UPDATED 1/29/25 TO INCLUDE DECEMBER 2024 BUREAU OF LABOR STATISTICS INFLATION RATES!

View/Download the PDF report version of this guide or our 2024 Top LIFO Candidates List Excel file by clicking the buttons below!

LIFOPro's 2024 Top LIFO Election Candidates Guide PDF Report

LIFOPro's Top 2024 LIFO Election Candidates List Excel File

LIFOPro’s 2024 Top LIFO Election Candidates List

LIFOPro’s 2024 top LIFO election candidates list provides you with the ability to quickly accomplish the following:

- Determine if a company or industry is a good LIFO candidate (establish that LIFO is a preferable method for a given industry/commodity)

- Determine if a company or industry is a top LIFO election candidate for the 2024 year end (meaning meaningful tax benefits from a 2024 LIFO election for a given industry/commodity)

- Estimate 2024 & long-term LIFO tax benefits

- Perform LIFO cost/benefit analysis (or obtain a free comprehensive benefit analysis report from LIFOPro)

- Quickly calculate your company or client’s estimated 2024 LIFO reserve & LIFO inventory value (which can be used to record a LIFO adjustment, present 2024 year end financial statements on a LIFO basis & ensure IRS LIFO conformity rule compliance)

LIFO Tax Savings Opportunities Abound

Although inflation has returned to a more normalized level, there are many industries with inflation at or above the historical levels & will be good LIFO election candidates for the 2024 year end. The best opportunities will be in the following areas:

- Processed foods & beverages – 4% inflation

- Meats, poultry & fish – 10% inflation

- Dairy products – 5% inflation

- Canned fruits & juices – 4% inflation

- Frozen fruits, juices & ades – 19% inflation

- Sugar & confectionery – 15% inflation

- Refined sugar – 11% inflation

- Confectionery materials – 49% inflation

- Confectionery end products (candy & snacks) – 8% inflation

- Beverages & beverage materials – 4% inflation

- Soft drinks – 7% inflation

- Packaged beverage materials (including coffee & tea) – 12% inflation

- Paper & paper products – 3% inflation

- Converted paper & paperboard products – 3% inflation

- Publications, printed matter & printing material – 3% inflation

- Machinery & equipment – 3% inflation

- General purpose machinery & equipment – 3% inflation

- Pumps, compressors & equipment – 5% inflation

- Material handling equipment – 4% inflation

- Fluid power equipment – 6% inflation

- Motors & generators – 7% inflation

- Switchgear, switchboard, industrial controls equipment – 7% inflation

- Instruments (including environmental controls and process control instruments) – 4% inflation

- Nonmetallic materials & products – 4% inflation

- Concrete ingredients & related products – 7% inflation

- Construction sand, gravel & crushed stone – 8% inflation

- Insulation materials 8% inflation

- Transportation equipment (including PPIs used by auto dealers)

- Motor vehicles (including cars, crossovers, trucks, SUVs & minivans) – 2% inflation

- Motor homes – 2% inflation

- Aircraft & aircraft equipment (including parts) – 4% inflation

- Miscellaneous products – 6% inflation

- Sporting goods & athletic goods – 4% inflation

- Small arms & ammunition – 3% inflation

- Tobacco – 12% inflation

- Personal & industrial safety equipment & clothing – 4% inflation

LIFOPro’s list of 2024 top LIFO election candidates are shown further below, and instructions for quickly identifying , and the Top LIFO election candidates tables are shown below the instructions. Alternatively, view/download LIFOPro’s 2024 Top LIFO Election Candidate List Excel file by clicking this link: LIFOPro’s 2024 Top LIFO Election Candidates List Excel File

Why Use LIFO?

When there’s inflation, LIFO creates a tax benefit by lowering the inventory value and increasing cost of goods sold, which in turn reduces taxable income. The LIFO method (last-in, first-out) is the most beneficial inventory-based tax savings strategy because it uses inflation to create material long-term benefits (LIFO creates a tax benefit when there’s inflation), and tens of thousands of companies use LIFO because of this (most companies use LIFO in perpetuity after an election is made since the tax benefits become bigger for every subsequent inflationary period). Since the LIFO tax benefit amount is primarily tied to the amount of inflation measured in a given period (for example, a 5x bigger LIFO tax benefit will occur in a period with 10% inflation compared to a period with 2% inflation), thousands of companies have elected LIFO over the past few years because of the unprecedented inflation that’s occurred during this period.

Quick LIFO Tax Benefit Formula

- Current year taxable income reduction from LIFO (also known as LIFO expense): Prior year inventory balance * Current year inflation rate

- Current year tax liability reduction from LIFO (aka tax deferral or after-tax savings from LIFO): Current year LIFO expense * Current year combined federal and state tax rate

LIFO Tax Benefit Example

- Inputs

- Prior year end inventory balance: $10M

- Current year inflation rate: 5%

- Current year combined federal & state tax rate: 30%

- Outputs

- Current year LIFO expense: $10M * 5% = $500K

- Current year after-tax cash savings from LIFO: $500K * 30% = $150K

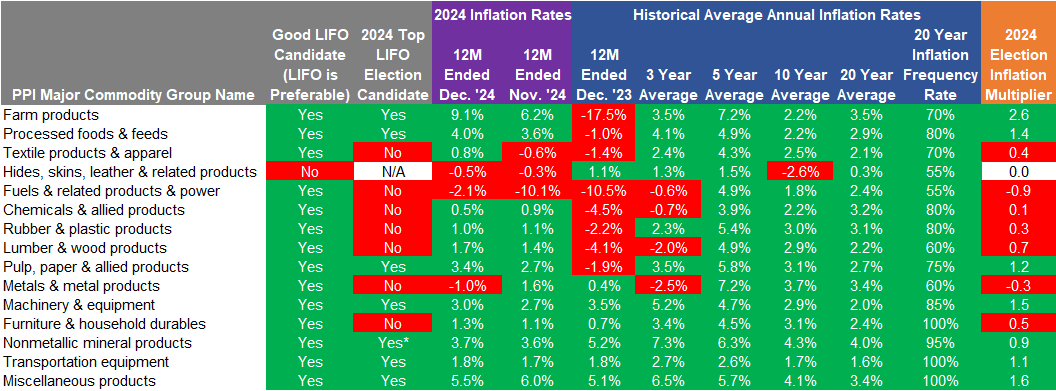

Table 1. Top 2024 LIFO Election Candidates by BLS PPI Major Commodity Group

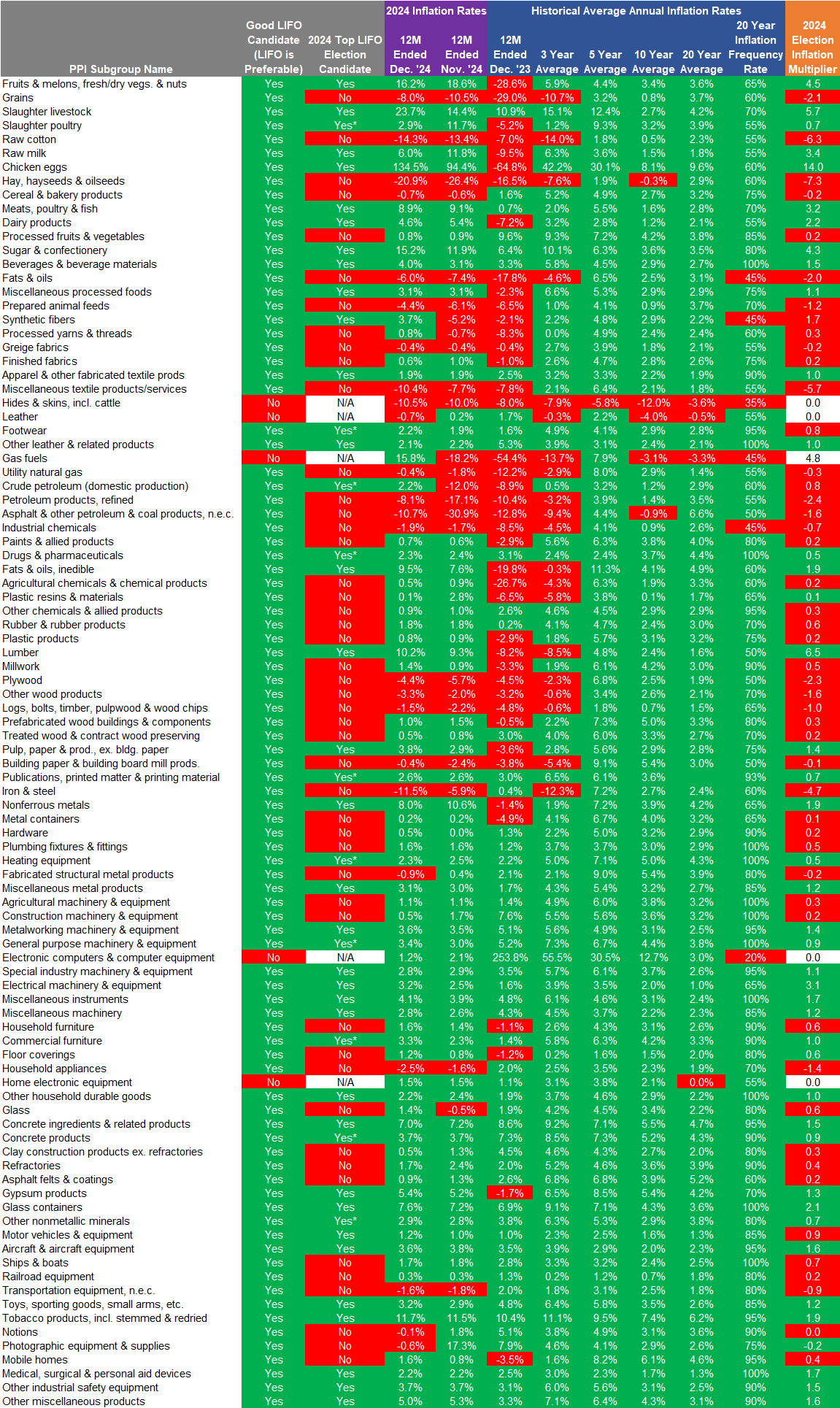

Table 2. Top 2024 LIFO Election Candidates by BLS PPI Subgroup

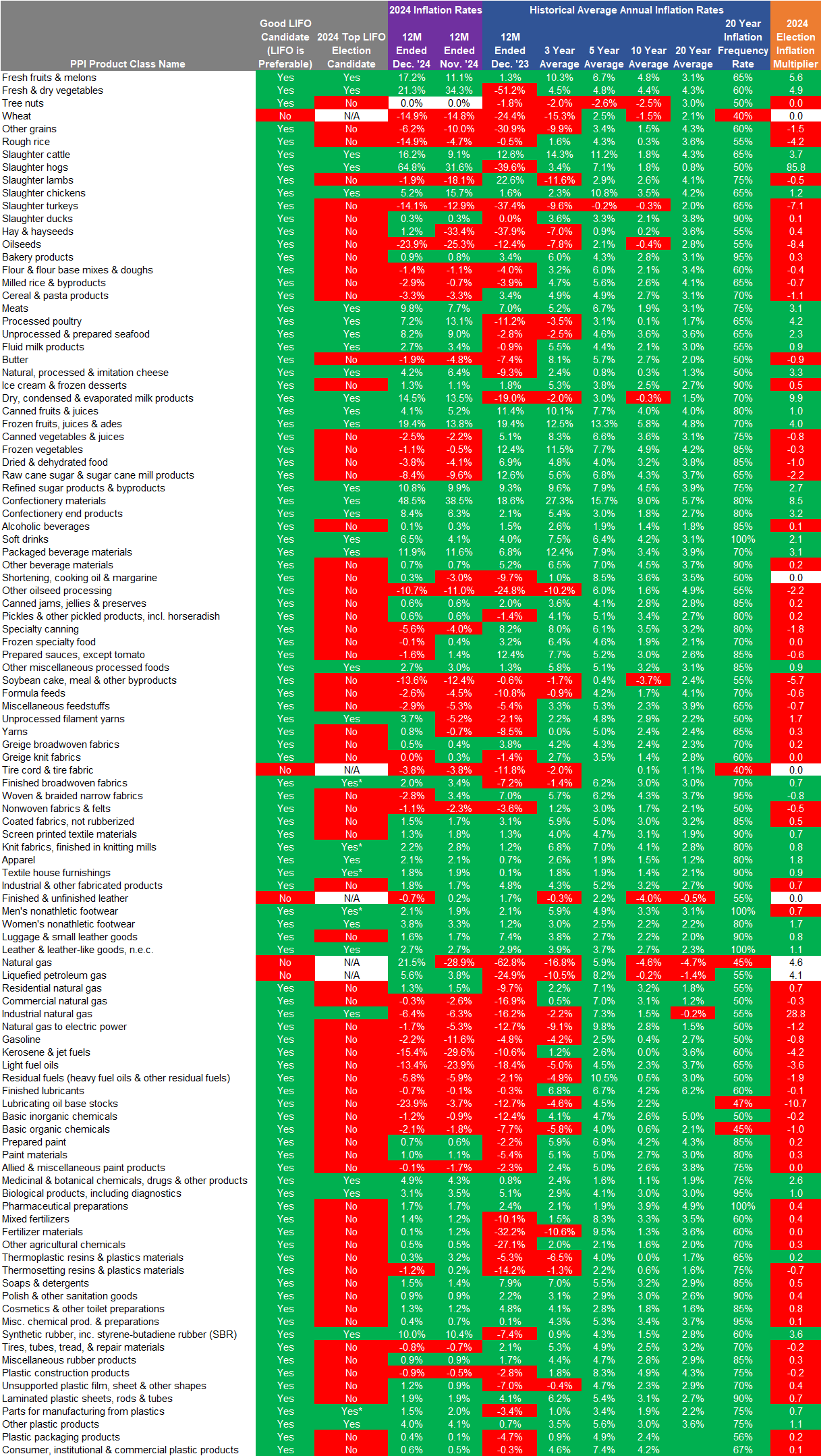

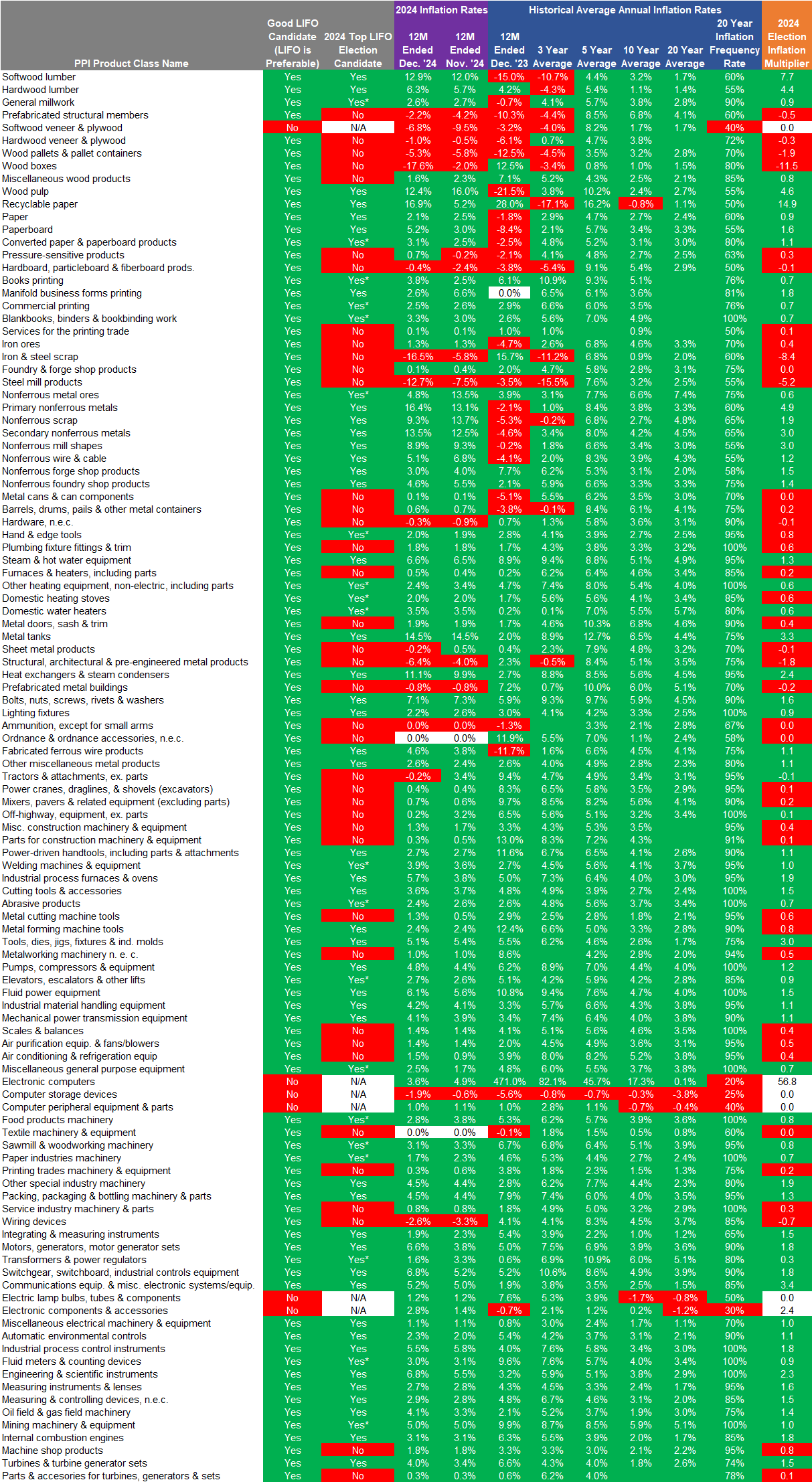

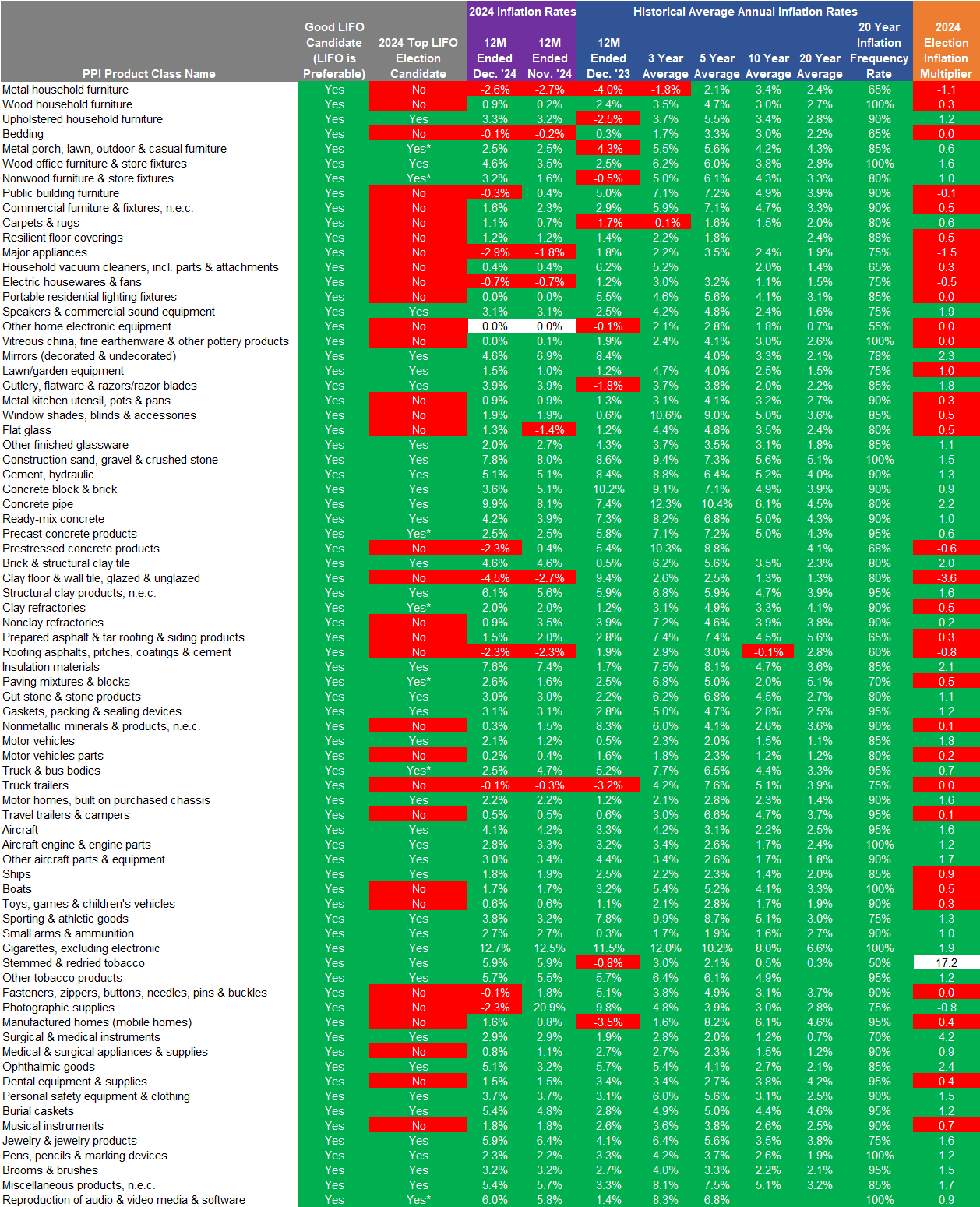

Table 3.1 Top 2024 LIFO Election Candidates by BLS PPI Product Class

Table 3.2 Top 2024 LIFO Election Candidates by BLS PPI Product Class

Table 3.3 Top 2024 LIFO Election Candidates by BLS PPI Product Class

LIFOPro’s 2024 Top LIFO Election Candidates Tables

- Major commodity group (Table 1)

- BLS PPI major commodity groups are the least-granular or broadest BLS groupings, and there are a total of 15 major commodity groups. For example, the Processed foods & feeds major commodity group includes the most goods most predominantly carried by a food wholesaler/retailer.

- The major commodity group table is best suited for the following situations:

- CPA firms seeking to identify the 2024 top LIFO election candidates at an industry level that will be used to create a list of clients that will be targeted to explore a LIFO election (will likely be the most suitable table to use since your clients can be more easily organized into the broadest groupings)

- The major commodity group may be most suitable for certain companies that carry a broad range of products. For example, the major commodity group table would be most suitable for a food wholesaler/retailer for the following reasons:

- The Processed foods & feeds PPI major commodity group is the only applicable major commodity group for food wholesaler/retailers, it includes all goods carried by the food wholesaler & it excludes goods that aren’t carried by most food wholesaler/retailers

- There are multiple PPI subgroups and product classes applicable to a food wholesaler/retailers, meaning a single subgroup or product class can not be chosen for a food wholesaler

- Subgroups (Table 2)

- There are a total of 96 subgroups which break out goods into more granular groupings than the 15 major commodity groups. For example, there are nine BLS PPI subgroups that fall within the Processed foods & feeds major commodity group.

- The Subgroup table is best suited for the type of company or industry that may carry a more specific or narrow range/type of products than a company or industry such as a food wholesaler/retailer. For example, a dairy wholesaler would find the Subgroup table to be the most suitable table for the following reasons:

- The Dairy products PPI subgroup is the only applicable subgroup for dairy wholesalers, it includes all goods carried by the dairy wholesaler, and excludes goods that aren’t carried by dairy wholesalers

- The major commodity group table options are broader than the subgroup options for a dairy wholesaler because the most applicable major commodity group (Processed foods & feeds) includes price surveys for goods not carried by a dairy wholesaler

- Multiple product classes exist for a dairy wholesaler, meaning a single product class can not be chosen for a dairy wholesaler

- Product classes (Table 3)

- There are a total of 301 product classes which break out goods into more granular groupings than the 15 major commodity groups and 96 subgroups. For example, there are 37 product classes that fall within the Processed foods & feeds major commodity group.

- The product class table is best suited for an industry or company with a narrower range of products than a food wholesaler/retailer or dairy wholesaler. For example, a wholesaler of non-alcoholic beverages would find the product class table to be most suitable for the following reasons:

- The soft drinks PPI product class is the only applicable subgroup for a non-alcoholic beverage wholesaler, it includes all goods carried by the beverage wholesaler & excludes goods that aren’t carried by a beverage wholesaler

- The major commodity group and subgroup table options are broader than the subgroup options for a dairy wholesaler because the most applicable major commodity group (Processed foods & feeds) includes price surveys for goods not carried by a dairy wholesaler

How to Use LIFOPro’s 2024 Top LIFO Election Candidates List

- Step 1:

- Locate a single BLS group/subgroup/product class that most closely matches your company/client’s product mix or industry & proceed to Step 3

- If multiple BLS PPIs were identified, proceed to step 2

- Step 2: If multiple PPIs match your company’s or client’s industry or product mix, take one the following steps:

- Use one of the less-detailed BLS tables – For example, if multiple product classes were found that include a portion of but not all of your company or client’s product mix or industry (but no product class was found that included 100% of your goods), review the subgroup table to determine if there is a single subgroup that contains all goods & excludes most or all goods not carried. If no such subgroup can be found, review the major commodity group table and perform the same steps.

- Use the most predominant group/subgroup/product class in your company/client’s industry or product mix – For example, if your product mix includes 70% of one product class, 20% of another product class & 10% of third product class, select the product class that represents the largest proportion of the total inventory balance.

- Step 3: Locate the Good LIFO Candidate field entry for the selected PPI & take the following steps:

- If the Good LIFO Candidate entry is “Yes” – Your company is a goods LIFO candidate. Proceed to Step 4 and/or contact LIFOPro to obtain a free LIFO election benefit analysis.

- If the Good LIFO Candidate entry is “No” – Your client or company is not a good LIFO candidate & LIFOPro recommends not using LIFO (or contact LIFOPro to obtain confirmation of this)

- Step 4: Locate the Top 2024 Election Candidate field entry for the selected PPI & take the following steps:

- If the Top 2024 Election Candidate entry is “Yes” – LIFOPro recommends exploring a 2024 LIFO election and obtaining a complimentary benefit analysis from LIFOPro ASAP. Proceed to Step 5.

- If the Top 2024 Election Candidate entry is “No” – Although your company/client is a good LIFO candidate, it is likely that current year LIFO election should be deferred to a future period in time. Consider obtaining a free election benefit analysis from LIFOPro this year, or defer doing so until next year.

- Step 5: Take any of the following steps to further explore electing LIFO:

- Estimate 2024 LIFO tax benefit:

- 2024 taxable income reduction from LIFO (2024 LIFO expense/reserve): Multiply the higher of the two inflation rates shown in the 2024 inflation rate fields by last year’s inventory balance

- 2024 LIFO tax benefit (2024 LIFO after-tax savings): Multiply the 2024 LIFO expense by your combined federal & state tax rate

- Contact your client & inform them of the following:

- High likelihood that LIFO will create meaningful tax benefit for the upcoming year end

- They can attend a free LIFO discovery call to learn more about LIFO, how to get a free benefit analysis & learn about our turnkey outsourcing solutions which makes being on LIFO as simple as possible

- They can obtain a free, comprehensive benefit analysis to obtain a more accurate estimate and essential information on how LIFO works, election requirements and method alternatives

- Schedule a free LIFO discovery call to learn more about LIFO, how to obtain a free election benefit analysis & LIFOPro’s outsourcing solutions:

- Email or call Bob Richardson at jamie@lifopro.com or 531-466-4275

- Use our online scheduling tool: Schedule a call with LIFOPro

- Estimate 2024 LIFO tax benefit:

Does the Timing of the LIFO Election Matter?

Although LIFO can create meaningful short and long term tax benefits, there are many considerations that should be made prior to and during the implementation process. Most importantly, the timing of adopting LIFO is key for the following reasons:

- For tax purposes, LIFO must be applied prospectively (beginning in year LIFO is adopted), and the tax benefits are directly tied to the amount of inflation measured in the year of adoption (high inflation that recently occurred in a prior period can’t be applied in the LIFO election period)

- The size of the first year tax benefit is primarily dependent on the amount of inflation measured in the year the LIFO election is made, so the higher the inflation measured in the election year, the bigger the LIFO tax benefit will be

- Higher tax benefits are being forfeited when electing during a low inflation period instead of doing so during a period where inflation was greater than or equal to historical levels

How is a Good LIFO Candidate & Top LIFO Election Candidate Determined?

LIFOPro uses proprietary inflation metrics and a standard grading system to establish whether or not LIFO is a preferable method for a company or given industry. From this grading system, a determination can be made regarding if a company is a good LIFO candidate, and subsequent recommendations are also provided regarding the proper timing of when to elect LIFO. Our grading system & scoring criteria is organized as follows:

- Historical Preferability (Good LIFO candidate criteria): These criteria use past pricing metrics sourced from the Bureau of Labor Statistics Consumer/Producer Price Indexes (BLS CPI/PPI) to establish preferability as of the time of exploring a LIFO election. These are also called our “good LIFO candidate” criteria, which are as follows:

- Inflation level – How much inflation has there been historically?

- The inflation level is the most fundamental metric used to establish LIFO as a preferable method because higher the historical inflation level, the higher the likelihood that LIFO will create a material tax benefit and be more clearly reflective of income than other non-LIFO methods in the future.

- LIFOPro’s inflation level requirement is to have a long-term average annual inflation rate of 1% or more. Auto dealers and supermarkets (predominant users of LIFO) have 20 year average annual inflation rates of around 1% – 2%, which is more than sufficient to establish preferability because over a 20 year period, there will have been 20% – 40% cumulative inflation, and in most cases, inflation at this level will yield material long-term LIFO tax benefits.

- Inflation frequency – How often has inflation occurred historically?

- Inflation frequency is another key metric used to establish LIFO as a preferable method because the more often there has been inflation in the past, the higher the likelihood that LIFO will be most clearly reflective of income & create a tax benefit in the future

- Inflation frequency is a key LIFO risk assessment metric because there is an inverse relationship between the amount of LIFO risk and inflation frequency rate. More specifically, the lower the inflation frequency rate, the higher amount of LIFO risk. Conversely, the higher inflation frequency rate, the lower the risk. Certain industries have 20 year inflation frequency rates of 100% (inflation measured in all of the last 20 years), meaning there is little or no LIFO risk in these areas.

- LIFOPro’s inflation frequency requirement is to have a rate of greater than or equal to 50% over the last 20 years (inflation measured in 10 or more of the last 20 years)

- Both historical preferability criteria must be met for LIFO to be a preferable method and for a company/industry to be a good LIFO candidate. LIFO is not a preferable method and a company/industry is not a good LIFO candidate if neither or only one of the two historical preferability criteria is met.

- Inflation level – How much inflation has there been historically?

- Present Preferability (Current year LIFO election candidate): These criteria provide the basis of recommending either a current year LIFO election, or deferring the LIFO election to a later period, which are as follows:

- Both historical preferability criteria met

- Current year vs. Historical average inflation multiplier – Is the current period inflation rate greater/less than or equal to the historical average inflation rate?

- Inflation multiplier is calculated by taking the quotient of the Current year inflation rate and the Historical average annual inflation rate

- Current year inflation rate uses the higher of the following two options:

- Year to date inflation: For a December year end, the year to date inflation rate at the time of this publication is 9 months ended September 2024 PPI (Sep. ’24 ÷ Dec. ’23) since the last BLS release was September PPI.

- 1 Year inflation: For a December year end, the 1 year inflation at the time of this publication is 12M ended September 2024 PPI since the last BLS release was September PPI

- Historical average annual inflation rate computed using the BLS PPI 20 year average annual inflation rate as of September 2024 (if available; 3/5/10 year average annual inflation rates used for BLS PPIs that have existed for less than 20 years)

- LIFOPro’s inflation multiplier requirement is to have an inflation multiplier of greater than or equal to 1. For example, if there’s 5% inflation in 2024 & a 20 year average annual inflation rate of 2%, the inflation multiplier would be 2.5, and a current year LIFO election would be recommended.

- Both present preferability criteria must be met for a current period LIFO election to be recommended. If the inflation multiplier is less than 1, a LIFO election recommendation is deferred to the next period where the inflation multiplier is greater than or equal to 1.

Make Electing LIFO Easy!

Electing LIFO can be a lot easier than you think with the help of the experts at LIFOPro. Our complimentary benefit analysis lowers the barriers to LIFO entry. We do all the heavy lifting required to perform comprehensive analysis. We take the guesswork out of determining who is or is not a good LIFO candidate, when the LIFO election should be made, and which submethods should be used. Best of all, we serve as a LIFO subject matter expert for both companies and CPA firms, meaning all parties can count on us for all their LIFO needs! Schedule a call today with the LIFOPro team to learn more about LIFO & our benefit analysis & outsourcing solutions or download our content below to learn more.

LIFOPro's Election Benefit Analysis Schedule a LIFO Discovery Call/Meeting How LIFO Works & LIFOPro's Offerings LIFO Tax Savings CalculatorLIFOPro's Top 2024 LIFO Election Candidates List Excel File

Get a Free LIFO Election Benefit Analysis Today

Are you a company not on LIFO, but are interested in scoping out a potential election and want to obtain a cost/benefit analysis? Contact LIFOPro to obtain your complimentary LIFO election benefit analysis today! Minimal documentation and work is required to obtain your free benefit analysis, and we also include a fee quote for outsourcing all the LIFO related work to us. Download the applicable questionnaire today! LIFOPro delivers your benefit analysis and fee quote within 1 week of receipt of the required documents.

LIFO Election Benefit Analysis Questionnaire: Non Auto Dealers LIFO Election Benefit Analysis Questionnaire: Auto Dealers