The convoluted nature of LIFO has caused confusion behind the fact that companies are allowed to use differing Book (Financial Reporting) & Tax LIFO methods. Both GAAP & the IRS allow for companies to have differing Book & Tax LIFO methods. Aside from International Financial Reporting Standards (IFRS), the only true Book & Tax LIFO conformity requirements are as follows:

- LIFO must be used for both Book & Tax reporting purposes

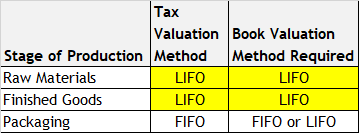

- The scope of LIFO inventories reported for Book purposes must be greater than or equal to the scope of Tax LIFO inventories (see example below)

The 1981 LIFO Conformity Requirement is considered to be both the GAAP & Tax authoritative references/regulations on the use of differing Book and Tax LIFO methods.

List of Acceptable Book-Tax LIFO Method Differences

Shown below is a complete list of acceptable Book-Tax LIFO method differences:

- LIFO index computation method (dollar value vs. specific goods)

- LIFO election scope (Book LIFO inventory scope must be greater than or equal to the Tax LIFO inventory scope)

- Item definition method (Individual items, fungible commodities, etc.)

- Inflation comparison period (Link-chain vs. Double-extension)

- Current-year cost & layer valuation method (Latest acquisitions/FIFO, earliest acquisitions, moving average or any other method that clear reflects income)

- LIFO pooling method (Line/type/class of goods, Natural business units, raw materials contents, IPIC pooling method)

- Inflation measurement source (Internally calculated index vs. IPIC – CPI/PPI)

- Index timeframe selection (Final vs. Preliminary indexes)

- Discontinued categories treatment (Compound inflation vs. substitute index methods)

- Pool index calculation method (10% method vs. most-detailed category method)

- Appropriate month selection (Annual selection vs. Representative appropriate month)

Why Companies Use Different Book & Tax LIFO Methods

Numerous private and publicly traded companies employ the use of different Book & Tax LIFO methods for the following purposes:

- Differences in Book & Tax LIFO regulations (i.e. Book LIFO requires ending inventory balance to be valued net of obsolescence reserves while Tax LIFO requires this amount to be gross)

- Maximize Tax LIFO benefits (i.e. Using inflation measure source that provides the maximum Tax LIFO deferral benefit)

- Minimize Book LIFO effect (i.e. Using inflation measure source that produces the least net income reduction on the balance sheet)

1981 LIFO Conformity Rule – IRS Regulations

IRS Reg. §1.472-2(e)8, titled “Use of different methods”, is contained within the 1981 LIFO Conformity Rule describes the Internal Revenue Service’s interpretation of acceptable differing Book & Tax LIFO methods, and reads as follows:

[otw_shortcode_quote border_style=”bordered”]Use of different methods. The following are examples of costing methods and accounting methods that are neither inconsistent with the inventory method referred to in §1.472-1 nor at variance with the requirement of §1.472-2(c) and which, under paragraph (e)(1)(vi) of this section, may be used to ascertain income, profit, or loss for credit purposes or for purposes of financial reports regardless of whether such method is also used by the taxpayer for Federal income tax purposes:

(i) Any method relating to the determination of which costs are includible in the computation of the cost of inventory under the full absorption inventory method.

(ii) Any method of establishing pools for inventory under the dollar-value LIFO inventory method.

(iii) Any method of determining the LIFO value of a dollar-value inventory pool, such as the double-extension method, the index method, and the link chain method.

(iv) Any method of determining or selecting a price index to be used with the index or link chain method of valuing inventory pools under the dollar-value LIFO inventory method.

(v) Any method permitted under §1.472-8 for determining the current-year cost of closing inventory for purposes of using the dollar-value LIFO inventory method.

(vi) Any method permitted under §1.472-2(d) for determining the cost of goods in excess of goods on hand at the beginning of the year for purposes of using a LIFO method other than the dollar-value LIFO method.

(vii) Any method relating to the classification of an item as inventory or a capital asset.

(viii) The use of an accounting period other than the period used for Federal income tax purposes.

(ix) The use of cost estimates.

(x) The use of actual cost of cut timber or the cost determined under section 631(a).

(xi) The use of inventory costs unreduced by any adjustment required by the application of section 108 and section 1017, relating to discharge of indebtedness.

(xii) The determination of the time when sales or purchases are accrued.

(xiii) The use of a method to allocate basis in the case of a business combination other than the method used for Federal income tax purposes.

(xiv) The treatment of transfers of inventory between affiliated corporations in a manner different from that required by §1.1502-13.