- Alternative LIFO method (ALM): Measures inflation based on comparing current & prior period’s invoice costs; Item definition is specific to each vehicle/VIN, meaning inflation must be calculated for each vehicle, not just by make or type (car, truck, SUV)

- Pros

- Historically created more inflation & tax deferral than IPIC method until 2020

- IRS safe harbor method & used by many auto dealers since its inception

- Cons

- Inflation calculation is materially more burdensome than IPIC since invoice costs must be compared on a vehicle-by-vehicle basis

- Interim estimates take more time than IPIC method since inflation is measured by invoice cost

- Year end calculations require more turnaround time since inflation data typically isn’t available until after year end

- Typically materially higher outsourcing costs than IPIC method

- Pros

- IPIC method: Measures inflation by using Bureau of Labor Statistics Consumer/Producer Price Indexes (BLS CPI/PPI); Item definition are the BLS categories, which is New cars, New trucks, SUVs & minivans, Used vehicles & Parts

- Pros

- Inflation calculation is materially less burdensome since inventory breakdowns by 3 – 5 BLS categories are used, which precludes the need to utilize invoice costs to calculate inflation

- IRS safe harbor method & has grown exponentially in popularity over the last three years

- Interim estimates can be easily performed on demand since they can be made using the most recent BLS index release

- Year end calculations can be completed more quickly than ALM calculations since an appropriate month other than the year end month can be used to complete inflation calculation (i.e. November PPI can be used for December year end)

- Typically materially lower outsourcing costs than ALM

- Cons

- Prior to pandemic, creased less inflation & tax deferral than ALM

- Pros

- Most auto dealerships used the alternative LIFO method (ALM) up until the pandemic

- Many auto dealers also excluded used vehicles from LIFO election scope up until the pandemic

- Many auto dealers either elected LIFO using IPIC or changed to the IPIC method in 2020 – 2021 for the following reasons:

- 2021 CPI New vehicle inflation was 12% compared to 1% – 4% ALM inflation, which afforded the opportunity for dealers to avoid most or all LIFO recapture that would otherwise have occurred under ALM

- CPI Used vehicle inflation in 2021 was 37% & parts inflation was 11% which afforded dealers ability to expand LIFO election scope to include used vehicles/parts & further maximize LIFO tax benefits

- 2022 inflation environment is as follows:

- IPIC method

- 12M ended Oct. ‘22 IPIC CPI inflation is 8% – 10% for new vehicles, 2% for used vehicles & 12% for parts (see next slide)

- 12M ended Nov. ‘22 IPIC PPI inflation is 2% for cars, 7% for trucks/SUVS/minivans & 4% for parts (BLS does not publish separate new vs. used PPIs unlike CPI, so a single PPI is used for new/used cars & new/used trucks, SUVs & minivans)

- New vehicle ALM

- Non-domestic manufacturers: Average is 3%, but has been as low as 1% & as high as 4%

- Domestic manufacturers: Average is around 6%, but has been as low as 3% & as high as 10%

- Used vehicle ALM: Unknown, but likely to be deflation

- IPIC method

- Opportunities & Strategies for Dealers on LIFO

- Depending on ALM inflation, switch to IPIC method from ALM could create materially higher tax benefits on new vehicles, especially for imported vehicles

- Tax benefits could be maximized by expanding LIFO election scope to include used vehicles and/or parts and switching to IPIC method

- Opportunities & Strategies for Dealers not on LIFO

- Many years worth of LIFO tax deferral can be obtained in election year by adopting in 2022 with inflation being at or near record highs, and election can be made using the lowest administrative burden & outsourcing costs

- Tax benefits from LIFO can be maximized by including used vehicles and/or parts in election scope

- Opportunities & Strategies for All dealers

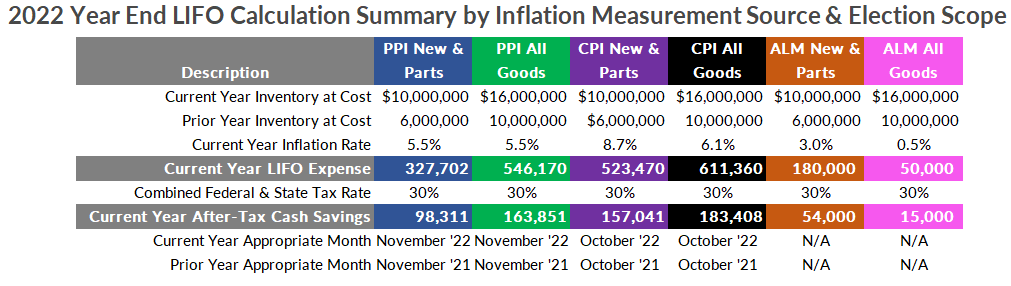

- If switching to IPIC method & only new vehicles are to be included in election scope, CPI should be used since the inflation for new vehicles is higher than PPI

- If electing LIFO or switching to IPIC method and including used vehicles and/or parts in election scope, CPI or PPI could be used depending on the appropriate months selected and proportion of new vs. used vehicles inventories & cars vs. SUVs/Trucks/minivans/crossovers balances

- Quick LIFO Expense Formula Analysis for incorporating IPIC method estimate into P12 financial statements:

- Input #1: Estimated prior year inventory balance at cost for all goods to be included in LIFO election scope for 2022 year end

- Input #2: Estimated current year CPI/PPI inflation rate for all goods to be included in LIFO election scope for 2022 year end

- IPIC LIFO expense calculation example for P12 financial statement estimate:

- 2021 year end inventory balance at cost for new vehicles, used vehicles & parts: $10M

- 2022 year end estimated CPI/PPI inflation for all goods: 7%

- 2022 year end IPIC LIFO expense (LIFO reserve increase) for P12 financial statement estimate: $10M * 7% = $700K

- First-time LIFO elections

- LIFO conformity requirement

- Estimated LIFO value must be reported on Period 12 financial statements issued to external parties (OEM’s, floorplan lenders, banks/creditors, shareholders/owners)

- Actual LIFO value must be reported on Period 13 financial statements issued to external parties

- Conformity should be considered top priority as IRS considers violating this rule to be grounds for terminating election

- Use of IPIC method streamlines incorporating LIFO into P12/P13 financial statements since all that’s required to perform interim estimate & final calculation are balances by vehicle type

- When using IPIC method, P12 2022 estimated LIFO value can be incorporated into year end financial statements as early as December 9th/13th since November CPI/PPI are released on those dates

- When using IPIC, 12M ended November PPI can be used to complete final LIFO calculation to facilitate quick close & incorporating actual LIFO value into P13 financial statement (BLS releases November ’22 indexes on December 9th/13th)

- IRS forms filing

- IRS Form 970 Application to use LIFO Inventory Method & statement must be prepared and attached to tax return

- No Form 3115 is filed for first-time elections since Form 970 serves as a special purpose Form 3115

- Implications of submethods selected for initial election & potential future changes

- Election year Submethods selections are considered first-time elections

- IPIC method & ALM are both safe-harbor methods, meaning:

- IRS has allowed for changes to/from IPIC & ALM to be automatic approval changes that are applied on a cutoff basis (prospectively; no §481A adjustment required nor permitted)

- Certain changes within IPIC & ALM are also considered automatic approval change and can be made as soon as the second year on LIFO, such as change to/from CPI to PPI

- LIFO conformity requirement

- Dealers already on LIFO

- First-time changes to IPIC method and/or LIFO election scope expansions

- For dealers expanding election scope to include used vehicles and/or parts, P12 financial statements MUST SHOW ESTIMATED LIFO VALUES FOR BOTH NEW AND USED VEHICLES

- P12 2022 estimated LIFO value using IPIC method should be incorporated into P12 year end financial statements NOW if expanding election scope to include used vehicles or parts to ensure LIFO conformity rule compliance

- Current period inventory balances or estimated year end balances & year to date or 12M ended October/November CPI/PPI can be used as an easy way to quickly incorporate LIFO estimate into P12 statements

- 12M ended October/November PPI can be used to complete final LIFO calculation to facilitate quick close & incorporating final LIFO value using actual year end balances by type into P13 financial statement

- Change from ALM to IPIC method is automatic approval change & is applied prospectively

- Change to IPIC method requires for Form 970/3115 to be prepared, which is attached to tax return (

- Subsequent changes following making a switch to IPIC method

- Once the switch to IPIC from ALM is made, taxpayer must wait five years until a change back to the ALM can be made under automatic change procedures

- For dealers switching from ALM to IPIC, a switch can be made from CPI to PPI or PPI to CPI as soon as the second year using the IPIC method (but must wait five years following changing between CPI/PPI for the first time)

- First-time changes to IPIC method and/or LIFO election scope expansions

- All dealers

- Vast majority of dealers who elected/switched to IPIC method in 2021 used CPI because CPI used vehicles inflation was 37% & provided far more inflation/tax benefits than PPI (PPI inflation was 2% – 4% in 2021)

- In 2022, all dealers who elected/switched to IPIC method in 2022 & will include used vehicles and/or parts in election scope should use PPI since used vehicles will have between 2% – 6% inflation under PPI, but would have deflation under CPI

- Historical PPI inflation rates & frequency has been more favorable than CPI from a tax perspective, so despite the CPI inflation being much better than PPI in 2021, the 2022 & long-term inflation/tax benefits from LIFO using PPI can be expected to be more favorable & less volatile than CPI (especially for used vehicles)

IPIC Benefit Analysis Request Form

- LIFOPro offers free IPIC LIFO Benefit Analysis for auto dealers considering changing to IPIC method or electing LIFO, and will facilitate expedited turnaround to use your analysis results as the estimated LIFO estimate figure on P12 financial statement

- For dealers on LIFO, analysis includes the following:

- Comparative IPIC CPI vs. Alternative LIFO method calculation results, including estimated tax deferral/savings from switch

- Breakdowns of including new vehicles only vs. expanding scope to include used vehicles and/or parts & using CPI vs. PPI

- For dealers electing LIFO, analysis includes the following:

- Potential tax deferral/savings you could achieve from electing LIFO

- How LIFO Works Appendix (includes details on practical application of LIFO for first-time users), implementation steps & turnkey outsourcing solutions fee quote

- Benefit analysis documentation requirements:

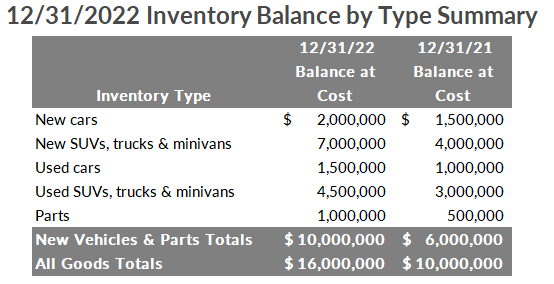

- Breakdown of current & prior period’s inventory balances at cost by the following types:

- New cars

- New SUVs, trucks, vans & crossovers

- Used cars

- Used SUVs, trucks, vans & crossovers

- Parts

- Breakdown of current & prior period’s inventory balances at cost by the following types:

- How to Get Started

- Request your complimentary IPIC LIFO Benefit Analysis using one of the following methods:

- Complete questionnaire online: Auto Dealer IPIC LIFO Benefit Analysis Request Form

- Download questionnaire PDF file, fill in required fields & email to LIFOPro:

- Dealers already on LIFO: Auto Dealer IPIC LIFO Benefit Analysis Questionnaire

- Dealers not on LIFO: Auto Dealer IPIC LIFO Election Benefit Analysis Questionnaire

- Recipients will receive free analysis/case study PDF report & fee quote via email within one week of questionnaire submittal, but expedited turnaround time as soon as same day can be accommodated upon request

- Benefit analysis will include outsourcing fee quote

- LIFOPro offers turnkey outsourcing solutions to manage all aspects of your company’s LIFO calculation, including:

- Year end LIFO calculation & 3 interim estimates

- LIFOPro PDF report package providing comprehensive calculation documentation

- IRS Forms preparation, including:

- Auto dealers on LIFO: IRS Forms 970 & 3115 – both Forms are required to be filed & attached to 2022 year end tax return for switch from ALM to IPIC method

- Auto dealers electing LIFO: IRS Form 970 Application to Use LIFO Method

- Estimated turnkey outsourcing solutions fee ranges are as follows (dependent on number of dealerships inventory balance)

- First year, including IRS Form 3115/970 preparation & three interim estimates: $1,000 – $5,000

- Recurring annual service fee (optional) including three interim estimates: $400 – $2,000

- LIFOPro offers volume discounts to CPA firms engaging LIFOPro directly on behalf of their clients

- LIFOPro also licenses the LIFOPro software to CPA firms who wish to automate calculating LIFO in-house for their clients

- LIFOPro facilitates fast turnaround to accommodate quick-closes and to ensure LIFOPro report package is delivered in time to incorporate estimated & final LIFO values required to be included on P12/P13 financial statements