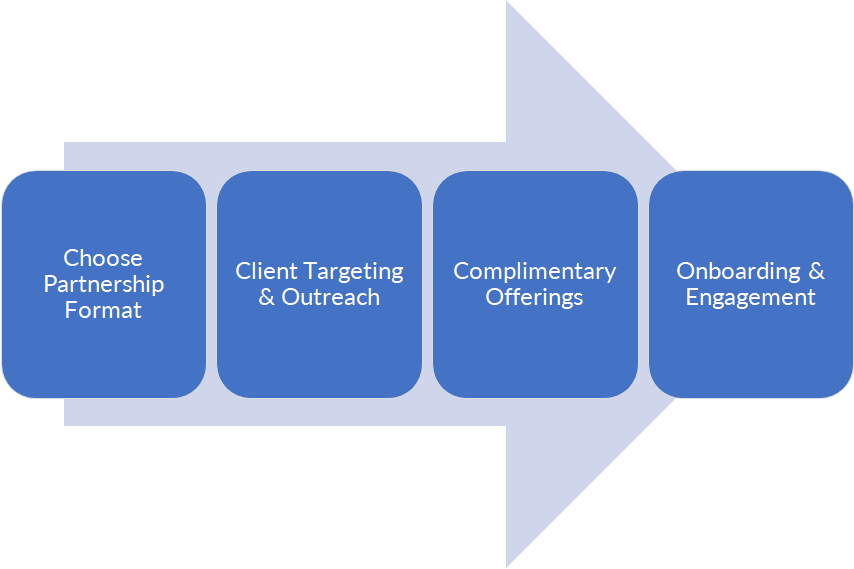

LIFOPro partners with CPA firms & their clients to provide a complete range of complimentary resources, complimentary offerings & outsourcing solutions

The IRS may terminate a taxpayer’s LIFO election if the taxpayer fails to comply with any of the requirements listed above. See Rev. Proc. 79-23, Sec. 3.01.

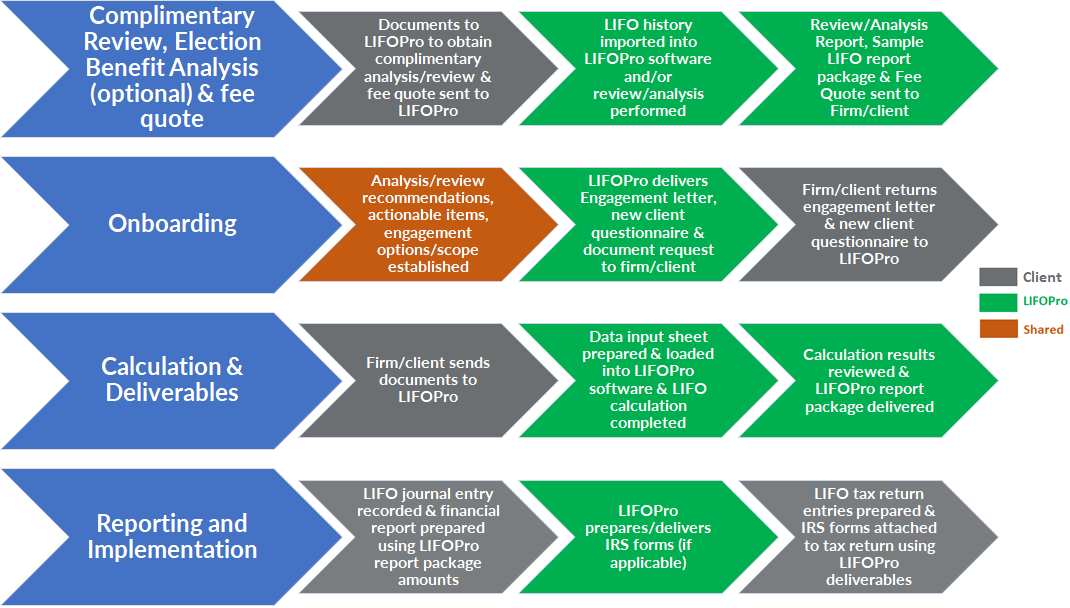

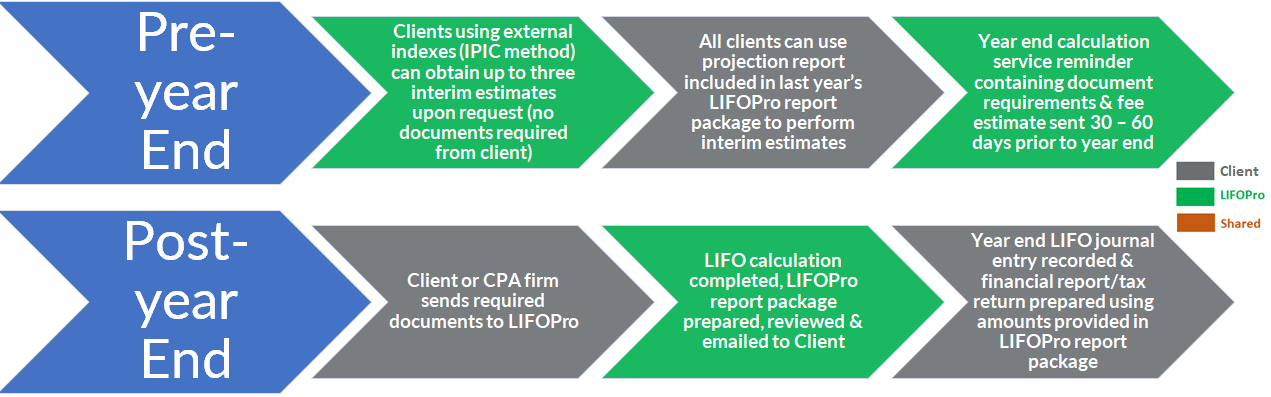

LIFOPro Outsourcing Engagement Process Flow: Recurring Annual Calculation Services

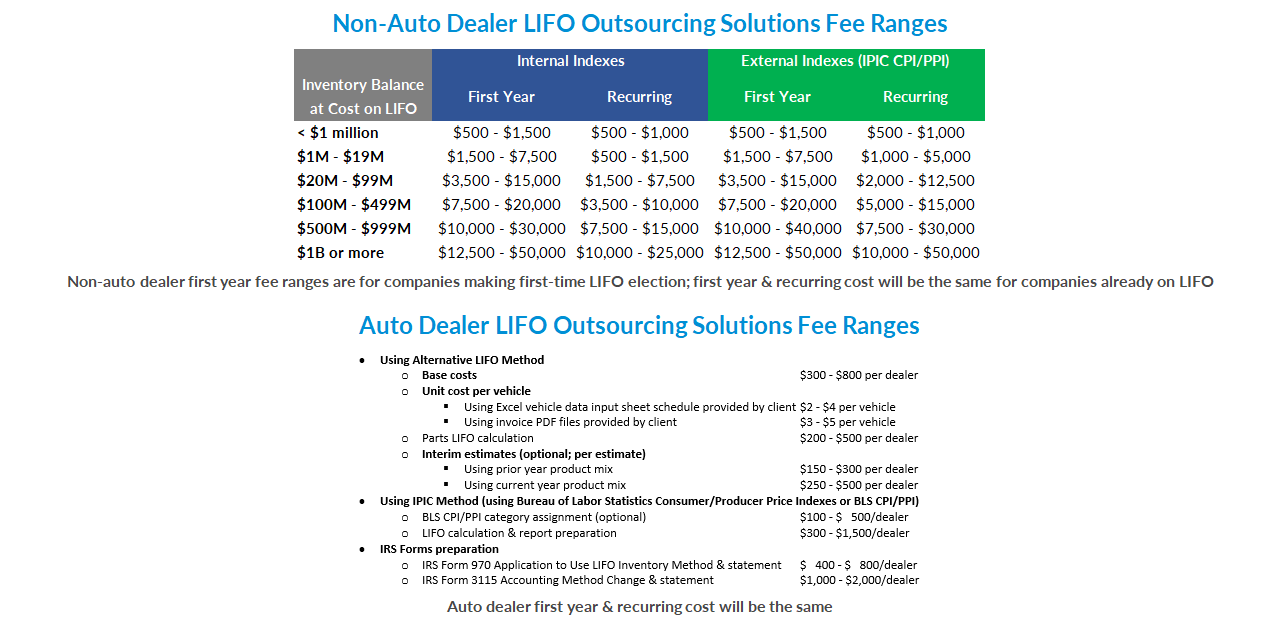

LIFOPro strives to provide the highest quality of services at the most competitive prices, and we promise to provide an outsourcing solution that fits your CPA firm’s or client’s budget. Fees listed below are general estimates.

Guides

Sample Reports

LIFOPro makes it simple for companies to quickly obtain accurate estimates of the projected tax savings from electing LIFO this year. Get your complimentary analysis PDF report & turnkey outsourcing solutions fee quote within one week of submitting your request!

Learn MorePlug in your client's inventory balance, tax rate & year to date inflation rate to quickly estimate the projected tax savings from LIFO this year. Use LIFOPro's online inflation table to easily identify year to date inflation rates.

Learn MoreHave a phone call or WebEx with the LIFO-PRO team to get started today or learn more about our offerings. Schedule online using our easy-to use booking tool.

Schedule Call or DemoRequest a complimentary LIFO Calculation, Methods & Best Practices Review Report, cost estimate or complete our online NDA at our Request Forms page.

Request Forms PageTrial the software for 90 days. Get a complimentary review. Request a cost estimate. Use our simple request form to get your complimentary offering today!

Sign up today to receive industry news & promotional offers from LIFO-PRO