Request your complimentary benefit analysis report by completing & submitting the form below. You’ll receive your complimentary analysis PDF report & fee quote within one week of submitting this form. Note: if you are submitting your request using the form below, you will need to upload your documentation using the upload file button located at the bottom of this form. Alternatively, you may email your documentation to lifopro@lifopro.com

Want to learn more about LIFO & our offerings? Schedule an introductory call or Teams meeting with LIFOPro by calling 402-330-8573, emailing lifopro@lifopro.com or using our online scheduling tool by clicking here: Schedule Call With LIFOPro

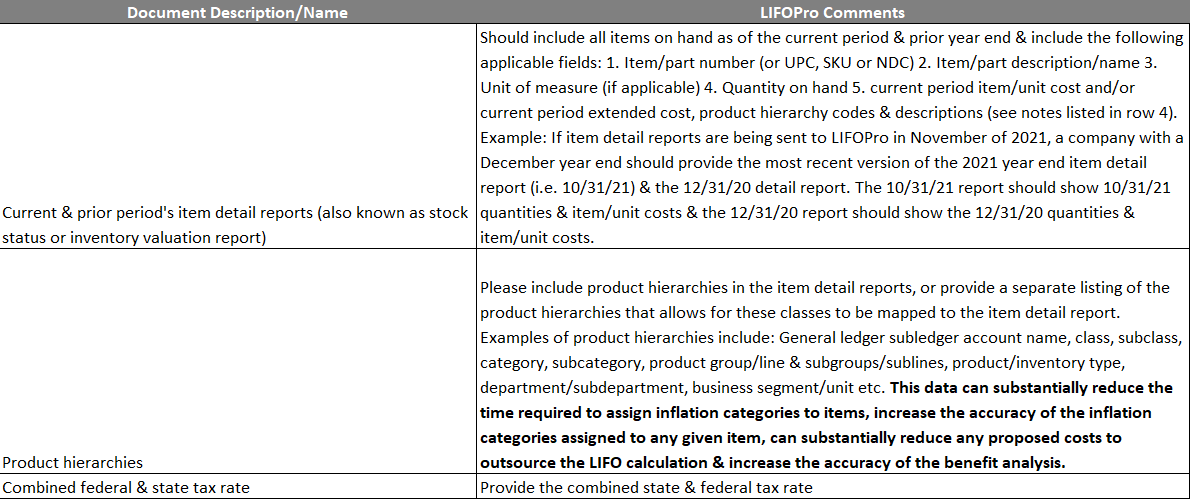

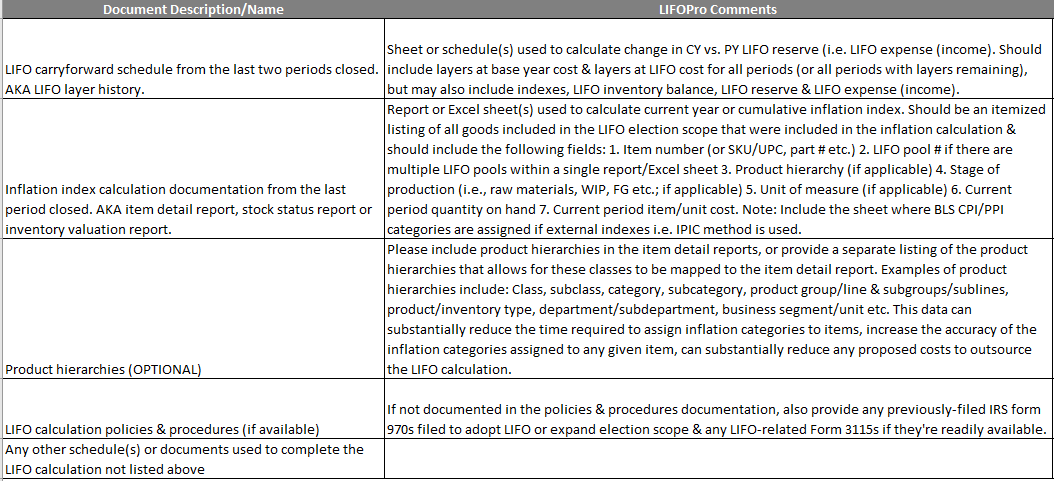

LIFO Election Benefit Analysis Documentation Request Listing

Sample LIFO Election Benefit Analysis Report

How LIFO Works & LIFOPro’s Offerings Slide Deck

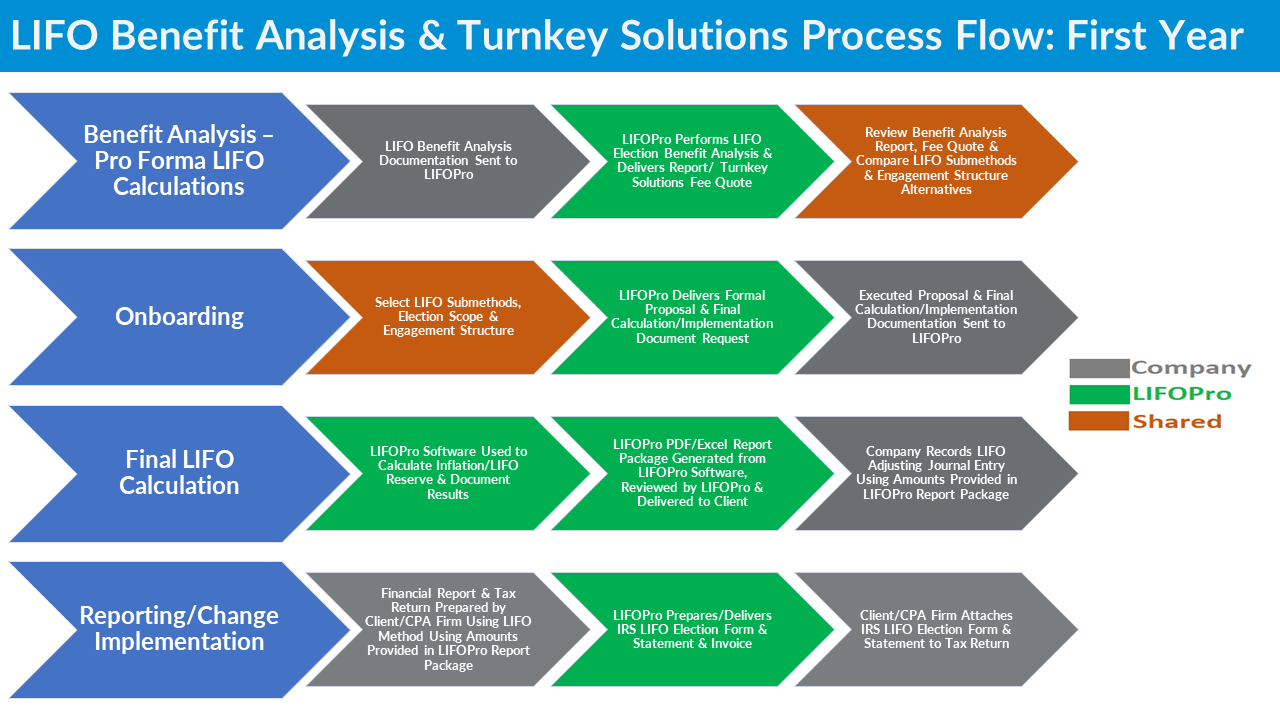

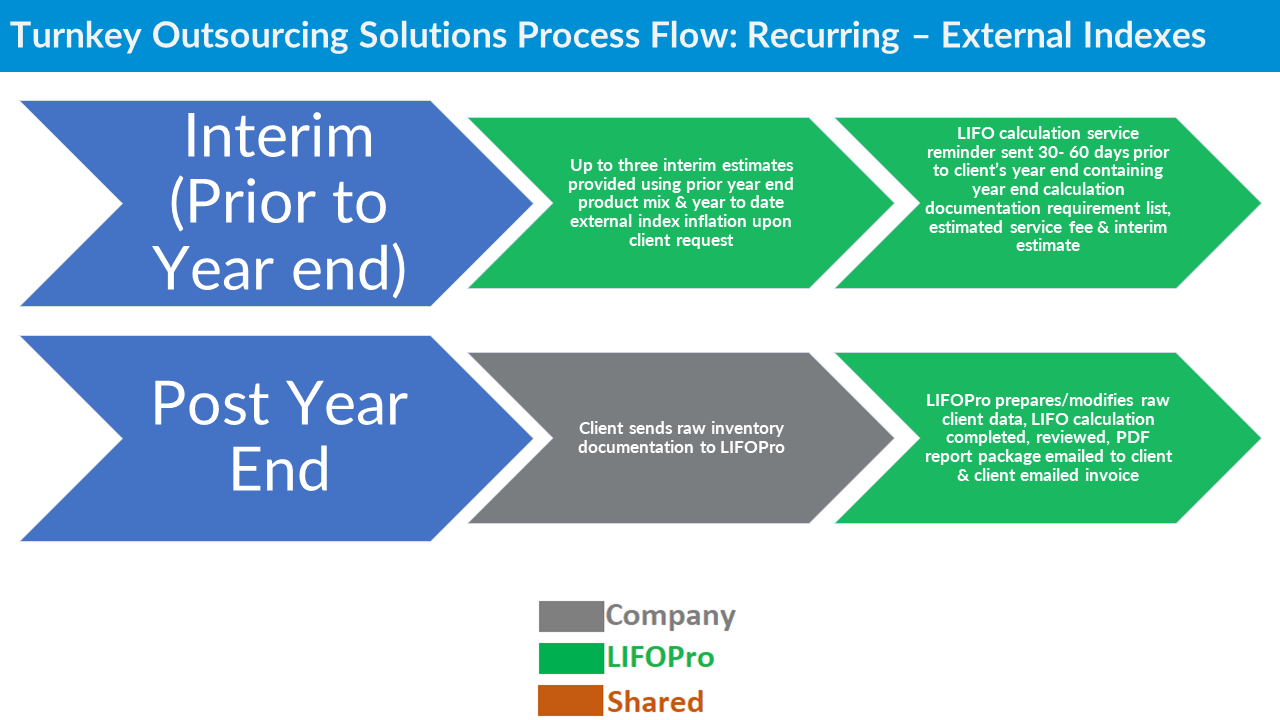

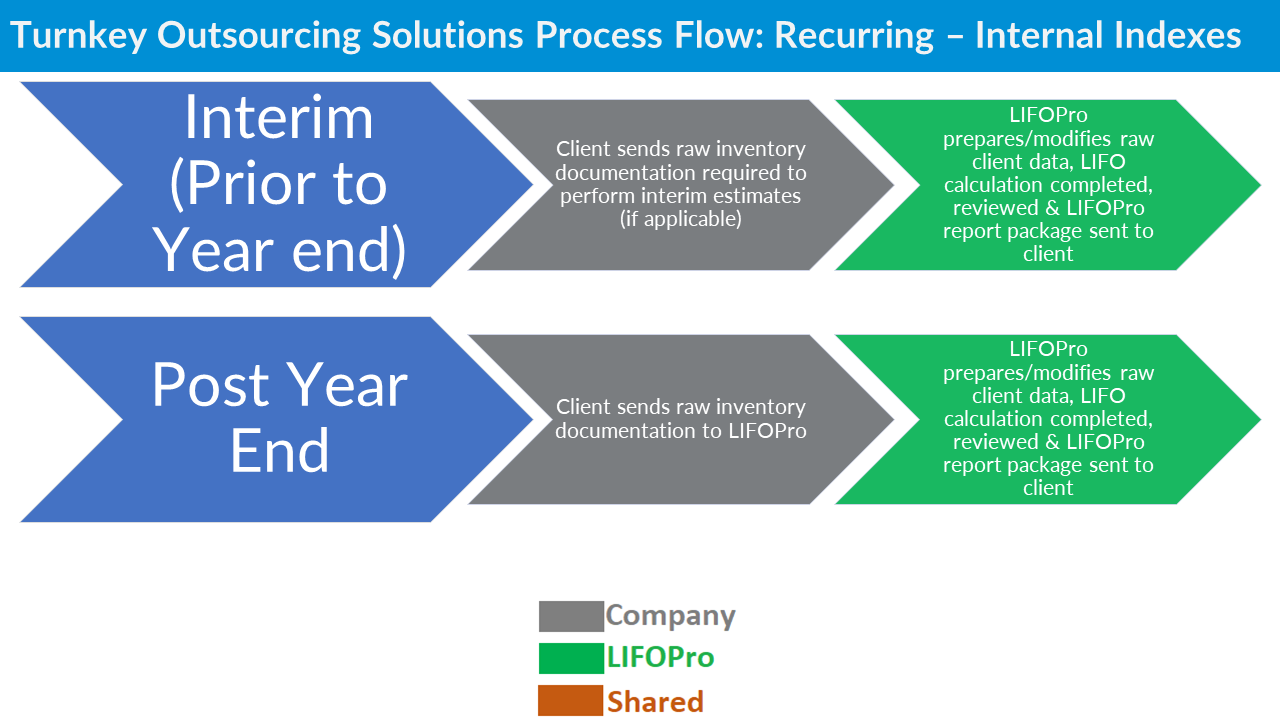

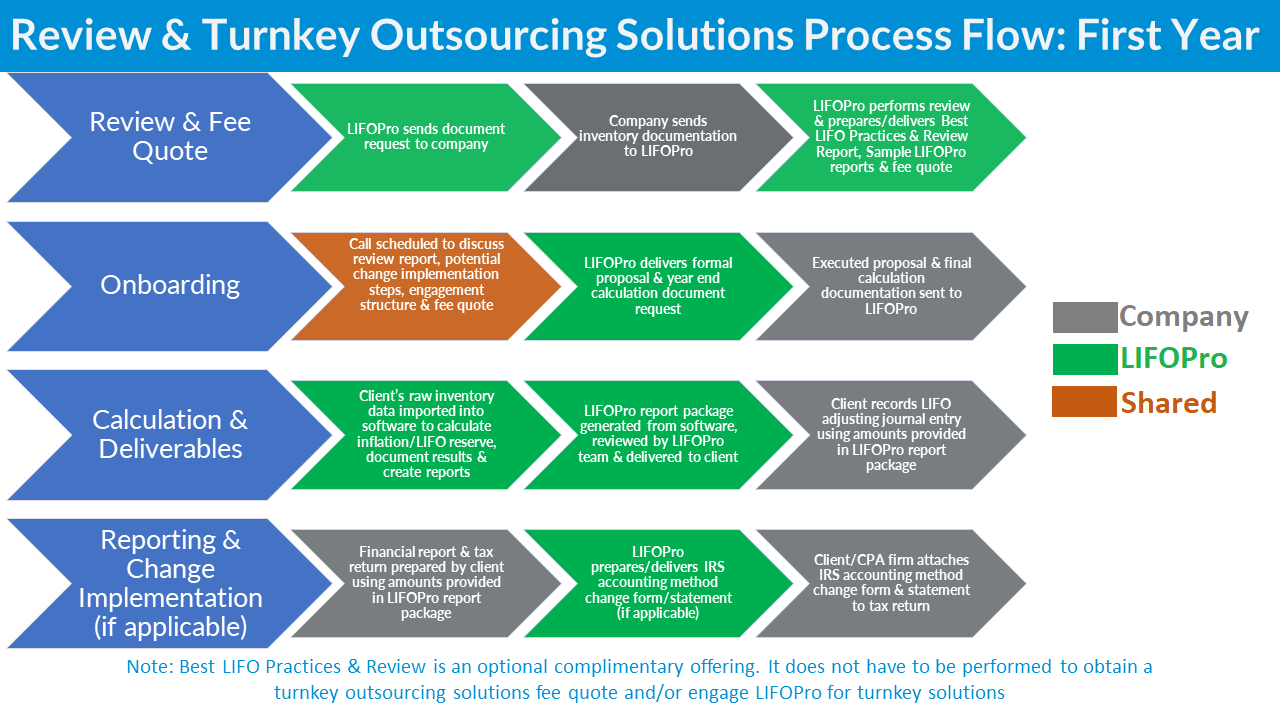

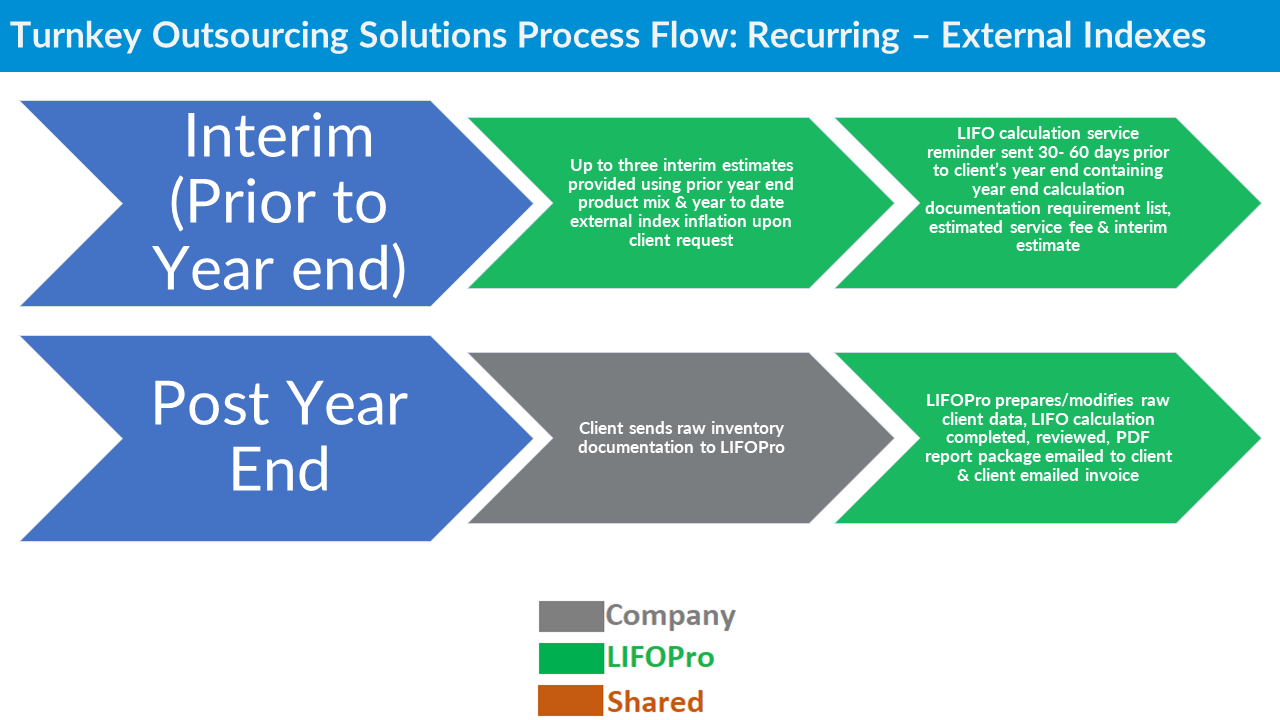

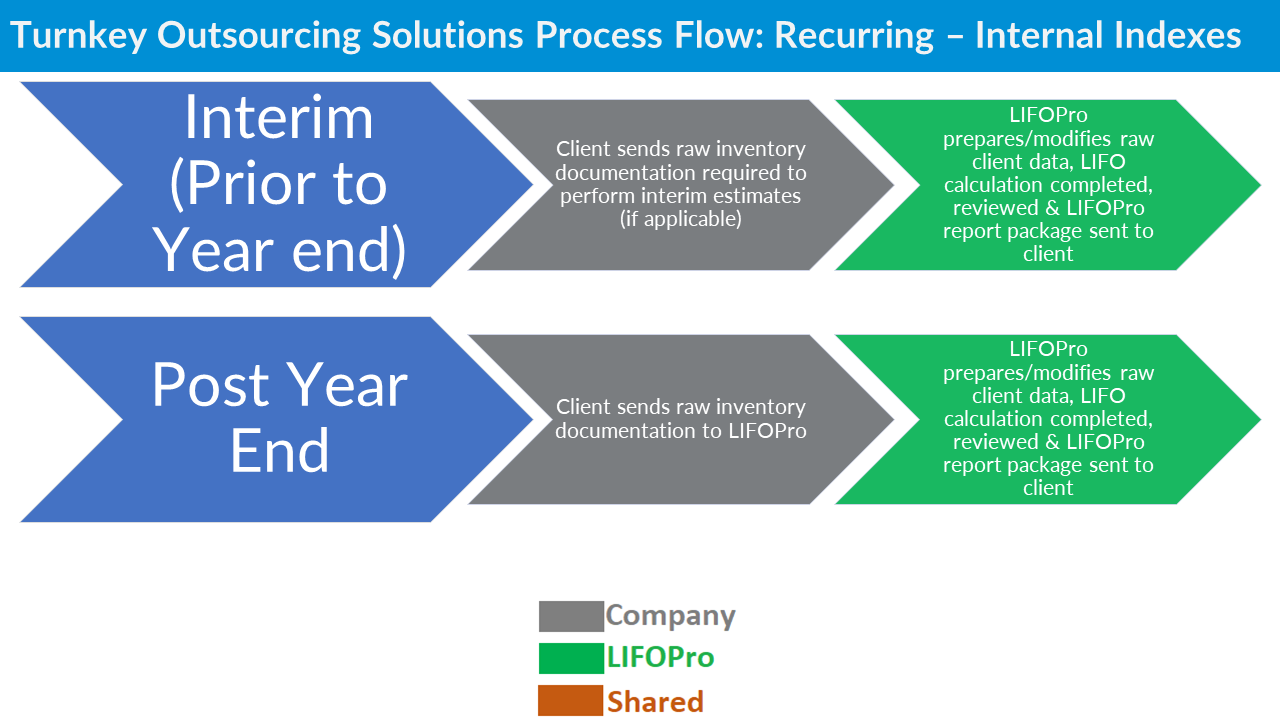

LIFO Benefit Analysis & Turnkey Solutions Process Flow Charts

Request your complimentary Best LIFO Practices & Review Report by completing & submitting the form below. You’ll receive your complimentary PDF report within one week of submitting this form. Note: if you are submitting your request using the form below, you will need to upload your documentation using the upload file button located at the bottom of this form. Alternatively, you may email your documentation to lifopro@lifopro.com

Want to learn more about the review process & our offerings? Schedule an introductory call or Teams meeting with LIFOPro by calling 402-330-8573, emailing lifopro@lifopro.com or using our online scheduling tool by clicking here: Schedule Call With LIFOPro

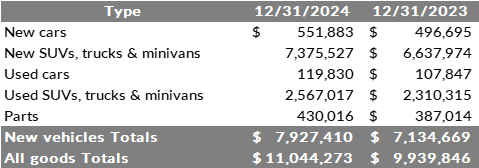

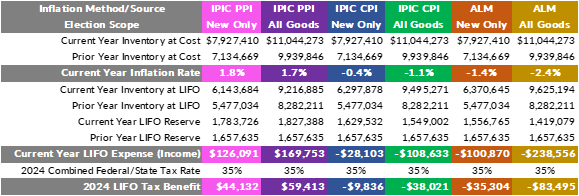

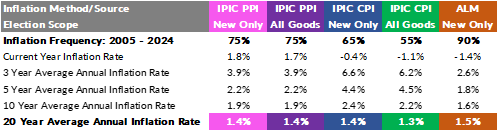

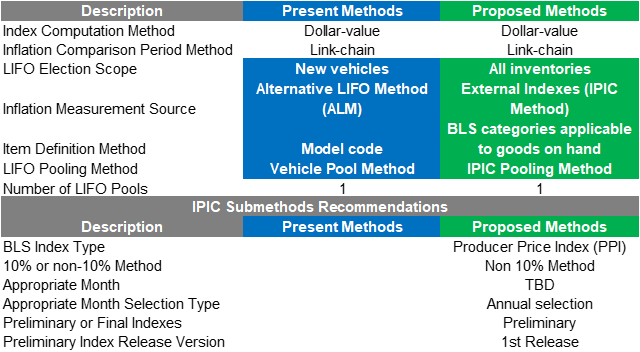

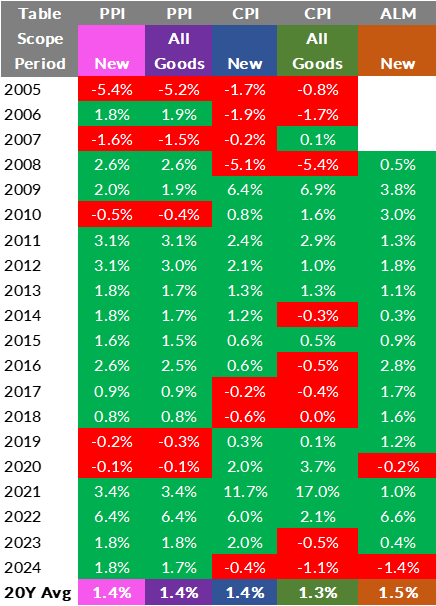

Under the ALM, items are defined by model code, and inflation is measured by comparing each model code’s current & prior period’s invoice base costs for all vehicles on hand at year end. To calculate inflation, the model code & base vehicle cost for each vehicle on hand at year end must be extracted from the invoice to create a schedule of quantities & average year end base vehicle costs by model code. A subsequent mapping of each model code’s prior period base vehicle cost is performed, and inflation is calculated by double extending the current year end quantity for each model code against its current/prior invoice base vehicle costs & taking the quotient of the sum of the current & prior period’s extensions.

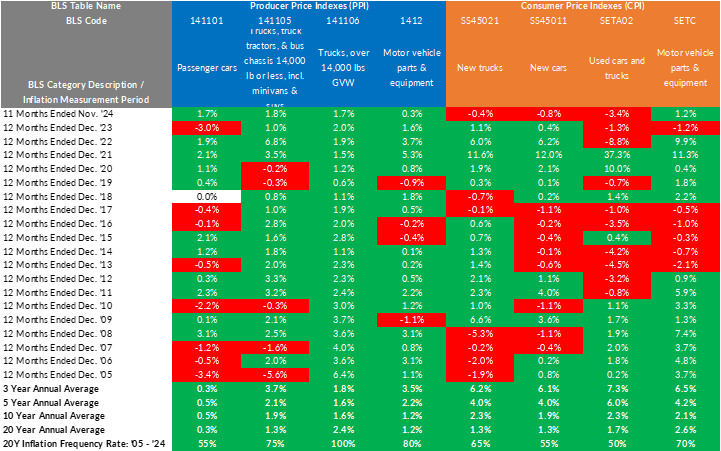

Under the IPIC method, items are defined by the Bureau of Labor Statistics Consumer/Producer Price Index categories that includes the goods in a company’s product mix. For auto dealers, there are three BLS PPIs applicable to their inventory (1. Cars 2. Trucks, SUVs, minivans & crossovers 3. Parts) & four BLS CPIs applicable to their inventory (1. New cars 2. New trucks, SUVs, minivans & crossovers 3. Used vehicles 4. Parts). Since most auto dealers have separate general ledger subledger accounts provide a direct mapping to the 3-4 BLS CPI/PPIs, there’s no need to obtain information from each vehicles invoice. Once a schedule of inventory balances by BLS category is prepared, inflation is calculated by calculating a category inflation index for each BLS category, calculating the harmonic dollars weighted quotient by BLS CPI/PPI & taking the quotient of the sum of the inventory balances at specific ID cost & the sum of the harmonic dollars weighted quotients.

Recipients will receive free analysis/case study PDF report & fee quote via email within one week of questionnaire submittal, but expedited turnaround time as soon as same day can be accommodated upon request

Present Methods

Proposed Methods

Trial the software for 90 days. Get a complimentary analysis for companies considering using LIFO. Get a complimentary review for companies on LIFO. Request a cost estimate. Use our simple form to submit your request.

Get startedHave a phone call or WebEx with the LIFO-PRO team to get started today or learn more about our offerings. Schedule online using our easy-to use booking tool.

Schedule Call or DemoReceive a Unilateral Non-disclosure Agreement by electronically consenting & signing using our online form.

Receive a Non-disclosure AgreementSimplify LIFO calculation, documentation & reporting procedures. Eliminate complicated Excel schedules. Reduce time on LIFO & increase reporting transparency!

Sign up today to receive industry news & promotional offers from LIFO-PRO