As with other Schedule M items, a LIFO schedule M adjustment represents a difference between the financial reporting (book) & tax treatment of an item that effects the computation of income (change in LIFO reserve affects cost of goods sold). There are two key concepts related to LIFO Schedule M adjustments. The first concept is understanding the facts & circumstances that give rise to differences in the book & tax LIFO calculation. The second concept is identifying the appropriate computation of the LIFO schedule M adjustment. Those two concepts are further discussed below.

When is a LIFO Schedule M adjustment required?

Companies with separate book & tax LIFO calculations are required to make a LIFO Schedule M adjustment. Companies that make a single LIFO calculation (meaning the book & tax LIFO inventory/reserve balances are the same) are neither required nor allowed to make a LIFO Schedule M adjustment.

What gives rise to separate book & tax calculations being required?

The following can cause for separate book & tax calculations to exist & result in a LIFO schedule M item to exist:

- An event or transaction required for the LIFO reserve to be recaptured for financial reporting but not for tax & vice versa. This is common when a company on LIFO is acquired by another company via stock purchase. Another example would be where a company converts from a C to an S Corp., which would require the tax LIFO reserve to be recaptured, while leaving the book LIFO reserve unchanged.

- Different book & tax LIFO submethod(s) usage: This is highly prevalent with publicly traded companies. Examples of LIFO submethods & alternatives are as follows:

- Current-year cost method: This is the IRS lingo for the method used to value the ending inventory balance at cost under Sec. 471. It includes the following alternatives

- Cost flow methods: FIFO & average cost are the most common methods, but also include earliest acquisitions & specific identification

- Treatment of certain top-line adjustments such as:

- Vendor discounts/trade allowances (aka vendor rebates/monies)

- Reserves such as LCM or excess & obsolete (aka slow moving)

- In-transit goods valuation

- Inflation measurement source: Most common examples are as follows:

- Internal indexes – where current & prior/base period item costs are extended by the current period quantity & compared to calculate a cumulative or current year inflation index

- External indexes – where government published Bureau of Labor Statistics are assigned to goods to calculate category inflation indexes & weighted average pool indexes

- Pooling methods: Common examples are as follows:

- Natural business units

- Locations and/or legal entity

- IPIC pooling method based on BLS major expenditure/commodity groups

- Current-year cost method: This is the IRS lingo for the method used to value the ending inventory balance at cost under Sec. 471. It includes the following alternatives

Identifying & applying the appropriate LIFO schedule M adjustment computation method

A common misconception is that all LIFO Schedule M adjustments can be calculated by comparing the change in the current & prior year’s book vs. tax LIFO reserve (aka LIFO expense (income); expense = increase in CY vs. PY LIFO reserve & decrease = income). This misconception is wrong since a different calculation is required when the book & tax Current-year cost balances are different. Examples of differing Current-year cost methods are as follows:

- FIFO is used as the Current Year Cost method for book, but Earliest Acquisitions Cost (EAC) is used for tax. Under such an example, you may have a book Current-year cost of $10M, but have a tax Current-year cost of $9M. Regardless of the differences, if the Book & Tax Current-year cost balances are different, the Schedule M adjustment can’t be calculated by comparing the book vs. tax LIFO reserve or LIFO reserve change (i.e. LIFO expense or income).

- For book purposes, trade discounts & vendor allowances are excluded from the Current-year cost computation, but are included in the tax Current-year cost. A simple illustration under this example would be for the book Current-year cost excluding trade discounts to be $8M, but the tax Current-year cost including trade discounts equaling $7M. Because of this, there will be different starting points for calculating the change in the LIFO reserve.

Accordingly, the correct computation methods for calculating the LIFO Schedule M is based on the following:

- Same book & tax Current-year costs: Can use change in CY vs. PY book vs. tax LIFO reserve OR change in CY vs. PY tax vs. book LIFO inventory balance (when calculated, will be the same regardless of if comparison is made using either the LIFO reserve or LIFO inventory balance)

- Different book & tax Current-year costs: Must use change in CY vs. PY tax vs. book LIFO inventory balance

Schedule M Calculation Comparisons: Using LIFO Reserve vs. LIFO Inventory Balance Changes

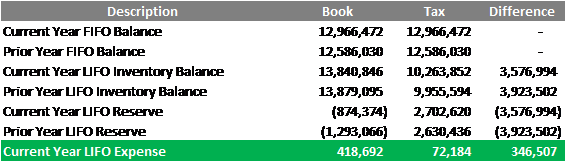

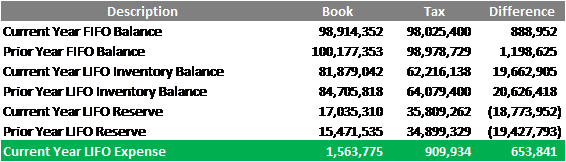

Figure 1. Schedule M Adjustment Calculation Method Comparison: Same Book & Tax Current Year Costs

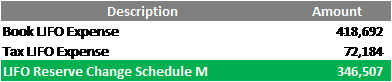

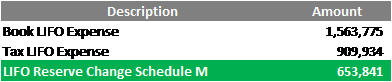

Figure 1a. Schedule M Adjustment Using Change in LIFO Reserve (LIFO Expense; Unfavorable Schedule M)

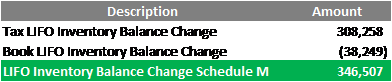

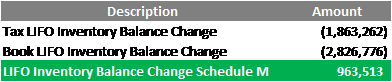

Figure 1b. Schedule M Adjustment Using Change in LIFO Inventory Balance

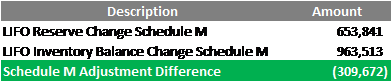

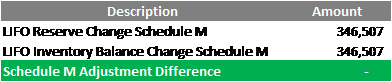

Figure 1c. Schedule M Comparison: Using LIFO Reserve vs. LIFO Inventory Balance Change

Figure 2. Schedule M Adjustment Calculation Method Comparison: Different Book & Tax Current Year Costs

Figure 2a. Schedule M Adjustment Using Change in LIFO Reserve (LIFO Expense) – Incorrect

Figure 2b. Schedule M Adjustment Using Change in LIFO Inventory Balance – Correct (Unfavorable Schedule M)

Figure 2c. Schedule M Comparison: Using LIFO Reserve vs. LIFO Inventory Balance Change: Difference between Incorrect & Correct