LIFO Financial Reporting Disclosure Requirements & Alternatives

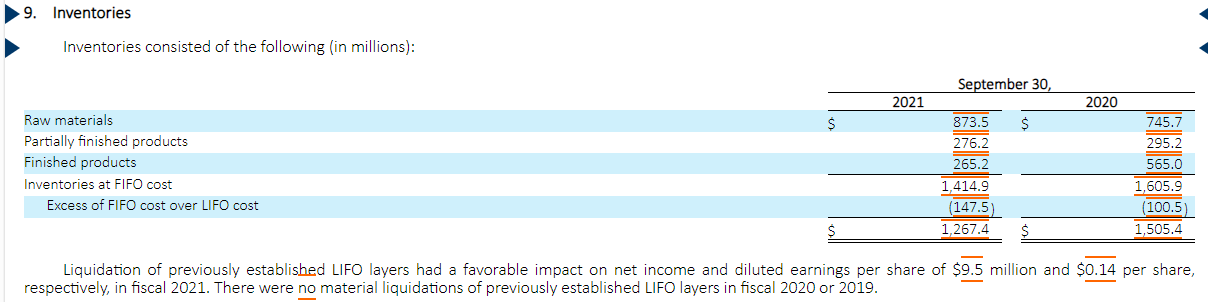

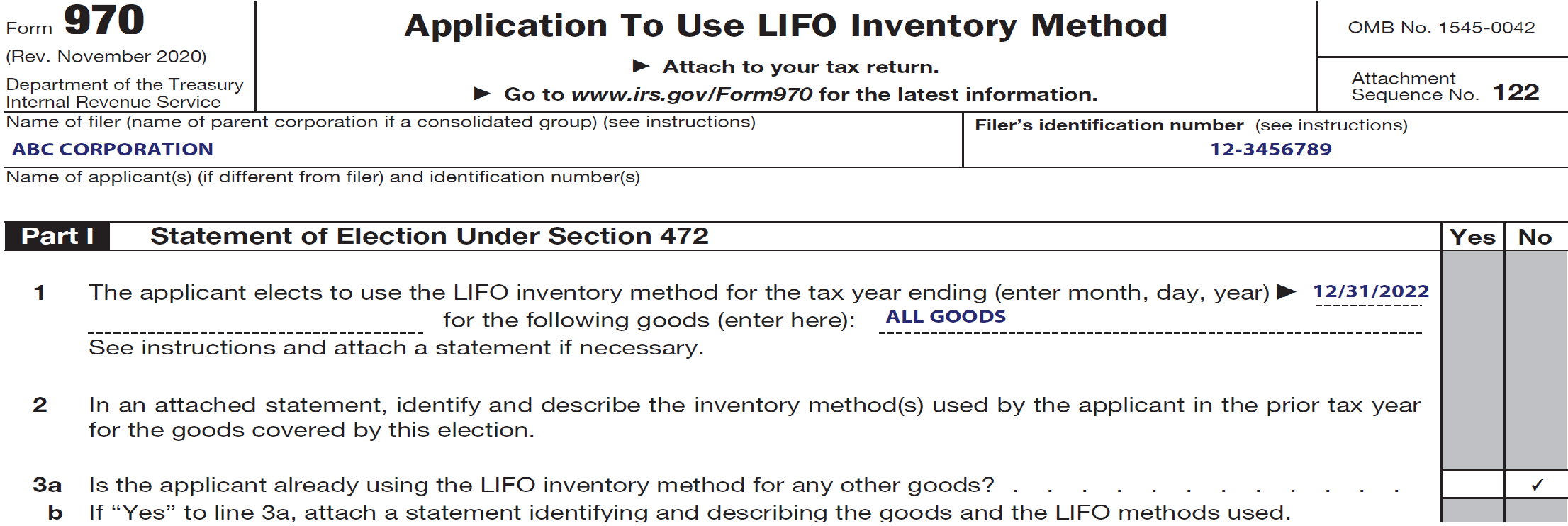

What Rules Exist Regarding LIFO Disclosures for Financial Reporting Purposes? The IRS tax law commonly referred to as the “LIFO conformity rule” is the authoritative guidance that prescribes the financial report and statement requirements for companies that use the LIFO method (assuming financial reports or statements are issued to external parties; these rules are not […]