Machinery & Equipment Dealer LIFO Overview

- Many machinery & equipment dealers use LIFO because of the consistent long-term historical inflation

- Majority of machinery & equipment dealers on LIFO have use external indexes & Bureau of Labor Statistics Producer Price Indexes (BLS PPI), which is also known as the IPIC method

- IPIC method most predominantly used because it has historically provided much higher after-tax cash savings compared to the use of an internal index method which relies on actual current & prior/base year item costs to calculate inflation

- Many dealerships have what is referred to as a limited or selective LIFO election, which infers that less than 100% of goods are valued under LIFO

- Reasons for having limited LIFO election are as follows:

- Minimal or negative tax savings from having used equipment & parts on LIFO if using internal indexes

- Taxpayers are required to value inventories on LIFO at cost & are therefore not allowed to maintain LCM reserves on used equipment if they’re on LIFO

- Many dealerships also maintain lower of cost or market reserves for used equipment, which provides a form of tax savings since it reduces ending inventory balances, increases costs of goods sold & reduces taxable income

- Some dealers leave used equipment off LIFO because they perceive the tax savings of maintaining LCM reserve on these goods to be greater than the tax savings of having these goods on LIFO

2021 Auto Dealer Inflation Environment

- Supply constraints & pent up demand have caused unprecedented machinery & equipment inflation

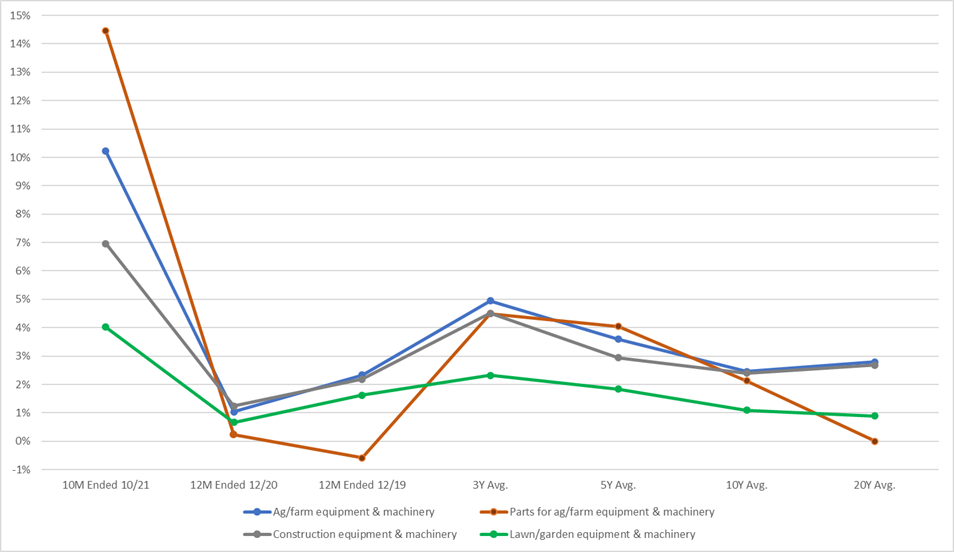

- Year-to-date Producer Price Index (PPI) inflation for Ag/farm equipment & machinery is 10% for the 10 months ended October 2021 (see chart below)

- Parts for Ag/farm equipment & machinery year-to-date PPI inflation is 15% for the 10 months ended October 2021

- Year-to-date PPI inflation for Construction machinery & equipment is 7% for the 10 months ended October 2021

- Year-to-date PPI inflation for Lawn/garden equipment & machinery is 4% for the 10 months ended October 2021

- Year to date averages are far above the historical averages for all machinery & equipment categories (see below)

2021 Tax Savings Opportunities for Machinery & Equipment Dealers

- Dealers Not on LIFO

- Could substantially increase 2021 tax savings from LIFO by switching to IPIC PPI if they’re currently using internal indexes or price book/list

- Dealers with only new equipment on LIFO could capture even more 2021 tax savings by both switching to IPIC PPI & expanding LIFO election scope to include used equipment and/or parts

- Dealers Already on LIFO

- Unprecedented inflation provides ideal opportunity for dealers not already on LIFO to elect for the 2021 year end

- Tax savings from LIFO begins accruing in the year of election, meaning these benefits would be reported on 2021 year end tax return

- 2021 tax savings from LIFO can not be retroactively recaptured by electing LIFO in a later period

- LIFO should be elected in a period of inflation, and companies considering electing LIFO risk forfeiting substantial tax savings by opting not to elect in 2021

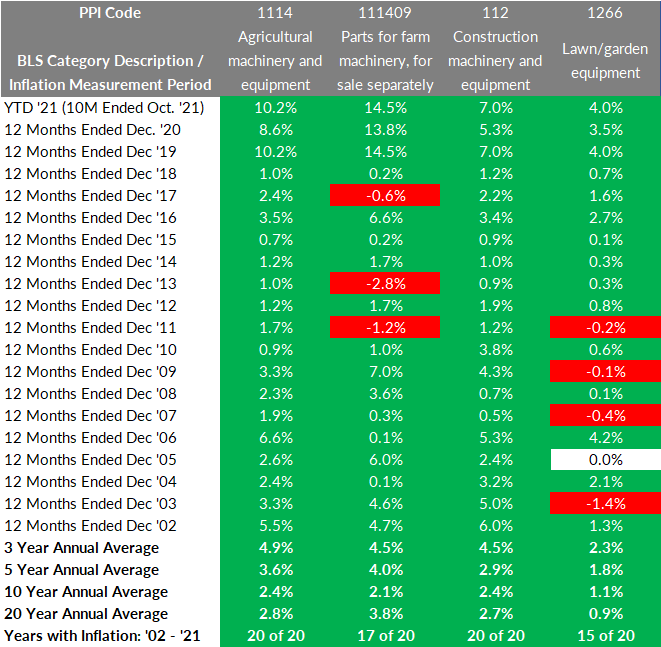

Machinery & Equipment Dealer BLS PPI Inflation

BLS PPI Historical Average Annual Inflation Rates

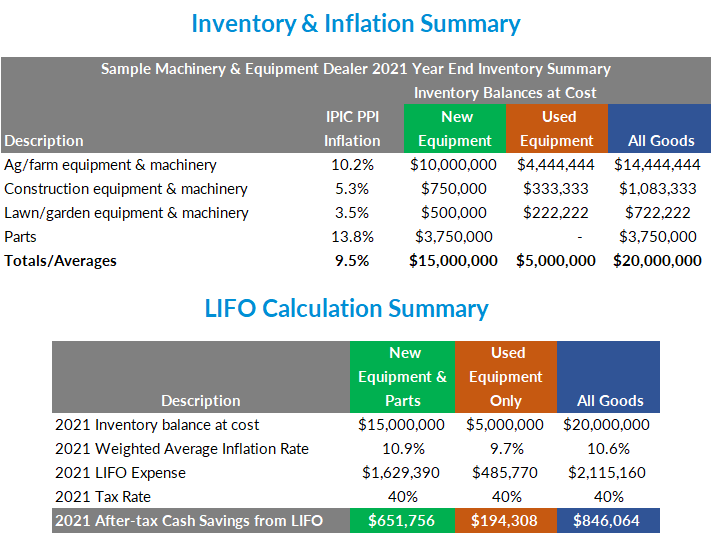

2021 IPIC CPI vs. Alternative LIFO Method After-tax Cash Savings Comparison

Other Considerations

- Dealers Not on LIFO

- Must report inventories at LIFO cost on financial statements in the same year that it’s elected on tax return

- Must file IRS Form 970 Application to Use LIFO Inventory Method with IRS Form 1120 (regardless of if filing on extended deadline or not)

- After-tax Cash savings begin accruing beginning in year of adoption i.e., prospectively, and can not be applied retrospectively for any prior periods for tax purposes (also treated as a prospective change for financial reporting purposes)

- Must wait five years to terminate LIFO election under automatic approval procedures; terminating election prior to being on LIFO for five years is advanced approval & requires $11,800 IRS Users Fee

- Dealers on LIFO

-

- IRS Form 3115 must be filed by return extended filing deadline to switch to IPIC method, but the switch is an automatic approval change

- Change is made prospectively on a cutoff basis, meaning prior year end LIFO reserve remains intact

- Must wait five years to switch back to alternative LIFO method

- Any preexisting lower-of-cost or market (LCM) reserves associated with used equipment inventories must be restored into income over a three year period beginning in the year of change if LIFO scope expansion is made to include used equipment

-

- All Dealers

- Lower-of-cost or market (LCM) reserve must be restored into income over a three-year period if:

- Adopting LIFO for the first time & including used equipment in election scope (assumption being that LCM reserve is exclusive to used equipment)

- Already on LIFO & expanding election scope to include used equipment

- Lower-of-cost or market (LCM) reserve must be restored into income over a three-year period if:

- Implementing LIFO or changing to the IPIC method

- LIFOPro offers turnkey outsourcing solutions to manage all aspects of your company’s LIFO calculation, including:

-

-

- Year end LIFO calculation & 3 interim estimates

- LIFOPro PDF report package providing comprehensive calculation documentation

- IRS LIFO election forms and/or IRS Form 3115 Change in Accounting Method preparation

- Estimated turnkey outsourcing solutions fee estimates are as follows:

- First year, including IRS Form 3115/970 preparation: $2,500 – $5,000

- Recurring annual service fee (optional): $1,000 – $3,000

-

-

- LIFOPro offers turnkey outsourcing solutions to manage all aspects of your company’s LIFO calculation, including:

Key Takeaways

- Machinery & equipment dealers not already on LIFO should consider electing LIFO for the 2021 year end using the IPIC method & PPI

- Machinery & equipment dealers already on LIFO using internally calculated inflation indexes or price books/lists should consider switching to the IPIC method using PPI for the 2021 year end, and also consider expanding LIFO election scope to include used equipment & parts

Complimentary IPIC PPI Tax Savings Analysis

- LIFOPro offers complimentary pro forma IPIC LIFO Benefit Analysis Report using your company’s actual product mix to quantify the 2021 IPIC PPI tax savings

- For companies considering electing LIFO, report includes How LIFO Works Appendix & includes details on the practical application of LIFO for first-time users

- Only need a breakdown of current & prior inventories at cost by the following groups:

- New ag/farm equipment & machinery

- New construction equipment & machinery

- New lawn/garden equipment & machinery

- Used equipment/machinery

- Parts

- Request your complimentary IPIC LIFO Benefit Analysis Report using one of the following methods:

- Complete questionnaire online: Machinery & Equipment Dealer Pro Forma IPIC Analysis Questionnaire

- Download & email completed questionnaire PDF file to lifopro@lifopro.com:

- Dealers on LIFO: Auto Dealer IPIC LIFO Benefit Analysis Questionnaire

- Dealers not on LIFO: Auto Dealer IPIC LIFO Election Benefit Analysis Questionnaire

- Recipients will receive complimentary analysis PDF report & fee quote via email within one week of questionnaire submittal

Machinery & Equipment Dealer Case Study PDFLIFO Q & A: New LIFO ElectionsTurnkey Outsourcing Solutions