Overview

The IRS defines a bargain purchase as an acquisition of assets at a price that’s lower than the seller’s cost. Such events frequently occur as a part of a bulk purchase of assets from a business experiencing financial distress. These events can also occur with a bulk purchase of assets where the allocation of the total purchase price to inventory results in the goods being acquired by the buyer at a cost that’s less than the seller’s cost of producing the goods.

When bargain purchases occur, it often results in the buyer of the discounted goods recognizing a sizable gain, which can in turn create a material tax liability in the period that the bargain purchase goods are sold or disposed of. A popular strategy employed to materially offset the tax consequences of bargain purchase gains is to elect the LIFO method in the period that the bargain purchase occurs.

When using the LIFO method, the difference between the inventory value at cost (i.e. FIFO, average cost, specific identification) and its LIFO inventory value represents the amount that LIFO has reduced taxable income. When electing LIFO in a period where inventories were acquired in a bargain purchase, taxpayers have the opportunity to establish their base year inventory costs at amounts that will be significantly lower than their end of year replacement costs. In many cases, the amount of tax deferral from electing LIFO immediately after a bargain purchase will represent an amount that would normally require many years of being on LIFO to accumulate (in some cases, the bargain purchase component attributable to the election year LIFO tax benefit can represent what would normally take a decade or more of being on LIFO to accumulate).

Illustrative Examples of Bargain Purchase LIFO Tax Benefits

Example 1 – Bulk bargain purchase of assets by newly formed corporation

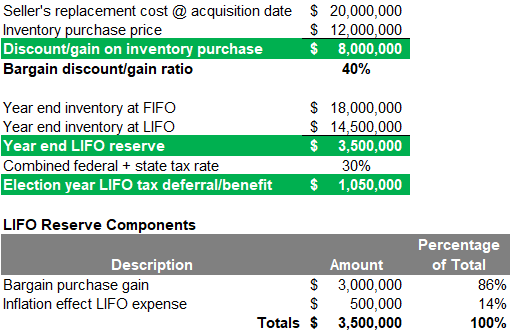

A bulk purchase of assets of a newly formed corporation occurred, and the buyer acquired inventories as a part of the transaction. At the date of the purchase, the seller’s replacement cost of the inventory was $20 million. The buyer acquired these inventories for $12 million (40% discount). As a result of the bargain purchase, the newly formed corporation faced a $8 million bargain purchase gain on the inventories, which would be eventually be recognized in the period that the bargain purchase goods were sold or disposed of.

To minimize the tax consequences of the newly formed corporation’s $8M inventory bargain purchase gain, the buyer subsequently chose to elect LIFO on their first tax, which resulted in a $3.5M LIFO reserve being created in the year that LIFO was elected (current period taxable income reduction from electing LIFO). At a 30% combined federal & state tax rate, the LIFO election reduced the buyer’s tax liability by just over $1 million in the first year alone ($3.5 million LIFO reserve * 30% tax rate = $1,050,000).

Of the $3.5 million LIFO reserve created from the newly formed corporation’s LIFO election, $3M was attributable to the bargain purchase discount, and the remaining $500K was attributable to inflation that occurred in the ending inventories on hand between the bargain purchase date & the newly formed corporation’s tax year end, making roughly 85% of the tax liability reduction attributable to the bargain purchase discount and the remaining 15% being created from the “inflation effect” LIFO tax benefit.

Figure 1. LIFO tax benefit: Bulk purchase of assets by newly formed corporation

Example 2 – Bulk bargain purchase of assets by an existing corporation

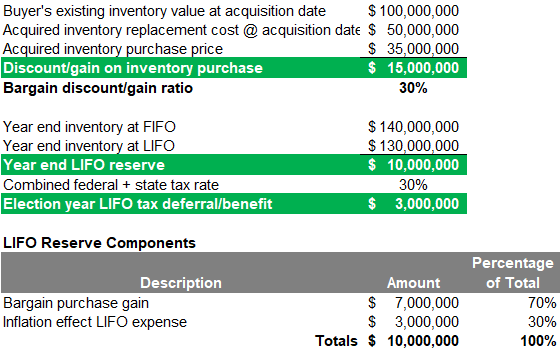

An existing company with $100 million of inventory purchased the assets of a company in the same industry that was liquidating, and the buyer acquired inventories from the liquidating company as a part of the transaction. At the date of the acquisition, the seller’s replacement cost (FIFO) of the inventory was $50 million, which also equaled the seller’s inventory cost. The buyer acquired these inventories for $35 million (30% discount). As a result of the bargain purchase, the existing company who purchased the liquidating corporation’s assets faced a $15M bargain purchase gain on the inventories, which would eventually be recognized in the period that the bargain purchase goods are sold or disposed of.

To reduce some of the eventual tax liability that the purchasing company would face as a result of the $15M bargain purchase gain, they chose to elect LIFO on the tax return of the period that included the acquisition of the discounted inventories. This resulted in a $10M LIFO reserve being created in the year that LIFO was elected. At a 25% combined federal & state tax rate, the LIFO election reduced the acquiring corporation’s tax liability by $2.5M in the first year alone ($10M LIFO reserve * 25% tax rate = $2.5M).

Of the $10M LIFO reserve created by the acquiring corporation’s LIFO election, $7M was attributable to the bargain purchase discount, and the remaining $3M resulted from inflation, making roughly 70% of the LIFO tax savings occurring as a result of the bargain purchase & the remaining 30% occurring from inflation.

Figure 2. LIFO tax benefit: Bulk purchase of assets by an existing corporation

Considerations

Contrasting Bargain Purchase vs. Inflation LIFO Tax Benefits

Deferral of taxable income from using the LIFO inventory method using the most commonly used LIFO methods occurs because of inflation and the amount of the deferral correlates to how much current year inflation there is. For a bargain purchase situation, the amount of the tax deferral in the first year in which LIFO is elected for the year in which the bargain purchase occurs is caused by not only the inflation that occurred during the year but also because of the difference in the net of bargain purchase discount item cost and the end of the year inventory cost recorded in the general ledger at FIFO cost.

Bargain Purchases Have Been Challenged by the IRS in the Past

Although pairing a LIFO election with bargain purchases of inventory can be a meaningful and effective tax savings strategy, the IRS has challenged taxpayers doing so on numerous occasions. See Hamilton Industries, Inc. v. Commissioner & Kohler co. v. United States. In the Hamilton Industries case, two bargain purchases were made with 97% and 60% discounts from the replacement costs of the goods, and the Tax Court ruled that the bargain purchase items must be treated as separate items from the identical goods subsequently acquired or produced by the taxpayer (which eliminated the LIFO tax benefit resulting from the bargain purchase gain). In Kohler Co. v. United States, the purchase discount was 50%, and the Court of Federal Claims ruled in the same manner that was made in the Hamilton Industries case.

Based on past court cases, there’s an informal rule that any bargain purchase with a discount of greater than 50% that’s also incorporated into a LIFO election will be challenged by the IRS, and there’s a high likelihood that’ll ultimately be denied. Furthermore, there’s an unofficial rule of thumb that only applies if the discount is 25-50%. Starting at discount of 25% or more, the IRS would start challenging it if they focused on it during audit.

Because of this, companies should only integrate a LIFO election with a bargain purchase when the discount attributable to inventory is less than 50%. Accordingly, for companies that have the flexibility regarding the agreed-upon proportion of the overall bargain discount percentage that will be allocated to inventory, those who’re seeking to elect LIFO in the period of the bargain purchase should establish a purchase price to inventory that is greater than 50% of the seller’s replacement cost of the inventories as of the acquisition date.

Key takeaways on the bargain purchase inventory discount amount are as follows:

- Relief from the low carry-over basis rules will be provided in all cases where the purchase discount is less than 25%

- Bargain purchase inventory discount LIFO elections in the 25% – 49% range are defensible and worthy of consideration, but will be considered by the IRS on a case by case or facts and circumstances basis

- Bargain purchase inventory discount LIFO elections of 50% or more are not only controversial, but will almost certainly be challenged in the event of an IRS audit, and is likely to be reversed

Specific Bargain Purchase Disclosure Required on IRS LIFO Election Form

Taxpayers electing LIFO are required to complete and attach an IRS Form 970 Application to Use LIFO Inventory Method and statement to the tax return in the period that LIFO is elected. Line 14a of this form reads as follows: “Did the applicant acquire any of the goods covered by this election at below-market prices?”.

Taxpayers who’ve made a bargain purchase during the period that covers the LIFO election to answer Yes to Question 14a, and they’re also required to attach a statement explaining whether the applicant did, ow will account for the goods purchased at below-market prices and similar goods produced or acquired at market prices as separate items. If applicable, the applicant must explain and justify why both types of goods were accounted for as the same item.

Since the IRS has gone out of its way to include a question specifically related to bargain purchases, one could speculate that answering this question in the affirmative could trigger an IRS audit. Accordingly, it’s of high importance to not only answer Yes to this question when electing LIFO as a part of a bargain purchase, but to also accurately describe the nature of the bargain purchase transaction on the Form 970 statement, and to follow the correct procedures when performing the bargain purchase calculation.

Bargain Purchase LIFO Tax Benefits are Usually Lasting & Not Just a Timing Difference

In general, LIFO is a tax savings strategy that’s not just a one-time benefit because the benefits not only remain locked in place in most cases, they’ll continue to grow whenever there’s inflation. Since most goods have inflation over long periods of time, most companies will eventually create a cumulative LIFO tax benefit that is exponentially higher than the one obtained in the year that LIFO was first adopted.

Although the bargain purchase tax benefit that is obtained in the year of a LIFO election cannot grow, most or all of it will remain locked in place unless the following occurs:

- Asset sale or LIFO termination

- Material inventory liquidation

Although deflation can also create LIFO recapture, the amount of the LIFO recapture that is created from deflation is often negligible in comparison to the overall LIFO tax benefit achieved in the period of the bargain purchase.

Companies seeking to avoid LIFO recapture or to further grow their LIFO tax benefits after their second or third year on LIFO will often change from an internal to external inflation measurement source (aka IPIC method where Bureau of Labor Statistics Consumer/Producer Price Indexes or BLS CPI/PPIs are used to calculate inflation as opposed to double extending current quantities against current/prior year unit costs to do so). The IPIC method is an IRS safe harbor method that bears an array of benefits that are not afforded to taxpayers using a non-IPIC method. Furthermore, the change to the IPIC method is made under automatic change procedures and is applied prospectively, meaning the LIFO tax benefits accrued under the method used to calculate the bargain purchase LIFO reserve remains intact. Lastly, the deadline for affecting a change to the IPIC method for tax purposes is the extended filing deadline, which allows companies to compare the internal vs. external index LIFO reserve and effectively time the change from internal to external indexes to one that’s most advantageous from a tax perspective. Learn more about the IPIC method here: IPIC LIFO Guide

Bulk Asset Purchases of Newly Formed Corporations

The vast majority of companies use what’s called the dollar-value method where changes in inventory are measured by comparing the end of year inventory value at cost to its base year value rather than changes in quantities (aka specific goods or unit LIFO). The first step in dollar-value LIFO calculations is to determine the end of year inventory value at cost. IRS Regs. allows for the following cost flow assumptions to be used to determine the end of year inventory value at cost (aka Current-year cost method):

- Latest acquisitions cost (aka first-in, first-out or FIFO)

- Average cost

- Earliest acquisition cost (EAC)

- Other method that’s clearly reflective of income (such as specific identification which is often used by auto dealers)

When a bulk purchase of assets by a newly formed corporation occurs, the earliest acquisition cost (EAC) method must be used to obtain a tax benefit from electing LIFO. This applies to obtain a LIFO tax benefit from a bargain purchase discount and the one created purely by inflation from a conventional LIFO election. This is because when the bulk purchase of inventory by a newly formed company occurs, the base period (or bargain purchase date) LIFO layer amount is zero. If FIFO was the Current-year cost method used to determine the value of ending inventory, the first year end tax LIFO reserve would be zero regardless of the amount of current year inflation or bargain purchase discount. When the EAC method is used, the election year tax LIFO reserve will be the difference between the year end FIFO balance and the EAC balance calculated, which will include both a bargain purchase discount and inflation component.

When the earliest acquisitions cost method is employed, the calculation of the bargain purchase discount and inflation is more complex compared to using FIFO or average cost because the acquisition date and first inventory turn date quantities and unit costs are included in the computation of the tax LIFO benefit. Accordingly, additional data availability requirements and complexity in the computation of a bargain purchase LIFO election should be expected when it occurs as a bulk asset purchase by a newly formed corporation.

Plan Bargain Purchases to Occur as Close as Possible to Year End

When using LIFO to minimize or offset bargain purchase inventory gains, the amount or percentage of that gain that can be locked into the LIFO inventory value is dependent on a company’s inventory turnover rate & the proportion of the bargain purchase goods that remain on hand or in stock as of the close of the tax year. Accordingly, the timing of the bargain purchase and inventory turnover frequency are key considerations when planning a subsequent LIFO election as it creates material differences size of the LIFO tax benefit from the bargain purchase.

For example, let’s assume a company with a December tax year end makes a bargain purchase in February, and has an inventory turnover ratio of 4 in the year of the bargain purchase & LIFO election. Since the amount of the LIFO tax benefit is proportional to the amount of bargain purchase goods remaining in ending inventory, it’s likely that most of the bargain purchase goods will have been sold during the 11 month period following the purchase.

To further illustrate, let’s assume a company with a December tax year end and an inventory turnover rate of 4 makes the bargain purchase in the middle of December instead of February. If this were the case, it’s safe to assume that the large majority of the goods on hand at year end were the goods obtained in the bargain purchase, and that most of the bargain purchase can be captured in the election year LIFO tax benefit.

The key takeaway is to pay attention to inventory turnover rate and purchase date when planning a bargain purchase in conjunction with a LIFO election. The key considerations are as follows:

- Companies with a very high inventory turnover rate should plan the purchase date to be as close as possible to the tax year end to maximize the LIFO tax benefit achieved from the bargain purchase. Conversely, companies with low turnover rates can place a lower priority on the timing of the acquisition date than those with high turnover rates.

- Companies with high inventory turnover who’re also unable to change the bargain purchase date (including bargain purchases that have already occurred) may consider changing their tax year end month to a date that’s closer to their bargain purchase date

Actionable Items

LIFOPro offers a full line of LIFO outsourcing services, including bargain purchase LIFO election consultations, calculations and IRS forms preparation. We have provided bargain purchase LIFO election outsourcing services for numerous clients, including both small and large manufacturers and wholesalers/retailers. We provide solutions tailored to your company’s exact wants/needs and offer big-firm quality at small firm costs!

LIFOPro makes being on LIFO as simple as possible. Contact us today to schedule a complimentary bargain purchase LIFO election discovery meeting or call!

LIFOPro’s bargain purchase experts

Bob Richardson, CPA: robert@lifopro.com 531-466-4275

Lee Richardson, CPA: lee@lifopro.com 531-466-3472