There’s still time left to maximize LIFO tax savings for the 2022 year end! Companies with March, June or September year ends will likely have once in a lifetime, tax savings opportunities from electing LIFO and/or switching to the IPIC method. For companies switching to IPIC CPI or considering electing LIFO for the first time, LIFOPro offers free analysis & turnkey outsourcing solutions at affordable costs with lightning fast turnaround time.

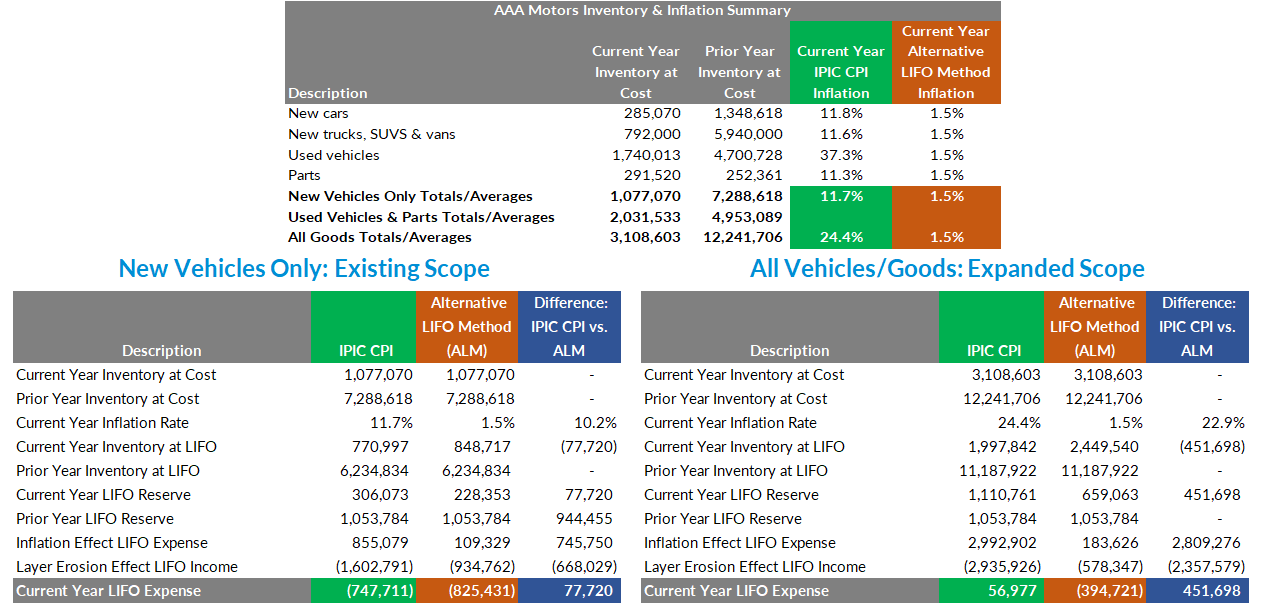

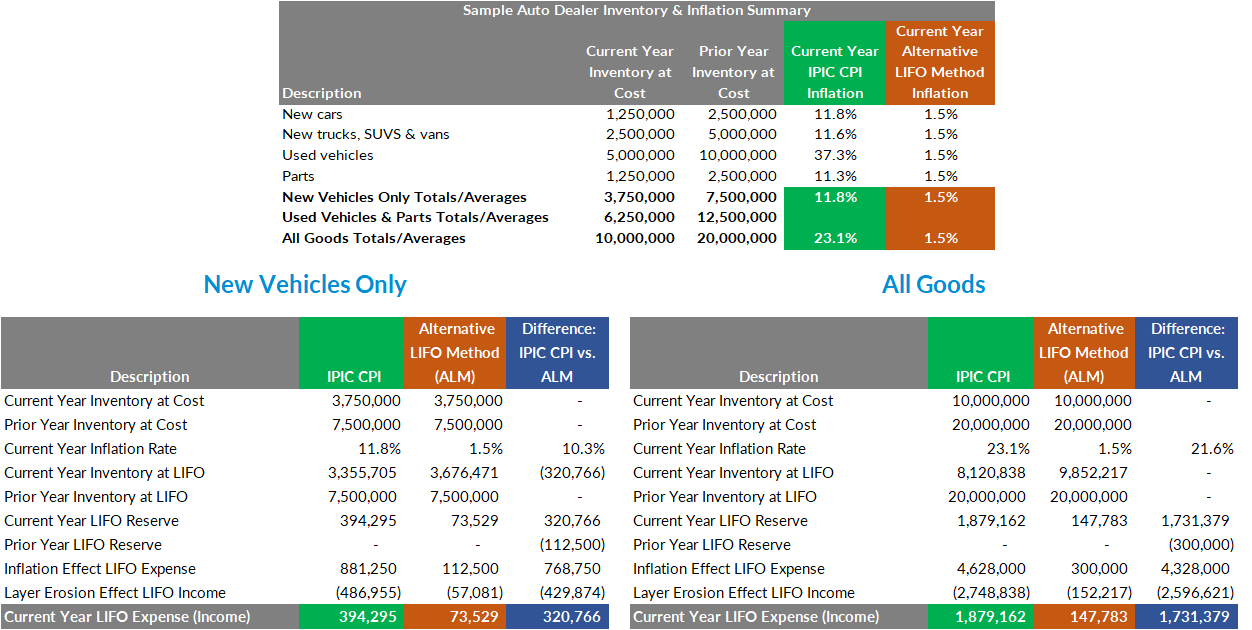

Case Study #1: AAA Motors

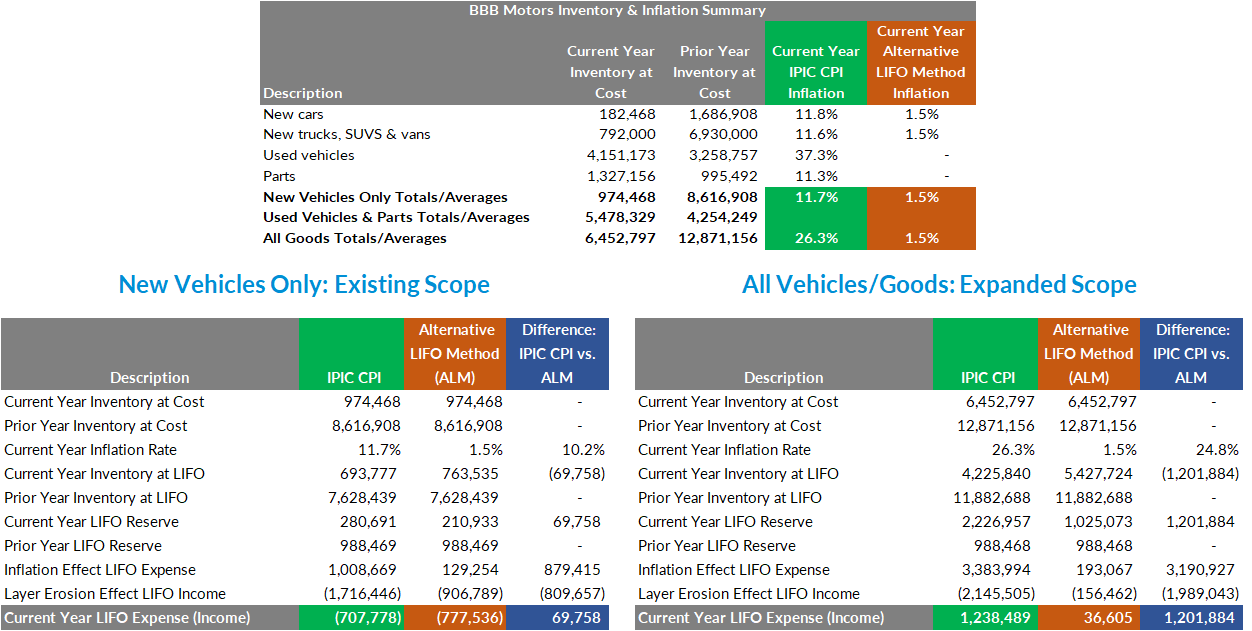

Case Study #2: BBB Motors

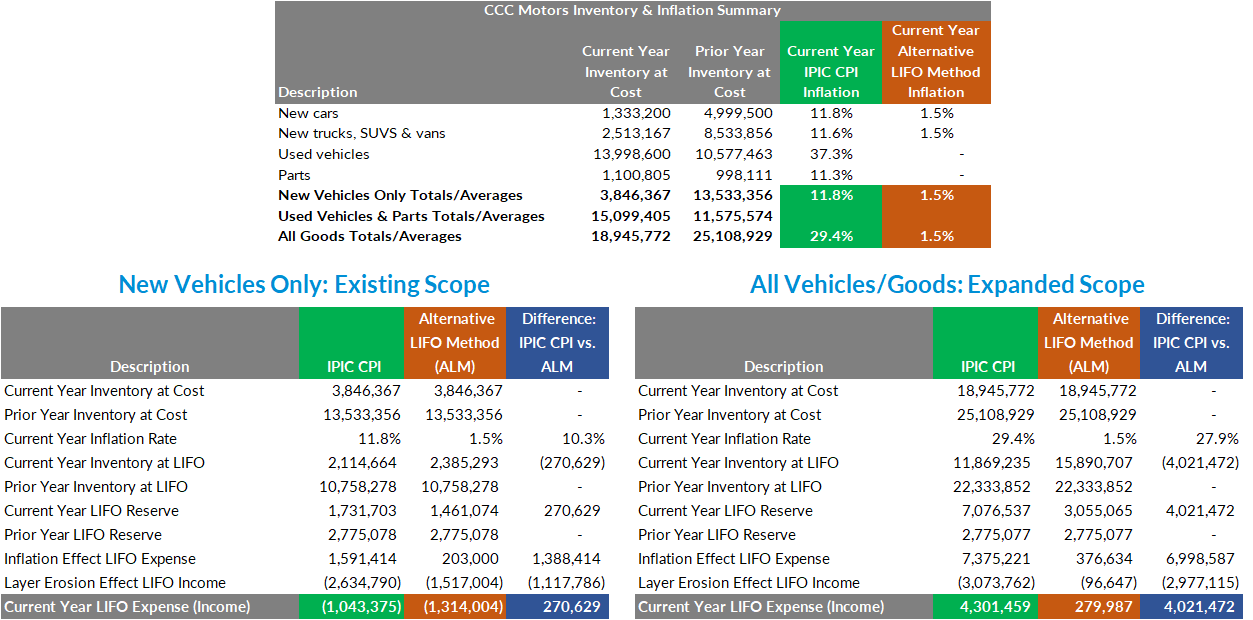

Case Study #3: CCC Motors

Sign up today to receive industry news & promotional offers from LIFO-PRO