How the IPIC Method Could Maximize Your LIFO Reserve

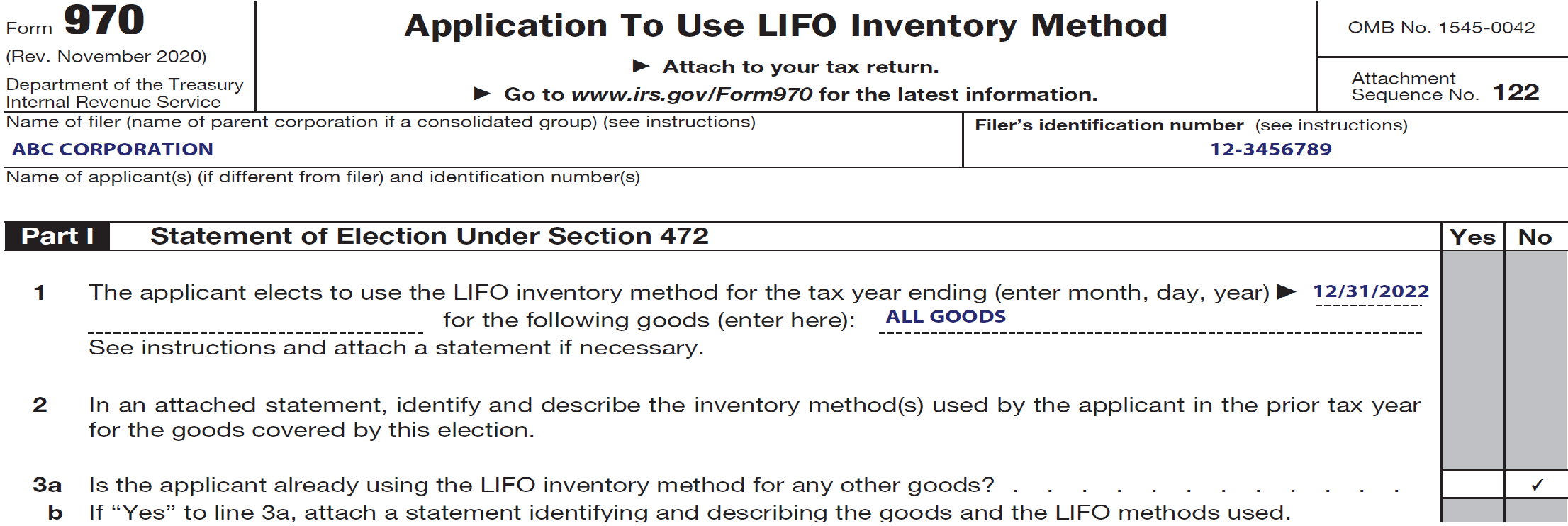

What is the IPIC Method? Dollar-value LIFO method users are allowed to use an internal or external inflation measurement source to calculate inflation. Here’s an overview of these two methods: Internal indexes Current period’s quantities are double extended against current & prior period unit costs (prior period unit costs are used if the link-chain method […]