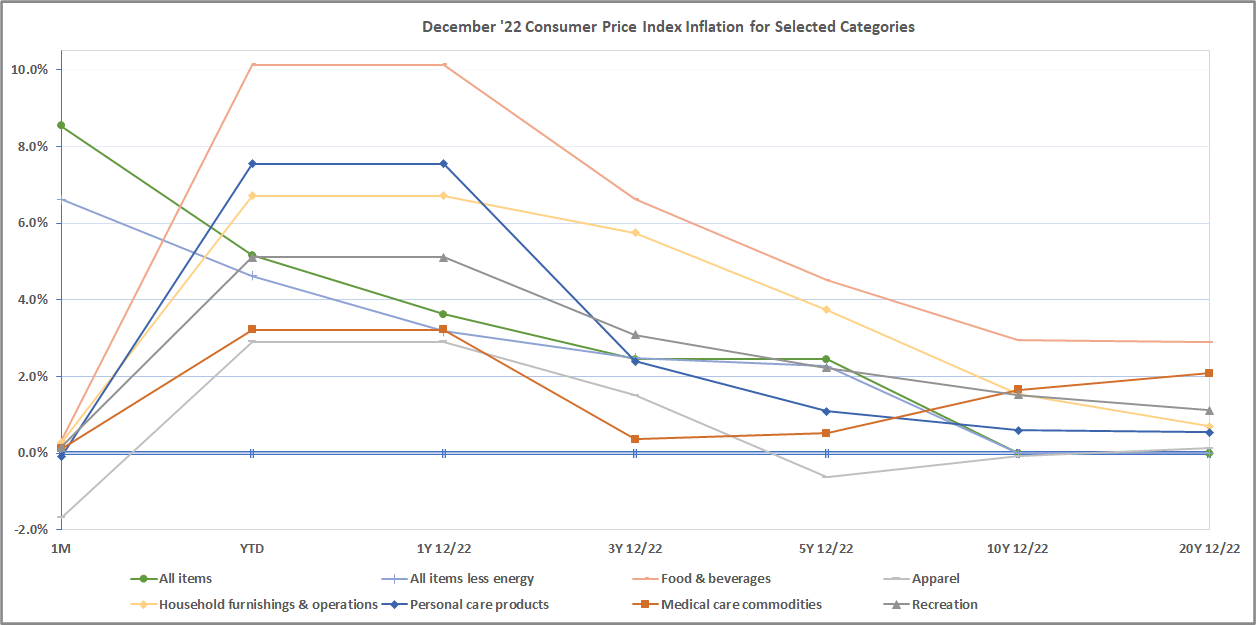

January 2023 CPI Release Highlights

The Bureau of Labor Statistics (BLS) released January 2023 Consumer Price Indexes (CPI) today. Highlights are as follows (all indexes are on a seasonally unadjusted basis): All items decreased by 0.1% in the last month and rose 6.4% in the last twelve months All items, less energy, increased 0.3% from December 2022 and rose 6.4% […]