benefit analysis & outsourcing solutions or download our content below to learn more.

- Schedule a discovery call with LIFOPro

- How LIFO Works & LIFOPro’s Offerings

- LIFOPro’s Election Benefit Analysis

- LIFO Tax Savings Calculator

Get a Free LIFO Election Benefit Analysis Today

Are you a company not on LIFO, but are interested in scoping out a potential election and want to obtain a cost/benefit analysis? Contact LIFOPro to obtain your complimentary LIFO election benefit analysis today! Minimal documentation and work is required to obtain your free benefit analysis, and we also include a fee quote for outsourcing all the LIFO related work to us. Download the applicable questionnaire today! LIFOPro delivers your benefit analysis and fee quote within 1 week of receipt of the required documents.

LIFO Election Benefit Analysis Questionnaire: Non Auto Dealers

LIFO Election Benefit Analysis Questionnaire: Auto Dealers