COVID-19 has caused the following circumstances for RV dealers:

- Above average sales volume

- Appreciating used equipment prices

- Depleted inventory levels

- LCM reserve liquidations

- Increased taxable income from:

- Above average sales volume

- LCM reserve liquidations

LIFOPro identified the following planning opportunities for RV dealers seeking to create after-tax cash savings & reduce taxable income:

RV dealers who aren’t on LIFO

- Elect LIFO for the 2020 year end

- Include both new & used equipment as well as parts in your LIFO election scope

- Effect of doing so will:

- Partially offset LCM reserve liquidations

- Partially offset increased taxable income from above average sales volume

RV dealers who are on LIFO, but don’t have used equipment or parts on LIFO

- Expand the LIFO election scope to include both used equipment & parts

- Effect of doing so will provide the same benefits listed above for RV dealers who aren’t on LIFO

The LCM Reserve Conundrum

The LCM reserve can become fairly sizable for many equipment dealerships because of the quantities held & depreciation that occurs with used inventories. These reserves ultimately represent taxable income deferral tools. We describe them as a tool because an LCM reserve effectively reduces taxable income by lowering ending inventory & increasing the cost of goods sold when certain conditions are met. These conditions are as follows:

- The used equipment has either:

- Depreciated below it’s original cost between the time it was purchased in the current year until the current tax year end

- Further depreciated when comparing its CY vs. PY FMV against the original purchase cost

- The used equipment that has been written down to below cost is still on hand at year end

Although this concept is fairly simple, the perfect storm in 2020 has caused many RV dealers facing the following issues with their LCM reserves:

- Much of their used equipment that had an associated LCM reserve tied to it was sold

- The value of the remaining used equipment remained either stable or may have even increased

- The two above points have caused the LCM reserve to significantly decrease this year, leaving RV dealers with additional taxable income burdens on top of the additional income from higher than average sales

Why a LIFO Reserve Will Provide More Long-term Tax Savings than an LCM Reserve (i.e. why LIFO is better than LCM)

With an LCM reserve, the ability for an RV dealer to count on an LCM reserve to defer taxable income is dependent on many factors. Included in these factors is the need to hold the inventory in order to maintain the reserve. For example, if a used RV were purchased by a dealer for $50,000 and now has a FMV of $25,000, the dealership would have a $25,000 LCM reserve associated with that used RV. Although this can grow to become quite sizable as used equipment quantities grow & prices further depreciate, the tax benefits for any used equipment with an LCM reserve goes away as soon as it’s sold. Because of this, LIFOPro considers an LCM reserve to be more of a “tax deferral” tool as opposed to a tax savings annuity that will grow in perpetuity as long as any given company is a going concern.

The beauty behind LIFO is that the tax benefits are preserved even when the inventory that attributed to building the LIFO reserve in prior years is sold. In other words, the LIFO reserve will continue to grow even as the inventory that was on hand at the time of the LIFO reserve growing is sold as long as equipment is repurchased by the end of the taxable year. Furthermore, the LIFO reserve can increase even when the current vs. prior year end inventory balances have decreased because of the mechanics of LIFO calculations. In most cases, the LIFO reserve will increase in any given year as long as there is inflation & there hasn’t been a substantial liquidation in the current vs. prior year end inventory balances. Because of this, LIFOPro considers the LIFO reserve to be more of a “tax savings” tool than a tax deferral tool as the benefits will grow in perpetuity.

Related: How Your LIFO Reserve can Grow When CY vs. PY Ending Inventory Balances Decreased

Why This Year Provides the Best Opportunity for RV Dealers to Trade in Their LCM Reserve for a LIFO Reserve

Normally when we speak with equipment dealerships about electing LIFO, a decision must be made regarding their LIFO election scope, which is selecting the inventories that will or won’t be valued using LIFO. This is because the IRS allows for taxpayers to make what are called “selective elections”, meaning RV dealers have the luxury of picking and choosing what goods will or won’t go on LIFO. For RV dealers who have used equipment, they will often have a sizable LCM reserve built up related to that equipment. What typically happens for the RV dealers that are electing LIFO & have a sizable LCM reserve will be that they put their new equipment & parts on LIFO & maintain valuing used equipment at the lower of cost or market. The reason why most RV dealers do this is that LIFO inventories must be valued at cost, and any inventories that will be put on LIFO that have an LCM reserve associated with it must be taken into income over a three year period beginning in the year that those inventories are begun to be valued using the LIFO method. Because of this, RV dealers are reluctant to to put their used equipment on LIFO because it would mean paying their LCM reserve into income. Because of this, RV dealers typically value new equipment & parts under LIFO, which allows them to preserve their used equipment LCM reserve while being able to pave the way to build a LIFO reserve on new equipment & parts. It’s essentially what many RV dealers consider to be “the best of both worlds”. Although this may often appear to be the case, in a year like 2020 where used equipment inventory has been liquidated for many dealers & any remaining used equipment on hand at the end of the year has either maintained or appreciated in value, the idea of protecting the LCM reserve when electing LIFO has effectively become not applicable. Because of this, many RV dealers are essentially paying a large portion of their LCM reserve into income in 2020, much like a company would be required to do if they were to switch their used equipment valuation method from LCM to LIFO. The only difference is that RV dealers are paying all of their 2020 LCM reserve liquidation into income, as opposed to over a three year period as is required when LIFO taxpayers convert the costing method of used equipment from LCM to LIFO cost.

What this means for RV dealers is that the idea of keeping used equipment off LIFO because of a sizable preexisting LCM reserve is essentially not applicable this year because it’s going to be taken into income. In other words, RV dealers have been given a clean slate in terms of weighing the benefits & costs of maintaining used equipment under LCM or LIFO. When stacked up against one another, it’s inevitable that the LIFO reserve will always outgrow an LCM reserve because of the reasons laid out in the preceding paragraph.

Quantifying the Benefits of LIFO

When we talk about LIFO tax benefits, we’re talking taxable income reduction & real after-tax cash savings. The technical term for this is LIFO expense, which represents the CY vs. PY change in your LIFO reserve. When the CY vs. PY LIFO reserve increases, you’ll have LIFO expense that effectively increases the cost of goods sold & reduces taxable income. The LIFO reserve is your cumulative taxable income reduction & the LIFO expense is the CY vs. PY change in the LIFO reserve (LIFO income occurs if there’s deflation and/or significant inventory liquidations). In other words, the LIFO reserve represents the difference between inventory valued at cost & inventory valued at LIFO (i.e. FIFO – LIFO = LIFO reserve).

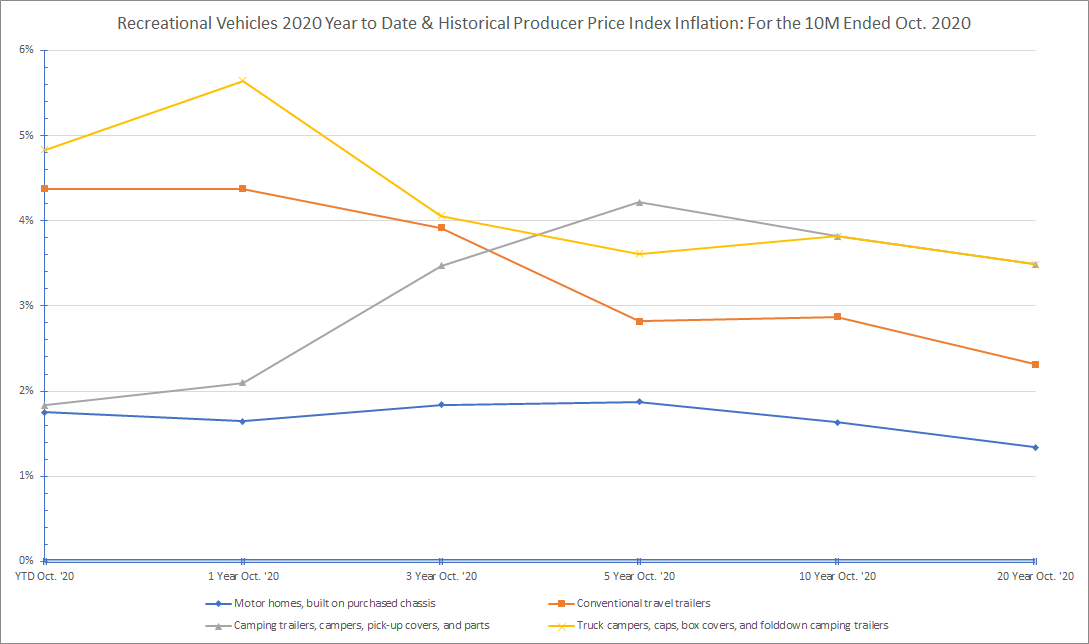

Year to date, RV inflation is running between 2 – 4% depending on the specific type of RV you have. A quick formula for estimating the CY taxable income reduction from LIFO would be to take the prior year end inventory balance & multiply it by the inflation rate that’s most representative of your product mix (or by calculating a range). For example, a company with $10M in PY inventory at cost & 2% inflation would have somewhere between $200K – $400K in taxable income reduction from LIFO if it were to be elected this year. Shown below are both the year to date & historical Bureau of Labor Statistics (BLS) Producer Price Index (PPI) inflation rates for RVs (YTD = Oct. ’20 ÷ Dec. ’19 PPI. LIFO taxpayers are allowed to use external price indexes, and more specifically the PPI shown below).

What if my 2020 y/e Inventory is Much Lower Than my 2019 y/e Inventory?

Growing your LIFO reserve is only dependent on two components:

- Inflation

- CY vs. PY ending inventory balance has not significantly decreased

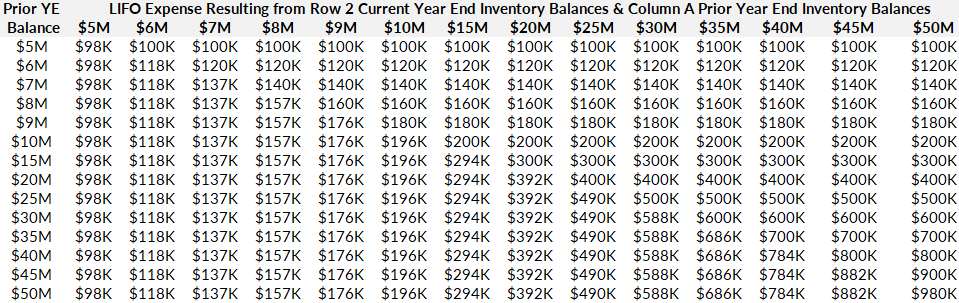

The CY LIFO expense i.e. increase in the CY vs. PY LIFO reserve begins to erode when there are significant decreases in the CY vs. PY ending inventory balances. Even though this is the case, there is still tax from LIFO, but it will be less than what it would have been if the CY ending inventory balance was the same or slightly higher than last year. The table below shows the resulting LIFO expense from a range of CY & PY ending inventory balances.

Resulting LIFO Expense from Range of CY & PY Ending Inventory Balances: Assuming 2% CY Inflation

Takeaway #1: Tax savings can still be achieved from LIFO even if your CY vs. PY ending inventory balance is lower

As shown above, a company with CY & PY ending inventory balance at cost of $5M & $10M will still achieve roughly $98K of taxable income reduction from LIFO with 2% inflation. Compared to the $196K of LIFO expense that would have been achieved if the CY & PY ending inventory balance at cost was $10 for both years, the CY LIFO expense of $98K from a $5M CY ending inventory balance is about half. The key takeaway is that although you forego some of your LIFO benefits when CY vs. PY ending inventory has decreased, the LIFO reserve will almost always increase to some extent unless there was a huge amount of inventory liquidation. Since this has been a common misconception that LIFOPro often has to explain, we’ve wrote a blog that provides an in-depth explanation behind how this works. Read more at our blog: How Your LIFO Reserve Can Increase Even if Your Ending Inventory Balance is the Same or Lower Than it was Last Year

Takeaway #2: There is a cap on the amount of CY LIFO expense that can be achieved

As seen above, the LIFO expense will usually be close to the PY ending inventory balance at cost multiplied by the 2% inflation rate used to calculate the values above. When there is inflation, there is a cap on the maximum amount of LIFO expense that can be achieved that is calculated as follows: Maximum CY LIFO expense = (CY inflation rate + 1) * PY ending inventory balance at cost. Because of this, your LIFO expense will reach a ceiling after the CY ending inventory balance at cost is equal or greater to the PY ending inventory balance at cost * CY inflation rate. For example, here’s the maximum CY LIFO expense that can be achieved & CY ending inventory balance required to achieve that amount based on the inputs shown below:

CY Inflation: 2%

PY Ending Inventory Balance: $5M

CY LIFO Expense Ceiling: PY Ending Inventory Balance * CY Inflation Rate ($5M * 2%) = $100K

CY Ending Inventory Balance Required to Achieve Maximum CY LIFO Expense = (CY Inflation Rate + 1) * PY Ending Inventory Balance (1.02 * $5M) = $5.1M (also known as minimum balance required to avoid LIFO layer erosions)

Can I outsource my LIFO calculation or obtain software to do so?

The simple answers are yes and yes. LIFOPro specializes exclusively in LIFO software & turnkey outsourcing solutions for the smallest companies with less than $1M of inventory to the largest companies in the world such as Walmart. We provide solutions to make being on LIFO as simple & easy as possible. Our turnkey solutions are a fraction of the cost of your after-tax LIFO savings, and our software license cost is even less, meaning we have a solution for every company & budget out there. For RV dealers, our turnkey outsourcing solutions costs are rarely above $2,000/year. For most, they’ll be somewhere between $750 – $2,000/year depending on your company’s size. Our software costs are even lower & would likely be between $300 – $1,300/year.

Tell Your CPA Firm About Us!

LIFOPro works with hundreds of CPA firms of all sizes to provide LIFO calculation services to the CPA firm on behalf of their clients. Many CPA firms don’t have the capability to make LIFO calculations since it can be complex or difficult for firms that don’t have experience with LIFO. Our flexible service engagements can be customized to fit the exact needs of your company, meaning we can work directly with your CPA firm to provide LIFO calculations on behalf of your company. We can also work to help both your CPA firm and your company to become familiar with LIFO, and provide all the services required to make your LIFO election occur seamlessly.

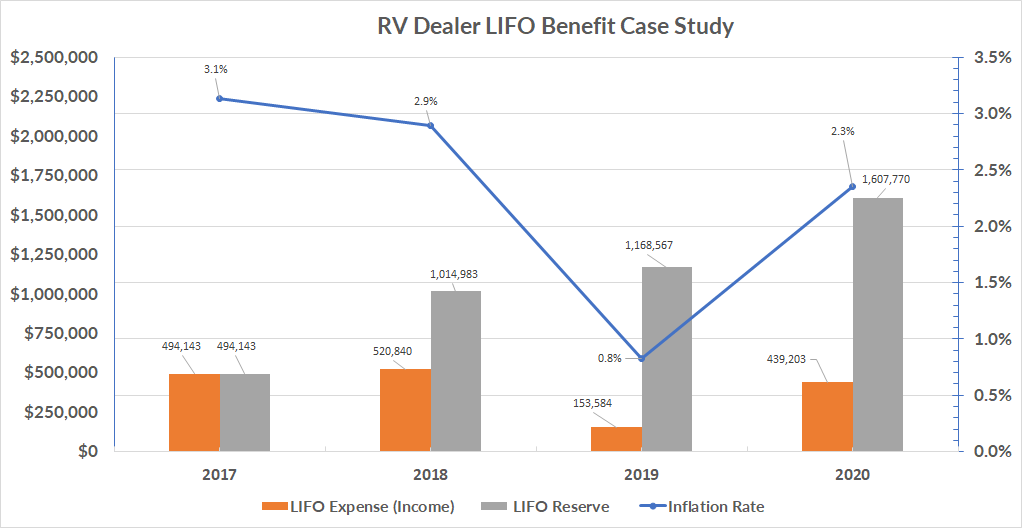

RV Dealer LIFO Case Study

Shown below is the profile of a LIFOPro RV dealer client

Years on LIFO: 4 (2017 = 1st year on LIFO)

2020 y/e inventory balance: $19M

Average annual inflation rate: 2.3%

2020 y/e LIFO reserve: $1.6M

Average tax rate: 30%

Cumulative after-tax cash savings: $482K

Average prime rate + 1%: 5%

Cumulative after-tax interest savings: $24K

Annual LIFO calculation cost: $1K

Cumulative LIFO calculation cost: $4K

Cost as a percentage of after-tax cash savings: 0.8%

Get a Complimentary LIFO Election Benefit Analysis Today!

LIFOPro offers complimentary LIFO election benefit analysis for companies not on LIFO whom are seeking to determine the potential tax savings that could be achieved. Your analysis is delivered in the form of a report & includes the following:

- LIFO election recommendation detailing why LIFO should or should not be used

- Good LIFO candidate scoring criteria

- Pro forma LIFO calculation results

- Historical inflation summary

- How LIFO Works guide

Complete our simple, no obligation form online to get a complimentary analysis today!

Get a LIFO Election Benefit Analysis

Sample LIFO Election Benefit Analysis Report