There’s still plenty of time to lock in material tax benefits from electing LIFO for the 2024 year end! Find out if your company or client is a top LIFO election candidate & estimate your 2024 tax benefit today using the content provided in our guide. View/Download the PDF report version of this guide or our 2024 Top LIFO Candidates List Excel file by clicking the buttons below!

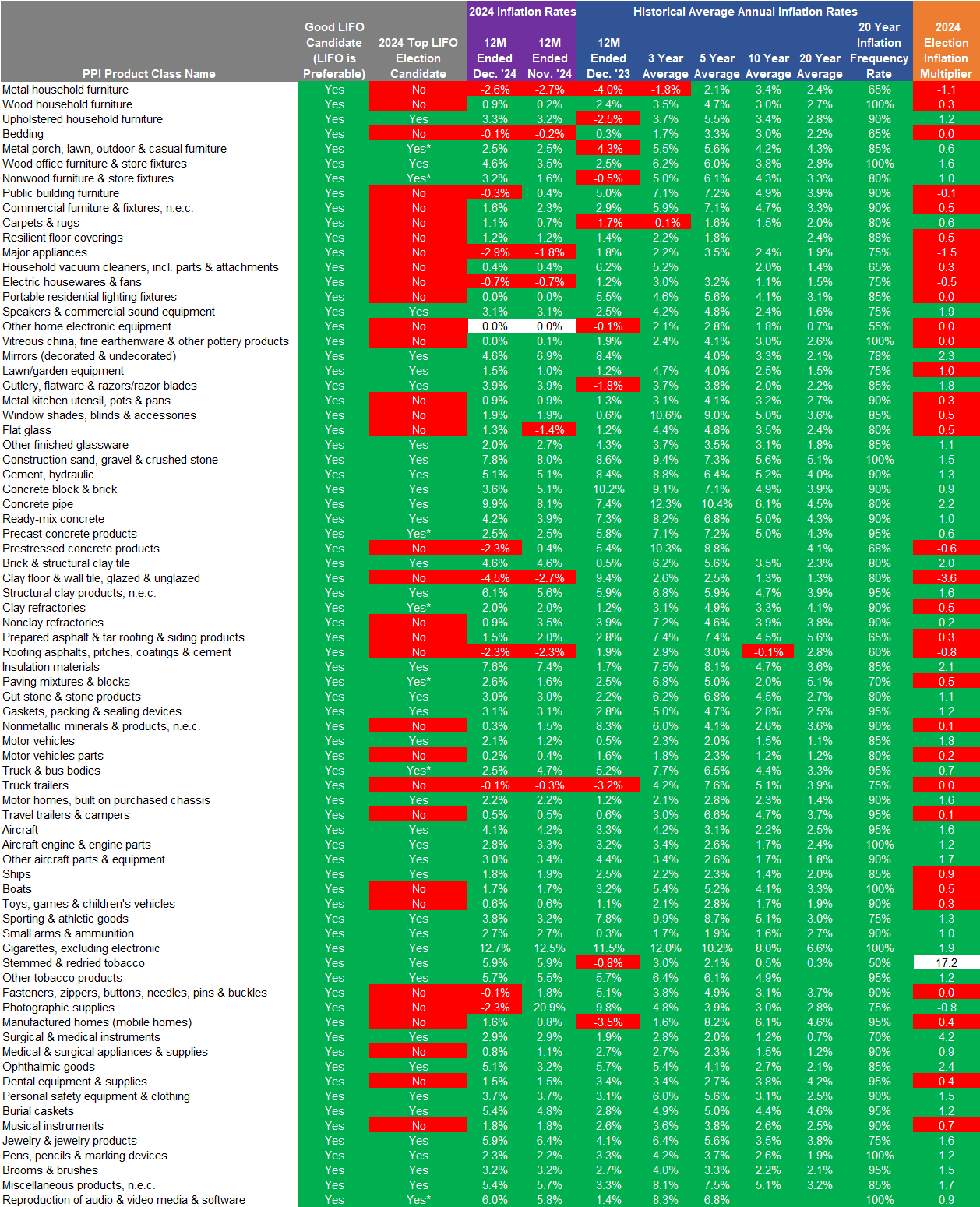

Note: The 2024 Top LIFO election candidates tables were updated on 12/14/24 with November 2024 Bureau of Labor Statistics Producer Price Index (BLS PPI) inflation rates. These tables will be updated with December 2024 BLS PPI inflation rates following their release on 1/14/2025.

LIFOPro's 2024 Top LIFO Election Candidates Guide PDF Report

LIFOPro's Top 2024 LIFO Election Candidates List Excel File

LIFOPro’s 2024 top LIFO election candidates list provides you with the ability to quickly accomplish the following:

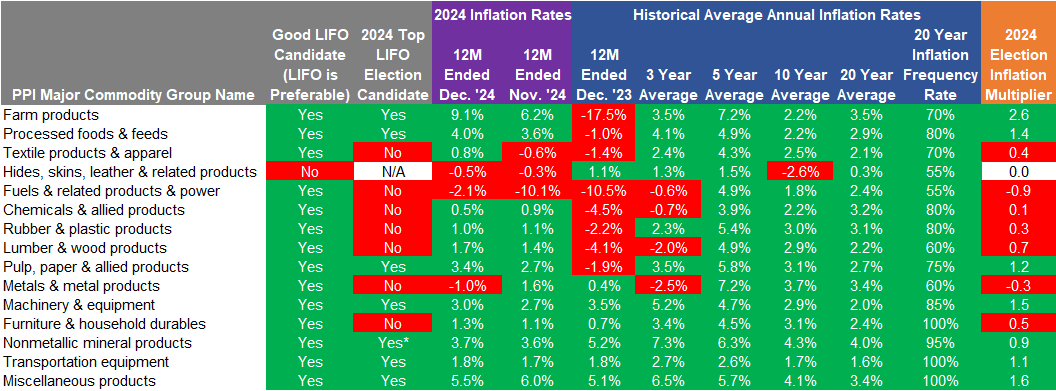

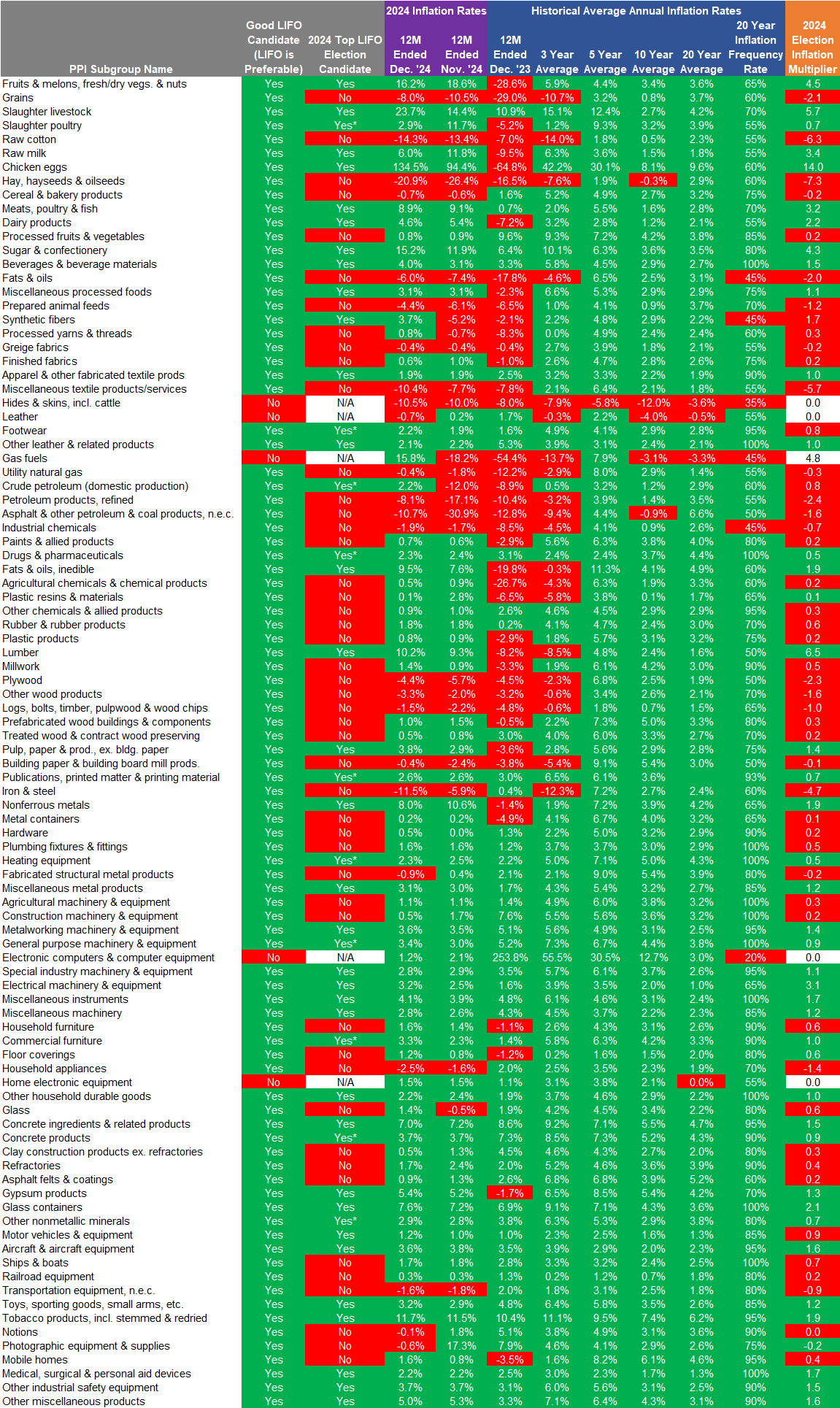

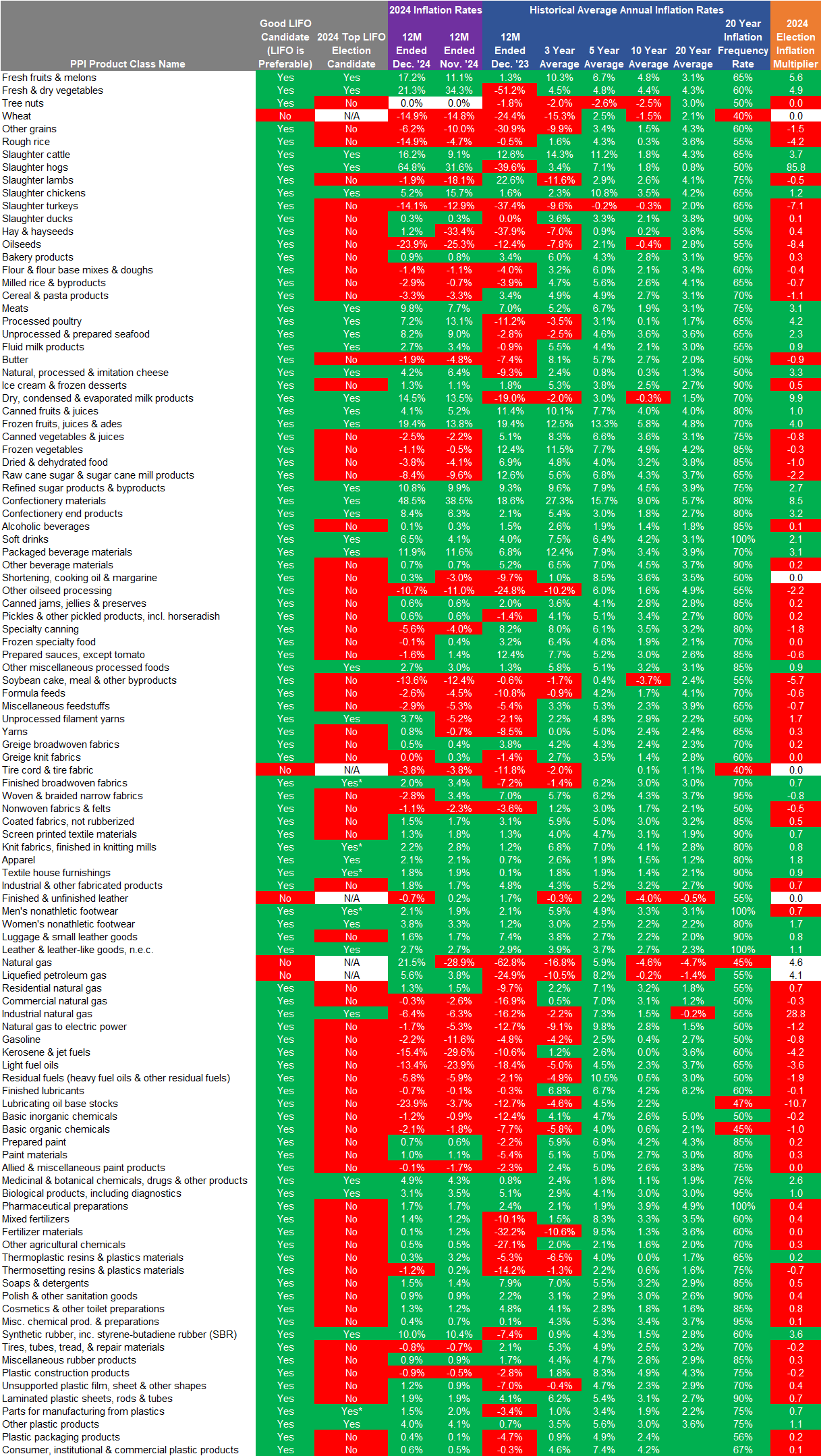

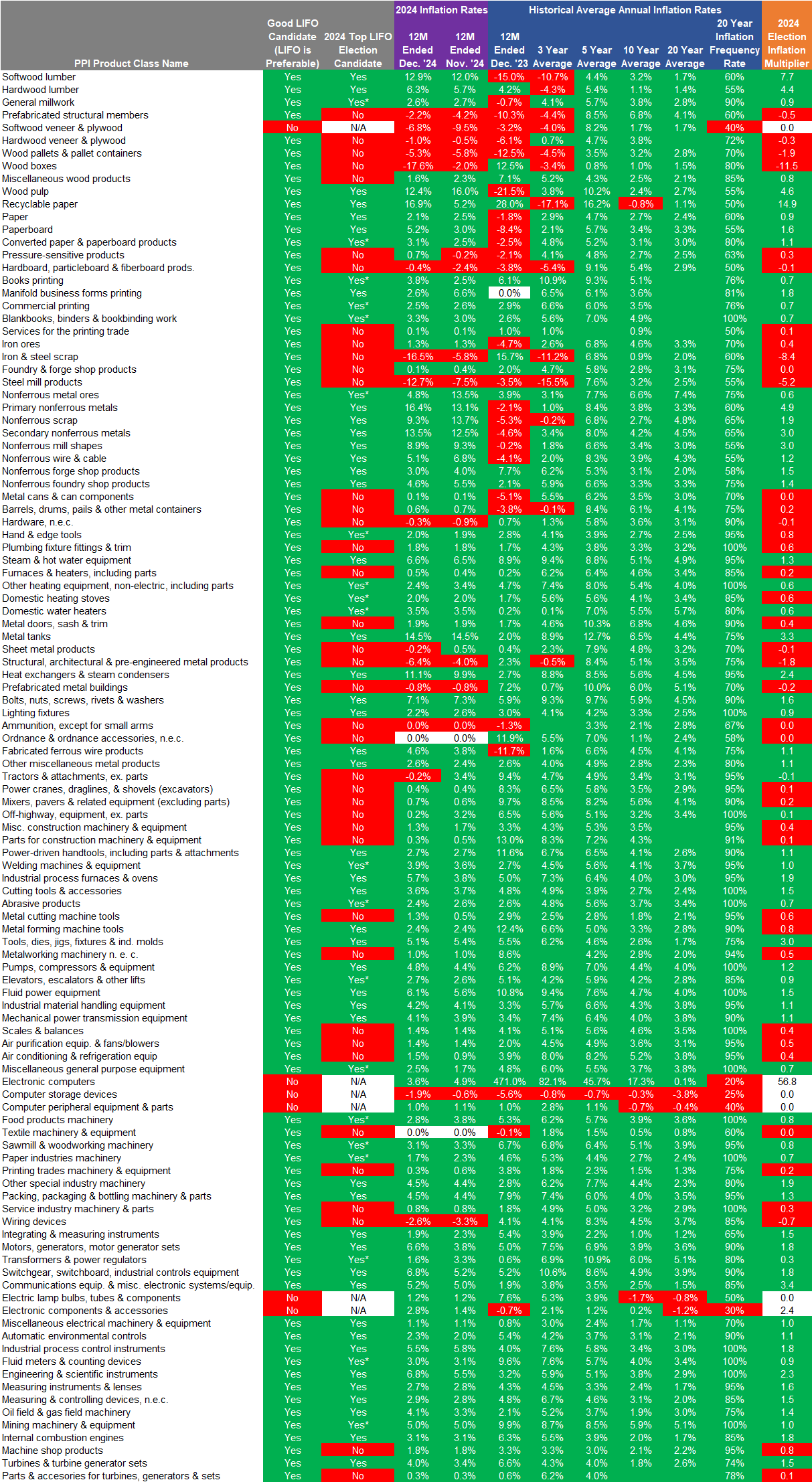

Although inflation has returned to a more normalized level, there are many industries with inflation at or above the historical levels & will be good LIFO election candidates for the 2024 year end. The best opportunities will be in the following areas:

LIFOPro has compiled a comprehensive list of the 2024 top LIFO election candidates. The tables can be found in the Top 2024 LIFO Election Candidates section below & instructions for using the lists can be found in the Single/Multi Company Top 2024 LIFO Election Candidate Identification Instructions sections below. View/download LIFOPro’s 2024 Top LIFO Election Candidate List Excel file by clicking this link: LIFOPro’s 2024 Top LIFO Election Candidates List Excel File

When there’s inflation, LIFO creates a tax benefit by lowering the inventory value and increasing cost of goods sold, which in turn reduces taxable income. The LIFO method (last-in, first-out) is the most beneficial inventory-based tax savings strategy because it uses inflation to create material long-term benefits (LIFO creates a tax benefit when there’s inflation), and tens of thousands of companies use LIFO because of this (most companies use LIFO in perpetuity after an election is made since the tax benefits become bigger for every subsequent inflationary period). Since the LIFO tax benefit amount is primarily tied to the amount of inflation measured in a given period (for example, a 5x bigger LIFO tax benefit will occur in a period with 10% inflation compared to a period with 2% inflation), thousands of companies have elected LIFO over the past few years because of the unprecedented inflation that’s occurred during this period.

Quick LIFO Tax Benefit Formula

The actual flow or physical movement of goods does not need to match the inventory costing method used to value inventory (aka cost flow assumption). The most two most predominant inventory valuation methods can be simplified as follows:

Because of the advantages of the dollar-value method & disadvantages of the unit LIFO method, almost all companies using LIFO track and value inventories in their accounting system on a FIFO, average cost or standard cost basis for the following reasons:

One of the biggest misconceptions is item/unit costs must be tracked and valued on a last-in, first out basis once LIFO is adopted. Although this is not true, it’s a misnomer that causes many companies to not to use LIFO. The reality is there are two methods or options how goods are to be tracked and valued on a LIFO basis, which are as follows:

Although LIFO can create meaningful short and long term tax benefits, there are many considerations that should be made prior to and during the implementation process. Most importantly, the timing of adopting LIFO is key for the following reasons:

IRS LIFO Requirements

Considerations

Disclaimers

IRS Regs. §1.472-2(e) requires income to be reported and inventories to be valued on a LIFO basis on the face of the income statement and balance sheet beginning in the same year that LIFO is adopted for tax purposes. This is commonly referred to as the LIFO conformity rule. An overview of the LIFO financial reporting disclosure rules and alternatives are listed below.

Some or all goods can be valued using LIFO. A selective election scope infers that less than 100% of inventories are valued using the LIFO method. Although a general rule of thumb is to place all goods on LIFO to maximize the tax benefit, thorough analysis is highly recommended prior to electing LIFO. This is because including deflationary goods in the election scope could materially reduce LIFO’s long-term tax benefits. LIFOPro’s best practices regarding determining the LIFO election scope is described below.

The costing method used to value inventory is considered an accounting method or principle. Since there are multiple inventory valuation methods available, preferability must be established when changing to the LIFO method from a non-LIFO method. Because of this, companies issuing GAAP financial statements must establish that LIFO is preferable to the existing method.

No authoritative body has established criteria for determining the preferability among alternative inventory valuation methods, but the Securities & Exchange Commission’s Staff Accounting Bulletin Topic 6.G.2b states the following:

Furthermore, most companies use LIFO in perpetuity, and because of this, the LIFO reserve will often grow and become a materially large amount. For these reasons, companies and CPA firms should obtain or perform meticulous analysis prior to adopting LIFO for the following reasons:

Such analysis should include historical calculations, current period estimates, exploring all available submethods & preparing comparisons amongst the available submethods (such as valuing all or only certain goods using LIFO, using an internal vs. external inflation measurement source, pooling methods & determining whether the same or different book & tax LIFO submethods will be used). Additional considerations should include comparing the administrative burden and risks, outsourcing costs, and considering licensing software to automate the calculation if managed in-house.

LIFOPro uses proprietary inflation metrics and a standard grading system to establish whether or not LIFO is a preferable method for a company or given industry. From this grading system, a determination can be made regarding if a company is a good LIFO candidate, and subsequent recommendations are also provided regarding the proper timing of when to elect LIFO. Our grading system & scoring criteria is organized as follows:

LIFOPro’s grading system & scoring criteria are integrated into LIFOPro’s 2024 Top LIFO Election Candidates Tables shown below. They’re also integrated in our complimentary LIFO election benefit analysis reports prepared for companies who aren’t on LIFO but are considering adoption.

LIFOPro’s 2024 top LIFO election candidates list provides you with the ability to quickly determine or accomplish the following:

LIFOPro’s lists are divided into the following three tables:

LIFOPro uses Bureau of Labor Statistics Producer Price Indexes (BLS PPI) to measure inflation metrics & identify the best LIFO election candidates each year. LIFOPro releases the first version of our Top LIFO Election Candidates list beginning with the release of the September BLS indexes.

Two separate sets of instructions are provided below. The single company instructions are designed for CPA firms seeking to determine if one client is a top LIFO election candidate. The multi-company instructions are designed for CPA firms who’re seeking to prepare a client target list of potential LIFO election candidates.

Notes

Notes

Notes

Schedule a call with the LIFOPro team today to lean how your firm, client or company can partner with us for all your LIFO needs & to make being on LIFO as simple as possible!

Sign up today to receive industry news & promotional offers from LIFO-PRO