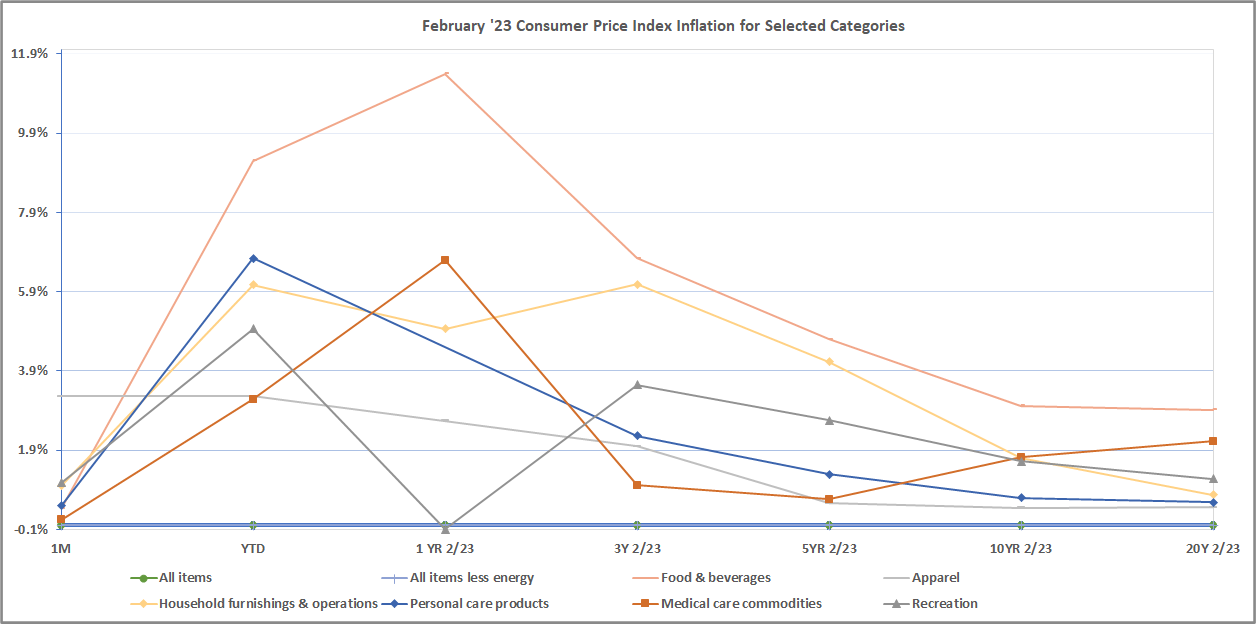

February 2023 CPI Release Highlights

The Bureau of Labor Statistics (BLS) released February 2023 Consumer Price Indexes (CPI) today. Highlights are as follows (all indexes are on a seasonally unadjusted basis): All items saw no change in the last month and rose 6.4% in the last twelve months Food at home increased 0.6% from January and rose 13.0% from February […]