The double-extension method does not reliably measure the amount of price inflation during a year and should not be considered a permissible LIFO method. The double-extension method has been considered by the IRS to be the preferred method to make dollar-value method LIFO index calculations for the almost 60 years that the dollar-value LIFO method has been permitted. Not only should the double-extension method not be considered the preferred dollar-value LIFO method but it also should not be considered a permissible method.

The use of the double-extension method has been accepted by the IRS and for GAAP for many years but this is not evidence that it is a viable method now or should have ever been considered a viable method. The purpose of this article is to describe the reasons why the double-extension method is not a reliable price inflation measurement method. Included in this article are LIFO index and LIFO reserve calculations for six different examples using both the double-extension and link-chain methods for the same facts and the significant differences in the results between the two methods help to illustrate the distortions of income that can result from using the double-extension method.

Companies and CPAs have long complained about the difficultly and ill effects of using the double-extension method but these complaints have focused almost solely on the problem of determining a reasonable base year cost for new items in inventory (not present in inventory the previous year). While this issue alone should have by now caused the demise of the double-extension method, there is an even more fundamental flaw in the use of the double-extension method and this flaw is described in this article.

The most important factor in determining a LIFO reserve is the reliable measurement of price inflation for both the current year and for the length of time the LIFO method has been used by a company. The double-extension method is not a reliable inflation measurement method for any period of time except in the year of LIFO adoption when the double-extension and link-chain cumulative indexes will always be identical. All shortcomings of the double-extension method are overcome by using the alternative link-chain method and the link-chain method should be the only permissible LIFO index method.

Any method used to measure inflation for a group of inventory items for which the mix of inventory items continually changes will be an estimate of the average inflation for the items in the group. Many aspects of accounting involve estimation of the dollar value of balances to be recorded and many estimates are used for inventory accounting. When estimates are used, the concepts of precision and accuracy may not always apply which means that an accounting method should be judged on the reasonableness of results in measuring or valuing assets, liabilities, income and expense. This is why we describe the double-extension method as not being a reliable, viable or reasonable method rather than an inaccurate or imprecise method.

Comparison of inventory at base prices between years is required when the dollar-value LIFO method is used. To convert the year end current-year cost balance (usually determined using the FIFO or average cost method) to base year prices, a cumulative index is used to measure the cumulative amount of price inflation that has occurred for each LIFO pool since the adoption of the LIFO method. For the double-extension method, the cumulative index is measured directly by comparison of base year to current year prices for each item in a LIFO pool. The double-extension method cumulative index is the sum of the extensions at the current year prices divided by the sum of the extensions at the base year prices.

For the link-chain method, the cumulative index is calculated indirectly by measurement of the current year inflation by comparison of prior year to current year prices for each item in a LIFO pool and then summing the extension of these values times the current year end inventory quantity on hand. The current year link-chain method index is the sum of the extensions at the current year prices divided by the sum of the extensions at the prior year prices. The cumulative index for each year using the link-chain method is a product of multiplying all years’ (that LIFO has been used) current year price inflation index together which is the same as multiplying the prior year cumulative index times the current year index each year.

The double-extension method measures the cumulative inflation from the base year to the present for the inventory mix that is on hand at each year end. The link-chain method measures the cumulative inflation for the weighted average of the inventory mix on hand at the end of the year for all years LIFO has been used. Since the inventory mix constantly changes for most companies, an index calculation method should be used that most reasonably or reliably measures price inflation when the inventory mix is different at each year end.

The double-extension will reliably measure the cumulative amount of inflation for a given inventory mix over a multiple year period, but the double-extension method is not suitable to measure the amount of inflation attributable to any given year as long as there is any change in the inventory mix from one year end to the next. Since an income statement shows income and expense for one year at a time, the double-extension method should not be a permissible price inflation measurement method.

The link-chain method works in practice because the value of the LIFO inventory for each year end is the sum of the LIFO layer created for the most recent year (if any) and the remaining portion of layers created in all prior years. Because the link-chain cumulative indexes are calculated as the multiplication of all years’ current year indexes, a link between and among all years is established to reasonably determine: 1) whether there will be an increment or decrement for the current year and 2) when there is an increment, how that layer will be valued and when there is a decrement, which prior years’ layers are eroded and in what amounts. The double-extension method cumulative index may be a reliable method to calculate the cumulative inflation for any year end inventory mix but the double-extension cumulative indexes are only a snapshot of the cumulative inflation for the inventory mix for each year end only and there is no linkage of each years’ cumulative indexes. This is the reason why double-extension is not a reliable method to measure price inflation attributable to each year and this disadvantage is overcome by use of the link-chain method.

In both the Amity Leather Products Co. v. Commissioner and Hamilton Industries Inc. v. Commissioner Tax Court decisions, this sentence is found: “If factors other than inflation enter into the cost of inventory items, a reliable index cannot be computed.” The double-extension method is not a reliable method because the use of this method does not provide for a reasonable comparison of costs from the base year to the current year when the inventory mix changes. This is because the changes in the double-extension cumulative index reflects a factor (inventory mix change effect) other than the inflation for that year. The link-chain method is a reliable method because the changes in the link-chain cumulative index reflect only the inflation for that year.

We do not know the complete history of the development of the double-extension method for calculation of price inflation indexes when the dollar-value method was first permitted as an alternative to the specific goods LIFO method. I have read several articles written many years ago discussing the rationale for using the LIFO method and describing the math used for the dollar-value method and why this was more practical than using the specific goods LIFO method. I have yet to read an article or Tax Court decision or any other IRS guidance in which demonstrates or argues that the double-extension method is an appropriate means of measuring price inflation or why this method would be preferable to the link-chain method.

The double-extension method will reliably measure price inflation on an item-by-item basis. This may be why the double-extension method was chosen to be incorporated into the dollar-value method which replaced the specific goods LIFO method when those using LIFO realized that an item-by-item LIFO value determination was not practical. The fact that the double-extension method was not suitable to measure price inflation for multiple items in a LIFO pool was apparently thought to be a defect of lesser importance by all involved with the evolution of the dollar-value method (don’t blame me for this, I was yet to be born at that time) and not enough pro forma calculations into future years were made to validate the hypothesis that the double-extension method was a viable method. It would probably have been worthwhile for the accountants and lawyers that were involved with the development of the double-extension method to consult with the Bureau of Labor Statistics (BLS). The BLS uses comparison of current month to prior month prices in compiling both the PPI and CPI indexes and this is a link-chain method concept.

The AICPA in its LIFO Issues Paper published in 1984 recognized that big changes in double-extension method cumulative indexes from year to year could be caused by changes in the inventory mix. Their specific concern in Section 4 of this paper was the difficulty a LIFO taxpayer may have in reconstructing base year costs for new items entering inventory. Big changes in double-extension method cumulative indexes from year to year can also be caused by changes in the inventory mix regardless of whether there are new items or not. The AICPA recognized that the inventory mix change problem that results from the use of the double-extension method could be solved by using the link-chain method or by a double-extension taxpayer using what they describe as the “substitute base year technique” which is also known by CPAs as “updating the base year”. When a substitute base year is used, the measurement of inflation for the year in which this technique is used is from the prior year end to the current year end with future years’ inflation measured from the new base year to the current year. The prior years’ cumulative indexes and layers at base are then restated as per the steps shown in the IRS Regs. for updating a base year. If using a substitute base year is what is required to correct a deficiency of the double-extension method when there is an inventory mix change that produces significantly different results than not using a substitute base year, a logical conclusion would be that a substitute base year ought to be used every year in which there is any inventory mix change (which will be every year for most taxpayers). If a substitute base year is used every year, this results in exactly the same change in cumulative indexes as the results produced by using the link-chain method.

IRS statistics show that there are upwards of 20,000 different LIFO taxpayers. We have had involvement in some fashion with LIFO calculations for a substantial number of different taxpayers over the years. While the double-extension method is now used far less than in the past, I believe a fair estimate is that there are probably at least 1,000 taxpayers still using the double-extension method for either tax or financial reporting purposes. We believe that the fact that there are now far fewer double-extension method taxpayers than in the past should not prevent efforts now to discontinue the use of the double-extension method.

The IRS Regs. permitted the use of only the specific goods LIFO method from 1938 when the LIFO method was first permitted through 1961, although a tax court decision in 1947 allowed the use of the dollar-value LIFO method. The IRS Regs. were amended in 1961 to allow the use of the dollar-value method and these new Regs. permitted the use of the link-chain method as an alternative to the double-extension method. While any taxpayer using the IPIC LIFO method can use either the link-chain or double-extension method, Reg. Sec. 1.472-8(e)(1) permits non-IPIC method taxpayers to use the link-chain method only if the taxpayer can demonstrate that the use of the double-extension method is impractical. Unofficially, this can be demonstrated to the IRS if there is at least a 85% turnover in inventory items within the latest five years prior to the change to the link-chain method.

There are two substantial shortcomings of the use of the double-extension method for LIFO purposes. The shortcoming described above is what we refer to as the “broken link” effect because there is no link between the double-extension method cumulative indexes from year to year.

The other substantial double-extension method shortcoming is the “new item cost” pricing issue which is the sole double-extension method shortcoming the IRS and CPAs have debated for many years. A “new item” is an item which was not present in inventory (or this item did not exist) at the base year for the double-extension method or the prior year for the link-chain method. There are three alternatives for accounting for new items for LIFO index calculations. These alternatives are:

Reconstruction of base year or prior year item costs becomes increasingly impractical with the passage of time particularly when no similar item existed in the base year. If no base year or prior year item cost can be reconstructed, method 3 above is often used (this is the simplest alternative) and the cumulative LIFO index will be diluted because of this. The new item cost inflation dilution occurs using both the double-extension and link-chain methods but the amount of the dilution is substantially greater where the double-extension method is used because the lost inflation is for all years LIFO has been used in years preceding the current year instead of just for the current year.

The double-extension method should long ago have been discredited as a good price inflation measurement method if for no other reason than for the extra record keeping work required to deal with the new item cost issue and this burden becomes much worse with the passage of time. For many taxpayers, eventually there will be no items that were present at the base year and all base year costs will be reconstructed base year cost guestimates or based on surrogate information.

Les Schneider, in Sec. 14.02[3][a] of his Federal Income Taxation of Inventories treatise makes reference to an IRS belief that when the link-chain method is used, an error in the calculation of the annual index will be locked into the cumulative index and layers forever. One could argue that index calculation errors made using the double-extension method are “self-correcting” in the year following the error as long as the earlier error was in the current year item pricing. An error in the pricing of the current year end pricing for a link-chain calculation would also be “self-correcting” in the year following the error if the same erroneous price is used in the prior year price column. This hypothetical advantage the double-extension method might have over the link-chain method in the event of an index calculation error and if the facts of the error are just so is a hypothetical molehill compared to the mountain of the reasons why double-extension is not a viable method.

Taxpayers, CPAs and tax lawyers have long tried to convince the IRS that the use of the double-extension method was not practical or that the link-chain method should be deemed to be equally acceptable as the double-extension method. In 1980, the Section of Taxation of the American Bar Association made a recommendation to the U.S. Treasury Department that the link-chain method, index method and double-extension method be viewed as equally acceptable methods and that the Regs. should be amended accordingly. A U.S. Senate tax bill in 1981 included a provision which would have treated the link-chain method as equally permissible as the double-extension method however this provision was not included in the House-Senate conference. The LIFO Regs. that were written in 1982 to allow for the use of the IPIC method for the first time specify that the link-chain and double-extension methods are equally acceptable for IPIC method taxpayers. One of the reasons the use of the IPIC LIFO method has been so popular is that is solves the lost inflation issue and it provides a sure means of changing from double-extension to link-chain. The history of the IRS attitude towards use of the link-chain method is described in greater detail in Sec. 14.02[3] of the Federal Income Taxation of Inventories treatise authored by Les Schneider.

The rationale used by taxpayers and CPAs to attempt to persuade the IRS that the use of the double-extension method was not practical were presented only in the more limited context of the new item cost issue. We think that this heavy focus on the problems caused for double-extension method taxpayers because of the new item cost issue distracted from the fact that “broken link” effect is much more important than the new item cost issue. The new item cost issue makes the double-extension index calculations more complicated and a much less practical method to use but the double-extension “broken link” effect should by itself disqualify this method from consideration for use as a LIFO method.

The IRS Regs. also allow for use of what they describe as the “index method”. This is a variation of the double-extension method for which the base to current year cost comparison can be made for less than 100% of inventory items on a sampling basis. If the double-extension method is not a reliable method because it cannot deal properly with inventory mix changes, the index method should be even more of an invalid method because the index method provides a means for a taxpayer to manage the LIFO index more easily. Using the index method makes it a lot easier to manage the index by using judgmental sampling and favoring items for inclusion in the sample that fit the desire for more or less inflation that year. The use of the index method provides a means of managing the LIFO index not just by changing the inventory mix but also by the selection of items included in the index method sample selection.

The double-extension and index methods are not reliable methods because the comparison of cumulative indexes from one year to the next with this method does not produce a reliable measurement of the current year inflation. Problems caused by the use of the double-extension and index methods include:

The SEC has provided guidance in the past discouraging manipulation of LIFO indexes and artificial layer erosions by using creative item definition and LIFO pooling methods but I think they missed an even bigger possible abuse that may result from using the double-extension or index methods.

The differences in cumulative indexes from item to item within a pool increases with time and this increases the likelihood of bigger cumulative index changes resulting from inventory mix changes with the passage of time. The double-extension and index methods becomes increasingly less accurate as an inflation measurement method with the passage of time with respect to both the new items issue and the broken link effect.

The problems caused by the use of the double-extension and index methods described above are all overcome by the use of the link-chain method. We believe that not only should the link-chain method be considered acceptable for all taxpayers without the necessity for further justification but more importantly to the IRS or to the SEC, that the double-extension method should not be a permissible method.

Shown below are six examples of LIFO index calculations for which the double-extension method results do not appear to be reasonable but for which the link-chain method results do appear to be reasonable. The examples include schedules documenting the LIFO index calculations for both the double-extension and link-chain methods for multiple year examples as well as the resulting LIFO layer history schedule for both methods including a table showing the differences in values and results between the two methods. Each example includes a narrative summarizing the facts, assumptions and a comparison of the results of the double-extension v. link-chain methods. The Excel version of these examples are also made available with a file download link shown on a following page.

The examples all show how significantly different results are achieved using the link-chain method as compared to the double-extension method. For example, example 4 shows that despite there being annual price increases of 2% for each item for three successive years, the double-extension cumulative indexes show changes for those three years in the cumulative index of -10%, 16% and 6%, respectively. These examples that show double-extension method index changes that are far different than the current year inflation or deflation do not prove that the double-extension method is an unreliable method. We believe the results of the examples comparison along with the rationale described in this article together supports this conclusion.

While the examples shown in this article are all hypothetical examples, we have experienced numerous examples of big differences in price inflation for taxpayers using the double-extension method as compared to pro forma link-chain inflation and any CPA with substantial LIFO calculation experience has experienced this also.

We know from past experience that the differences in the indexes and LIFO reserve balances between double-extension method and link-chain method calculations are just as likely to go in one direction as the other and the examples of these differences show differences in both directions. The dollar amounts of these differences in LIFO reserve results are small but only because the current-year cost dollars used for the examples are small; the differences as a percentage of the total are substantial.

We did not cherry pick the examples to only show examples for which the double-extension method results do not seem reasonable but the link-chain results seem reasonable. We believe it is not possible to create a single example of the link-chain method that would produce results that would be unreasonable.

The LIFO reserve for the most recent year end is higher using the double-extension method than for the link-chain method for 5 of the 6 examples. This does not mean that the double-extension method is more likely to produce a greater LIFO reserve than the link-chain method. Double-extension LIFO reserves are just as likely to be lower than a link-chain LIFO reserve and the direction of the difference is dependent on the facts of the inventory mix changes. Some of the examples showing the most recent year end LIFO reserve being higher using the double-extension method show that the link-chain method LIFO reserve is greater in an earlier year.

The examples included are for companies that have only 2 to 4 inventory items. The examples illustrate the concept of why the double-extension method is not a reliable inflation measurement method when the use of the link-chain method alternative will not produce the distortions that can occur with the double-extension method. Inventory mix changes can cause big changes in double-extension method cumulative indexes regardless of whether there are many or few inventory items.

We have observed big changes like this when manufacturers experience a big change in the mix between raw materials and other stages of production (finished goods and work-in-process). The raw materials that are commodities (metals, rubber or plastics, etc.) have more volatile prices but also usually reflect greater cumulative inflation than finished goods and WIP inventories (which include labor and overhead costs). This means that the cumulative indexes for the different stages of production for these items are often a lot higher or lower than for the other stages of production and the large differences in cumulative indexes within a pool is what leads to big swings in the pool cumulative index when the inventory mix changes.

In our recent experience, an example of this would be a manufacturer for which the raw material items are mostly steel. The double-extension cumulative indexes for the raw material items reflect about three times the cumulative inflation as the work-in-process and finished goods inventories. 30% is the normal average of the raw material to total inventory ratio but for the most recent year end, the company had what they felt was a good opportunity to receive very favorable pricing and purchased a lot more steel before year-end than they usually carry. This resulted in the raw material value being 60% of total inventory. In this situation for this inventory pool, the double-extension method cumulative index for this year end will be significantly higher than normal reflecting a significant amount of artificial inflation solely from using the double-extension method with the big mix change. If the ratio of raw material to total inventory mix for the following year drops back to the normal 30%, the pool cumulative index will be significantly less than the prior year which will again create substantial artificial deflation solely from using the double-extension method.

All examples included in this article are hypothetical but they are helpful to show how and why LIFO expense and income can be distorted when the double-extension method is used. Anyone who has been involved with numerous LIFO calculations has seen multiple examples of unexpected results that can result from using the double-extension method. In just the past month of this writing, the CPA for a wholesale company using the double-extension method said that the owner of the business said that they should not have had anywhere near the 6.4% decrease in cumulative index for their 9/2015 year end that the index calculation produced. I made a pro forma link-chain method calculation and that showed 1.6% deflation in 2015. The double-extension method produced four times the amount of link-chain method deflation for 2015 for this company.

Calculation Example ExcelCalculation Examples PDF

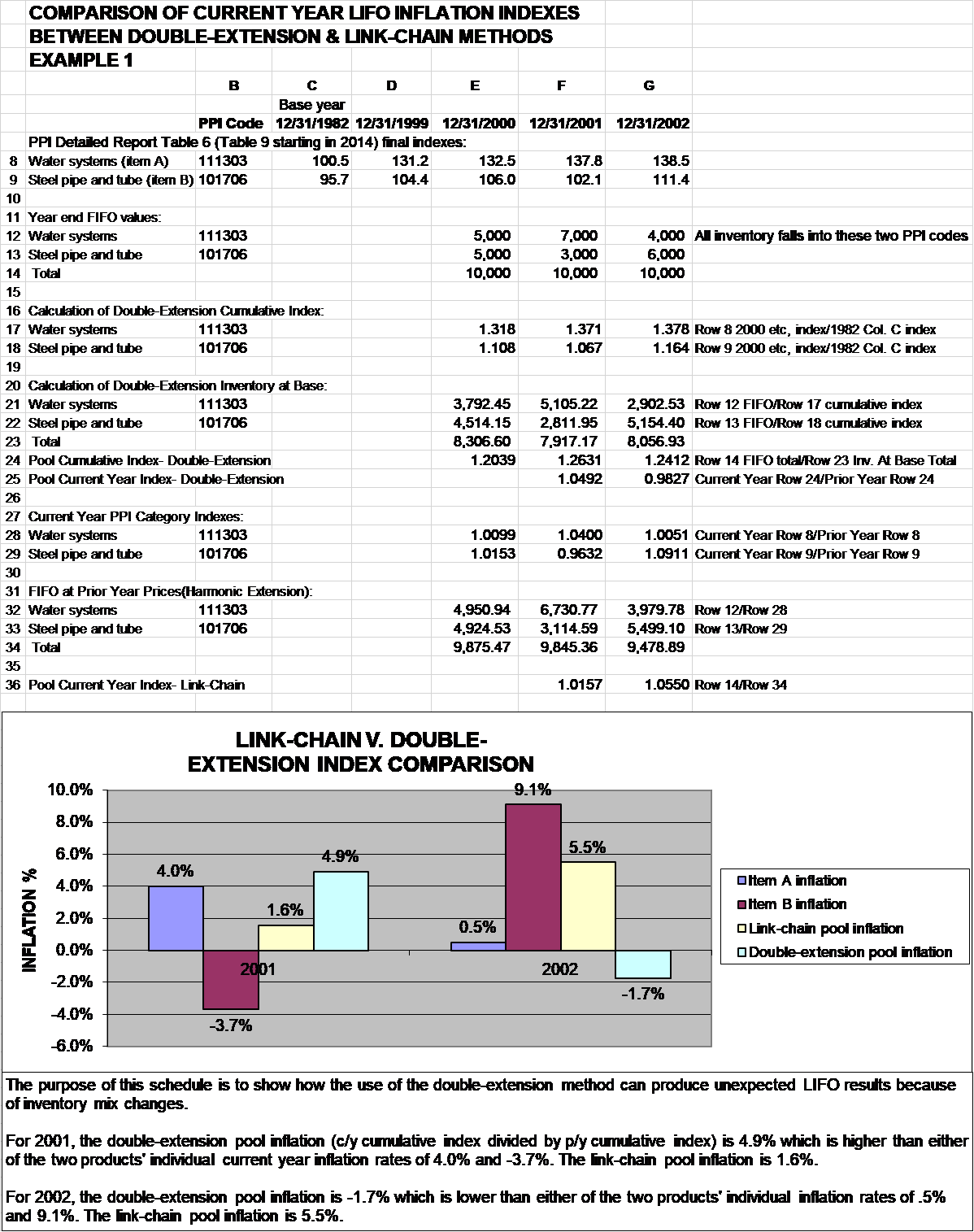

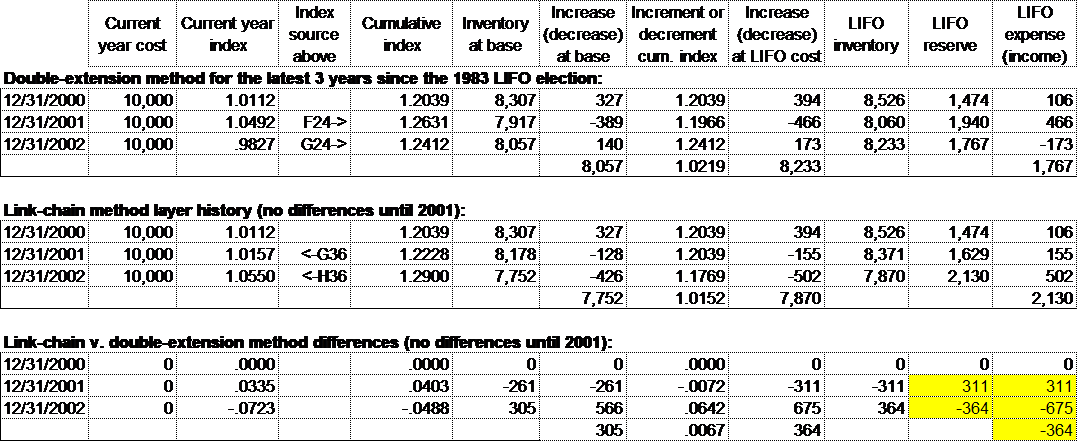

The company has used LIFO since 1983. The first table below shows the details of the index calculation for 2001 and 2002 for a company using the IPIC method with only two inventory items. This example shows how a change in the inventory mix can cause the change in the double-extension method cumulative index (shown in the current year index column of the layer history schedule below) to fall outside the range of the link-chain method current year index for each of the two items. In 2001, the current year indexes for the two items were 1.040 and .963, respectively. This resulted in a link-chain method current year pool index of 1.0157 but the double-extension method current year pool index was 1.0492 which is higher than the range of the individual items’ current year indexes.

In 2002, the link-chain method current year indexes for the two items were 1.005 and 1.091, respectively. This resulted in a link-chain method current year pool index of 1.055 which was bracketed by the individual current year indexes but the double-extension method current year index was .983 which is not only not within the range of the individual items’ current year indexes but it reflects deflation despite the fact that there was current year inflation for both items. For 2002, there was an increment for the double-extension method but there was a decrement using the link-chain method. There is a big difference in the LIFO expense or (income) amounts for each year. When the link-chain method is used, the pool current year index will always fall within the range of the lowest and highest current year indexes for the individual items but this is not always true using the double-extension method.

The chart below the first table shows a comparison of the double-extension and link-chain pool current year inflation rates (c/y cumulative index divided by p/y cumulative index) as well as the individual items’ current year inflation or deflation.

For examples 1 and 2, the double-extension method has been used for all years. Pro forma index and layer history calculations were made for the two most recent years, 2001 and 2002 to show the what the indexes and results would have been had the link-chain method been used for these two years. This is why the layer history schedule comparison shown below (second table) shows only the last three years of the 1982 through 2002 double-extension method LIFO layer history along with a comparison to the pro forma link-chain method results for 2000 through 2002 along with the value differences using the two different methods.

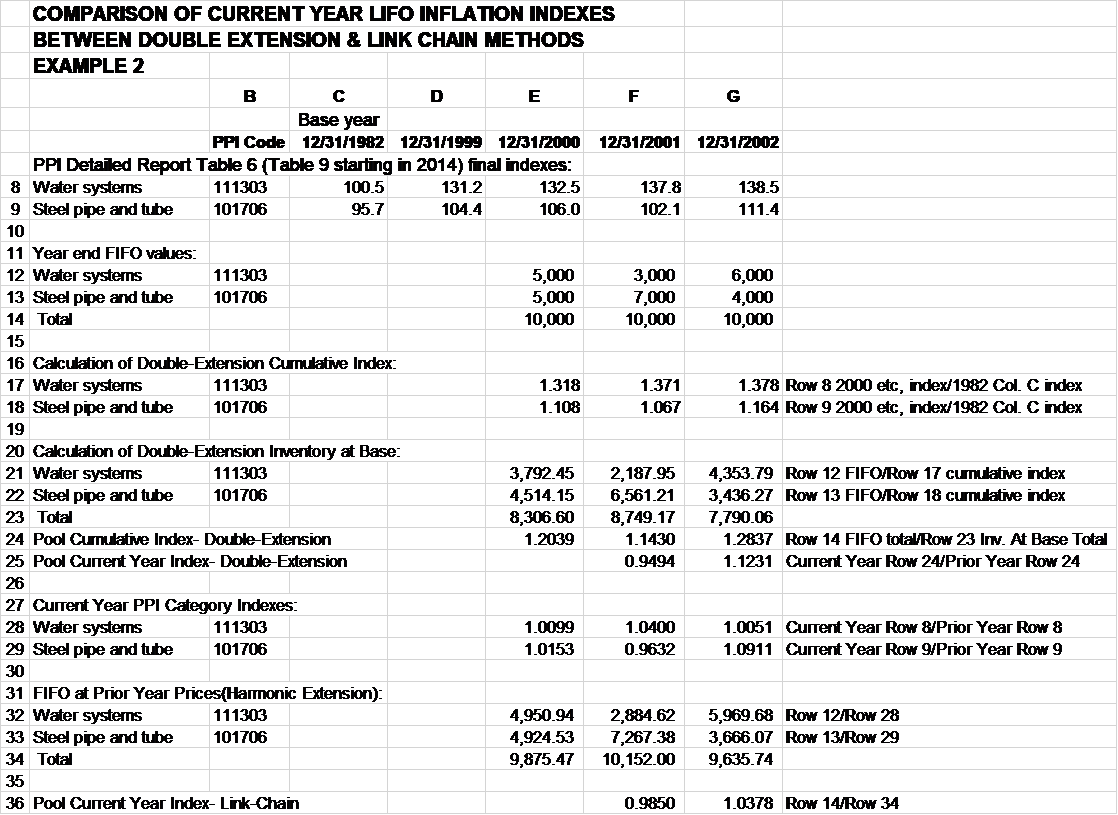

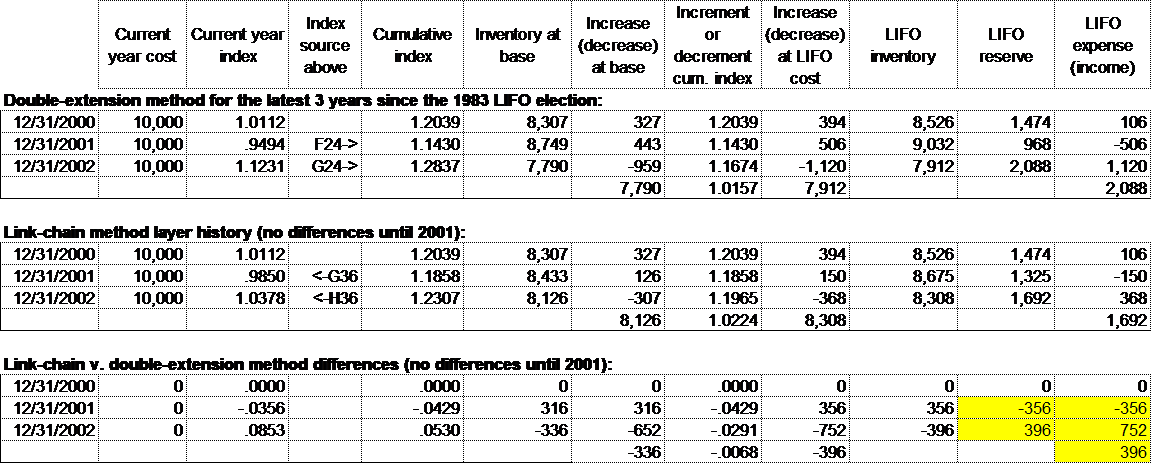

These are the same facts as for example 1 except that the inventory mix for 2001 and 2002 differs from that used for example 1. In 2001, the link-chain method current year indexes for the two items were 1.040 and .963, respectively. This resulted in a link-chain method current year pool index of .9850 but the double-extension method current year pool index was .9494 which is lower than the range of the individual items’ current year indexes.

In 2002, the link-chain method current year indexes for the two items were 1.005 and 1.091, respectively. This resulted in a link-chain method current year pool index of 1.0378 which was bracketed by the individual current year indexes but the double-extension method current year pool index was 1.1231 which is not within the range of the individual items’ current year indexes. There is a big difference in the LIFO expense or (income) amounts for each year as shown in the comparison table below.

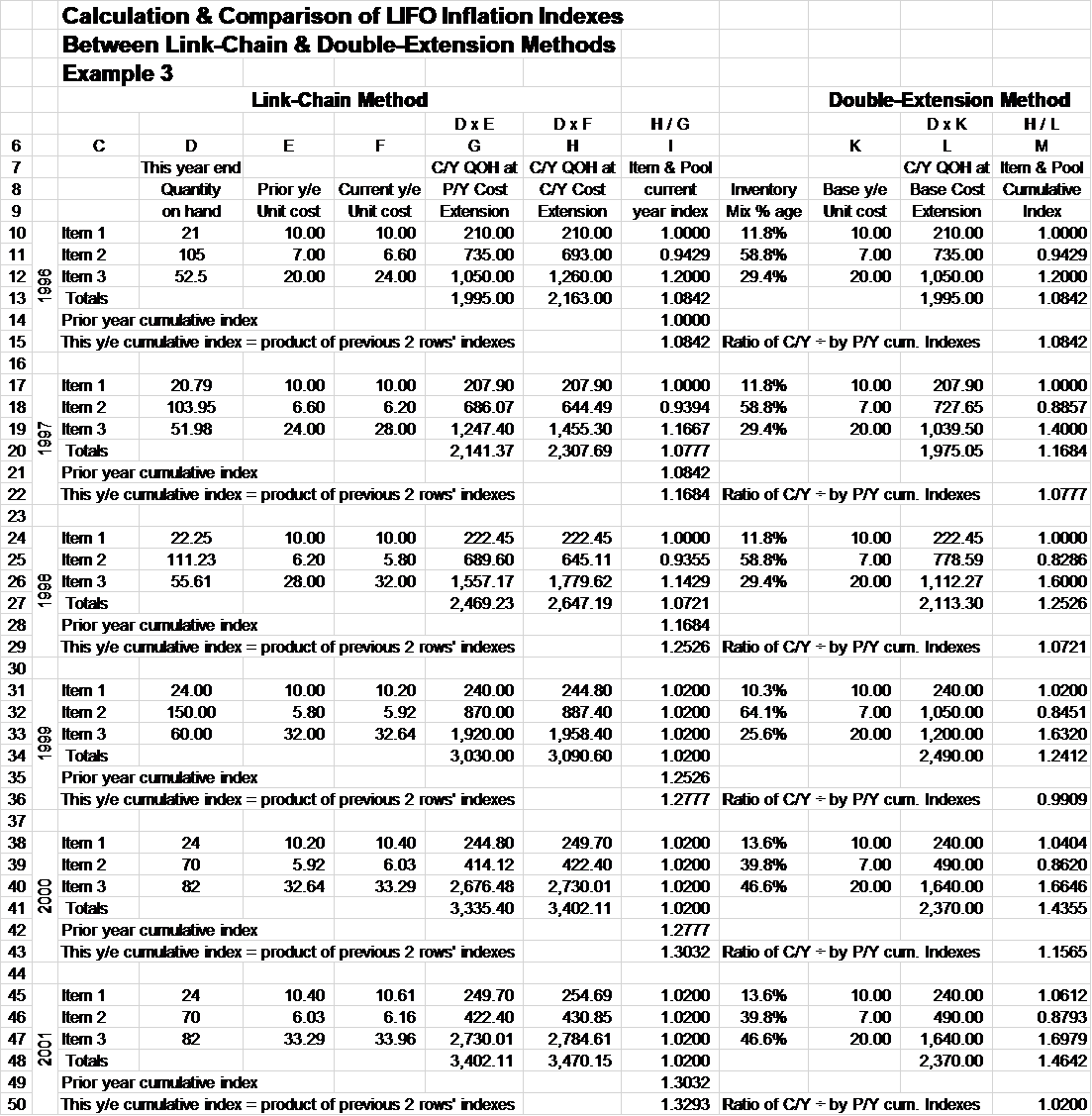

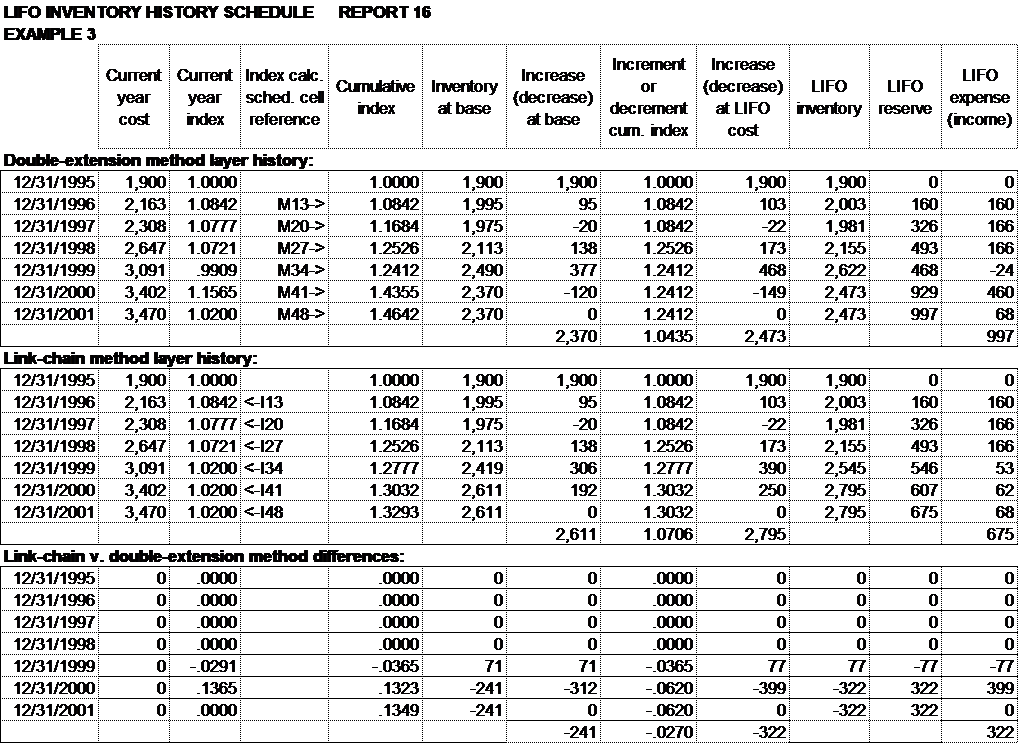

The company has used a LIFO internal index method from 1996 through 2001. The following shows the details of the internal index calculation for 1996 through 2001 for a company that has just three different inventory items. While the number of inventory items on hand and the item costs change at different rates for all these years, the inventory mix percentages (measured in terms of the quantity on hand) is exactly the same for the first three years, 1996 through 1998. The inventory mix percentages are then different for each of the two years from 1999 to 2000 and then the 2001 inventory mix percentages are exactly the same as that for 2000 (but the mix percentages are different from the 1996 through 1998 years when the mix percentages did not change). The table below shows the calculation of the pool indexes for both the link-chain and double-extension methods side-by-side for 1996 through 2001. This example shows that the pool indexes will be exactly the same for both these methods in the unlikely event that the inventory mix percentages do not change from year to year because the cumulative indexes for both the link-chain and double-extension method are exactly the same for 1996 through 1998 and despite the cumulative indexes being different after 1999, the 2% rate of change in the cumulative index for double-extension was exactly the same as for link-chain in 2001. Starting in 1999, the average inflation for the year as measured by the link-chain current year index, was 2% but the rate of change for the double-extension method for the two years, 1999 and 2000 for which the inventory mix percentages do change from the prior year, was substantially different than 2% (substantially lower in 1999 and substantially higher in 2000).

It was stated earlier in the article that the only situations for which double-extension is a reliable method are when: 1) there is a single item in a pool or 2) when the inventory mix percentages never changes and this example lends credence to that statement.

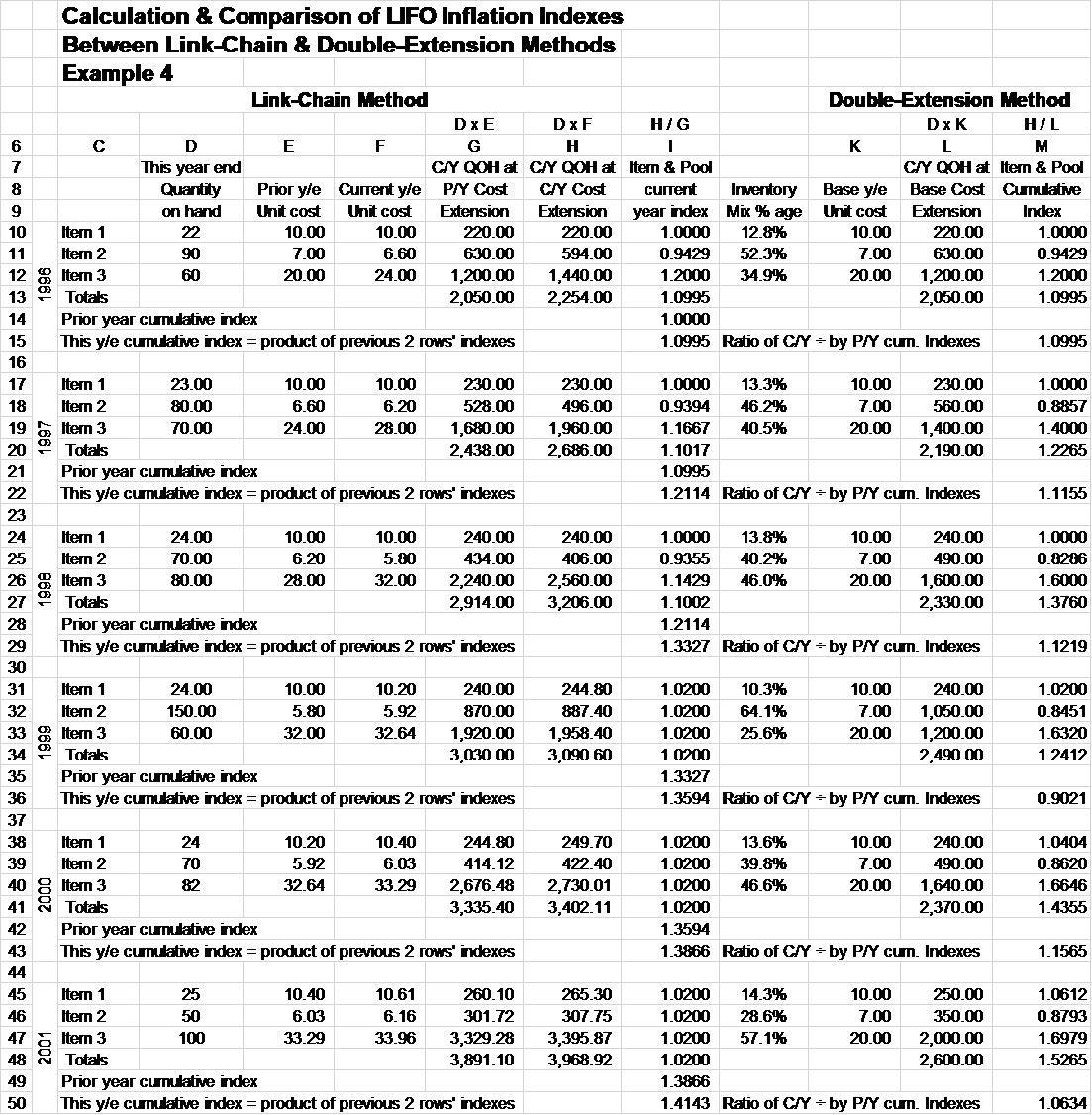

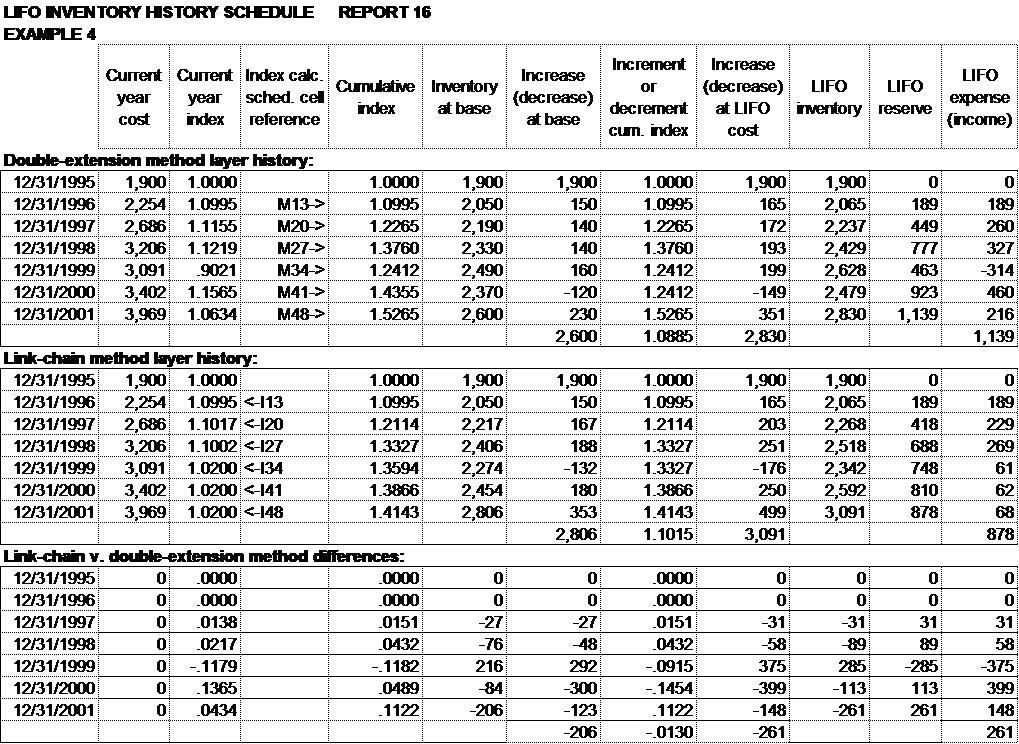

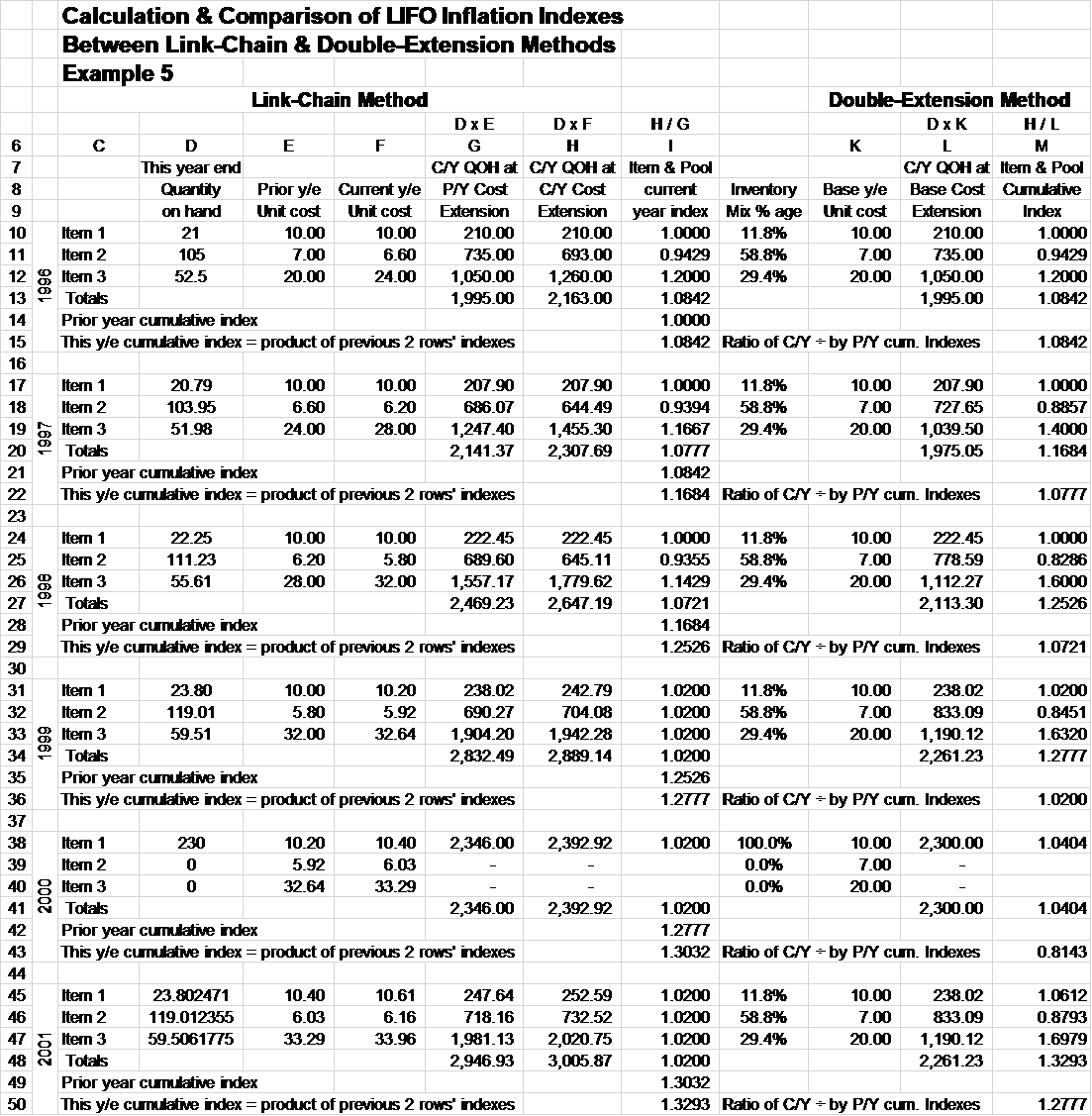

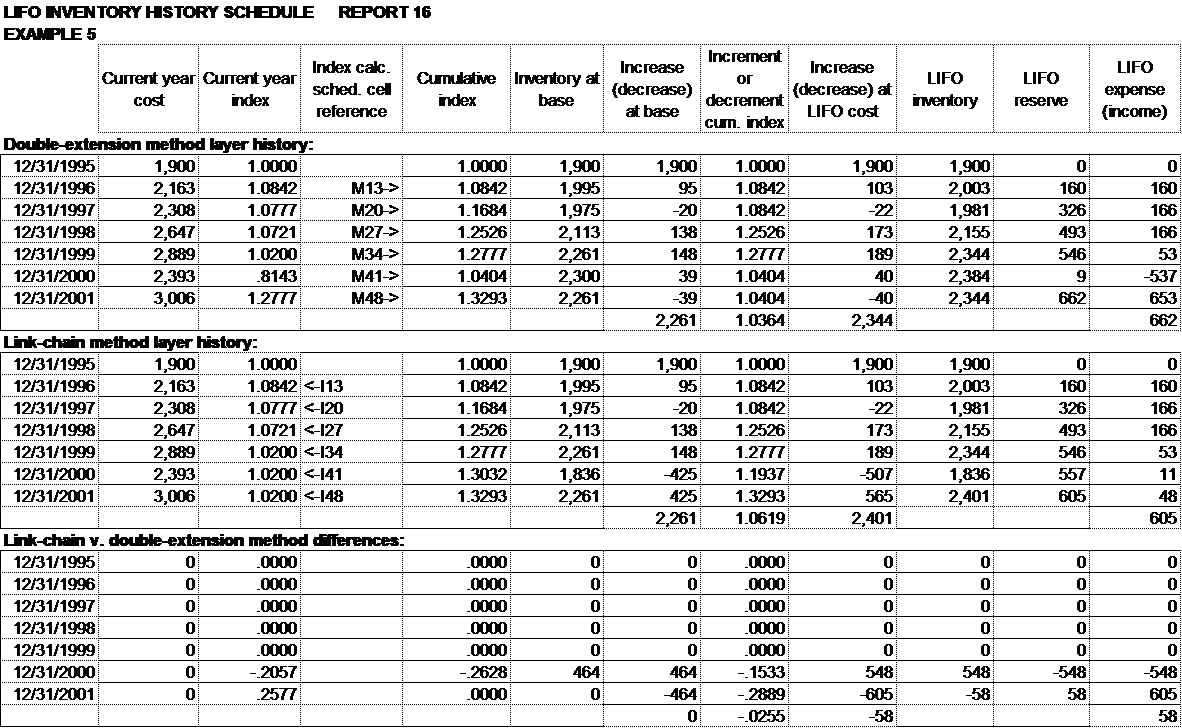

The company has used a LIFO internal index method from 1996 through 2001. The following shows the details of the internal index calculation for 1996 through 2001 for a company that has just three different inventory items. The inventory mix percentages are different for each of these six years. For the first three years, 1996 through 1998, the link-chain method current year index was different each year. After 1998, the company’s sole supplier agreed that for the next 3 years that the prices paid the supplier would increase once during the year on the first day of the year for all items by 2% over the prior year price.

The table below shows that the link-chain method current year index is 1.0200 (2% inflation) for each of the years from 1999 through 2001. Because the inventory mix percentages change for each year in this example, the link-chain current year index is not the same as the annual change in the double-extension cumulative index for any of these six years. The change in the double-extension cumulative index for each of these three years is substantially different that the link-chain 1.0200 current year index. The changes are approximately -10%, 16% and 6% respectively.

The company has used a LIFO internal index method from 1996 through 2001. The following shows the details of the internal index calculation for 1996 through 2001 for a company that has just three different inventory items. The inventory mix percentages are the same for each of the first four years, 1996 through 1999, so the link-chain current year index is exactly the same as the change in the double-extension cumulative index for those years. For the first four years from 1996 through 1999, the inventory mix percentages were exactly the same at each year end which resulted in the double-extension and link-chain LIFO reserve and expense amounts being exactly the same.

During 2000, there is a storm that destroyed all inventories two months before year end. The company will be able to resume operations in 2001 but they want to purchase enough raw material inventory before the end of 2000 to prevent loss of the entire LIFO reserve. They are able to purchase an unlimited amount of item 1 inventory but no amount of item 2 or item 3 raw material is available to purchase before the end of the year. The company purchased only inventory item 1 quantities before year end and their 2000 year end FIFO inventory value is $2,393 compared with $2,889 at the end of 1999. Their actions after the storm loss in 2000 prevented significant LIFO layer erosion, so the strategy was successful. Doing this created huge changes in the double-extension method LIFO reserves in 2000 and 2001 however. The reason for this is that the 2000 item 1 cumulative index was much lower than the 1999 pool cumulative index. The 2000 item 1 cumulative index was 1.0404 (it was 1.02 in 1999) and the 1999 pool cumulative index was 1.2777. The 1.0404/1.2777 ratio is the double-extension method forced current year index of .8143 (19% deflation) which compares to the 1.02 link-chain method current year index. This resulted in 2000 double-extension LIFO income of $537 compared to $11 link-chain method LIFO expense.

For the 2001 year end, the FIFO balance increased to $3,006 and the inventory mix was exactly the same as it was in for all prior years except for 2000. This caused the double-extension cumulative index to increase to 1.3293 which is exactly the same (to 4 decimal places) as the 2001 link-chain method cumulative index. The 1.3293/1.0404 ratio is the double-extension method forced current year index of 1.2777 (28% inflation) which compares to the 1.02 link-chain method current year index. This resulted in 2001 double-extension LIFO expense of $653 compared to $48 link-chain method LIFO expense.

This example shows that when the double-extension method is used and there is an event which leads to carrying only one inventory item, there can be wild swings in the LIFO reserve if the replacement inventory does not have an average double-extension cumulative index that approximates the prior year end inventory mix despite the fact that the annual price increases for all items was 2% starting in 1999.

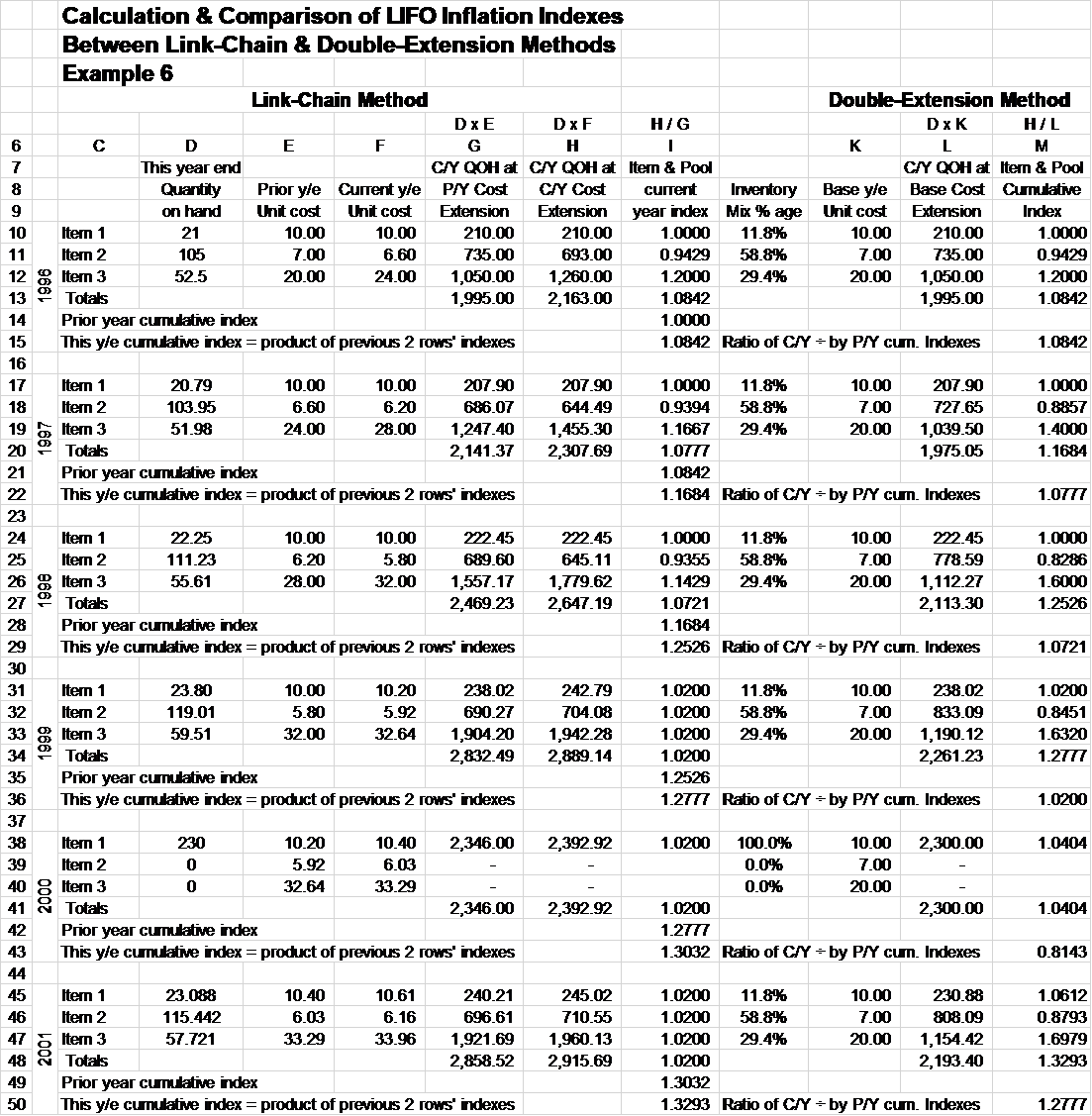

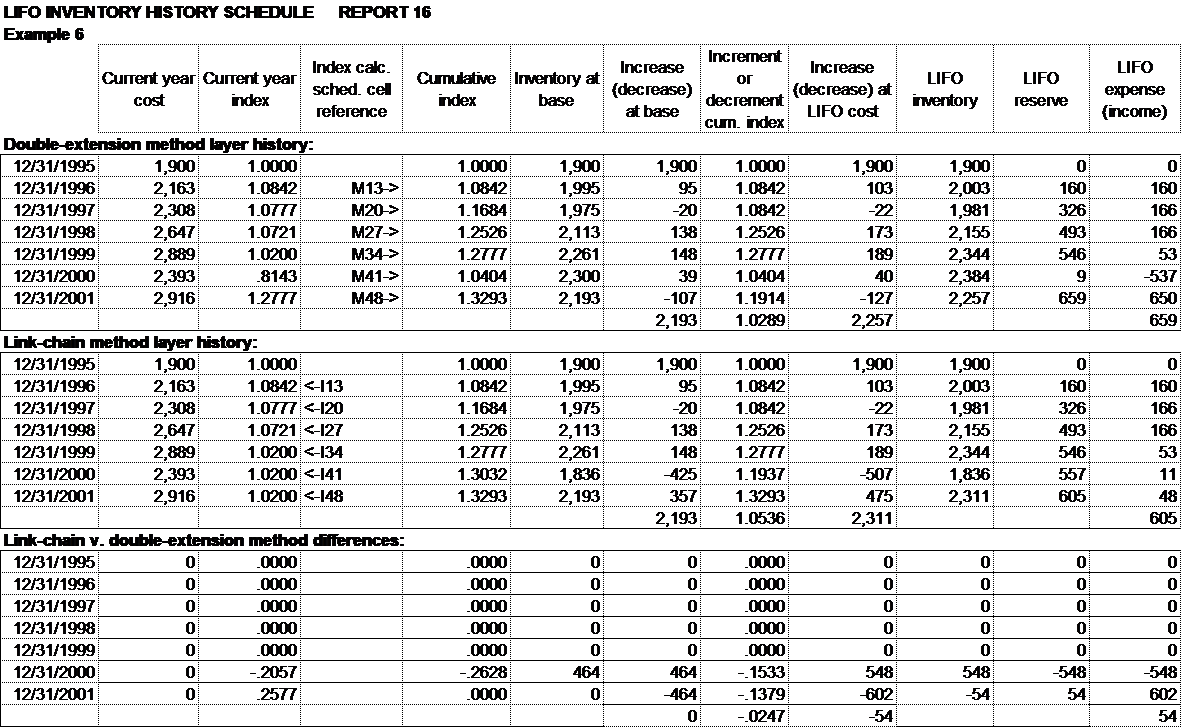

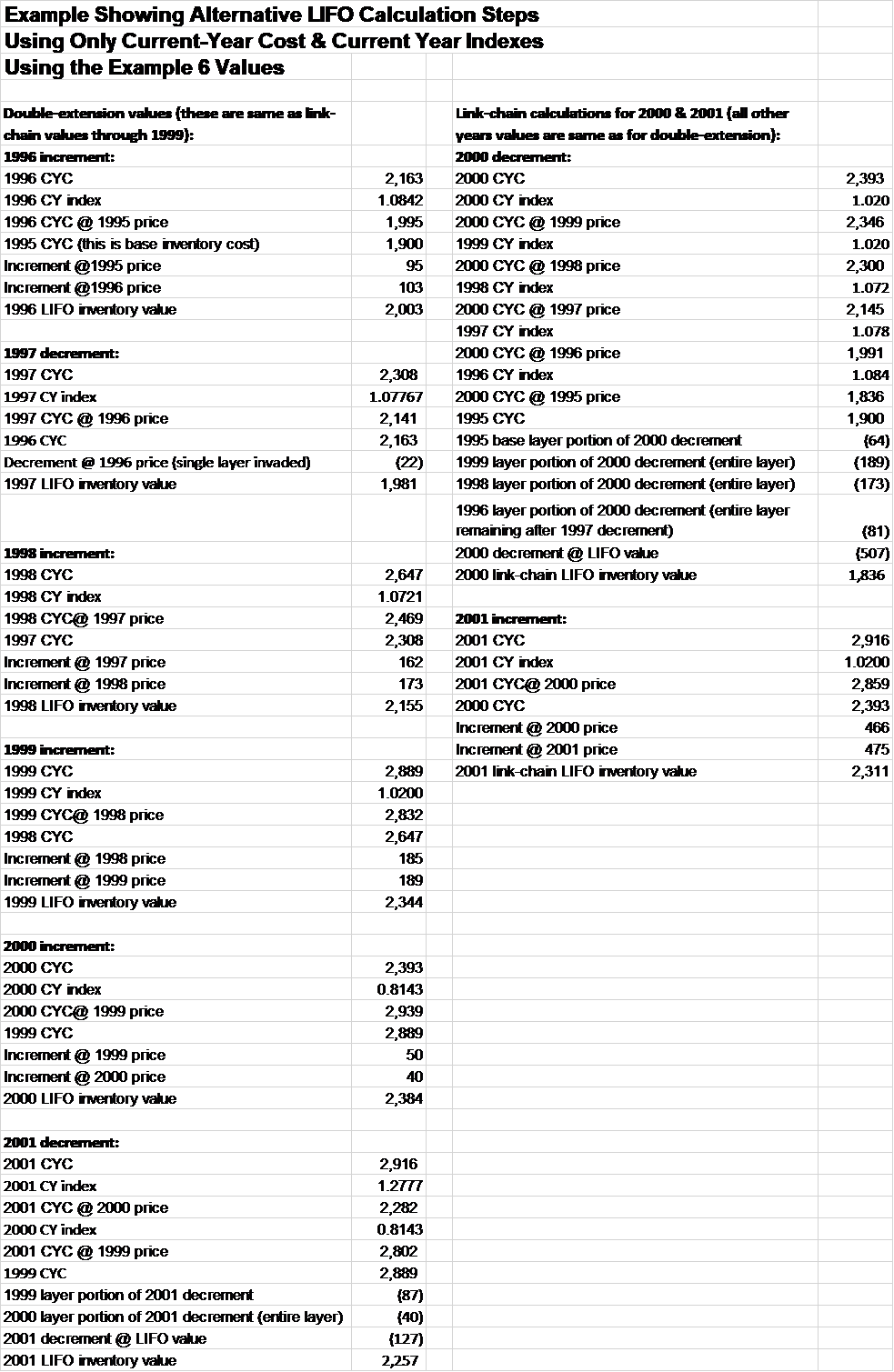

The assumptions for this example are the same as for example 5 except that the 2001 quantities for each item is a bit different which causes a double-extension 2001 decrement that invades two prior year layers for example 6 which helps illustrate the alternative LIFO calculation steps shown below. The results are not much different from those for example 5 other than this.

There are dollar-value LIFO reserve calculation steps that can be used that produce exactly the same LIFO inventory balance results that do not entail the use of cumulative indexes or inventory at base balances in the LIFO calculation schedule. This link-chain computational alternative is described in Sec. 14.02[3][b] of Les Schneider’s Federal Income Taxation of Inventories treatise. In my many years of reviewing LIFO calculation documentation, I have seen these link-chain alternative steps used several times. Using this approach, the only values required are the current-year cost balance (FIFO or average cost) and the current year index.

The concept of the link-chain computational alternative is that rather than comparing inventory at base balances to determine whether there is an increment or decrement, the current-year cost is deflated to prior year prices using the current year index to compare this deflated balance to the prior year current year cost to determine whether there is a layer or not. If the current-year cost deflated to the prior year prices minus the prior year end current-year cost is greater than zero, this “increment” is multiplied times the current year index to calculate the LIFO increment value. If there is a decrement that erodes a layer or layers earlier than the most recent year, the current-year cost balance deflated to the prior year prices are deflated yet again to the earlier year price and these “decrements” are valued at the applicable prior year current year indexes. The results using these link-chain computational alternative steps are exactly the same as with the conventional link-chain steps. We believe this method never gained acceptance for common use because the calculation steps documentation is more cumbersome and calculation errors would be more likely.

Although this approach is a link-chain alternative, once double-extension method cumulative indexes have been calculated in the normal fashion, it is possible to make pro forma alternative approach calculations of the LIFO inventory balance using the double-extension indexes that will tie to the normal LIFO-PRO Report 16 format approach results. This is done by dividing the current year cumulative index by the prior year cumulative index and using the “forced” value as the current year index for this calculation.

These alternative LIFO calculation steps are show in the third table below for both the link-chain and double-extension method indexes, following the normal LIFO-PRO Report 16 format (second table below) which shows the normal LIFO calculation steps including cumulative indexes and inventory at base balances.

This third table below showing the alternative calculation approach helps illustrate a shortcoming of the double-extension method. The 2000 double-extension increment is priced using the 2000 forced current year index of .8143 (19% deflation which is the result of the division of the 2000 cumulative index by the 1999 cumulative index) despite the fact that there was 2% inflation in 2000 for the single item in inventory at the end of 2000. This .8143 index is also used to calculate the 2001 decrement. The 2001 FIFO balance deflated to 2000 prices is then deflated to 1999 prices using the 19% change in double-extension cumulative index from 1999 to 2000 despite the fact that the 2000 price increase for the single item in the 2000 ending inventory had a 2% price increase for the year.

Have a phone call or WebEx with the LIFO-PRO team to get started today or learn more about our offerings. Schedule online using our easy-to use booking tool.

Sign up today to receive industry news & promotional offers from LIFO-PRO