Ready to get started today? Send the required documentation listed below to receive your complimentary Best LIFO Practices & Review Report, a sample LIFOPro report package & fee quote.

Want to learn more about our turnkey outsourcing solutions? Schedule an introductory call or Teams meeting with LIFOPro by calling 402-330-8573, emailing lifopro@lifopro.com or using our online scheduling tool by clicking here: Schedule Call With LIFOPro

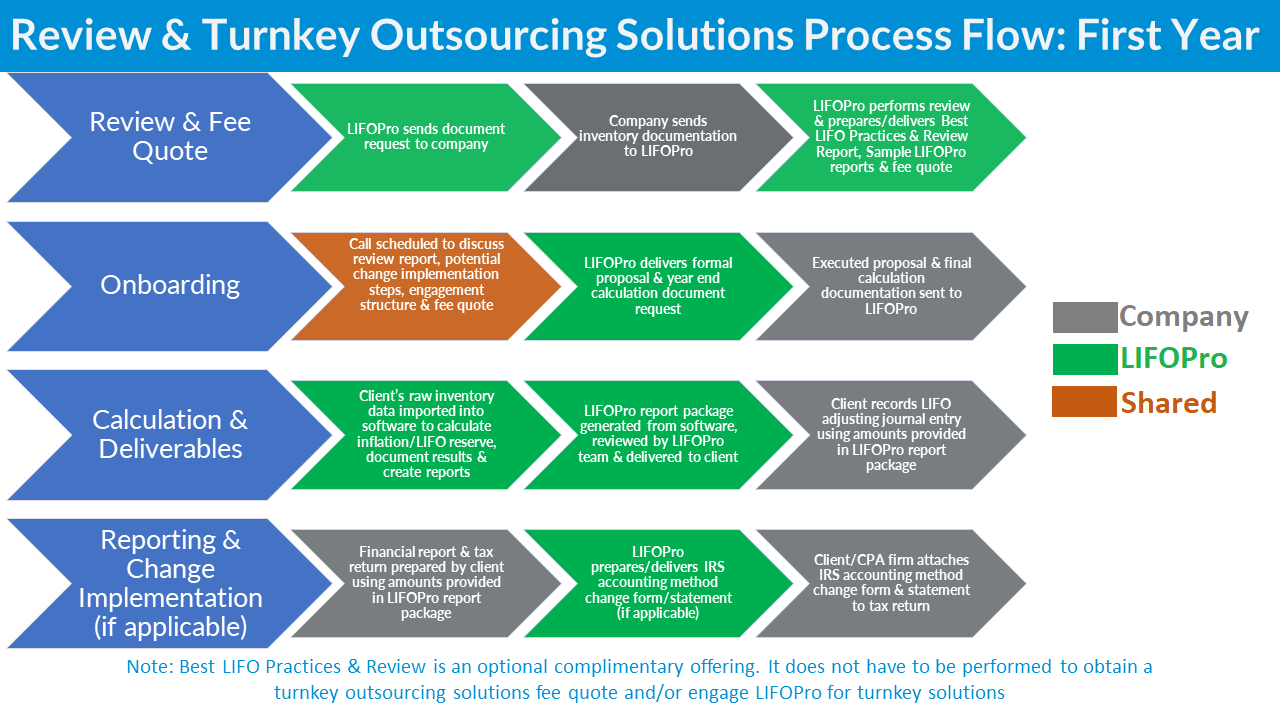

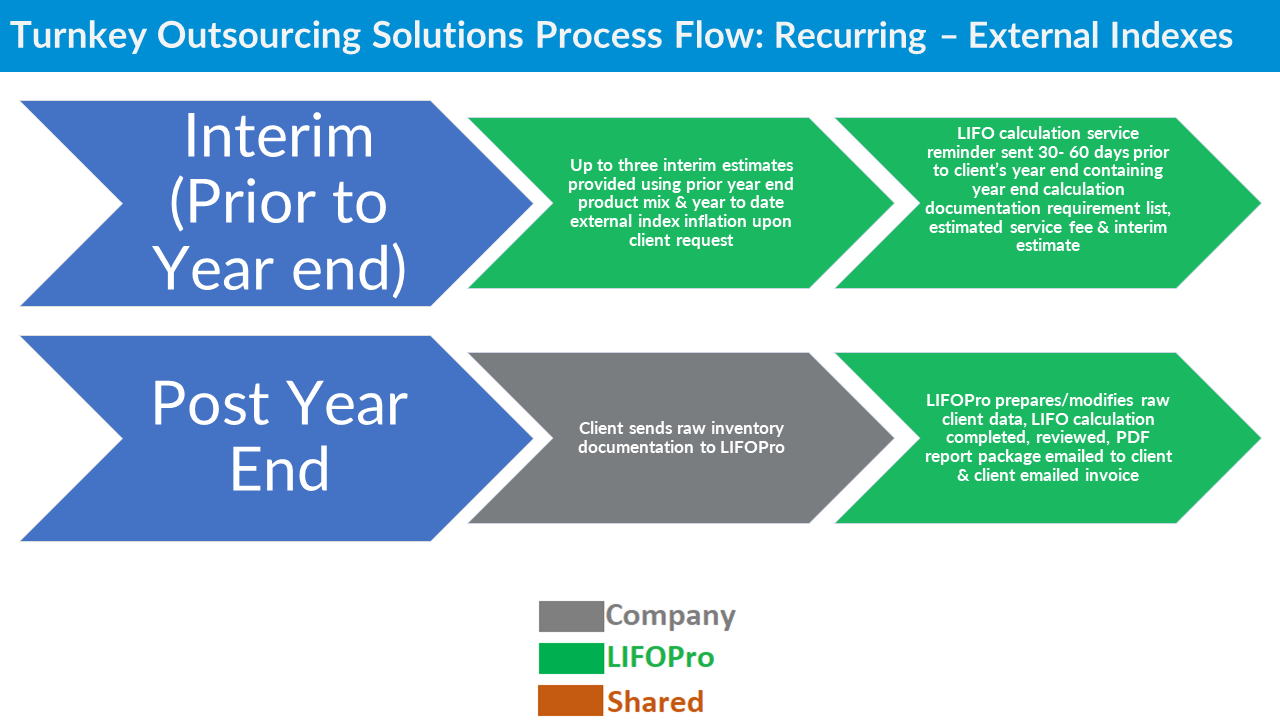

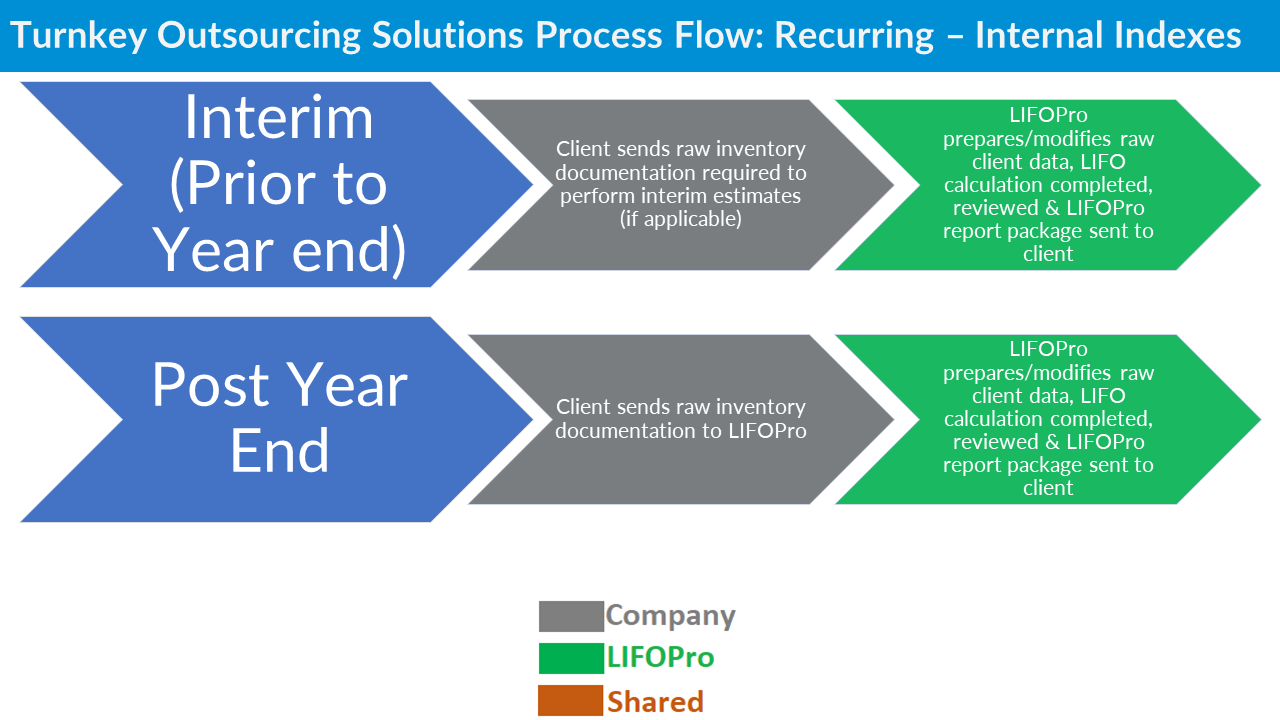

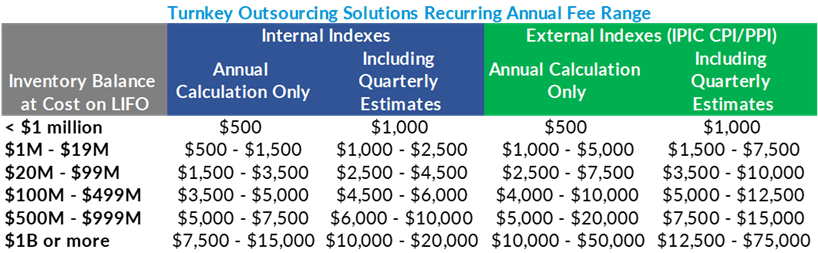

Turnkey Outsourcing Solutions Slide Deck

Have a call or Teams meeting with LIFOPro to get started today or learn more about our offerings. Schedule online using our easy-to use booking tool.

Schedule Call or DemoGet a complimentary analysis for companies considering using LIFO. Get a complimentary review for companies on LIFO. Request an outsourcing or LIFOPro software fee quote. Use our simple form to submit your request.

Get startedUse our online request tool to receive a Non-disclosure Agreement electronically. Avoid the hassle of sending NDAs back and forth and having to scan documents with our quick & easy online NDA request form!

Non-Disclosure Agreement RequestWould you like to determine the potential LIFO tax deferral benefit for your company or client?

Sign up today to receive industry news & promotional offers from LIFO-PRO