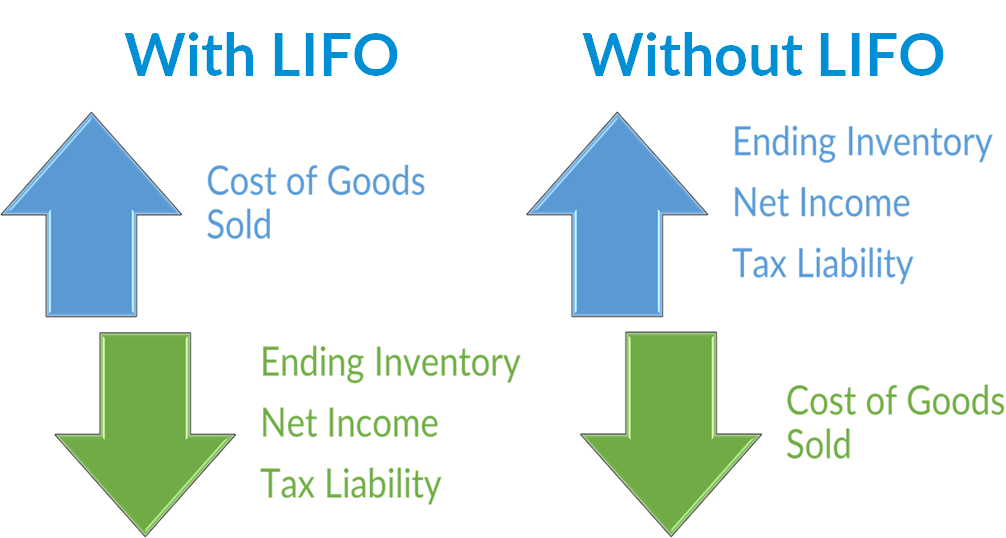

The LIFO method (last-in, first-out) is the most beneficial inventory-based tax savings strategy because it uses inflation to create material long-term benefits (LIFO creates a tax benefit when there’s inflation), and tens of thousands of companies use LIFO because of this (most companies use LIFO in perpetuity after an election is made since the tax benefits become bigger for every subsequent inflationary period). Since the LIFO tax benefit amount is primarily tied to the amount of inflation measured in a given period (for example, a 5x bigger LIFO tax benefit will occur in a period with 10% inflation compared to a period with 2% inflation), thousands of companies have elected LIFO because of the unprecedented inflation that’s occurred over the last few years. When there’s inflation, LIFO creates a tax benefit by lowering the inventory value and increasing cost of goods sold, which in turn reduces taxable income.

LIFO can be easily implemented and maintained with minimal administrative burden and costs when the calculation is outsourced to LIFOPro. Learn more about at our Turnkey outsourcing solutions page!

The actual flow or physical movement of goods does not need to match the inventory costing method used to value inventory (aka cost flow assumption). The most two most predominant inventory valuation methods can be simplified as follows:

Because of the advantages of the dollar-value method & disadvantages of the unit LIFO method, almost all companies using LIFO track and value inventories in their accounting system on a FIFO, average cost or standard cost basis for the following reasons:

One of the biggest misconceptions is item/unit costs must be tracked and valued on a last-in, first out basis once LIFO is adopted. Although this is not true, it’s a misnomer that causes many companies to not to use LIFO. The reality is there are two methods or options how goods are to be tracked and valued on a LIFO basis, which are as follows:

The costing method used to value inventory is considered an accounting method or principle. Since there are multiple inventory valuation methods available, preferability must be established when changing to the LIFO method from a non-LIFO method. Because of this, companies issuing GAAP financial statements must establish that LIFO is preferable to the existing method.

No authoritative body has established criteria for determining the preferability among alternative inventory valuation methods, but the Securities & Exchange Commission’s Staff Accounting Bulletin Topic 6.G.2b states the following:

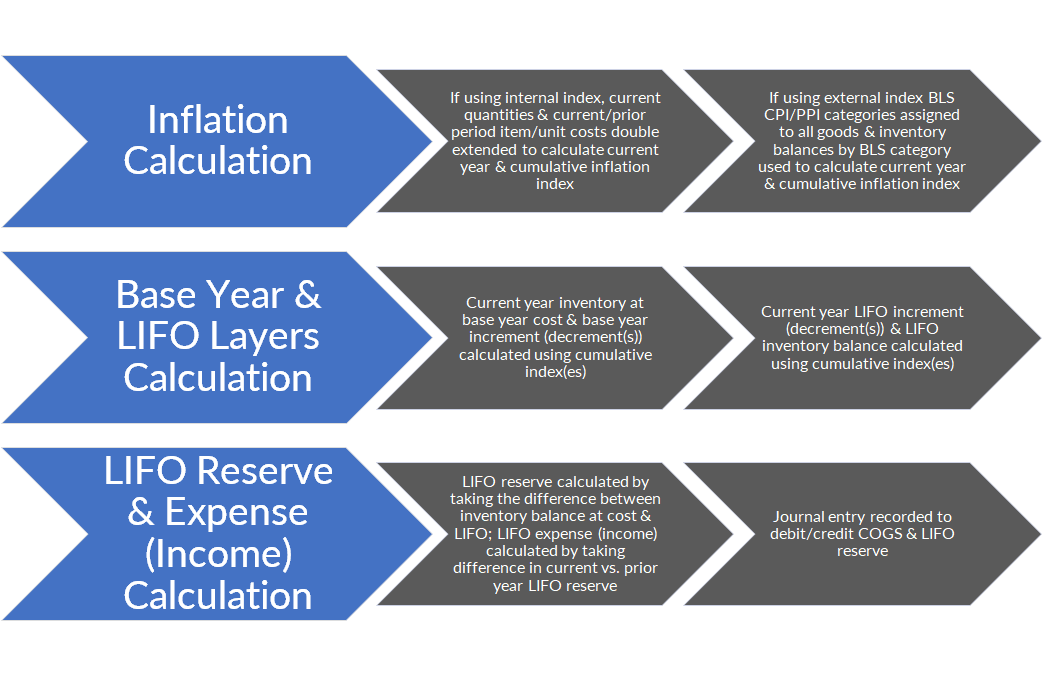

Furthermore, most companies use LIFO in perpetuity, and because of this, the LIFO reserve will often grow and become a materially large amount. For these reasons, companies and CPA firms should obtain or perform meticulous analysis prior to adopting LIFO for the following reasons:

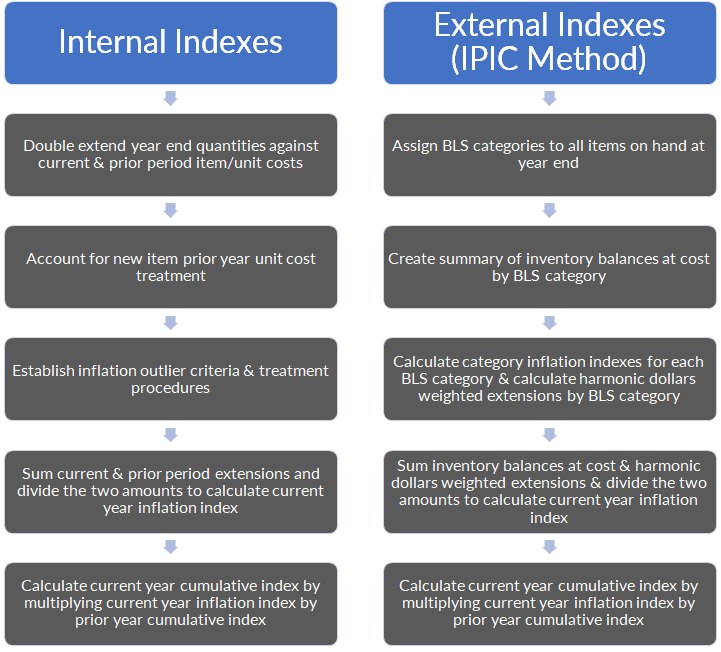

Such analysis should include historical calculations, current period estimates, exploring all available submethods & preparing comparisons amongst the available submethods (such as valuing all or only certain goods using LIFO, using an internal vs. external inflation measurement source, pooling methods & determining whether the same or different book & tax LIFO submethods will be used). Additional considerations should include comparing the administrative burden and risks, outsourcing costs, and considering licensing software to automate the calculation if managed in-house.

IRS Regs. §1.472-2(e) requires income to be reported and inventories to be valued on a LIFO basis on the face of the income statement and balance sheet beginning in the same year that LIFO is adopted for tax purposes. This is commonly referred to as the LIFO conformity rule. An overview of the LIFO financial reporting disclosure rules and alternatives are listed below.

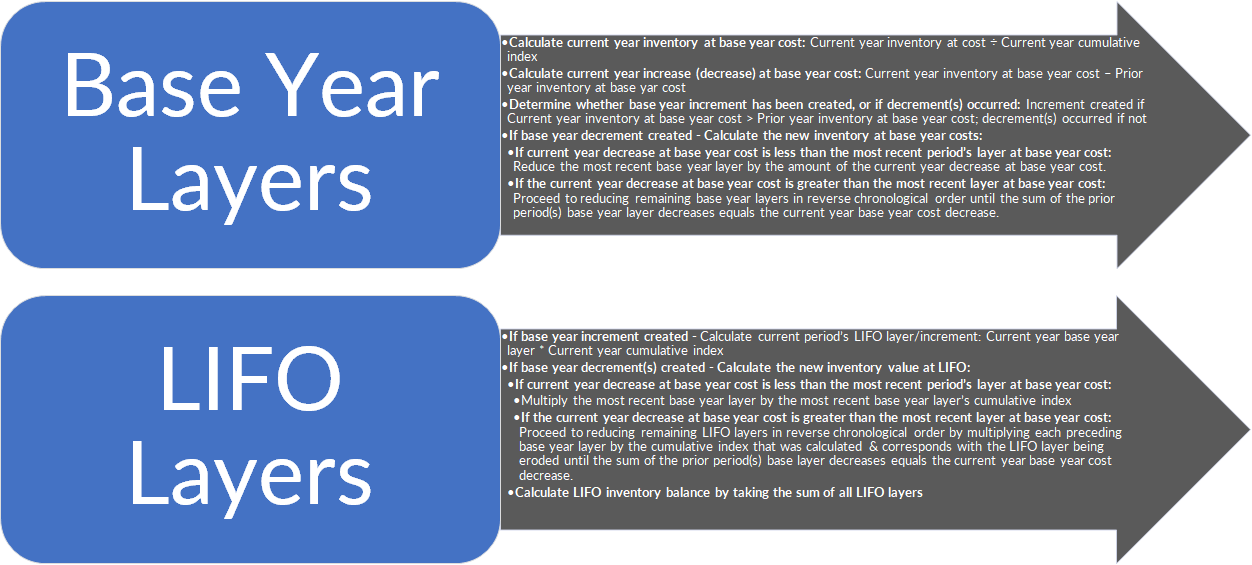

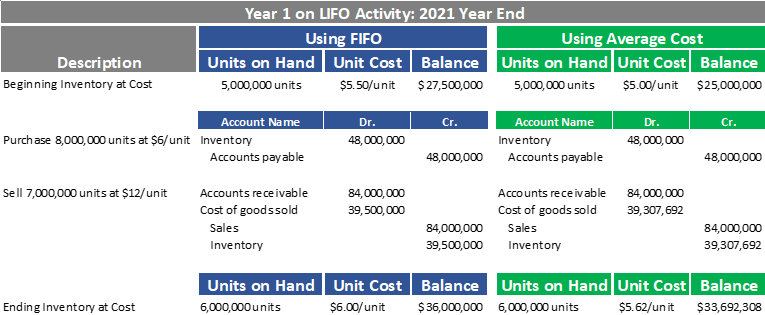

For dollar-value LIFO method users, a company will continue tracking inventory costs within their accounting database using the same method that was used prior to adopting LIFO. This means that beginning inventory, purchases, sales & cost of goods sold recorded during the reporting period continues to be valued any of the available non-LIFO methods (i.e. FIFO, average cost, earliest acquisitions etc.). Illustration 1 below provides an example of common inventory activity occurring during the course of a reporting period using FIFO or average cost:

Illustration 1. Accounting for Inventory Activity Under LIFO – Year 1 on LIFO

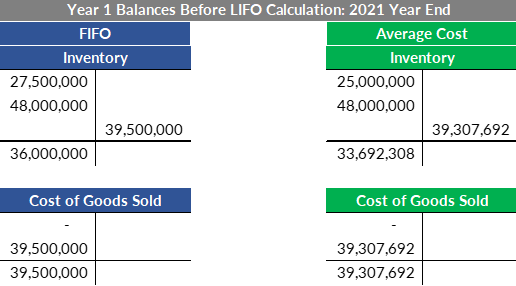

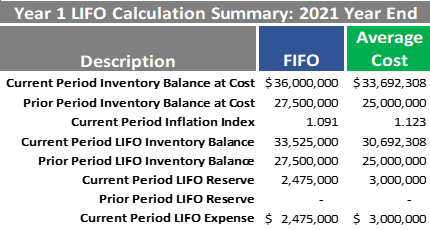

The LIFO reserve contra account is shown with a zero balance because this example assumes that the company will be adopting LIFO for the 2021 year end. The main consideration is to realize that companies on LIFO continue using some non-LIFO method such as FIFO or average cost to account for current period inventory activity. Once the period has been closed and all inventory related activity has been posted, the side calculation to compute the required LIFO values can now be made. Once the current year index is computed, the ending inventory balance at cost (i.e. FIFO, average cost etc.) is used along with the current period inflation index to compute the current period LIFO inventory, LIFO expense & reserve values. Using the same inventory data from Illustration 1, an example is shown below of the period end side calculation made to compute the LIFO inventory, expense & reserve balances as well as the general ledger adjusting journal entry required to account for the difference between inventory at cost & LIFO (LIFO expense is the difference in cost of goods sold between LIFO vs. cost & is the difference between the current & prior period’s LIFO reserve):

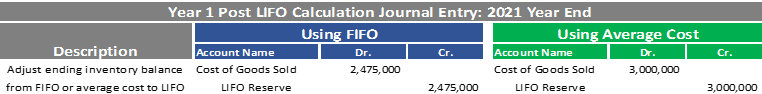

Illustration 2. LIFO Calculation & General Ledger Adjusting Journal Entry Year 1 on LIFO

Note: Above figures portrays a simplified version of a LIFO calculation & does not show the detailed math required to calculate current period inflation index, LIFO inventory & LIFO reserve/expense balances.

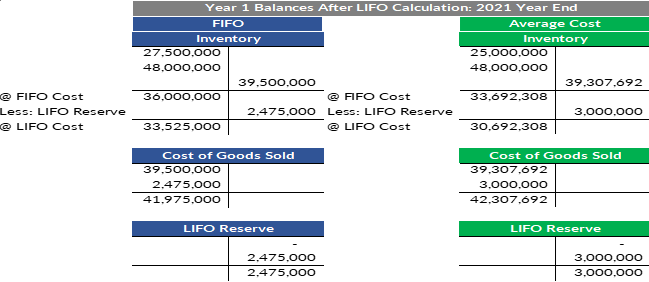

As shown in the calculation summary above, the LIFO inventory balance is between $2 – $3 million less than the current period end inventory balance at cost. This difference represents the LIFO expense (current – prior period LIFO reserve) & LIFO reserve balances (inventory at cost – LIFO inventory). It also represents how LIFO transfers inflationary inventory costs from the balance sheet (inventory) to the income statement (cost of goods sold). The debits and credits in the journal entry shown above represent increases to both cost of goods sold and the LIFO reserve contra inventory account. Since the LIFO reserve account is a contra inventory account, ending inventory gross of LIFO reserve represents inventory at cost & while ending inventory net of LIFO reserve represents inventory at LIFO. The cost of goods sold account is essentially the vehicle that allows for LIFO taxpayers to reduce their taxable income. Using the data from the illustrations above, the example below shows the 2021 year end balances after the LIFO general ledger adjusting journal entry has been made:

Illustration 3. Post LIFO Calculation Inventory Balances Year 1 on LIFO

As shown above in Illustration 3, the cost of goods sold account is now $2 – $3 million higher after the LIFO calculation. Aside from any other adjusting entries required after the LIFO calculation, this will be the amount used for financial reporting and tax purposes. Although the cost of goods sold account balance will be closed out after recording the closing entries, the LIFO reserve contra inventory account is a permanent account that will be carried forward into the next reporting period.

Once elected, a LIFO calculation must be made annually at year end. This allows for LIFO to be a tax savings tool that accrues benefits in perpetuity & not just a one-time deduction. Using the data from the illustrations above, the examples shown below illustrate how inventory costs will be tracked when going from the first to the second reporting period on LIFO:

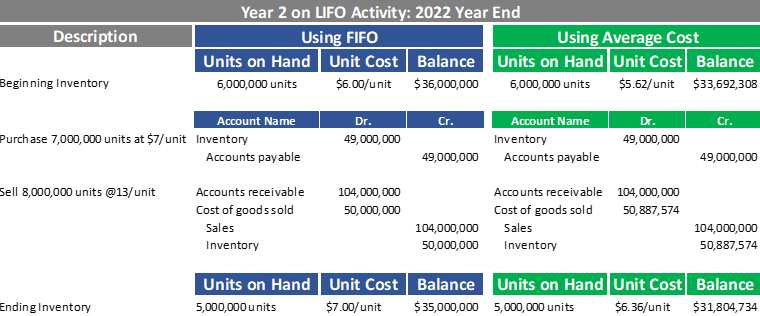

Illustration 5. Accounting for Inventory Activity Under LIFO – Year 2 on LIFO

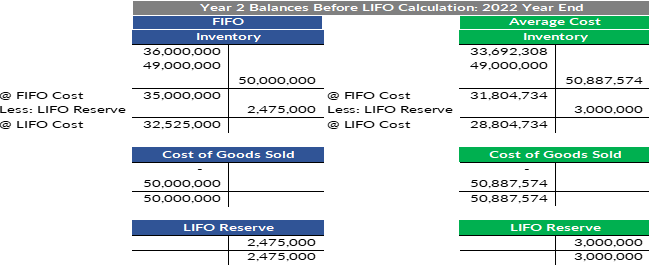

As shown above, beginning inventory, purchases, sales & cost of goods sold continue being valued at cost throughout the course of the second period on LIFO (will remain the case for all subsequent periods on LIFO). As explained earlier, the LIFO reserve contra inventory account remains in place because the beginning inventory balance net of LIFO reserve represents inventory at LIFO cost. The example below illustrates the year 2 LIFO calculation results along with the adjusting journal entries and post-LIFO calculation general ledger inventory balances:

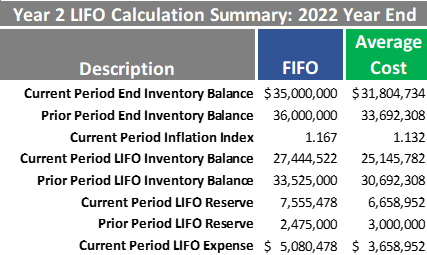

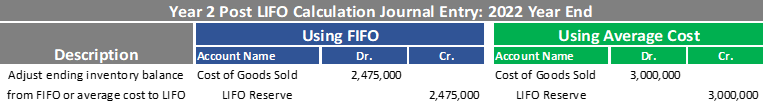

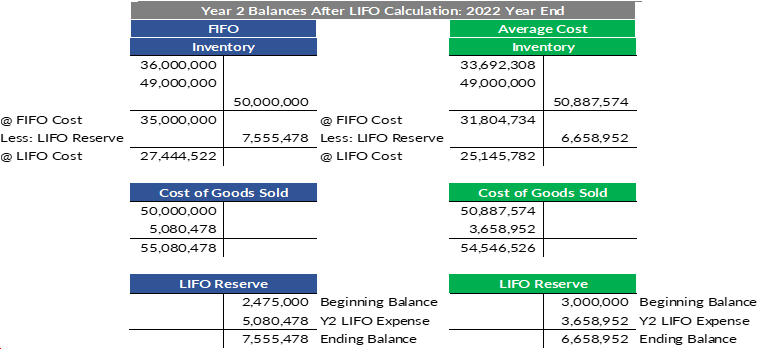

Illustration 6. LIFO Calculation, General Ledger Adjusting Journal Entry & Account Balances – Year 2

Note: Above figures portrays a simplified version of a LIFO calculation & does not show the detailed math required to calculate current period inflation index, LIFO inventory & LIFO reserve/expense balances. Note: Above figures portrays a simplified version of a LIFO calculation & does not show the detailed math required to calculate current period inflation index, LIFO inventory & LIFO reserve/expense balances.

As shown above, the current period LIFO calculation resulted in 17% & 13% inflation for each of the two calculations that resulted in approximately $5 million & $3.7 million of LIFO expense (increase to cost of goods sold). Although the LIFO inventory balance is the difference between ending inventory gross and net of the current period LIFO reserve, the LIFO expense is the difference between the current & prior period LIFO reserve and represents the current period increase to cost of goods sold. Using the data from the illustrations above, the example below shows the 2022 year end balances after the LIFO general ledger adjusting journal entry has been made:

Illustration 7. Post LIFO Calculation Inventory Balances – Year 2 on LIFO

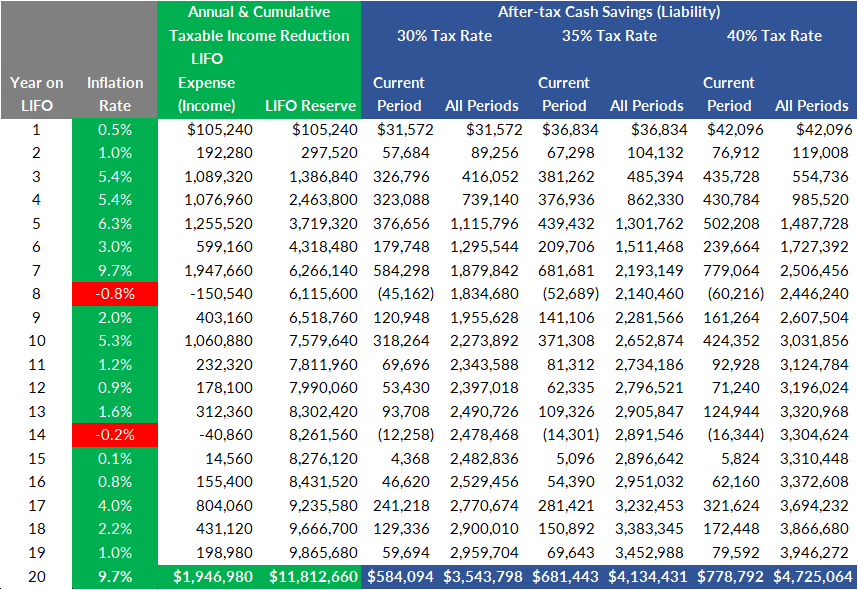

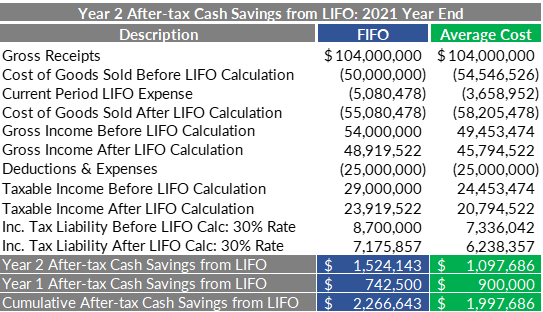

Using the data from the illustrations above, Illustration 9 below shows both the current period & cumulative after-tax cash savings from LIFO.

Illustration 8. After-tax Cash Savings Created from Years 1 & 2 on LIFO

As shown above, the year two after-tax cash savings from LIFO was between $1M – $1.5M under FIFO & average cost when assuming a 30% tax rate. This amount can also be more simply calculated by taking the product of the current period LIFO expense & a company’s tax rate. The LIFO expense represents the current period increase in the current vs. prior period’s LIFO reserve (called LIFO income when current vs. prior period LIFO reserve decreases). The cumulative after-tax cash savings from LIFO represents the sum of the Year 1 & Year 2 after-tax cash savings from LIFO. It can be more simply calculated by taking the product of the current period LIFO reserve & a company’s tax rate.

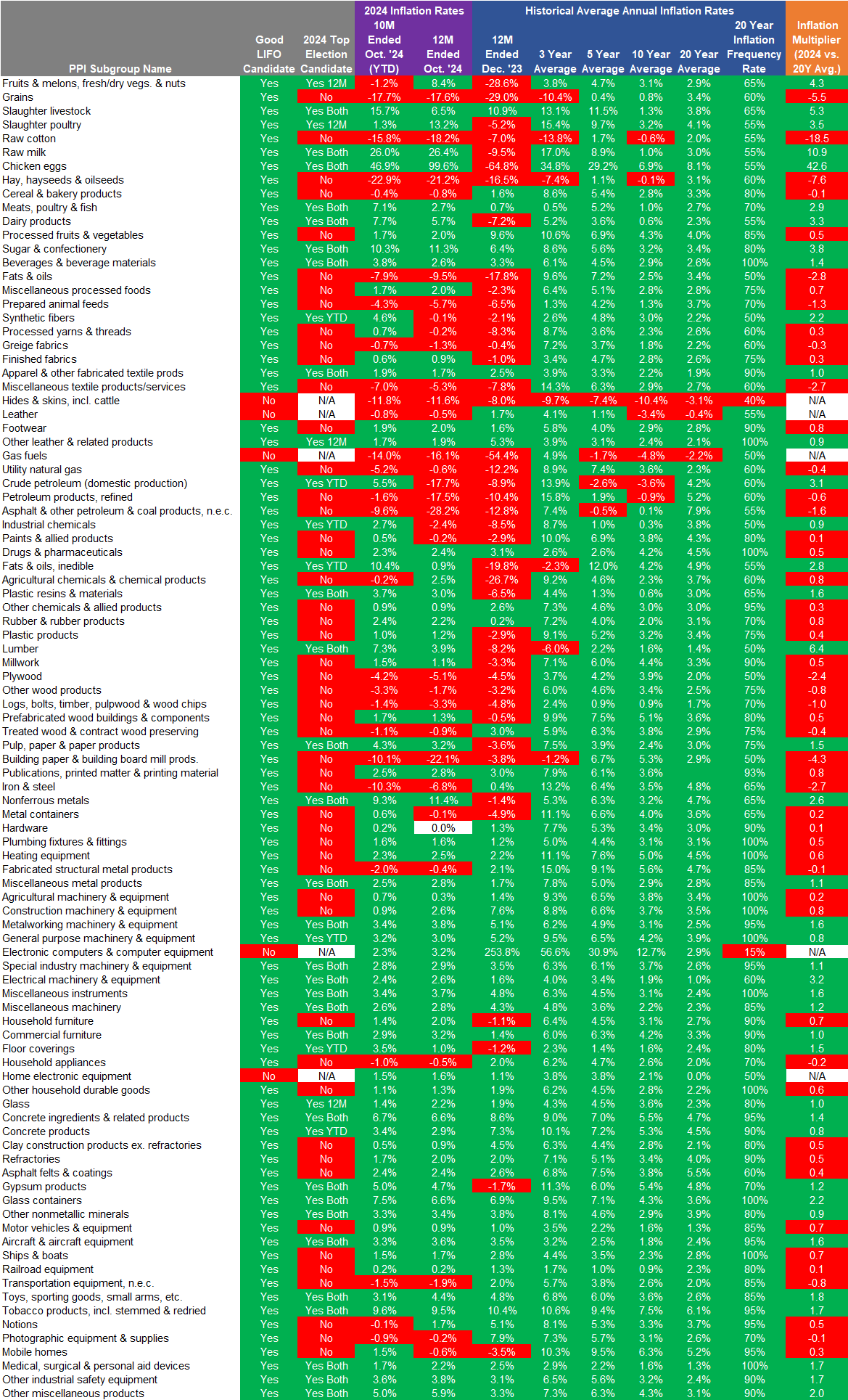

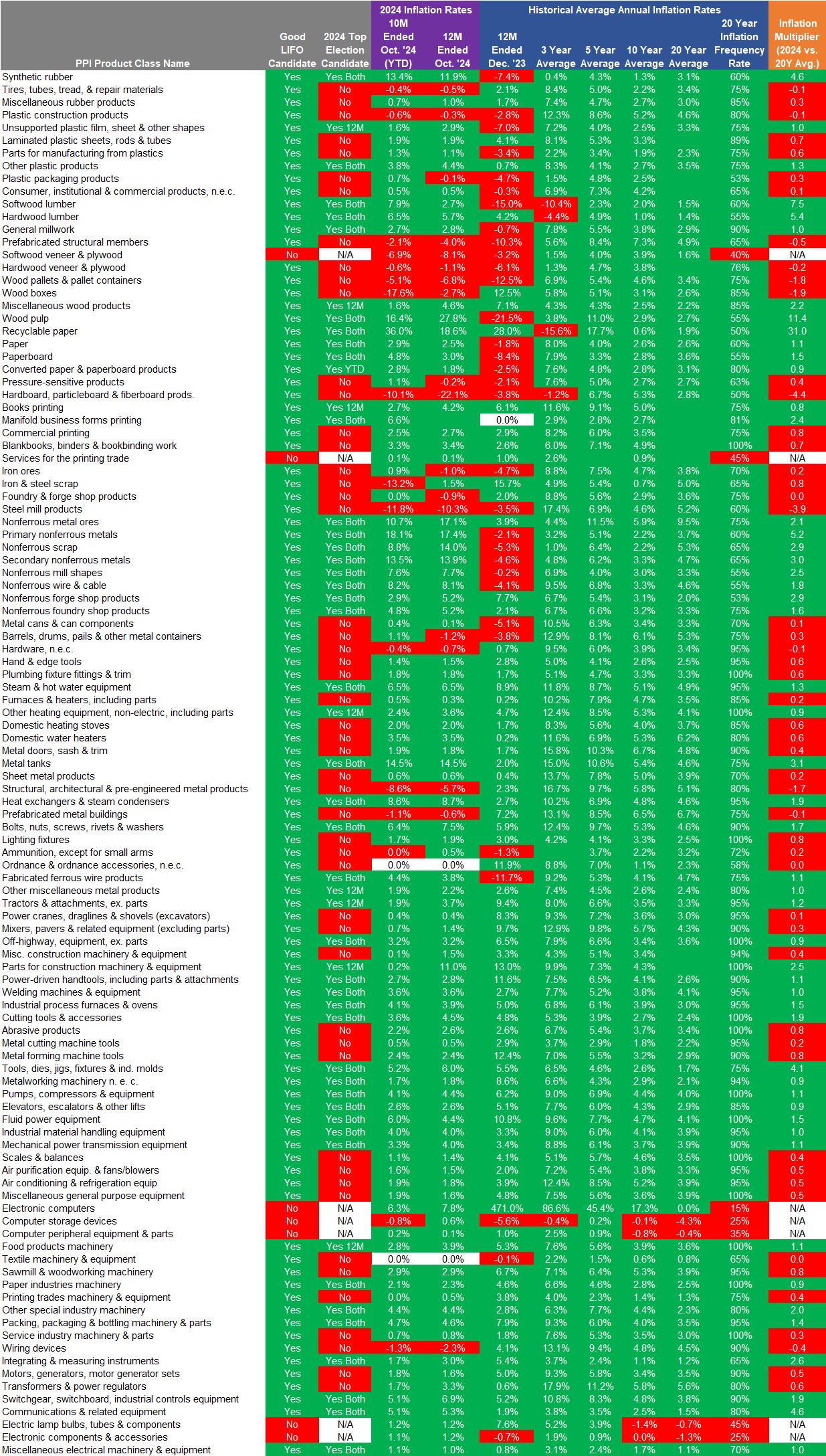

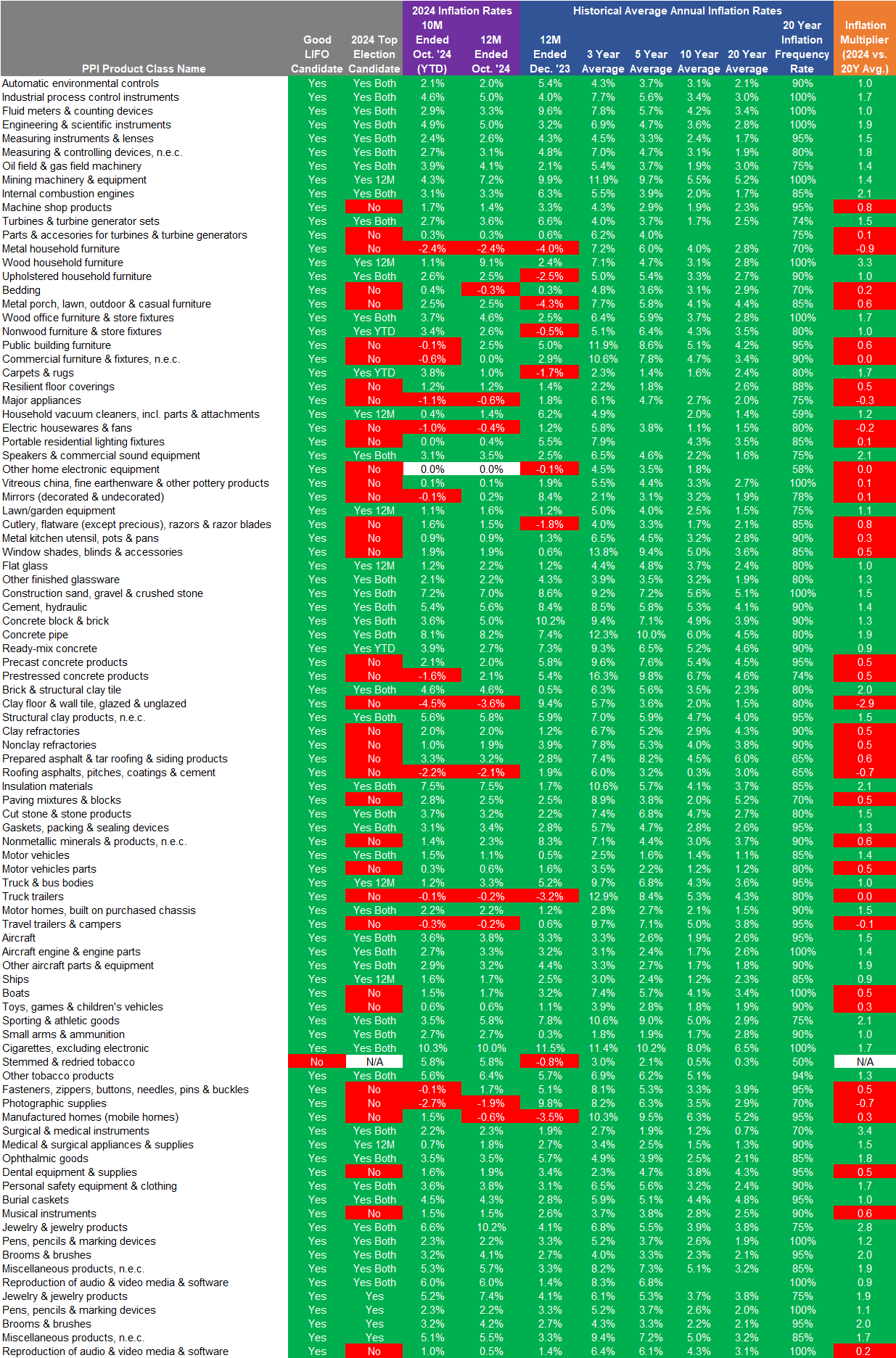

LIFOPro’s 2024 Top LIFO Election Candidates List

LIFOPro’s 2024 top LIFO election candidates list provides you with the ability to quickly accomplish the following:

Although inflation has returned to a more normalized level, there are many industries with inflation at or above the historical levels & will be good LIFO election candidates for the 2024 year end. The best opportunities will be in the following areas:

Although LIFO can create meaningful short and long term tax benefits, there are many considerations that should be made prior to and during the implementation process. Most importantly, the timing of adopting LIFO is key for the following reasons:

LIFOPro uses proprietary inflation metrics and a standard grading system to establish whether or not LIFO is a preferable method for a company or given industry. From this grading system, a determination can be made regarding if a company is a good LIFO candidate, and subsequent recommendations are also provided regarding the proper timing of when to elect LIFO. Our grading system & scoring criteria is organized as follows:

Trial the software for 90 days. Get a complimentary analysis for companies considering using LIFO. Get a complimentary review for companies on LIFO. Request a cost estimate. Use our simple form to submit your request.

Sign up today to receive industry news & promotional offers from LIFO-PRO