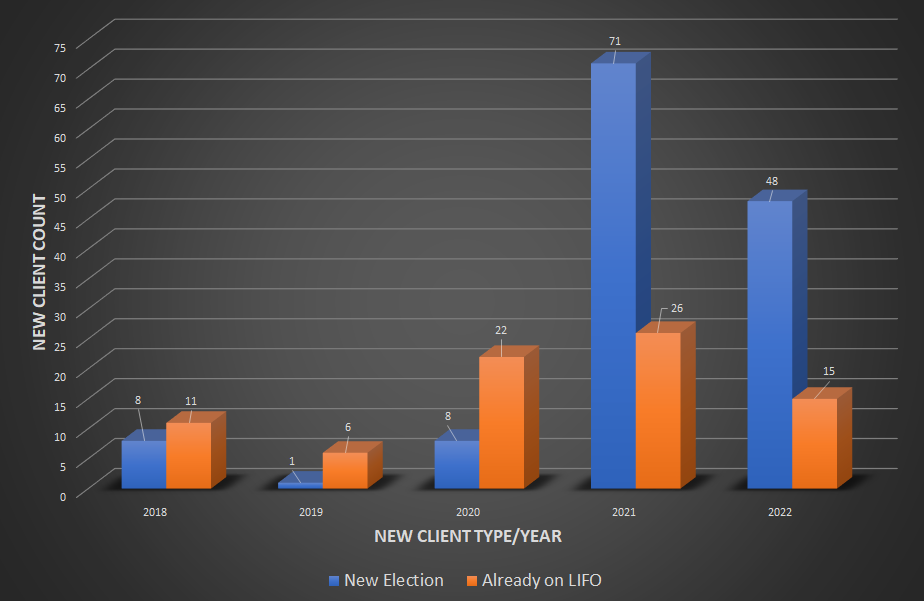

What has Caused the Surge in First-time LIFO Elections?

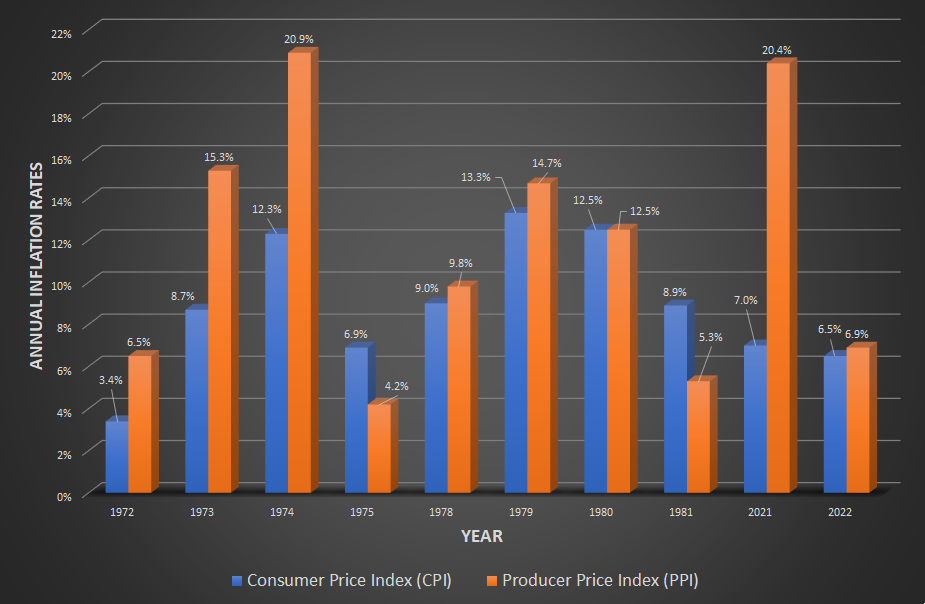

LIFOPro has seen a nearly 40% increase in first-time LIFO elections amongst new clients between 2021 – 2022. The primary cause of this record number of companies electing LIFO has been the highest inflation seen in 40 years over the last two years, which translated into material tax benefits from adopting LIFO and companies being highly incentivized to elect LIFO during this period. In 2021, the PPI inflation was 20% & the CPI inflation was 7%. In 2022, the CPI and PPI inflation was roughly 7%. These rates are extremely elevated compared to the Federal Reserve’s 2% inflation mandate. See the figures below.

Figure 1. LIFOPro’s New Client Statistics: 2018 – 2022

Figure 2. Bureau of Labor Statistics Consumer/Producer Price Index (BLS CPI/PPI) Inflation Rates for Selected Periods

Understanding the Tax Benefits of LIFO

Generally speaking, there is a straightforward formula to quantify the tax benefits or savings from LIFO, which is as follows:

Current year taxable income reduction from LIFO (also known as LIFO expense): Prior year inventory balance x Current year inflation rate

Current year tax liability reduction from LIFO (after-tax cash savings): Current year LIFO expense x Current year combined federal + state tax rate

LIFO Tax Benefit Example

Prior year inventory balance: $5M

Current year inflation rate: 10%

Current year federal + state tax rate: 30%

Current year LIFO expense: $5M x 10% = $500K

Current year after-tax cash savings: $500K * 30% = $150K

Understanding the “Election Year Inflation Multiplier”

For most companies on LIFO, the long-term historical average annual inflation rates vary between 1% – 4%. With the record-high inflation that’s occurred over the last two years, the “election year vs. long-term historical average annual inflation rate multipliers” were between 2 – 10 over the last 2 years. For example, a company with a 10% inflation in the election year and a 2% long-term historical average annual inflation rate would have an election year inflation multiplier of 5 (10% current year inflation rate ÷ 2% long-term average = 5). As a result, companies electing LIFO over the last two years obtained many years’ worth of tax benefits in the adoption year alone when compared to the historical average inflation rates. Because of this, LIFOPro recommends electing LIFO in a period where the election year inflation multiplier greater than or equal to 1. Knowing this, it’s easy to see why a record number of companies electing LIFO during a time of high inflation.

Why the Timing of Electing LIFO is Key

The timing of the LIFO election is important because LIFO is required to be applied prospectively for tax purposes. For example, if a company had 10% inflation in 2022 and 2% inflation in 2023, the LIFO election would have to occur for the 2022 year-end in order to obtain the tax benefits of the high inflation. Because of this, it’s very common for companies to elect LIFO when inflation rates are at or above the historical averages. Another reason why it’s advantageous to elect LIFO during a period of high inflation is that it eliminates the chance of materially recapturing the LIFO reserve in a future period. For example, let’s assume there was 10% inflation in the election year, but it was then proceeded by 2% deflation in each of the next two years. Under this scenario, you’d still have a cumulative inflation rate of 6% over a three-year period, and you’d still have 60% of your LIFO reserve remaining after the third year on LIFO despite having deflation in the second and third year. Conversely, let’s assume you elected LIFO when there’s 2% inflation, but also have 2% deflation in each of the next two years. Under this scenario, you’d have cumulative deflation rate of 2% over a three-year period, which would create what’s called a debit balance or negative LIFO reserve (meaning more taxes were paid from being on LIFO compared to if you weren’t on LIFO). Because of this, LIFOPro recommends obtaining a complimentary, no-obligation LIFO election benefit analysis report from us. Our thorough analysis helped demonstrate for countless companies the benefit of electing LIFO and undoubtedly played a role in the record number of companies electing LIFO through LIFOPro. This free case study includes the following:

- 20-year pro forma LIFO calculation (using current period’s product mix & Bureau of Labor Statistics Consumer/Producer Price Index inflation rates), including calculation of 20-year average annual inflation rate

- Current year LIFO calculation using internal & external indexes

- Current vs. 20-year average annual inflation rate multiplier

- Good LIFO candidate determination & current year LIFO election recommendation (LIFOPro recommends deferring LIFO election to a later period if the inflation multiplier is less than 1)

Sample LIFO Election Benefit Analysis Report

LIFO Tax Savings Calculator

Request a Free LIFO Benefit Analysis

2023 Top LIFO Election Locks