LIFOPro's 2024 LIFO Opportunities & Strategies Guide PDF Report

LIFOPro's Top 2024 LIFO Election Candidates List Excel File

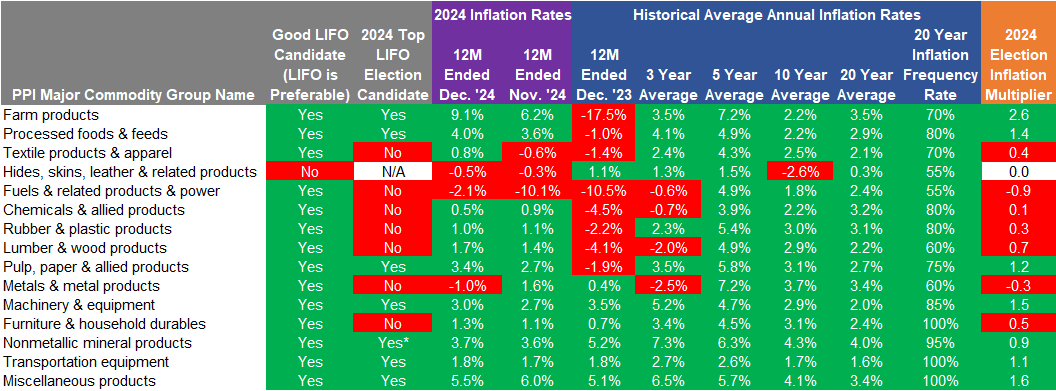

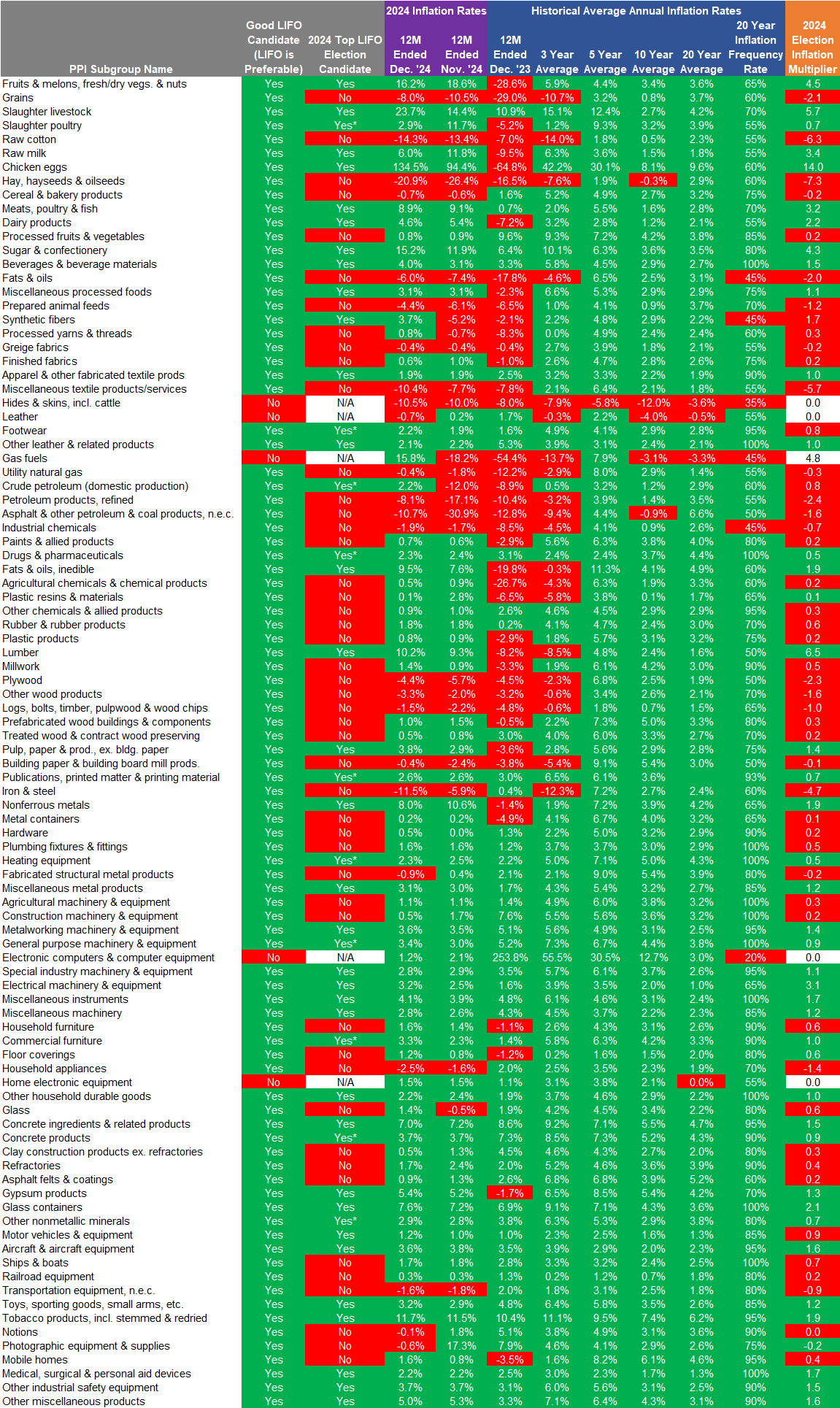

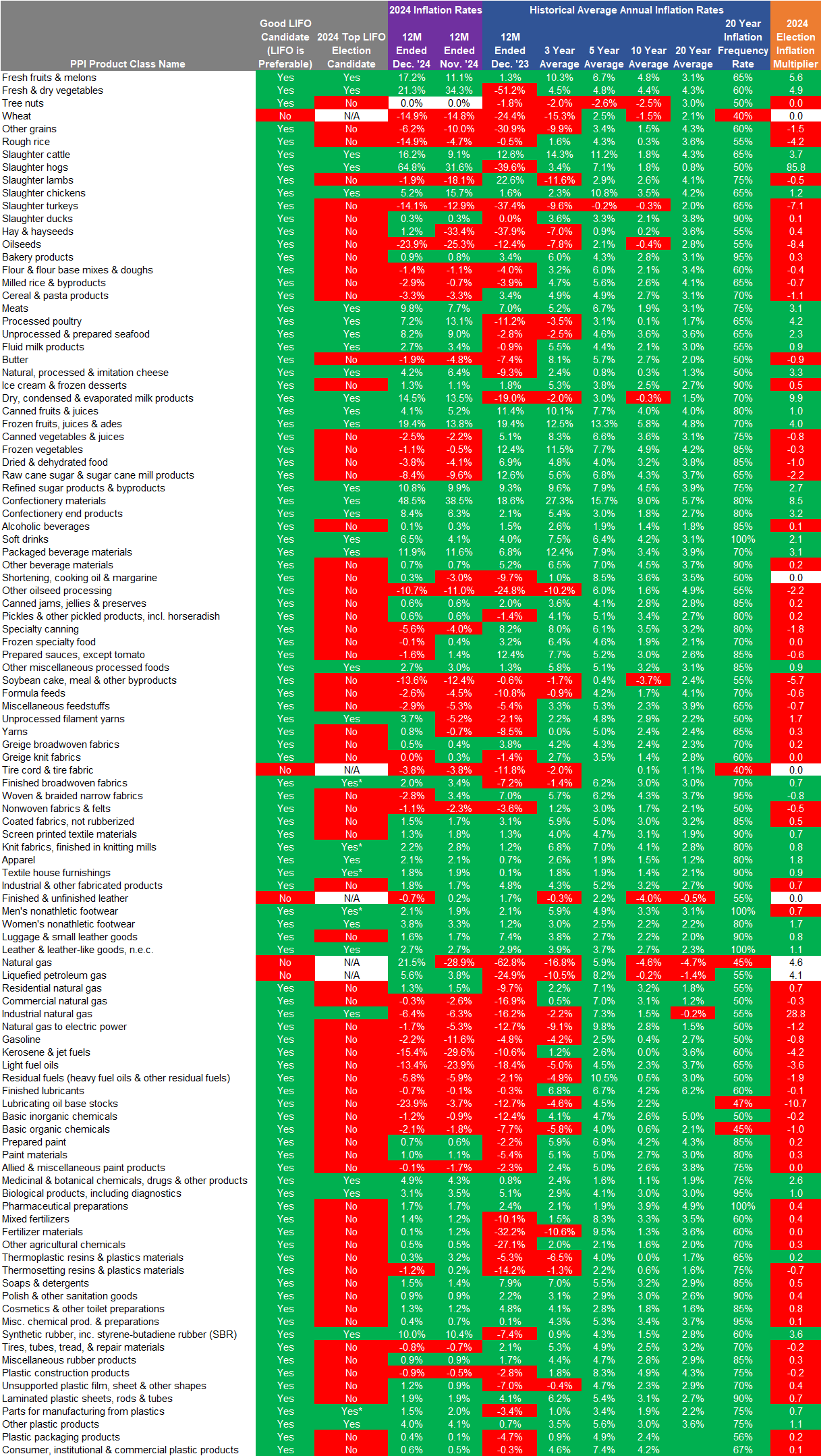

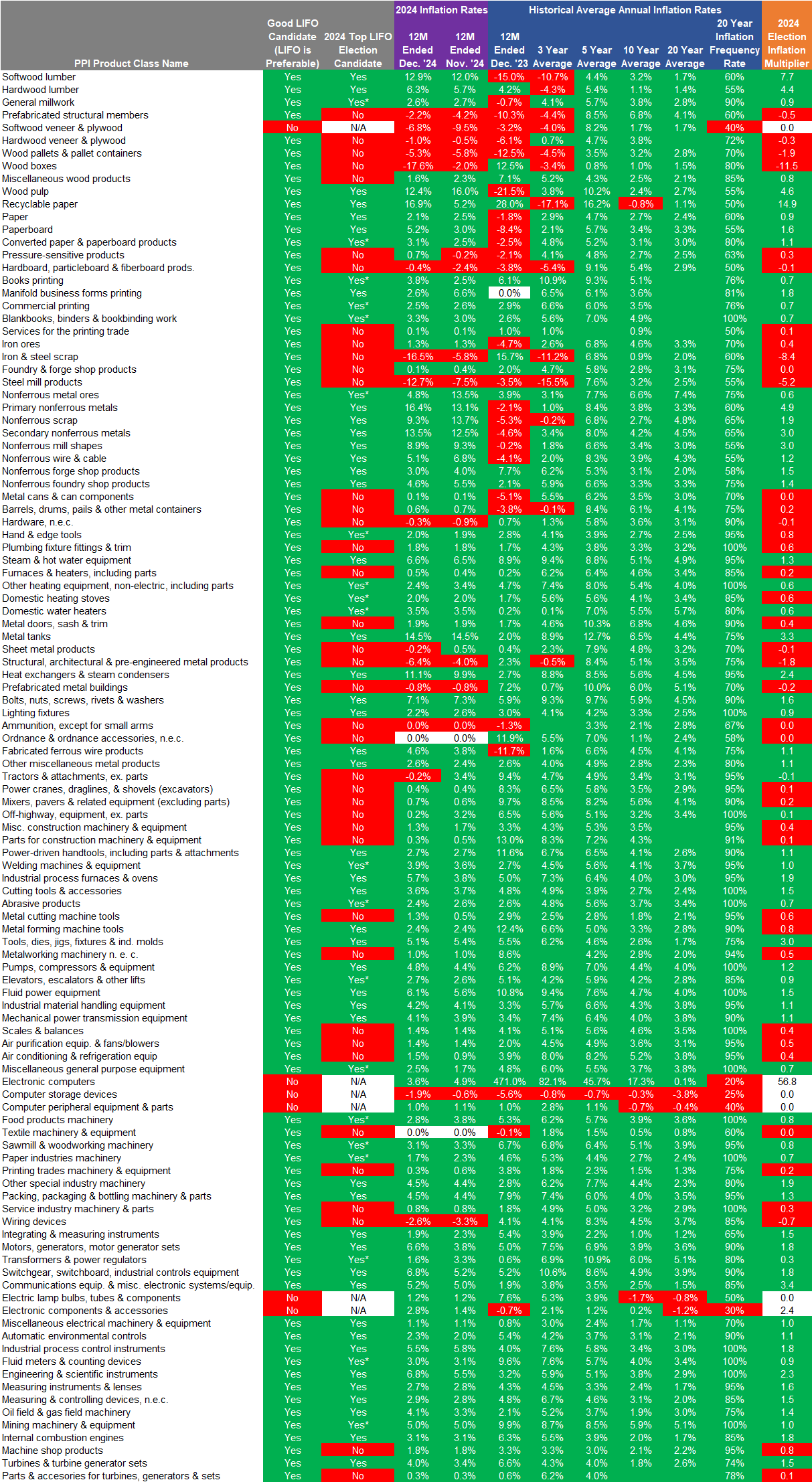

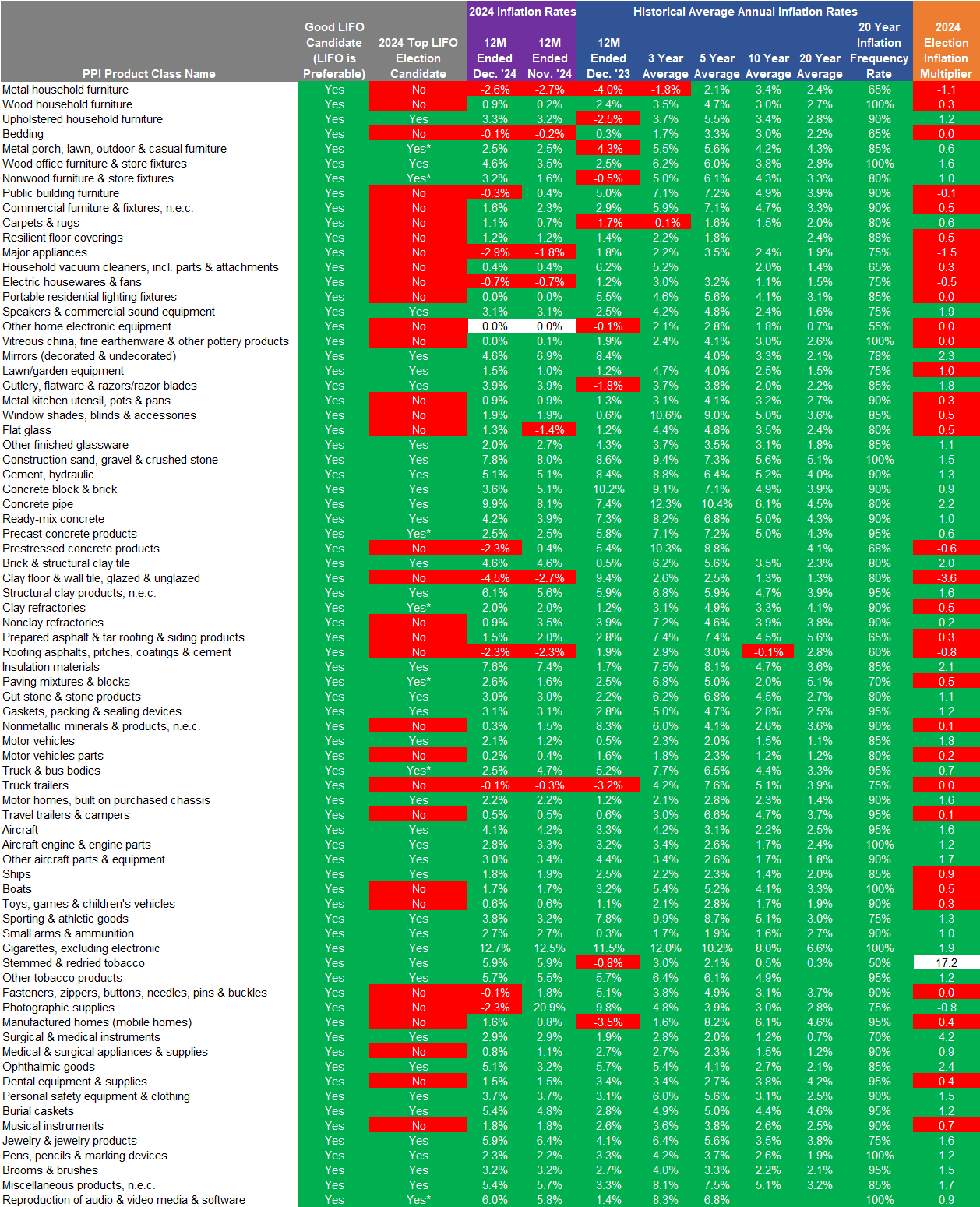

Although inflation has returned to a more normalized level, there are many industries with inflation at or above the historical levels & will be good LIFO election candidates for the 2024 year end. The best opportunities will be in the following areas:

LIFOPro’s list of 2024 top LIFO election candidates are shown further below, and instructions for quickly identifying , and the Top LIFO election candidates tables are shown below the instructions. Alternatively, view/download LIFOPro’s 2024 Top LIFO Election Candidate List Excel file by clicking this link: LIFOPro’s 2024 Top LIFO Election Candidates List Excel File

The LIFO method (last-in, first-out) is the most beneficial inventory-based tax savings strategy because it uses inflation to create material long-term benefits (LIFO creates a tax benefit when there’s inflation), and tens of thousands of companies use LIFO because of this (most companies use LIFO in perpetuity after an election is made since the tax benefits become bigger for every subsequent inflationary period). Since the LIFO tax benefit amount is primarily tied to the amount of inflation measured in a given period (for example, a 5x bigger LIFO tax benefit will occur in a period with 10% inflation compared to a period with 2% inflation), thousands of companies have elected LIFO because of the unprecedented inflation that’s occurred over the last few years. When there’s inflation, LIFO creates a tax benefit by lowering the inventory value and increasing cost of goods sold, which in turn reduces taxable income.

The actual flow or physical movement of goods does not need to match the inventory costing method used to value inventory (aka cost flow assumption). The most two most predominant inventory valuation methods can be simplified as follows:

Because of the advantages of the dollar-value method & disadvantages of the unit LIFO method, almost all companies using LIFO track and value inventories in their accounting system on a FIFO, average cost or standard cost basis for the following reasons:

One of the biggest misconceptions is item/unit costs must be tracked and valued on a last-in, first out basis once LIFO is adopted. Although this is not true, it’s a misnomer that causes many companies to not to use LIFO. The reality is there are two methods or options how goods are to be tracked and valued on a LIFO basis, which are as follows:

Although LIFO can create meaningful short and long term tax benefits, there are many considerations that should be made prior to and during the implementation process. Most importantly, the timing of adopting LIFO is key for the following reasons:

IRS LIFO Requirements

Considerations

Disclaimers

IRS Regs. §1.472-2(e) requires income to be reported and inventories to be valued on a LIFO basis on the face of the income statement and balance sheet beginning in the same year that LIFO is adopted for tax purposes. This is commonly referred to as the LIFO conformity rule. An overview of the LIFO financial reporting disclosure rules and alternatives are listed below.

Some or all goods can be valued using LIFO. A selective election scope infers that less than 100% of inventories are valued using the LIFO method. Although a general rule of thumb is to place all goods on LIFO to maximize the tax benefit, thorough analysis is highly recommended prior to electing LIFO. This is because including deflationary goods in the election scope could materially reduce LIFO’s long-term tax benefits. LIFOPro’s best practices regarding determining the LIFO election scope is described below.

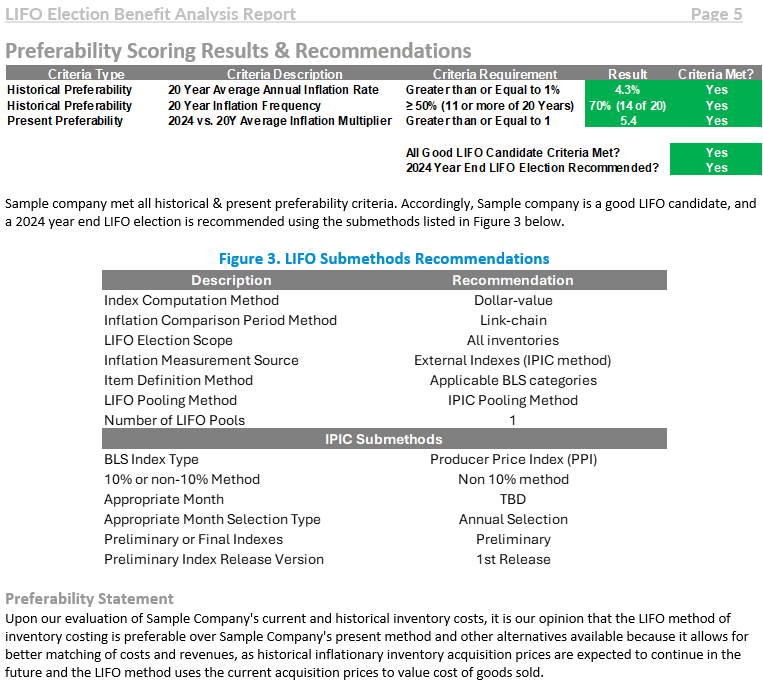

The costing method used to value inventory is considered an accounting method or principle. Since there are multiple inventory valuation methods available, preferability must be established when changing to the LIFO method from a non-LIFO method. Because of this, companies issuing GAAP financial statements must establish that LIFO is preferable to the existing method.

No authoritative body has established criteria for determining the preferability among alternative inventory valuation methods, but the Securities & Exchange Commission’s Staff Accounting Bulletin Topic 6.G.2b states the following:

Furthermore, most companies use LIFO in perpetuity, and because of this, the LIFO reserve will often grow and become a materially large amount. For these reasons, companies and CPA firms should obtain or perform meticulous analysis prior to adopting LIFO for the following reasons:

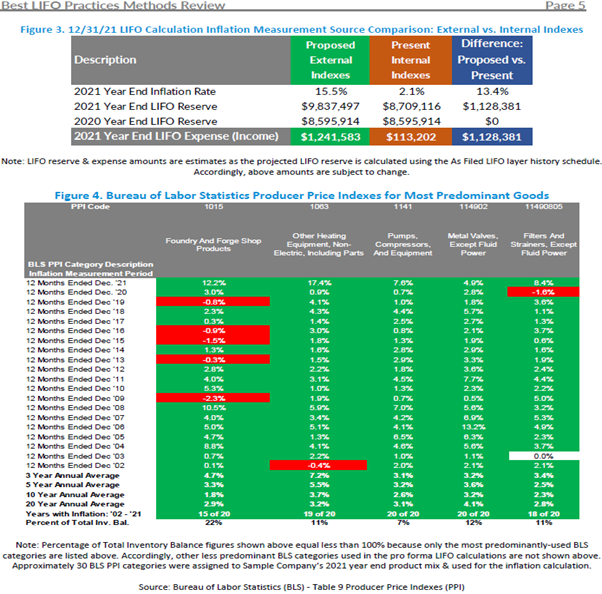

Such analysis should include historical calculations, current period estimates, exploring all available submethods & preparing comparisons amongst the available submethods (such as valuing all or only certain goods using LIFO, using an internal vs. external inflation measurement source, pooling methods & determining whether the same or different book & tax LIFO submethods will be used). Additional considerations should include comparing the administrative burden and risks, outsourcing costs, and considering licensing software to automate the calculation if managed in-house.

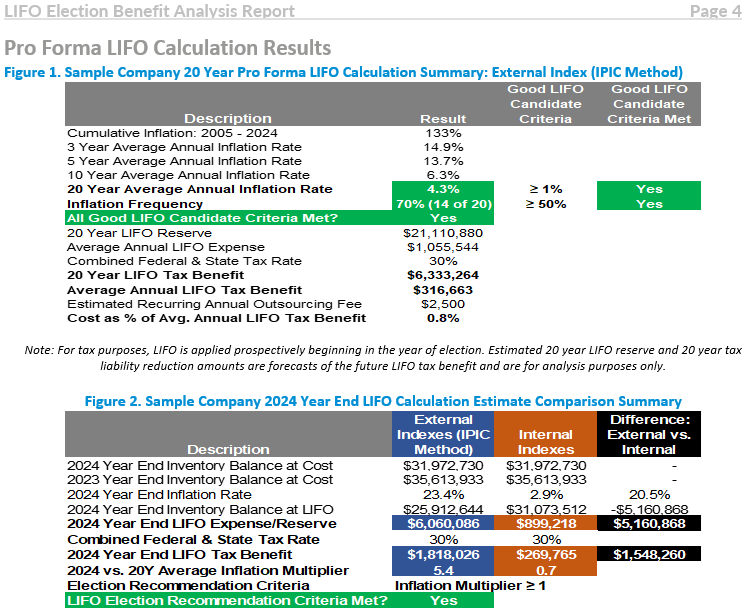

LIFOPro uses proprietary inflation metrics and a standard grading system to establish whether or not LIFO is a preferable method for a company or given industry. From this grading system, a determination can be made regarding if a company is a good LIFO candidate, and subsequent recommendations are also provided regarding the proper timing of when to elect LIFO. Our grading system & scoring criteria is organized as follows:

LIFOPro’s grading system & scoring criteria are integrated into LIFOPro’s 2024 Top LIFO Election Candidates Tables shown below. They’re also integrated in our complimentary LIFO election benefit analysis reports prepared for companies who aren’t on LIFO but are considering adoption.

LIFOPro’s 2024 top LIFO election candidates list provides you with the ability to quickly determine or accomplish the following:

LIFOPro’s lists are divided into the following three tables:

LIFOPro uses Bureau of Labor Statistics Producer Price Indexes (BLS PPI) to measure inflation metrics & identify the best LIFO election candidates each year. LIFOPro releases the first version of our Top LIFO Election Candidates list beginning with the release of the September BLS indexes.

Two separate sets of instructions are provided below. The single company instructions are designed for CPA firms seeking to determine if one client is a top LIFO election candidate. The multi-company instructions are designed for CPA firms who’re seeking to prepare a client target list of potential LIFO election candidates.

Notes

Notes

Notes

There are a variety of LIFO “submethod” alternatives available, and in some cases, there are material differences in the recurring administrative burden & long-term tax benefits amongst the various submethod options. Listed below are the most notable submethod alternatives & LIFOPro’s best practices feedback.

Using the costs of the goods paid to suppliers and vendors to measure inflation for LIFO calculation purposes is known as internal indexes. Inflation is measured by double extending current quantities against the current & prior period’s unit costs, and the sum of the current & prior period’s extensions are divided to calculate a current year inflation index. Since prior year unit costs don’t exist for new items, it’s critically important to understand the new item inflation treatment alternatives. This is especially important when new items represent a material value. A background & best practices are described below.

New Item Inflation Treatment Background

New Item Inflation Treatment Best Practices

Companies have the option to use one of the two following inflation measurement sources to calculate inflation:

Why many companies use the IPIC method

As an industry, auto dealers are one of the most predominant LIFO users. This is much in thanks to the consistent historical inflation that exists in the automobile industry. Most dealerships are eager to maximize tax deferral & minimize taxable income by using LIFO because of the profitable nature of the industry. There are a wide range of method alternatives & calculation options, so it’s critical to understand the various options available, and the best practices to employ, which are listed below.

LIFO Election Scope – Background

The long-term LIFO tax benefits will outpace the long-term LCM reserve tax benefits because the LIFO tax benefits will grow in perpetuity when there is inflation (even if the inventory balance doesn’t increase). Contrarily, the LCM reserve tax benefits only increase when inventory levels grow and/or more vehicles are reserved or written down, and they actually decrease or are recaptured every time that a vehicle with a reserve is sold (LCM reserve is directly tied to each vehicle) . Conversely, the LIFO reserve remains intact when vehicles are sold as long as additional vehicles replace the sold vehicles by the end of the year. Said another way, the LIFO reserve is not tied directly to each vehicle, but instead based on the total dollar-value, which is why most companies use the dollar-value method, and not the specific goods or unit LIFO method which ties a LIFO value to each item.

Note: a common misconception is that companies are using specific goods or unit LIFO when they are in fact using the dollar-value LIFO method, and are using the “specific identification” or specific ID method to determine their year end inventory balance at cost i.e. Current-year Cost. Nearly all companies use dollar-value LIFO because the tax benefits are materially higher than the unit LIFO method.

LIFO Election Scope – Best Practices

The recommendations for the scope of the goods to be valued using LIFO is dependent on the inflation measurement source used by auto dealers because there are differences in the way that inflation can be measured amongst the alternatives. The best practices are broken out by the two available inflation measurement sources:

Inflation Measurement Source Alternatives – Background

Historically speaking, the alternative LIFO method (ALM) has been the most predominantly utilized auto dealer LIFO inflation measurement source because from the time of its inception in the early 1990s up until COVID, it created materially higher long-term LIFO tax benefits than the IPIC method. With that being said, the IPIC method was occasionally used during this time because it offered an extremely simple means of calculating LIFO, and reduced the administrative burden and tight reporting deadlines associated with the ALM (IPIC only requires for inventory balances by cars, trucks and parts to calculate inflation. ALM requires invoices for all vehicles on hand at year end along with software or an outsourcing solution to determine a prior period base vehicle cost to measure inflation, which can be extremely burdensome).

Beginning with the COVID pandemic, the IPIC method inflation became initially comparable with the ALM. In 2021 and 2022, the IPIC method inflation became materially higher than the ALM, and because of this, sizably higher LIFO tax benefits were there for the taking by willing participants. As a result, a huge influx of accounting method changes were made by auto dealers to switch from the ALM to the IPIC method in 2021 & 2022. Additionally, many auto dealers who were making the change from the ALM to the IPIC method were also expanding their LIFO election scope to include used vehicles to take advantage of unprecedented inflation & LIFO tax benefits (and also to offset or eliminate LIFO recapture that had been or was occurring due to the material vehicle liquidations caused by the supply chain disruptions). The switch to the IPIC method was essentially a slam dunk for many auto dealers when the additional tax benefits were paired with the promise of significantly reduced administrative burden, expedited LIFO reporting and lower outsourcing costs.

As of today, there is wide-spread usage of both the alternative LIFO method and the IPIC method. As of 2024, the inflation differential & LIFO tax benefits for the upcoming year end is sometimes comparable or better for the IPIC method, but just as often can be more beneficial when using the ALM (year to date BLS PPI inflation is 1.6% as of 10 months ended October 2024 PPI; 2024 year to date ALM new vehicle inflation is wide ranging from flat to 1% – 2% inflation). With that being said, the alternative LIFO method will always carry higher administrative burdens, outsourcing costs, and longer LIFO reporting turnaround times compared to the IPIC method, so the best practices regarding the inflation measurement source will be dependent on the specific wants and needs of each dealer. An overview of the two alternatives are provided below.

Inflation Measurement Source: Best practices

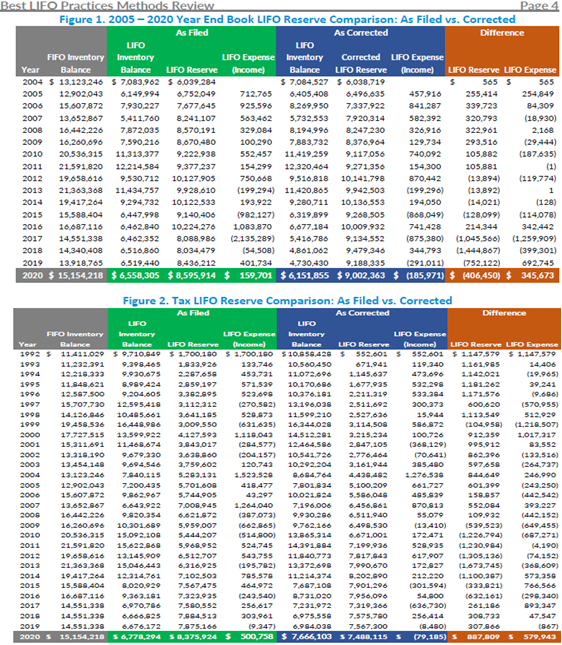

When an error or series of errors occur in the LIFO calculation, the corrective actions available and/or required to be made are dependent on the frequency of the error (if the error occurred once or in multiple consecutive periods). Separate GAAP or financial reporting and tax rules also apply when accounting for LIFO errors, which are outlined below.

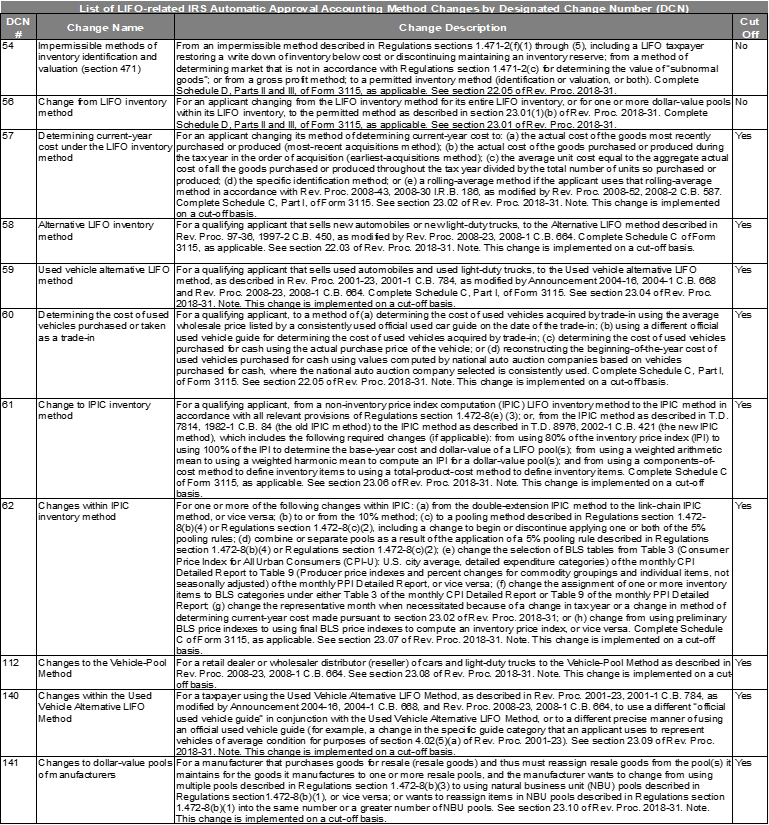

Most LIFO-related IRS accounting method changes are applied on a cut-off basis, which implies the change is applied prospectively beginning in the year of change, and no §481(A) adjustment to adjust income as reported under the new method is required or permitted. The two exceptions are designated change number (DCN) 54 for Impermissible methods of inventory identification & valuation & DCN 56 for changing from the LIFO method to a non-LIFO method (aka terminating LIFO election). Both of the aforementioned changes are not applied prospectively & require prior period adjustments because they relate to non-LIFO inventory regulations which fall under §471 (all LIFO regulations fall under §472). A complete list of LIFO-related automatic approval accounting method changes are provided below.

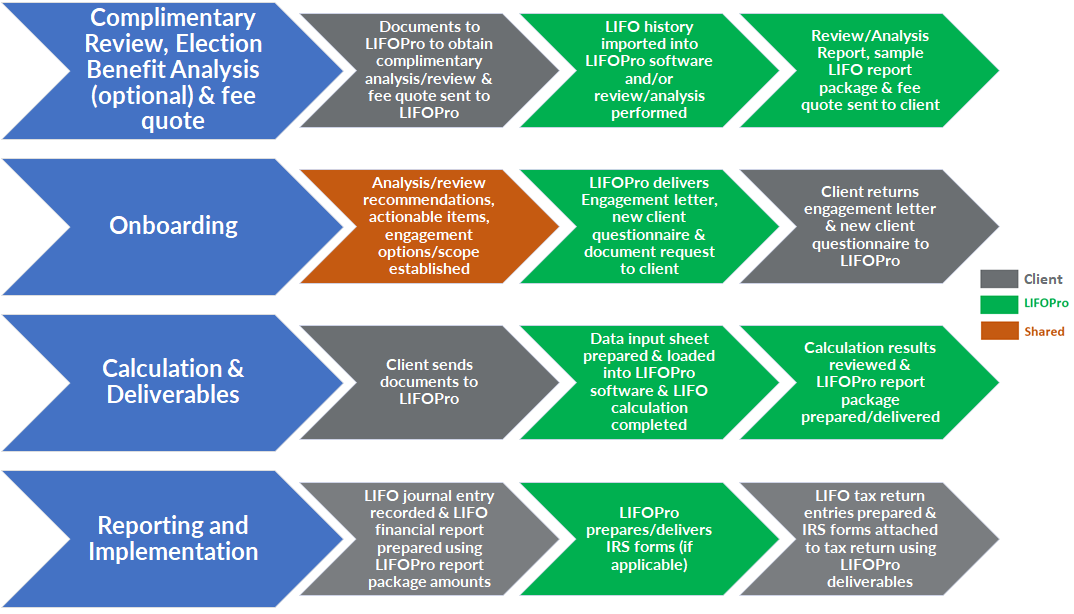

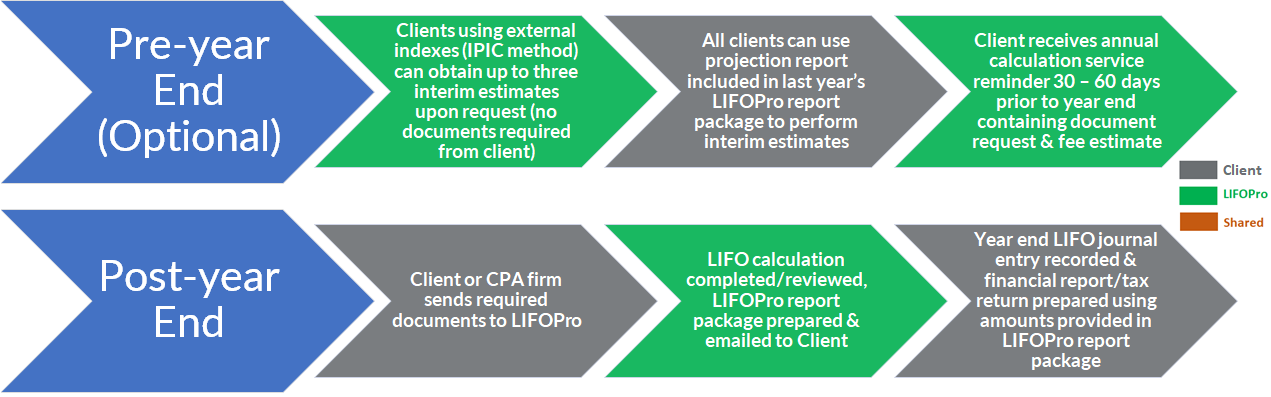

Get top-notch complimentary analysis & review from the LIFO experts. LIFOPro offers Best LIFO Practices & Methods Reviews for companies on LIFO. We also provide LIFO Election Benefit Analysis for companies considering adopting LIFO. Companies seeking an automated LIFO solution or replacement to their current LIFO system can get a free software trial.

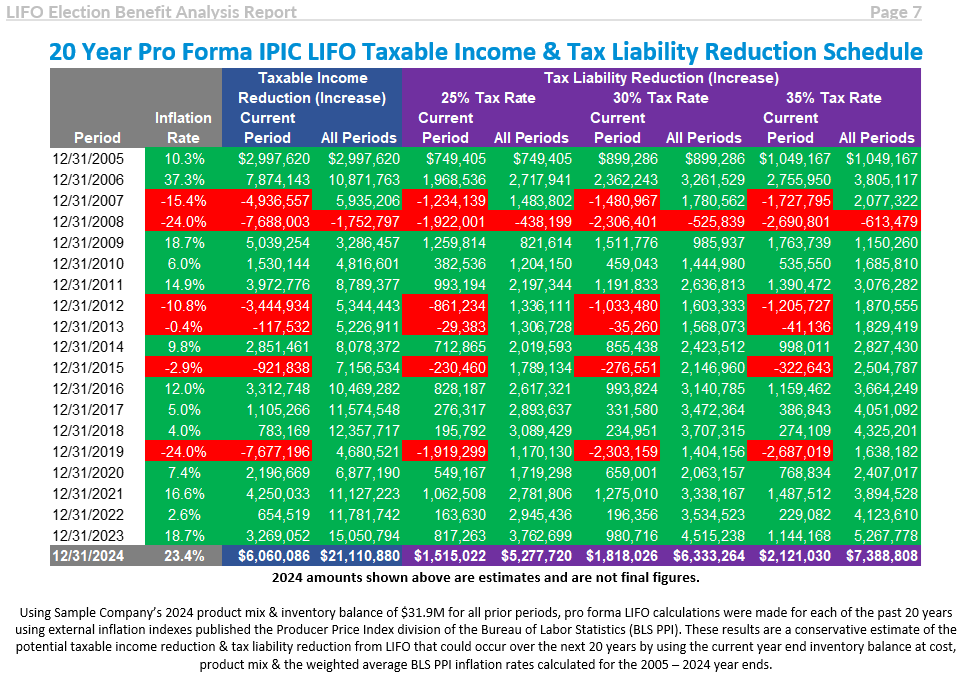

LIFO Election Benefit Analysis

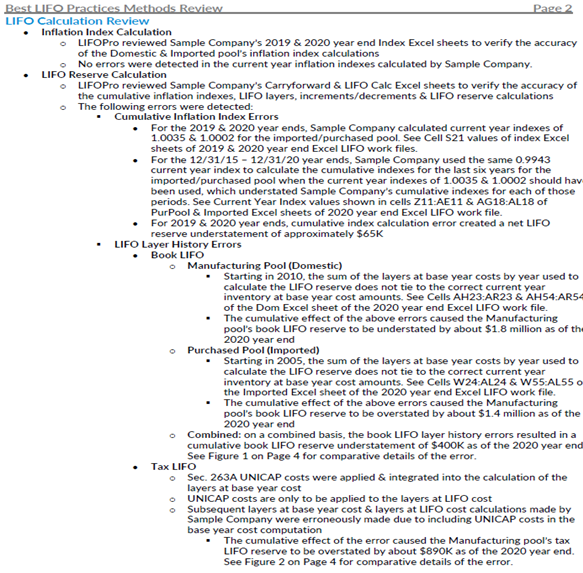

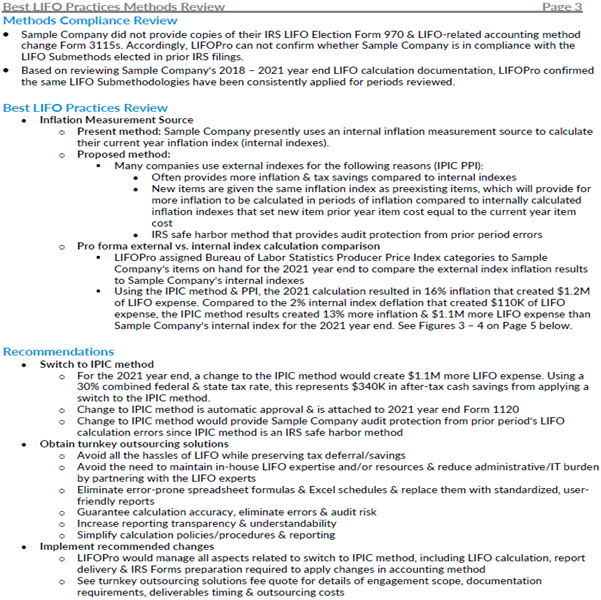

Best LIFO Practices & Review

Document Requirements

LIFOPro makes being on LIFO as simple as possible. We act as a third party LIFO service provider & subject matter expert to both CPA firms & companies. We design customized solutions that fit your firm & client’s LIFO needs, not a one-size fits all solution that offers more or less than what is needed. Our powerful in-house developed/maintained software allows us to automate most aspects of the work, spend a fraction of the time required by anyone else making manual LIFO calculations & deliver high-quality solutions at the most reasonable costs. We work with companies of all sizes and situations, including companies already on LIFO or those that aren’t but are considering a LIFO election.

LIFOPro’s Responsibilities

CPA Firm or Client Responsibilities

Guides

Complimentary Offerings

LIFOPro’s Offerings

Sample Reports

LIFO Library

Schedule a call with the LIFOPro team today to lean how your firm, client or company can partner with us for all your LIFO needs & to make being on LIFO as simple as possible!

Sign up today to receive industry news & promotional offers from LIFO-PRO