Most accounting systems track inventory costs using FIFO or moving average cost. The same can be said for companies on LIFO, but adjustments are obviously required to convert FIFO or average cost to LIFO. The most widely-used and accepted approach to make a link-chain LIFO calculation is what one could call a single index method. Under this approach, the same costing method is used to value the current year cost of ending inventory & calculate LIFO increments or decrements (also known as layers or converting base year cost to LIFO cost).These two concepts are commonly referred to as the current-year cost & layer valuation methods. Here’s how a single index link-chain LIFO calculation is made:

- Current period deflator index determined as follows:

- Current period extensions calculated as follows: Current period quantity on hand * current period unit cost

- Prior period extensions calculated as follows: Current period quantity on hand * prior period unit cost

- Current period deflator index = sum of current period extensions ÷ sum of prior period extensions

- Current period cumulative deflator index calculated as follows: current period deflator index * prior period cumulative deflator index (would have been the current period cumulative deflator index calculated in the prior period’s LIFO calculation; note: current period cumulative inflator & deflator indexes will be equal if there is a current period increase at base year cost)

- Current period inventory at base year cost calculated as follows: current-year cost (general ledger ending FIFO or average cost inventory balance) ÷ current period cumulative deflator index

- Current period increase (decrease) at base year cost calculated as follows: current – prior period inventory at base year cost

- Current period increase (decrease) at LIFO cost calculated as follows:

- Increases (increments or layers): current period increase at base year cost * current period cumulative inflator index (current period cumulative inflator & deflator indexes will equal one another when there is an increase at base year cost)

- Decreases (decrement or layer erosion/liquidation): current period decrease at base year cost * prior period cumulative inflator index(es)

- Current period LIFO inventory balance calculated as follows: Sum of increases at LIFO cost for all periods

This is the only approach discussed in §472 of the IRS LIFO regulations & AICPA LIFO Issues Paper. With that being said, a second approach called dual indexes was invented to likely create lower ending inventory balances, higher cost of good sold & decrease taxable income more so than what the conventional single index LIFO calculation approach affords. Multiple item costing methods are required when using dual indexes, and as the name implies, two separate cumulative indexes must also be computed to calculate the increase at LIFO cost (differs from single index where the cumulative deflator & inflator index are the same).

Under the dual index approach, the first costing method is used to compute the required indexes needed to calculate the increase (decrease) at base year costs & a second costing method is used to compute the indexes needed to calculate the increase (decrease) at LIFO cost. The inventory at base year costs is calculated using the current period deflator index as shown above, but a second set of extensions are used to calculate the increase at LIFO cost (single index uses the cumulative deflator index as the cumulative inflator index to convert the increase at base year cost to LIFO cost when there is an increment). Under this method, the same first five steps shown above are the same, but steps 1 – 3 must be repeated using the second costing method to calculate current year & cumulative inflator indexes for computing the increase at LIFO cost. Using the most common two sets of costing methodologies employed for dual index calculations, lets assume that that the FIFO method is used to calculate the current year cost of ending inventories while the earliest acquisitions cost (EAC) method is used to determine the index that will be used to value the LIFO increment. This is how the dual index calculation would work:

- Determine current-year cost balance

- Current year deflator index determined as follows:

- Current year extended FIFO or average item cost extensions calculated as follows: Current period quantity on hand * current period FIFO or average unit cost

- Prior year extended FIFO or average item costs extensions calculated as follows: Current period quantity on hand * prior period FIFO or average unit cost

- Current year deflator index = sum of current ÷ prior year item extensions

- Current period cumulative deflator index calculated as follows: current period deflator index * prior period cumulative deflator index (would have been the current period cumulative deflator index calculated in the prior year LIFO calculation)

- Current year inventory at base year cost calculated as follows: current-year ending FIFO or average cost balance ÷ current period cumulative deflator index

- Current period increase at base year cost calculated as follows: current – prior year inventory at base year cost

- Current period inflator index calculated as follows:

- Current year earliest acquisitions item cost extensions calculated as follows: Current period quantity on hand * current period EAC unit cost

- Prior year earliest acquisitions item cost extensions calculated as follows: Current period quantity on hand * prior period EAC unit cost

- Current year inflator index = sum of current ÷ prior year item extensions

- Current period cumulative inflator index calculated as follows: current year inflator index * prior year cumulative deflator index

- Current period increase at LIFO cost (i.e. increase at LIFO cost or LIFO layer) calculated as follows: current period increase at base year cost * current period cumulative inflator index

- Current period LIFO inventory balance calculated as follows: Sum of increases at LIFO cost for all periods

Sophisticated accounting systems and standard costing have caused for FIFO and average cost to now be the most predominately used and therefore most easily obtainable data. This means that most would prefer to use FIFO or average cost. Furthermore, businesses using LIFO already have an increased accounting burden compared to those not using LIFO. Knowing all this, the question then becomes is what would motivate a company to use dual indexes? The most convincing argument is that it provides lower ending inventory, higher cost of goods sold & reduced income. The idea behind this argument largely relies on the assumption FIFO is used for the current year cost method and earliest acquisitions cost is used as the increment valuation method. Under this theory, the current year cumulative inflator index used to value increments calculated under the earliest acquisitions cost method would be lower than the current year cumulative deflator index used to calculate inventory at base year costs under the FIFO method. If the increment valuation costing method’s inflation index is lower than the one used to calculate the increase at base year costs, dual indexes results in a lower LIFO inventory balance compared to a single index.

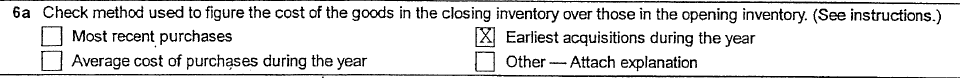

Our experience in dealing with this method is that using dual indexes will in fact provide more favorable results to the taxpayer than if a single index method were used. This being known, one might also wonder why it was sparingly if at all used in the past, but all of the sudden became much more frequently used in the 1980s and ‘90s. One theory suggests that a now superseded IRS LIFO election form question contained ambiguous wording that was suggestive of allowing for a dual index to be used. On this superseded form, the question that is supposed to provide the taxpayers’ current year cost & increment pricing method was described as the “method used to figure the cost of the goods in the closing inventory over those in the opening inventory” (see below):

The superseded form question shown above illustrates how the former terminology could have provided for the idea of using a different current year cost & increment valuation method.

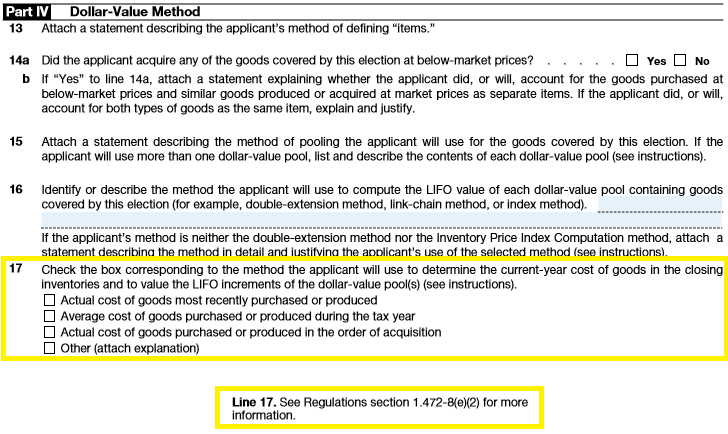

The most current version of the LIFO election form question now reads as follows: “ Check the box corresponding to the method the applicant will use to determine the current-year cost of goods in the closing inventories and to value the LIFO increments of the dollar-value pool(s) (see instructions)” (see below):

Before considering the use of dual indexes, think about this:

-

-

- Using multiple costing methods will require more effort than the dual index benefit affords

- The IRS has challenged countless dual index calculations & has issued Issues Paper stating they never intended to allow for dual indexes to be used

-

An April 2003 IRS Proposed Coordinated Issues Paper titled “Dollar-value LIFO Double Extension, Link-chain and Inventory Price Computation: Dual Index Methods” concluded the following:

“…A taxpayer may not use a different method of determining its current-year cost for purposes of converting its ending inventory from current-year cost to base-year cost (“deflator index”) from the method it uses to determine it’s current year cost for purposes of converting its increment at base-year cost to current-year cost (“increment valuation index.”). This conclusion applies to all taxpayers using the dollar-value LIFO method, including those using the IPIC variant.”

Although the seven-page Issues Paper cites many sources & provides detailed analysis as to the reasons behind its conclusion, the most convincing evidence against the usage of dual indexes contained within it is shown below:

Treas. Regs. § 1.472-8(e)(2) allows a LIFO taxpayer to elect the method of accounting used to compute the current cost of the LIFO pool. Once the method of determining current-year cost is established, the base cost of the pool must be determined. Under the double-extension method, the base cost is derived directly. Under an index method, the base cost is derived from a sample that produces the cumulative index of inflation. Under the link-chain method, annual inflation is computed and multiplied by the prior year’s cumulative inflation to compute the current year cumulative index of inflation and, ultimately, the base year cost of the pool.

The base cost is then compared to the prior year’s base cost to determine whether an increase or decrease to the “dollar-value” of the quantity of goods on hand has occurred. Any increase is called an increment, or layer. If there is an increment for the taxable year, the ratio of the total current year cost to the total base year cost of the pool must be computed for a double extension method taxpayer. A taxpayer that uses the link-chain method has already computed this ratio in the computation of the base cost. This ratio, when multiplied by the amount of the increment measured in terms of base-year cost, gives the LIFO value of such increment. For any particular pool, there can be one, and only one, ratio of current cost to base cost. The ratio is also referred to as the cumulative index of inflation. All the computational examples set forth in the regulations are consistent with the use of a single ratio, or cumulative index of inflation. The regulations contain no other reference to indicate that a second definition of the ratio or cumulative index of inflation was intended. Therefore, the assumption stands that none was intended.

Although these regulations address the double-extension method, no specific guidance is provided on the link-chain method. Therefore, conceptual congruency between the two methods should be applied to the extent possible. This is particularly true because of the preference stated in the regulations for the use of the double-extension method.

Since a single index is used under the double-extension method, it should also be used under the link-chain method to achieve conceptual parity between the two methods. Basically, the only difference between the link-chain and double-extension methods should be the cost reconstruction period of new items. Under the link-chain method these changes are measured annually. In contrast, under the double- extension method the changes are measured from the base-year to the current year. This difference can readily be accommodated through using a single cumulative index under the link-chain method. Accordingly, the link-chain method itself provides no legal justification for using a dual index.

In general, taxpayers using the dollar-value LIFO method already have compiled the necessary books and records to support a current-year cost based on most recent purchases. Thus, many taxpayers opt to elect the most recent purchase method of determining current costs to avoid having to also maintain books and records supporting the earliest acquisitions cost method.

Earliest acquisitions cost must be computed by determining the quantity of each particular item which is contained in the taxpayer’s ending inventory and by comparing a sufficient number of the same items purchased or produced by the taxpayer during the year, commencing with the first day of the year and working forward until the number of units which are priced equals the quantity of such items in the taxpayer’s ending inventory. To properly determine the cumulative index of inflation based on earliest acquisitions cost effectively requires taxpayers to compute their inventory value on the earliest acquisitions cost method. This is required even though the taxpayer is also required to compute their inventory value based on most recent purchase costs for other tax and non-tax accounting reasons.

Historically, the Service has indicated that it might, in rare situations, permit taxpayers using the link-chain method to use a dual index, provided the dual index method results in an inventory valuation that is substantially the same as if the ending inventory was double extended on an item-by-item basis. Significantly, however, in order to demonstrate that this is in fact the case, the taxpayer must have the requisite foundation supporting an accurate index based on earliest acquisitions cost. This earliest acquisition index would then be used as both the deflator index and the layer valuation index. Once a system is in place to complete the earliest acquisition computation, there effectively is no economy of effort derived from using a dual index and the earliest acquisition based deflator index would be used to value any current layer.

In electing to use the earliest acquisitions cost method the taxpayer assumes responsibility of maintaining the books and records to support the method. In fact, many taxpayers forebear using the earliest acquisitions cost method because they do not want to assume what they consider to be an additional burden, notwithstanding the fact the method generally results in lower ending inventory values. Thus, in order to apply the tax law with integrity and fairness to all, a consistent and uniform rule should apply. That rule requires that the layer be valued at the ratio of current cost to base cost.

This record-keeping requirement, however, will not place an undue burden on the taxpayer. The burden of maintaining records that enable a taxpayer to properly determine the LIFO value of the inventory under a true earliest acquisitions cost method is neither greater nor lesser than the burden under the most recent purchases cost method. The fact that the taxpayer already has its books and records based on most recent purchases is of no consequence.

Although the proposed Issues Paper was never finalized, its conclusions are in line with the positions taken within several dual index usage private letter rulings & technical advice memorandums published close to that period. See TAM 20070131, TAM 9853003 & PLR 9332003.

Takeaways

-

-

- Using dual indexes often requires the use of antiquated costing methods – The need to use earliest acquisitions cost should provide you enough of a reason to stay away from using dual indexes as this is an unconventional cost flow assumption that is not available in most conventional inventory accounting systems (as opposed to FIFO & average cost)

- It’s impermissible to calculate earliest acquisitions cost using a widely-adopted shortcut – Out of the several dual index TAMs & PLRs I read, one of the most predominant issues the IRS raised was where taxpayers were taking a shortcut to calculate earliest acquisitions cost. In all of these cases, the IRS contended that doing so will provide for the grounds that the LIFO calculation may fail to provide a clear reflection of income (in the event that the dual index calculation differs from the single index calculation)

- Single index LIFO calculations are the most widely accepted approach that will not be challenged by the IRS – Out of the thousands of LIFO calculations we’ve reviewed, a very small percentage of them used a dual index. Furthermore, although dual index usage wasn’t extremely uncommon in the 90’s, they became much more uncommon over the last 20 years as many companies that previously used them have switched to a single index method. This could have been because dual indexes presented additional audit risk that wasn’t worth the benefit, especially considering that using a single index poses no audit risk.

- The more LIFO benefit you create from using dual indexes, the less reflective of income your LIFO calculation becomes – Every IRS reference material that discusses dual indexes contend that the method is only permissible in the event that the taxpayer can prove the results are comparable to that of a single index. What this means is that a taxpayer accumulating a material amount of additional benefit from using dual indexes is merely building a case for the IRS to determine that your LIFO calculation does not clearly reflect income in the event of an audit.

- The current IRS LIFO Election Form instructions infer to check only one of the checkbox options relating to current-year cost of goods in the closing inventories and to value the LIFO increments – This simple fact leads one to assume that the a single valuation method will be used to calculate the current year cost & LIFO increments (i.e. single index)

- Dual indexes are not mentioned in the IRS form instructions, or in the IRS Regs. – This would leave one to believe that the IRS never anticipated for taxpayers to even attempt to use multiple costing methods and calculate two inflation indexes.

-

In light of this, companies using dual indexes looking to switch to a single index method would need to file an IRS Form 3115 Change in Accounting Method. This change would be made prospectively since all LIFO changes are made on a cutoff basis. This is an advanced approval change, meaning it needs to be filed by the end the taxable year, and a $10,800 IRS Users fee is also required.