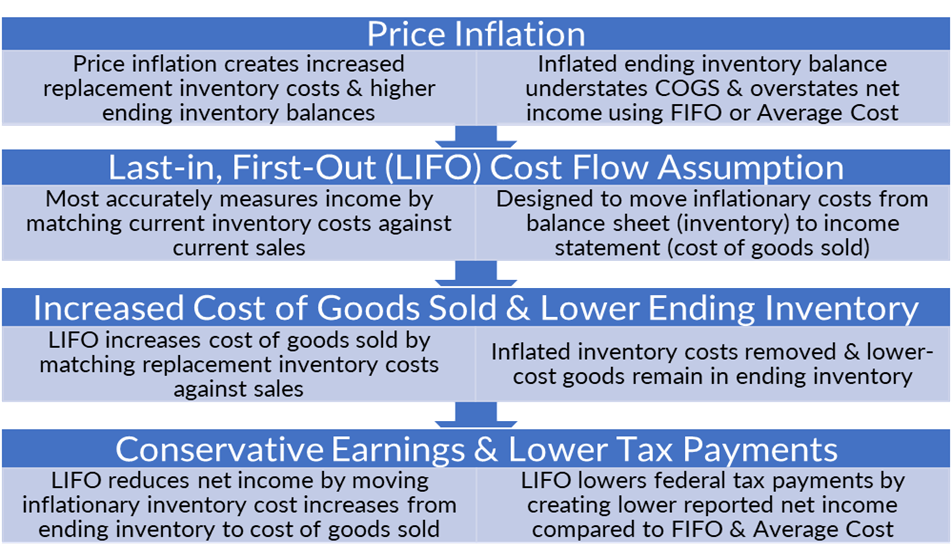

The Last-in, First-out method, also known as the LIFO method, is one of the four cost flow assumptions allowed by U.S. GAAP & the IRS (FIFO, average cost & specific identification are the three other acceptable methods). LIFO matches current inventory costs against current sales to provide a better measure of earnings. When there’s inflation, the effect of using LIFO is that the value of the most recently purchased, higher cost items are included in cost of goods sold while the older, lower cost goods remain in inventory. In other words, LIFO is designed to move some of the inflationary costs from the balance sheet (inventory) to the income statement (cost of goods sold).

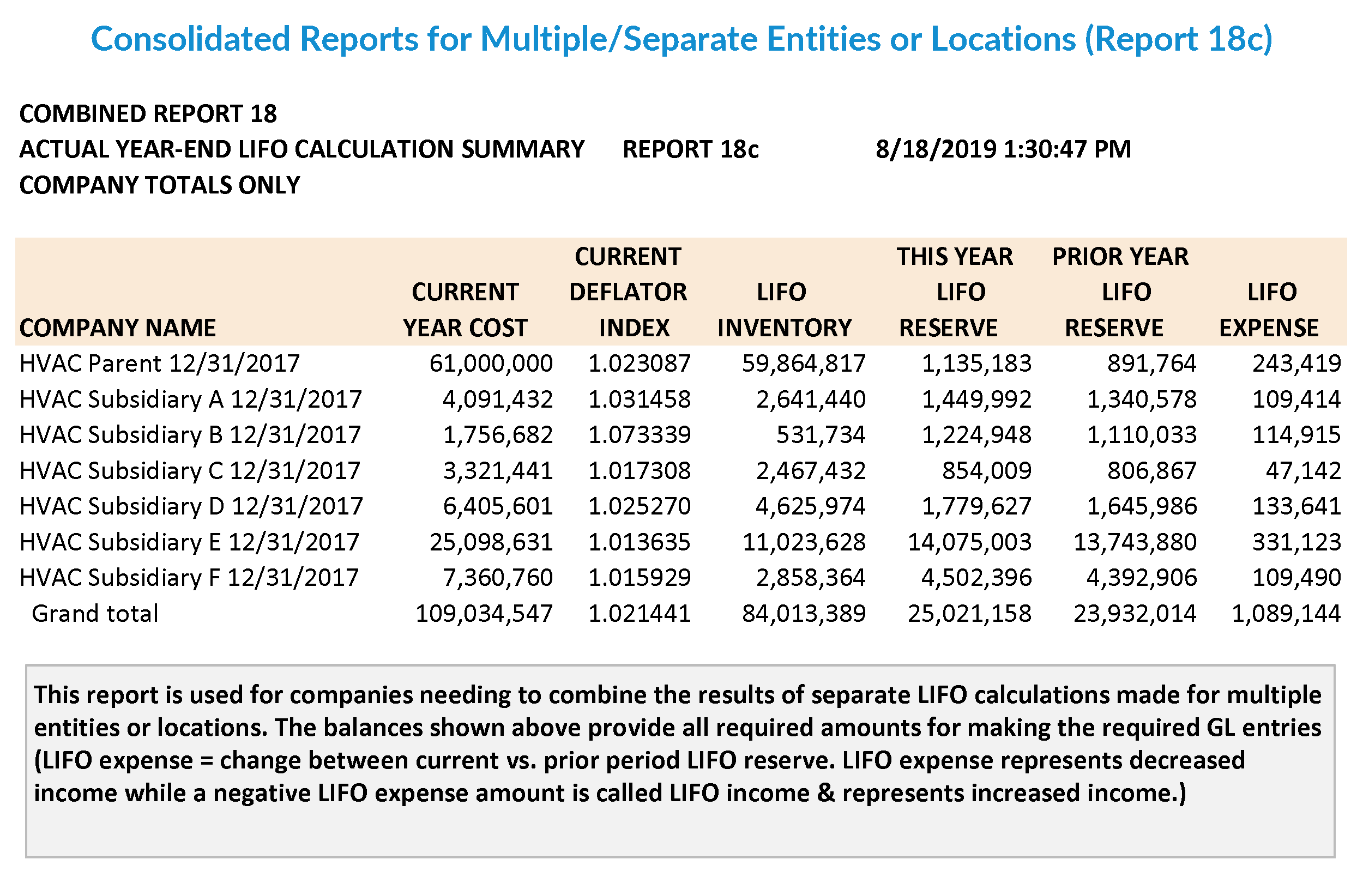

The IRS Tax Court made the following statement about LIFO, “The theory behind LIFO is that income may be more accurately determined by matching current costs against current revenues, thereby eliminating from earnings any artificial profits resulting from inflationary increases in inventory costs. At the heart of the LIFO method is the principle that income is more clearly reflected by matching current costs with current revenues.” The cumulative difference between inventory valued at LIFO vs. a non-LIFO method (i.e. FIFO, average cost) is known as the LIFO reserve and the annual change between the current & prior period LIFO reserve is known as LIFO expense (income if current vs. prior period LIFO reserve decreases). The infographic shown below further illustrates the concept of how LIFO works:

In the 1930’s, inflation was causing increased replacement inventory costs, artificially high ending inventory balances, understated cost of goods sold & overstated earnings. The unintended consequence was having to pay additional taxes based on artificial income on inventory not yet sold. Because of this, a large number of companies & industry trade associations collaborated with the Special Committee on Inventories of the American Institute of Accountants (now known as the AICPA) to develop an alternative inventory method that matched current costs against sales, and thereby more clearly reflecting income. The Securities & Exchange Commission considered LIFO to be permissible for financial reporting purposes in 1936 & the AIA later advocated for LIFO to be allowed for both financial reporting & tax in 1938. The combined lobbying efforts of the AIA, corporations & trade associations eventually led to Congress accepting the use of the LIFO method for tax purposes when the Revenue Act of 1938 was passed.

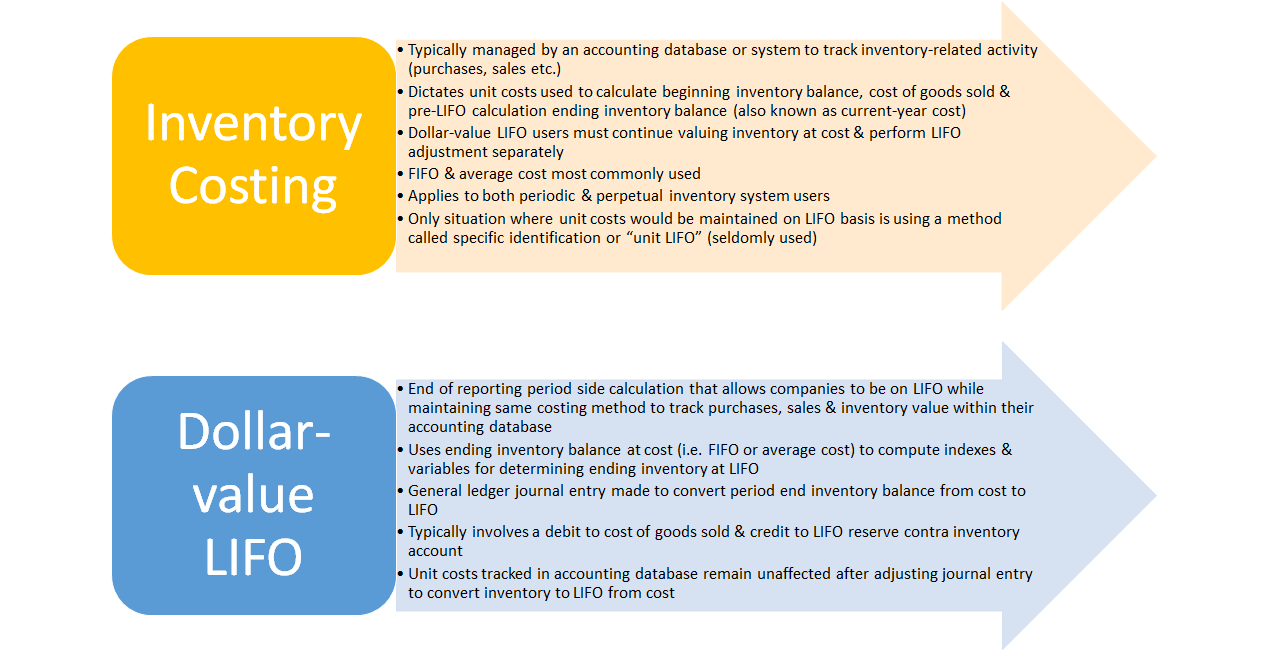

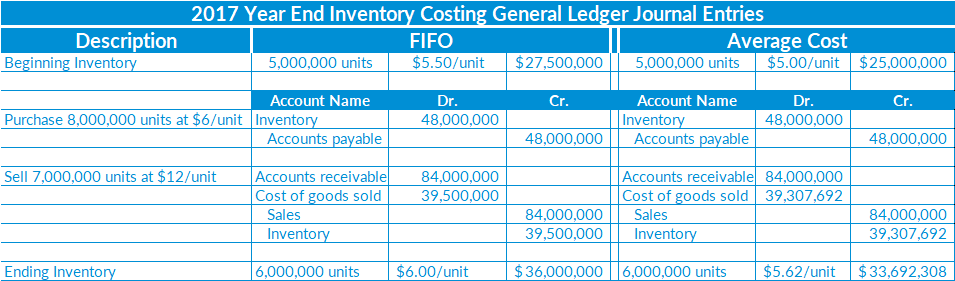

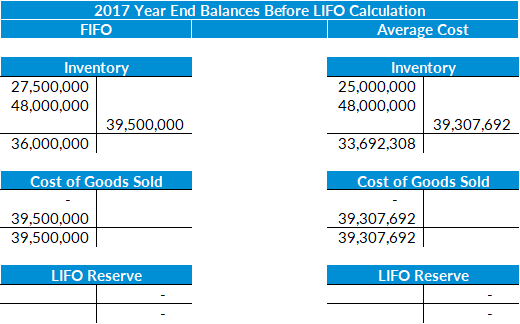

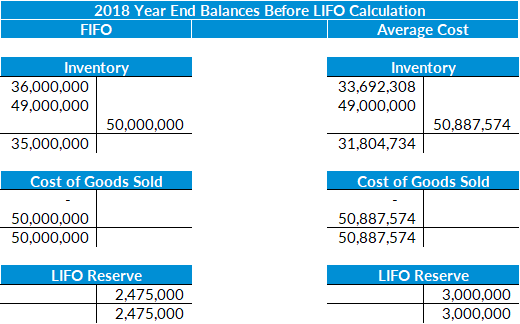

For dollar-value LIFO method users, a company will continue tracking inventory costs within their accounting database using the same method that was used prior to adopting LIFO. This means that beginning inventory, purchases, sales & cost of goods sold recorded during the reporting period continues to be valued any of the available non-LIFO methods (i.e. FIFO, average cost, earliest acquisitions etc.). Illustration 2 below provides an example of common inventory activity occurring during the course of a reporting period using FIFO or average cost:

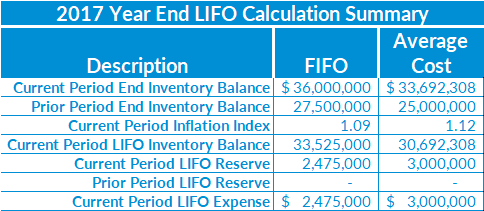

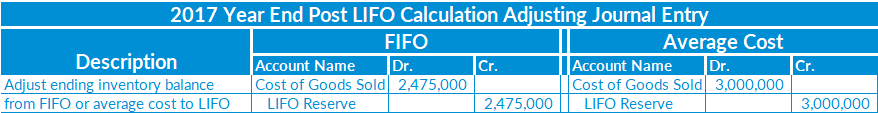

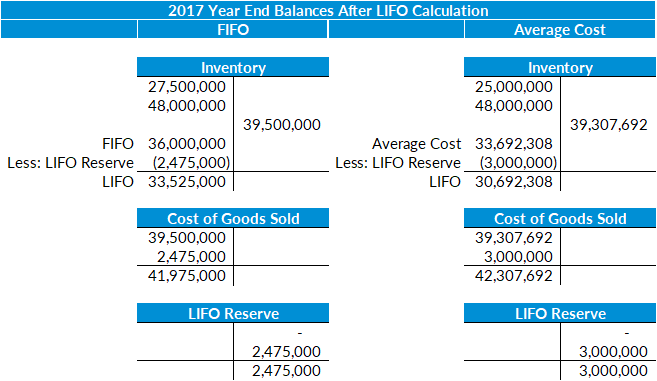

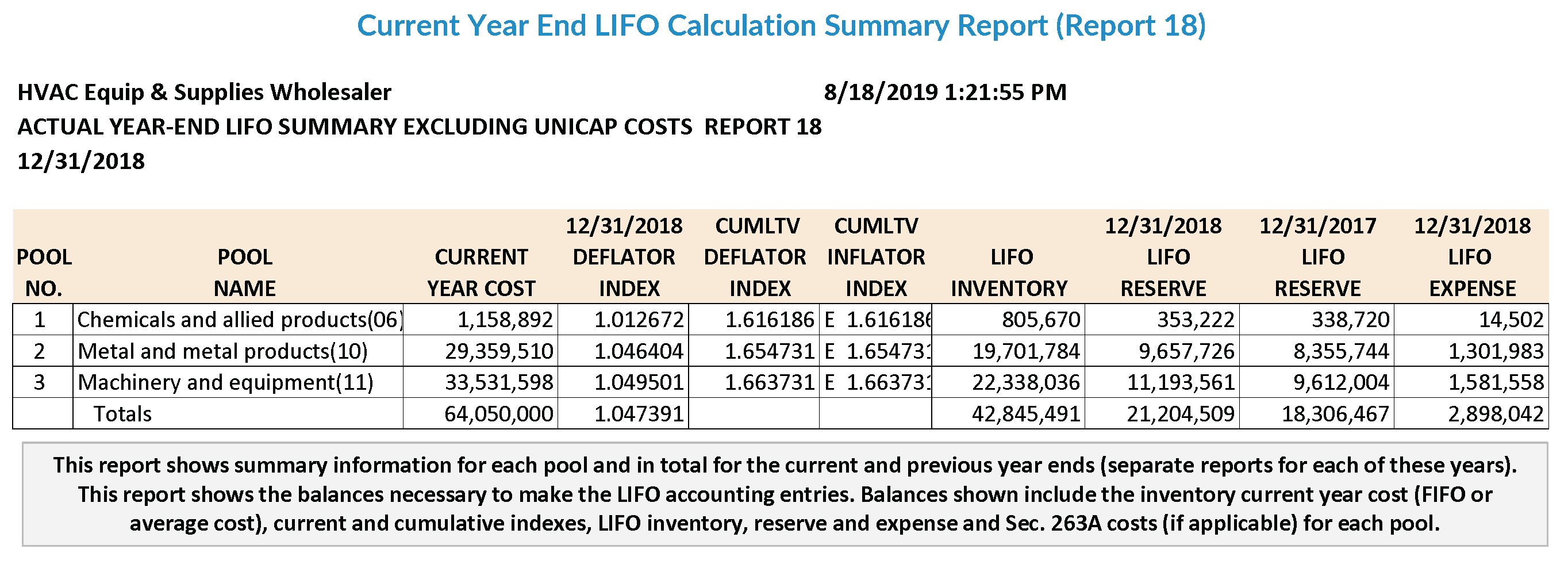

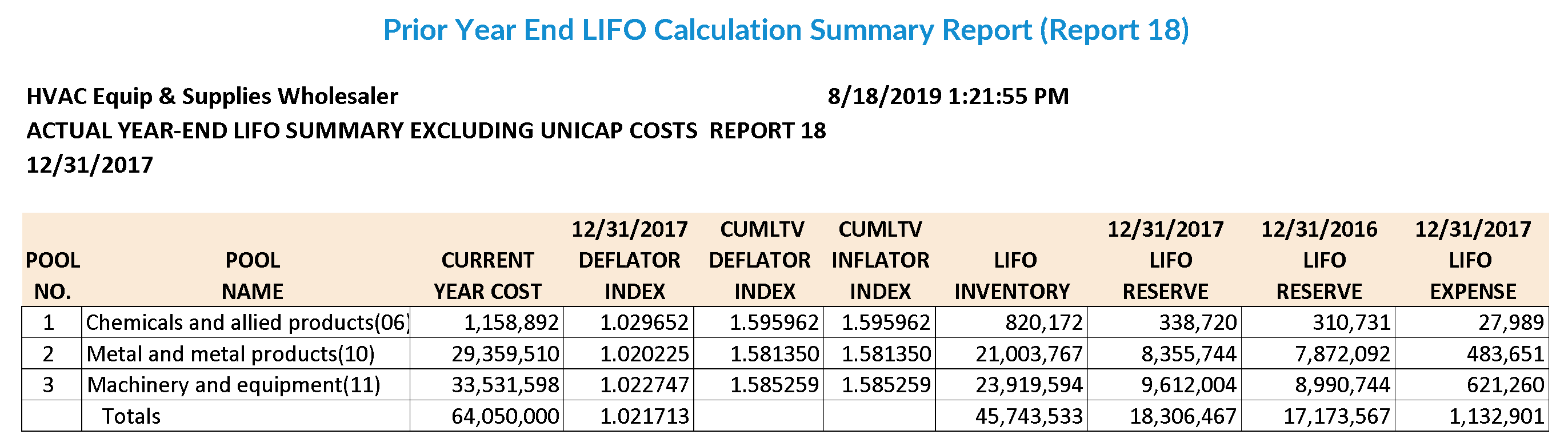

As shown in the calculation summary above, the LIFO inventory balance is between $2 – $3 million less than the current period end inventory balance at cost. This difference represents the LIFO expense (current – prior period LIFO reserve) & LIFO reserve balances (inventory at cost – LIFO inventory). It also represents how LIFO transfers inflationary inventory costs from the balance sheet (inventory) to the income statement (cost of goods sold). The debits and credits in the journal entry shown above represent increases to both cost of goods sold and the LIFO reserve contra inventory account. Since the LIFO reserve account is a contra inventory account, ending inventory gross of LIFO reserve represents inventory at cost & while ending inventory net of LIFO reserve represents inventory at LIFO. The cost of goods sold account is essentially the vehicle that allows for LIFO taxpayers to reduce their taxable income. Using the data from the illustrations above, the example below shows the 2017 year end balances after the LIFO general ledger adjusting journal entry has been made:

As shown above, the cost of goods sold account is now $2 – $3 million higher after the LIFO calculation. Aside from any other adjusting entries required after the LIFO calculation, this will be the amount used for financial reporting and tax purposes. Although the cost of goods sold account balance will be closed out after recording the closing entries, the LIFO reserve contra inventory account is a permanent account that will be carried forward into the next reporting period.

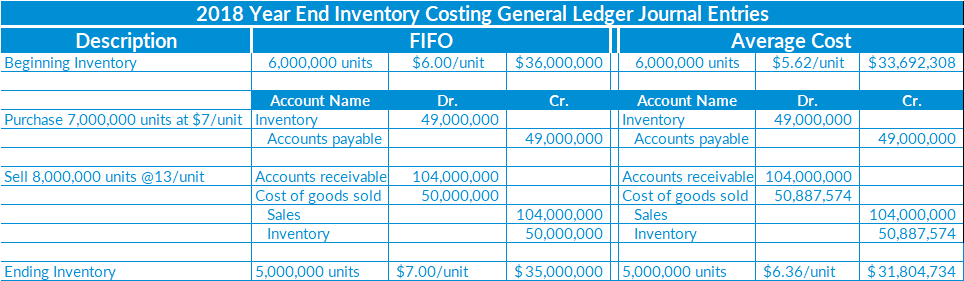

Using the data from the illustrations above, the examples shown below illustrate how inventory costs will be tracked when going from the first to the second reporting period on LIFO:

As shown above, beginning inventory, purchases, sales & cost of goods sold continue being valued at cost throughout the course of the second period on LIFO (will remain the case for all subsequent periods on LIFO). As explained earlier, the LIFO reserve contra inventory account remains in place because the beginning inventory balance net of LIFO reserve represents inventory at LIFO cost. The example below illustrates the year 2 LIFO calculation results along with the adjusting journal entries and post-LIFO calculation general ledger inventory balances:

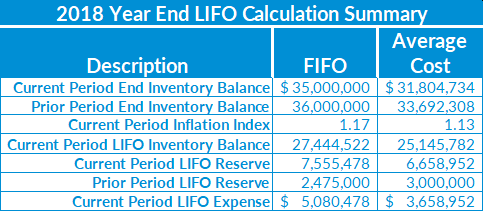

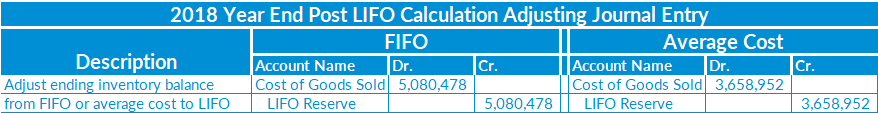

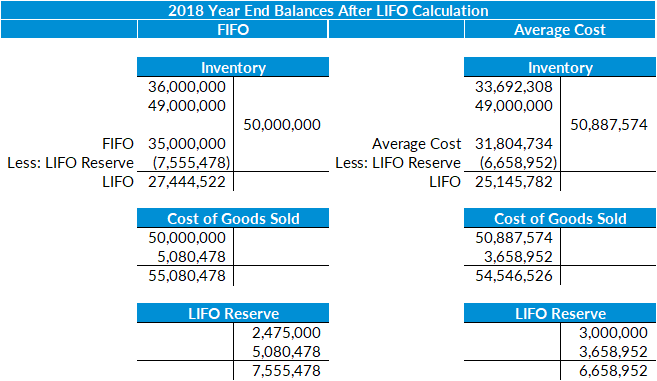

As shown above, the current period LIFO calculation resulted in 17% & 13% inflation for each of the two calculations that resulted in approximately $5 million & $3.7 million of LIFO expense (increase to cost of goods sold). Although the LIFO inventory balance is the difference between ending inventory gross and net of the current period LIFO reserve, the LIFO expense is the difference between the current & prior period LIFO reserve and represents the current period increase to cost of goods sold. Using the data from the illustrations above, the example below shows the 2018 year end balances after the LIFO general ledger adjusting journal entry has been made:

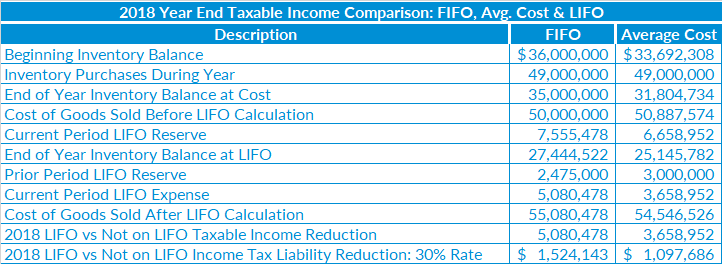

As illustrated above, the cost of goods sold account was increased in each of the two years shown and represents the vehicle for companies on LIFO to reduce their taxable income & tax liability. Using the 2018 year end (year 2) data from the illustrations above, the example below compare the differences in cost of goods sold, taxable income & federal income tax liability between LIFO, FIFO and average cost:

As shown above, there’s a $5 million & $1.5 million reduction in taxable income & federal income tax liability when comparing a LIFO vs. non-LIFO taxpayer that uses FIFO as their current-year cost method. Similarly, there’s a $3.5 million & $1.1 million reduction in taxable income & federal income tax liability when comparing a LIFO vs. non-LIFO taxpayer that uses average cost as their current-year cost method. It should be noted that this difference would also have been recognized in the first year on LIFO (prior period LIFO reserve amounts), and will recognition will continue in subsequent periods as long as there’s inflation. Another important concept is the fact that current period LIFO reserve grew despite the current vs. prior period ending inventory balance at cost decreasing. A common misconception exists that inventory balances must increase for the LIFO reserve to grow, but this is not the case. The LIFO reserve will continue to grow when the current vs. prior period end inventory balance is lower as long as the amount of inflation outpaces the amount of the inventory balance decrease.

| Requirement |

Financial Reporting |

Tax |

| IRS Form 970 Application to Use LIFO Inventory Method & statement attachment must be filed with federal tax return in year of adoption |

|

|

| Opening (beginning) inventories must be valued at cost for a company’s first year on LIFO |

|

|

| Ending inventories must be valued using FIFO, earliest acquisitions or average cost |

|

|

| Must be used for financial reporting & tax purposes for all periods beginning in year of election |

|

|

| Financial reporting LIFO election scope must be equal to or greater than Tax scope (i.e. goods on LIFO for tax purposes can not be greater than what is on LIFO for financial reporting) |

|

|

| Prior lower of cost or market writedowns must be restored through income over a three-year period |

|

| Requirement |

Financial Reporting |

Tax |

| IRS Form 970 Application to Use LIFO Inventory Method & statement attachment must be filed with federal tax return in year of adoption |

|

|

| Opening (beginning) inventories must be valued at cost for a company’s first year on LIFO |

|

|

| Ending inventories must be valued using FIFO, earliest acquisitions or average cost |

|

|

| Must be used for financial reporting & tax purposes for all periods beginning in year of election |

|

|

| Financial reporting LIFO election scope must be equal to or greater than Tax scope (i.e. goods on LIFO for tax purposes can not be greater than what is on LIFO for financial reporting) |

|

|

| Prior lower of cost or market writedowns must be restored through income over a three-year period |

|

Absorption Costing: Method of inventory costing in which all variable manufacturing costs and all fixed manufacturing costs are included as inventoriable costs.

Actual Costing: A costing system that traces direct costs to a cost object by using the actual direct-cost rates times the actual quantities of the direct-cost inputs and allocates indirect costs based on the actual indirect-cost rates times the actual quantities of the cost allocation bases.

Appropriate Month: This refers to which month’s CPI or PPI indexes are used to calculate IPIC method Category Inflation Indexes. IRS Reg. § 1.472-8(e)(3)(iii)(B)(3) provides rules regarding selection of “Appropriate Months”. The representative appropriate month (also referred to as representative month) is the appropriate month a taxpayer uses consistently every year as the result of their election to use the same appropriate month every year.

Average Cost: An inventory valuation method for which inventories are valued at an average of unit cost calculated for each inventory item. While there are several average cost calculation methods, the most commonly used for modern inventory accounting systems is a weighted moving average (the IRS refers to this method as the rolling average cost method) in which the average unit cost is recalculated with each inventory purchase for each item.

Base Year Cost: The amount of current year’s inventory converted to its cost in the year LIFO was adopted.

BLS: The Bureau of Labor Statistics, a division of the Department of Labor. The BLS publishes Consumer Price Indexes (CPI) in the monthly CPI Detailed Report. It also publishes Producer Price Indexes (PPI) in the monthly PPI Detailed Report. These published indexes are those used for IPIC method LIFO calculations.

Category Inflation Index: This is a term used in IRS Reg. § 1.472-8(e) to describe the LIFO index for a particular CPI or PPI category.

Conformity Requirement: An Internal Revenue Service code that requires a company that uses LIFO for income tax purposes to use LIFO for financial reporting purposes. The extent that the IRS prescribes for taxpayers to conform tax & financial reporting (book) LIFO are for the tax LIFO election scope (inventories on LIFO) to be less than or equal to the book LIFO election scope. Put in another way, the book inventories on LIFO must be greater than or equal to the tax LIFO inventories on LIFO.

Cost Component Method: A method of applying dollar value LIFO in which changes in the LIFO index are measured by the weighted average increase or decrease in the component costs of material, labor, and overhead that constitute ending inventory.

Cost LIFO: A term that describes the calculation of LIFO inventory balances by first converting cost inventory balances (current-year cost) to inventory at base balances using inflation indexes that are a measure of inflation in the cost of inventory items.

Cost Of Goods Sold: Total manufacturing cost of jobs or units sold during the period.

CPI (Consumer Price Indexes): These are price indexes compiled and published monthly by the BLS in the CPI Detailed Report. The indexes in Table 3 of this report are those which IPIC method taxpayers can use for LIFO calculations. Only retailers can use the CPI indexes for LIFO purposes although retailers can use either CPI or PPI indexes. There are over 300 CPI index categories in Table 3 and approximately 200 of these are for commodities (service category indexes cannot be used for LIFO purposes).

Cumulative LIFO Index: A LIFO index that is the measure of LIFO inflation from the base year to the current year end. For double-extension method LIFO index calculations, the cumulative index is calculated by dividing the sum of extensions at current year end prices (current year end on-hand quantity times current year end unit price) for all items or a representative sample of items by the sum of extensions at base year prices (current year end on-hand quantity times base year end unit price) for all items. For link-chain method LIFO index calculations, the cumulative index for the current year end is calculated by multiplying the cumulative index for the prior year end times the current year LIFO index. The current year link-chain LIFO index is calculated by dividing the sum of extensions at current year end prices by the sum of extensions at prior year end prices. Cumulative LIFO indexes are used to convert (by division) the current-year end inventory cost to base year dollars which is then compared to the prior year end inventory at base dollars to determine whether there is an increment or decrement for the year.

Current Year Cost: A term used by the IRS which describes the year end inventory balance that is to be converted to base year prices for companies using the dollar-value LIFO method. The current-year cost is usually the general ledger balance (for each LIFO pool) adjusted to exclude valuation reserves and to include adjustments for in-transit goods, shrink reserves, vendor discounts and other cost adjustments. The general ledger balance will usually be inventories stated at FIFO or average cost. There are four different current-year method alternatives allowed by the IRS in Reg. § 1.472-8(e)(2)(ii).

Current Year LIFO Index: A LIFO index that is the measure of LIFO inflation for the current year only. Current year LIFO indexes are used for link-chain method LIFO calculations.

Deflator Index: LIFO index used to convert or “deflate” current year cost inventory balances to inventory at base year price values.

Dollar-Value LIFO: Most commonly used LIFO inventory costing method; it determines and measures any increases and decreases in a pool in terms of total dollar value, not the physical quantity of the goods in the inventory pool.

Double-extension LIFO Method: Cumulative index method where all items are extended at current cost and base year costs. Considered an unreliable and unpredictable measure of inflation (Richardson, 2015).

Dual Indexes: A method for which the deflator and inflator indexes are not the same. Dual Index methods are no longer (since 2002) allowed by the IRS. When they were allowed, some companies used dual indexes to achieve a lower LIFO inventory valuation by using inflator indexes that reflected beginning of the year rather than end of year prices. There are no GAAP rules that preclude the use of dual indexes.

External or published indexes: The use of price indexes published by the Bureau of Labor Statistics to calculate LIFO inflation (as opposed to computing internally-calcualted inflation indexes); also is known as using the IPIC LIFO method. Under this method, applicable Consumer Price Index (CPI) or Producer Price Index (PPI) categories are assigned to inventory items & category inflation indexes are calculated using the price indexes published for each individual BLS category. After all items have been assigned BLS categories, the harmonic dollars weighted extension is calcualted to derive a weighted-average pool index.

FIFO: This is an acronym for “first in, first out” which is an accounting method for determining the cost of inventories. Under this method, the first items purchased are treated as being the first items sold. Period end inventories are valued using the unit cost of the last purchases made on an item-by-item basis.

Full Absorption Costing: Costing method required for external reporting (GAAP) in which product costs reflect the full cost of manufacturing.

Historical Cost: The amount paid or liability incurred by an accounting entity to acquire an asset and make it ready to render the services for which it was acquired.

Inflator Index: LIFO index used to multiply times (or “inflate”) layer (or increment) at base prices to produce a layer valued at LIFO cost. The inflator index used to value layers will be the same as the deflator index except, when a dual index method is used.Inflator index – LIFO index used to multiply times (or “inflate”) layer (or increment) at base prices to produce a layer valued at LIFO cost. The inflator index used to value layers will be the same as the deflator index except, when a dual index method is used.

Internal Index: A term used to describe a non-IPIC index calculation method which entails using that company’s actual unit prices to calculate LIFO indexes.

Inventory Item: Unit of inventory measurement for which LIFO inflation is measured for non-IPIC (internal index) LIFO methods. The inventory item is usually SKU (stock keeping unit) or goods with unique UPC (universal product code) codes for retailers and wholesalers. Some taxpayers define for LIFO inflation measurement purposes their inventory items to be the number of pounds of nails or board feet of similar types of lumber, e.g. The broader the definition of inventory item, the more IRS scrutiny is likely as to the appropriateness of item definition.

Inventory Price Index (IPI): This is a term used in IRS Reg. § 1.472-8(e)(3)(i) to describe a pool’s weighted average index for taxpayers using the IPIC method. For link-chain taxpayers, a pool’s IPI is multiplied times that pool’s previous year’s cumulative deflator index to produce the current year’s cumulative deflator index, which is then used to “deflate” current year cost balances to base year prices.

Inventory Price Index Computation (IPIC) Method: The Inventory Price Index Computation (IPIC) method was authorized by IRS Reg. § 1.472-8(e) in 1982. This method permits taxpayers to use of price indexes published by the Bureau of Labor Statistics to calculate LIFO inflation (as opposed to computing internally-calcualted inflation indexes); Under this method, applicable Consumer Price Index (CPI) or Producer Price Index (PPI) categories are assigned to inventory items & category inflation indexes are calculated using the price indexes published for each individual BLS category. After all items have been assigned BLS categories, the harmonic dollars weighted extension is calculated to derive a Weighted-Average Pool Index that are subsequently used to compute the other LIFO variables needed to calculate the LIFO inventory and reserve balances.

Involuntary LIFO Termination: The termination of a taxpayer’s LIFO election by the IRS. The IRS Regs. allow the IRS to terminate a taxpayers LIFO election for the following reasons: 1) improper LIFO election, 2) violation of LIFO conformity Regs., 3) the current-year cost of inventories used for the LIFO calculation that are net of valuation reserves and 4) inadequate books and records maintained to adequately document the calculation of LIFO indexes and LIFO inventory balances.

IRS Form 970: Application to Use LIFO Inventory Method. A Form 970 is required for:

IRS Form 3115: Application for Change in Accounting Method -Taxpayers must file Form 3115 for LIFO-related methods changes including: Change from LIFO to a non-LIFO method (also referred to as LIFO termination) Change from one LIFO method to another LIFO method Change from one LIFO pooling method to another LIFO pooling method.

Last-In, First-Out (LIFO) Method: Assumes a last-in, first out flow of cost. Results in the lowest taxable income during periods of inflation because it results in the highest cost of goods sold and the lowest inventory value. Price indexes are used for the valuation.

LIFO Conformity: The “LIFO conformity” rules are that section of the IRS Regs. (IRS Reg. § 1.472-2) that requires the use of the LIFO method for financial reporting purposes for those inventories for which the LIFO method is elected for tax purposes.

LIFO Decrement: The excess of the prior period end inventory at base minus the current period end inventory at base. Decrements result in reduction or “erosion” of increments or layers created in earlier years and therefore a LIFO layer is not created for years that have decrements. A LIFO decrement is not the same as a decrease in the LIFO reserve compared to the prior year LIFO reserve (this is referred to as LIFO income).

LIFO Effect: The change from one period to the next in the balance of the account (Allowance to Reduce Inventory to LIFO, also called the LIFO reserve) that companies use to record the difference between the non-LIFO inventory method used for internal-reporting purposes and LIFO used for tax or external-reporting purposes.

LIFO Election Scope: The inventories for which the LIFO method is used. Neither the IRS Regs. nor GAAP requires that the LIFO method be used for all inventories when the LIFO method is used. Situations for which the LIFO election scope does not encompass all inventories are referred to as “partial” or “selective” LIFO elections.

LIFO Expense: This is the difference between the current period end LIFO Reserve and the previous period end LIFO Reserve (LIFO Expense = current period end LIFO Reserve – previous period end LIFO Reserve). This is the amount that taxable income or financial reporting pre-tax income has been reduced by for the current period by using LIFO.

LIFO Income: This is the difference between the current period end LIFO Reserve and the previous period end LIFO Reserve (LIFO Expense = current period end LIFO Reserve – previous period end LIFO Reserve). This is the amount that taxable income or financial reporting pre-tax income has been reduced by for the current period by using LIFO.

LIFO Increment: The excess of the current period end inventory at base minus the previous period end inventory at base. This is also referred to as a “LIFO layer”. A LIFO increment is not the same as LIFO income which results from an increase in the LIFO reserve.

LIFO Index: A ratio expressed in decimal format that is the measure of LIFO inflation for each LIFO pool for taxpayers using dollar-value LIFO.

LIFO Layer: A LIFO layer is the same as a LIFO increment.

LIFO Liquidation: Erosion of the LIFO inventory under a specific-goods (unit LIFO) approach. Such erosion matches costs from preceding periods against sales revenues reported in current dollars, which often distorts net income and leads to substantial tax payments.

LIFO Pools: Inventory items that are similar in their end-use are grouped together to form a LIFO Pool. IRS Code Reg. §§ 1.472-8(b), (c) & (d) requires companies with more than one LIFO Pool using the dollar-value LIFO method make separate LIFO inflation measurements and LIFO reserve calculations for each defined LIFO Pool. There are several different methods of grouping inventory items into LIFO pools allowed by the IRS.

LIFO Reserve: This is the difference between the FIFO or average cost value of inventory and the LIFO value of inventory (LIFO Reserve = FIFO – LIFO). The LIFO Reserve is a measure of the cumulative amount that a company’s taxable income or financial reporting pre-tax income has been reduced by using LIFO since the method was first adopted. The general ledger contra asset account(s) used to record this difference is also referred to as the LIFO reserve.

Link-chain LIFO Method: Cumulative index method where items are extended at current cost and prior-year cost. The current year index is then “linked” to the prior-year cumulative inflation index.

Lower of Cost or Market Reserve(LCM): Another term for market write-downs or inventory valuation reserve. The IRS requires market write-downs to be eliminated for LIFO inventories in Reg. § 1.472-2(b).

Natural Business Unit: A LIFO pool, used under dollar value LIFO generally comprising the entire production capacity of the enterprise integrated vertically within one product line, or two or more related product lines, including any material procurement, processing of materials, and selling the produced goods.

New Items: New items are inventory items that were purchased for the first time during the year and are on hand for the current year end. New items present a problem for internal index calculations because the inventory accounting system has no record of a prior year end unit price for the new item.

Period Costs: All costs in the income statement other than cost of goods sold.

Reconstructed Cost: The amount at which items in inventory would have been priced if they had been acquired in the base year.

Replacement Cost: The current cost of replacing inventory or any reasonable approximation, which may be FIFO or average cost, at the lower of cost or market.

PPI (Producer Price Index): These are retail price indexes compiled and published monthly by the BLS in the PPI Detailed Report reflecting average prices paid producers (manufacturers and processors) for inventory purchase/sales transactions. The indexes in Table 9 of this report are those which IPIC method taxpayers can use for LIFO calculations (Table 11 indexes can be used but only if it is a better fit for the inventory item in question than any Table 9 index). There are approximately 2,500 commodity PPI index categories in Table 9 (service category indexes cannot be used for LIFO purposes).

Retail Inventory Method (RIM): Inventory accounting method historically used by many retailers whereby merchandise department cost balances are calculated by multiplying departmental cost complements (of gross profit margins) times departmental retail inventory balances because maintaining perpetual inventory records by item is not practical. Physical inventories for companies using the RIM method are taken using marked retail selling prices. The IRS refers to this method as the “retail cost” method on Form 3115 Schedule D, Part II, line 4a (page 6).

Retail LIFO: Retail LIFO – A term that describes the calculation of LIFO inventory balances by first converting retail inventory balances (the current-year cost) to retail basis inventory at base balances using inflation indexes that are a measure of retail price inflation. Layers at retail are then reduced to cost by multiplying them times the LIFO cost complements calculated for each pool.

Simplified LIFO: Simplified LIFO is often a misnomer used to describe the IPIC LIFO Method. Simplified LIFO is actually a term the IRS used to describe a more simplified LIFO method applicable only to very small businesses provided for in Reg. § 1.474 starting in 1981 but this Section became superseded after 1986.

Specific-Goods LIFO: Also known as “Unit LIFO”; an approach to applying LIFO in which changes in the quantity of individual types of inventory are the basis for determining whether the inventory levels have increased or whether a portion of the existing inventory has been liquidated. Doing this almost always guarantees lower LIFO benefits for a company because LIFO is applied on an item-by-item basis. LIFO layer erosions (causing reduction of previous years’ LIFO benefits) occur for every item each year there are fewer units on hand compared to the prior year because there is essentially a LIFO pool for each item. With dollar-value LIFO, pools are established for broad types of goods so increases and decreases in items on hand are netted together which results in fewer LIFO layer erosions.

Substitute Base Year: A technique in which beginning of year costs in the year of change are used instead of the base year’s costs to determine changes in dollar value LIFO pools.

UNICAP Costs: This is the amount of labor and overhead that IRS Reg. § 263A requires taxpayers to capitalize as an add-on to inventory balances in addition to labor and overhead costs capitalized as required by GAAP. In other words, these are inventory related costs for which the IRS requires treatment as product cost rather than period cost. These costs are also referred to as Sec. 263A costs.

Unit Cost: Cost computed by dividing total cost by the number of units. Also called average cost.

Unit Cost Method: A method of applying dollar value LIFO in which changes in the LIFO index are measured by the weighted average increase or decrease in the unit cost of raw materials, work in process, and finished good inventories.

Unit LIFO: See Specific-Goods LIFO.

Weighted Arithmetic Mean: A method for calculation of weighted average pool indexes whereby current year cost balances are multiplied times the current year inflation index for that CPI or PPI index category to determine an Arithmetic Mean “extension”. The pool index is calculated by dividing by the sum of the Arithmetic Mean extensions for all index categories by the sum of the current year cost. This method was used by most taxpayers prior to the issuance of the new IPIC LIFO Regs. in 2002.

Weighted-Average Pool Index: IPIC LIFO pool current year inflation index calculated by dividing sum of the current year cost for all index categories by the sum of the Harmonic Mean extensions. This is used to subsequently compute the other LIFO variables needed to calculate the current year LIFO inventory and reserve balances.

Weighted Harmonic Mean: The math prescribed by IRS Reg. § 1.472-8(e) to calculate weighted-average pool indexes for the IPIC method. Weighted Harmonic Mean math entails “deflating” current year cost balances to prior year prices by division of the current year cost by the current year inflation index for that CPI or PPI index category to determine a Harmonic Mean “extension”. The weighted-average pool index is calculated by dividing sum of the current year cost for all index categories by the sum of the Harmonic Mean extensions.

Specific Goods Method – This is also known as the unit LIFO method. This is an approach to applying LIFO in which a change in the quantity of individual types of inventory is the basis for determining whether the inventory levels have increased or whether a portion of the existing inventory has been liquidated. The specific goods method entails segregating physical quantities of inventory such as tons, gallons, or number of items. Each such unit is effectively a separate pool. The specific goods method was the only LIFO method allowed by the IRS from 1938 to 1947. It is seldom used today because it is cumbersome and almost always results in less tax benefits than the dollar-value method. This is because LIFO layer erosions occur for every item each year there are fewer units on hand compared to the prior year. These layer erosions reduce previous years’ tax deferrals. Calculation of LIFO indexes is not necessary for this method because layers are valued at the unit price applicable to each item.

Dollar-value Method – This is a LIFO method that groups inventory items into pools that are priced in terms of aggregate base-year cost. This precludes the need to account for the various unit cost values for individual inventory items. The result is compared with the pool’s aggregate base-year cost as of the end of the prior year to determine whether the inventory level has increased or whether a portion of the inventory has been liquidated. The pool aggregate base-year cost for any year is calculated by dividing the year end current-year cost by the cumulative index for that year. When dollar-value LIFO is used, increases and decreases in items on hand are netted together which results in fewer LIFO layer erosions than if the specific goods method was used. Fewer layer erosions–compared to the specific goods method–is why almost all companies use the dollar-value LIFO method today.

These are alternative methods for calculating inflation cumulative indexes. Double-extension method cumulative indexes are the quotient of current year item costs divided by base-year item costs, requiring a company to keep records of inventory item costs going back to the base year. Link-chain index calculations involve two steps: 1) calculate the “current year” inflation index by dividing the current year’s item costs by the previous year’s item costs, then 2) calculate the “cumulative” inflation index by multiplying the current year inflation index times the previous year’s cumulative index. Link-chain indexes can be calculated using only the current year and previous year inventory cost records.

Double-extension and link-chain are terms that were originally used to describe internal index calculations using individual inventory item prices. The IRS also allowed a third method for calculating inflation indexes called the “index” method which was the double-extension method applied on a sampling basis. In practice, calculating inflation indexes using a sampling basis is common. For all years for which the dollar-value method has been permitted, the IRS the use of the double-extension method to be preferable to the link-chain method and required that a company justify its use of link-chain on the basis of the impracticality of using double-extension. This justification is not required when the IPIC method is elected and a change from a non-IPIC double-extension method to a link-chain IPIC method is an automatic approval method change.

Use of the double-extension method is especially problematic for a company that experiences fast turnover of items in inventory. The IRS requires that base-year prices be reconstructed for new items introduced into inventory. A retailer with a base year of 1980, for example, that carries a new item in 2005 would have to reconstruct what that item’s cost would have been in 1980. If that is not possible the company would have to, in effect, use 2005 as the base year for that item. As older items are replaced by newer items, this has the effect of reducing the amount of inflation and, in turn, reducing the tax deferral benefit of using LIFO.

Another disadvantage of using the double-extension LIFO method is that it is much more likely to produce big swings in LIFO inflation or deflation from one year to the next, compared to using the link-chain method, when there are significant changes in the inventory mix. Current-year cost dollars are divided by cumulative indexes for each PPI category using the double-extension method (rather than current year indexes, as with the link-chain method) and the amount of inflation difference in cumulative indexes from one PPI code to another can be far greater than current year index differences. As a result, inventory mix changes from one year to the next can result in much larger changes in the pool cumulative index than when the link-chain method is used. An example of this is that one PPI code could have a cumulative index of 3.00 (200 percent inflation) while another PPI code might only have a cumulative index of 1.50 (50% inflation). Each of these PPI codes might only have a current year index of 1.02 (2% inflation) but there is 150% difference in the cumulative index inflation between the two. If the mix of dollars between the two changes significantly there can be a change in the pool cumulative index that indicates far more or less inflation than there was during the year. This can result in the amount of LIFO expense or income for the year being caused largely by a mathematical oddity rather than the actual PPI inflation or deflation. For this reason, we do not consider the double-extension method to be a reliable measure of LIFO inflation.

Most companies using the double-extension method use an internal index method but the double-extension method can also be used by companies using the IPIC method. This involves dividing current year CPI or PPI indexes by base-year CPI or PPI indexes for selected BLS categories. Double-extension is seldom used with the IPIC method because of the difficulty of reconstructing base-year costs for new items and the fact that the BLS regularly discontinues some PPI categories and introduces new ones. The IRS does not require a company to justify its use of the link-chain methodology when the IPIC method is used. A link-chain IPIC method index calculation involves dividing current year CPI or PPI indexes by previous year CPI or PPI indexes to calculate the current year inflation index which is then be multiplied times the previous year cumulative index to calculate the current year cumulative index.

For companies seeking to adopt LIFO, we recommend electing the link-chain LIFO method as this method avoids the many shortcomings described above. Although IRS Regs. define the double-extension LIFO method as the, “preferred method”, our experience in working dozens of companies that use this method has always proven to provide unpredictable measures of inflation. See LIFO-PRO’s white paper written by Lee Richardson, CPA titled “Why the Double-extension LIFO Index Calculation Method is Unreliable“.

IRS Reg. § 1.472-8(e)(2)(ii) specifies these alternatives for calculation of current-year cost:

Method 1 above is the FIFO method. Method 2 above is seldom used because a side calculation is required since this is not a normal inventory accounting system cost flow option. The average cost method (method 3 above) is known as the 12-month moving average method. This is not a normal inventory accounting system cost flow option either which means using this method would involve a side calculation. Current-year cost methods 2 and 3 are legacy methods permitted by the IRS in the 1940s before computerized inventory accounting systems were common.

The weighted moving average cost method is one of the most popular inventory accounting system cost flow assumptions today. Although it’s not specifically listed in methods 1 through 3 above, it falls under method 4 as the IRS considers this to be a permissible method . Under this method, the average unit cost is recalculated with every purchase of each unit and each sale of an inventory item results in a decrease in both the numerator and denominator of the average unit cost calculation fraction. The IRS refers to this method as the “rolling average” method in Rev. Proc. 2008-43 which specifies that this is a permitted LIFO current-year cost method under most circumstances. This means that it fits the description of a “proper method” referred to in method 4 above. Another current-year cost method deemed to be a “proper method” by the IRS is the specific identification method in which each inventory item is considered to be unique (such as an automobile) and the cost recorded for each item is the invoice cost.

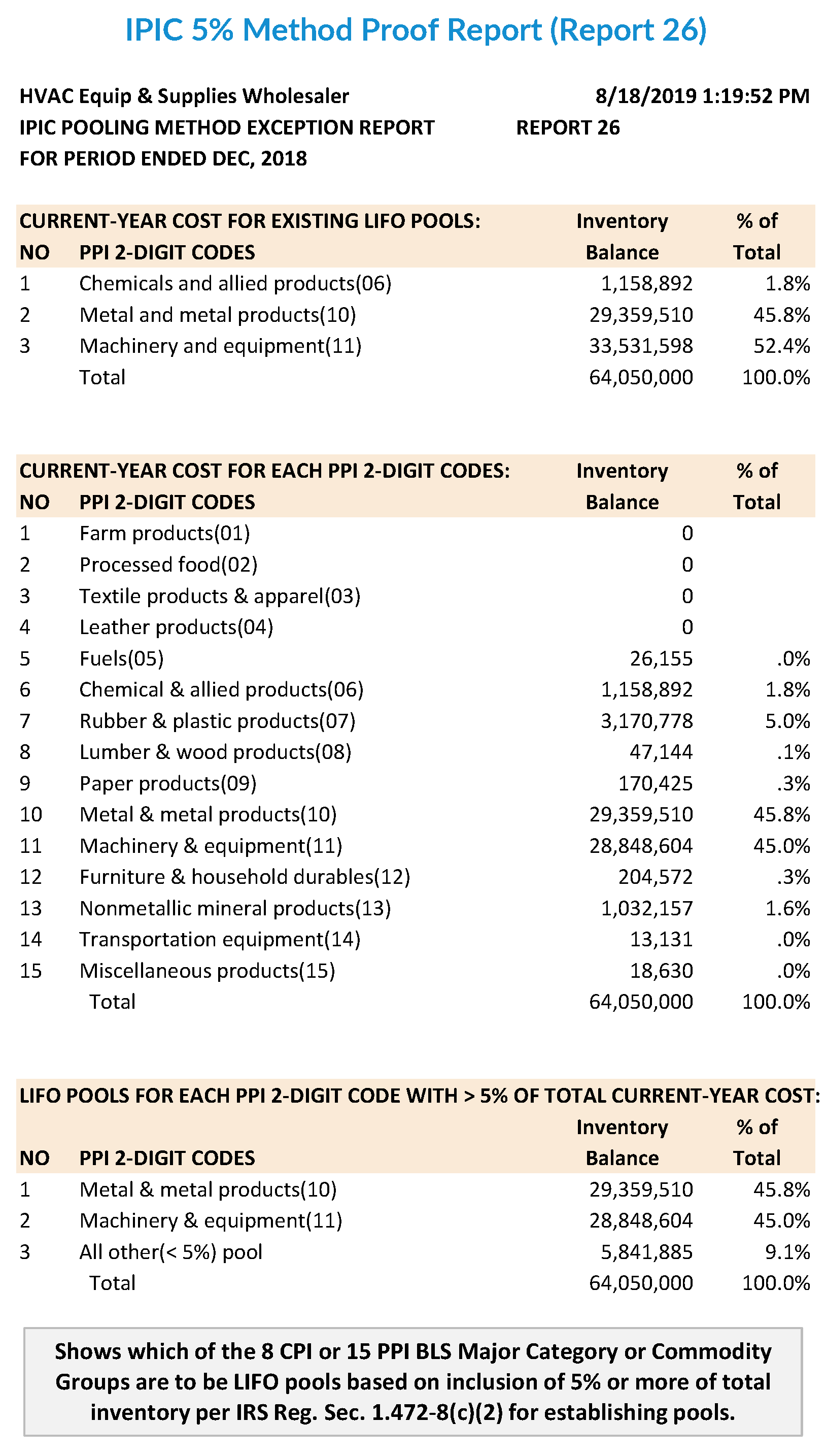

A LIFO pool is a grouping of similar inventory items. Separate indexes are calculated and layer histories maintained for each LIFO pool. To maximize tax savings, companies should use as few pools as possible because this will reduce the likelihood of decrements. This is because decreases in inventory values for some items will be offset by increases in others included in the same pool. Decrements result in lower-cost goods being included in cost of goods sold which increases taxable income. The following are alternative pooling methods permitted by the IRS:

Pooling methods available only to manufacturers:

These are alternative methods for calculating the inflation indexes necessary to convert current-year costs to inventory at base-year costs. Companies using the IPIC method assign their current-year cost balances to categories defined by the Bureau of Labor Statistics (BLS) and use either PPI or CPI indexes published by the BLS to calculate a weighted average pool inflation index.

The alternative to the IPIC method is to use internal indexes. Internal indexes compare the company’s actual unit prices for year end on-hand inventories to calculate LIFO indexes. The unit costs compared are the current year ends to the prior year ends for the link-chain method while the double-extension LIFO method compares current and base year costs.

The Bureau of Labor Statistics (BLS) publishes monthly Producer Price Indexes (PPI) and Consumer Price Indexes (CPI). Retailers using the IPIC method can choose to use either CPI Table 3 or PPI Table 9 indexes, while non-retailers must use PPI indexes. For taxpayers using PPI indexes, Table 9 of the PPI Detailed Report must be used unless the taxpayer can demonstrate that another PPI table is more appropriate. Use of PPI Table 11 indexes rather than Table 9 PPI indexes is rare because the main difference between these tables is in organization (Table 9 is organized by commodity type and Table 11 by industry type) and there are Table 9 index categories corresponding to almost every Table 11 index category. Some retailers use PPI for tax purposes and CPI for financial reporting because there has been consistently more PPI than CPI inflation for certain types of retailers.

This is an issue for companies using PPI indexes for IPIC calculations. The BLS publishes preliminary PPI indexes approximately two weeks after the end of a month (e.g., preliminary July 2014 PPI indexes were published in the middle of August 2014) and final PPI indexes were published four months later (e.g., final July 2014 PPI indexes were published in the middle of December 2014). Companies using the IPIC method may select either preliminary or final PPI indexes but must do so consistently. The final PPI indexes reflect the receipt of price surveys from producers not received in time to be included in the preliminary index compilations and corrections of data originally reported. Final PPI indexes are less commonly used than preliminary PPI indexes because most companies do not want to wait the additional four months entailed by the use of final indexes. CPI indexes are based on marked retail selling prices. No changes to CPI indexes are made after they are published.

These are alternative methods for assigning inventory balances to BLS categories and calculating inflation indexes when using the IPIC method. A company using the IPIC method must elect to use one of these methods. The most-detailed categories method provided for in Reg. § 1.472-8(e)(3)(iii)(C)(1) requires assigning the current-year cost balances associated with each item in inventory to a most-detailed BLS category (a category that does not subsume another category). The 10 percent method allows taxpayers to assign current-year cost balances to less-detailed BLS categories as long as these less-detailed categories do not subsume any more-detailed BLS categories that exceed 10 percent of the sum of current-year cost balances for that pool. The 10 percent method, which was mandated by the original 1982 IPIC Regs. and was retained as an optional method by the 2002 Regs. (§ 1.472-8(e)(3)(iii)(C)(2)), simplifies the task of assigning items in inventory to BLS categories.

While the 10 percent method makes the task of assigning inventory to BLS categories less burdensome, there is a trade-off involved because the math required to calculate category inflation indexes is more complicated. When the 10 percent method is used, the following two separate steps are required to calculate the pool index for each pool after the current year index for each BLS category (i.e. c/y PPI index divided by p/y PPI index) has been calculated:

Taxpayers using the most-detailed categories method only use inventory dollars to weight inflation indexes. The rules governing 10 percent category assignments and the resulting index calculations can seem convoluted and confusing, especially for companies using numerous BLS categories. The advantage of using the most-detailed categories method is the simplicity of the index calculation math and tends to be used by companies with relatively few items in inventory. The advantage of the 10 percent method is that assigning items to BLS categories can be less time consuming because a lesser number of more-detailed category breakdowns are required. This method is more likely to be used by companies with many different items in inventory.

IRS Reg. § 1.472-8(e)(3)(iii)(B)(3) provides rules regarding selection of an “appropriate month.” This refers to which month’s CPI or PPI indexes to use to calculate IPIC method category inflation indexes. For example, a company using December as their appropriate month would calculate 2004 year end category inflation indexes using December 2004 PPI or CPI divided by December 2003 PPI or CPI. In the case of a retailer using the retail method, the appropriate month is the last month of the retailer’s taxable year. In the case of all other taxpayers, the appropriate month is the month most consistent with the method used to determine the current-year cost of the dollar-value pool. A taxpayer not using the retail method may either annually select an appropriate month for each dollar-value pool or make an election on Form 970, Application to Use LIFO Inventory Method to use a representative appropriate month (a.k.a. representative month) consistently for the year of the IPIC LIFO method election and all future years.

All dollar-value method LIFO calculations, regardless of the methods used, consist of the following two primary steps:

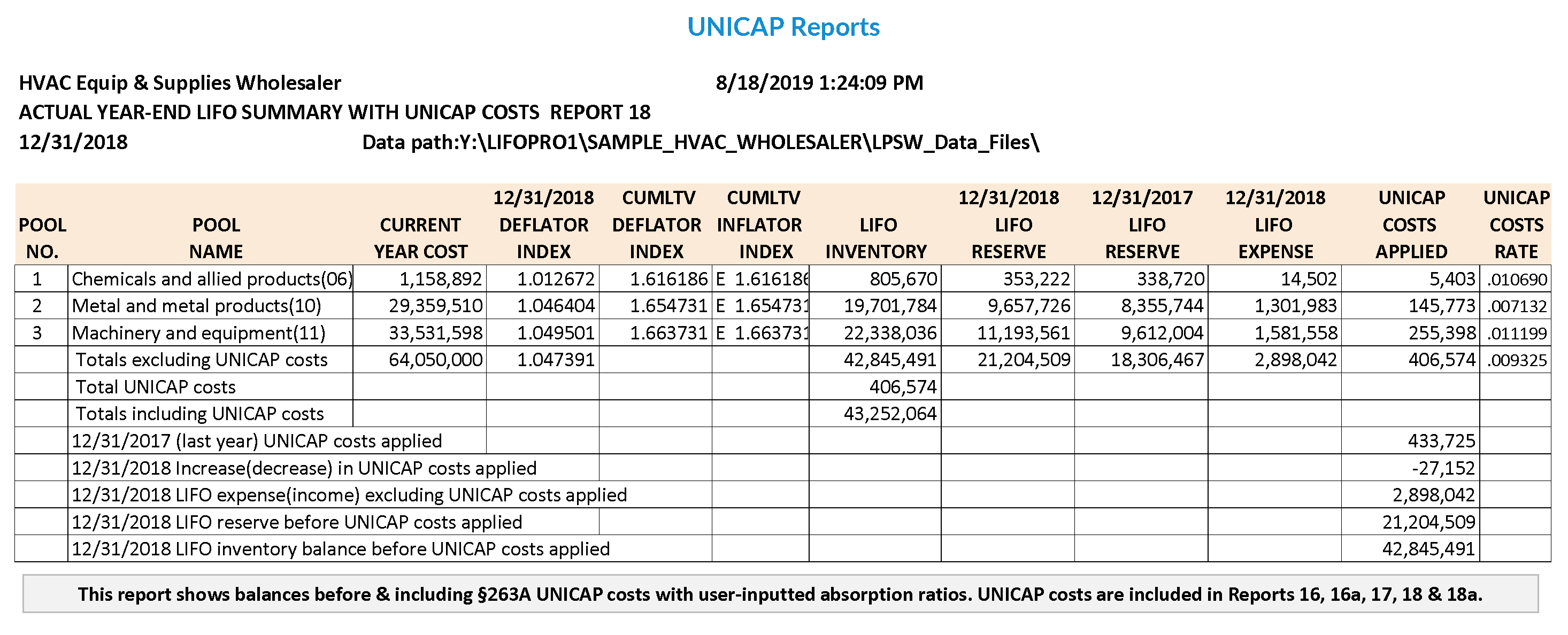

Most companies are required by IRS Reg. Sec. 1.263A to capitalize inventory related labor and overhead costs over and above that required by GAAP. For LIFO taxpayers using a simplified Sec. 263A method, these costs are added to various LIFO layers that remain at any given year end which means that the calculation of these additional costs for tax return purposes requires this calculation to be made using the tax LIFO layer history schedules.

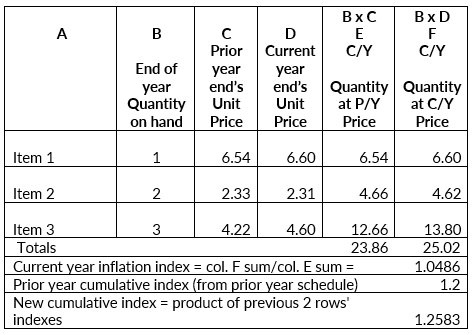

Companies must either calculate inflation indexes based on their actual unit prices (i.e., internal indexes) or use price indexes published by the U.S. government (i.e., the IPIC method). The example shown below is for an internal index link-chain method calculation. Current year end item quantities (column B) are extended using the prior year’s and current year’s prices (columns C & D, respectively). The sum of the current year’s price extensions are then divided by the sum of the prior year’s price extensions (25.02 ÷ 23.86 = 1.0486) to calculate the current year’s inflation index. The current year’s cumulative inflation index (1.0486 x 1.2 = 1.2583) is a product of the current year’s inflation index multiplied times the prior year’s cumulative inflation index (from the prior year’s LIFO index calculation schedule).

This example is greatly simplified. Non-IPIC index calculations are often made on a sampling basis.

No new items (items that were not on hand at the previous year end) are shown in the example above. If the policy for pricing of the new items is to set the prior year item cost equal to the current year end item cost for new items, the prior year end item cost column must be populated with the current value. Another way to make this calculation is to leave the prior year end item cost value blank and use formulas to accumulate the extended cost for new items v. existing items separately in order to properly apply this pricing policy (not recommended as this shortcut is prohibited by the IRS).

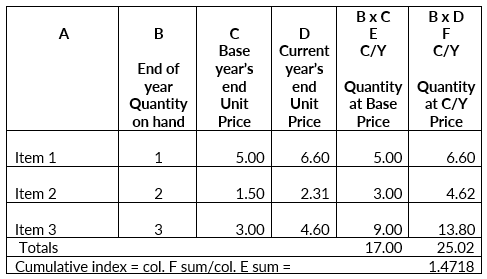

The example shown below is for an internal index double-extension method. Current year end item quantities (column B) are extended using the base year’s and current year’s prices (columns C & D, respectively). The sum of the current year’s price extensions are then divided by the sum of the base year’s price extensions (25.02 ÷ 17.00 = 1.4718) to calculate the cumulative inflation index.

In contrast to the link-chain method the math used for the double-extension method results in the direct calculation of the cumulative index.

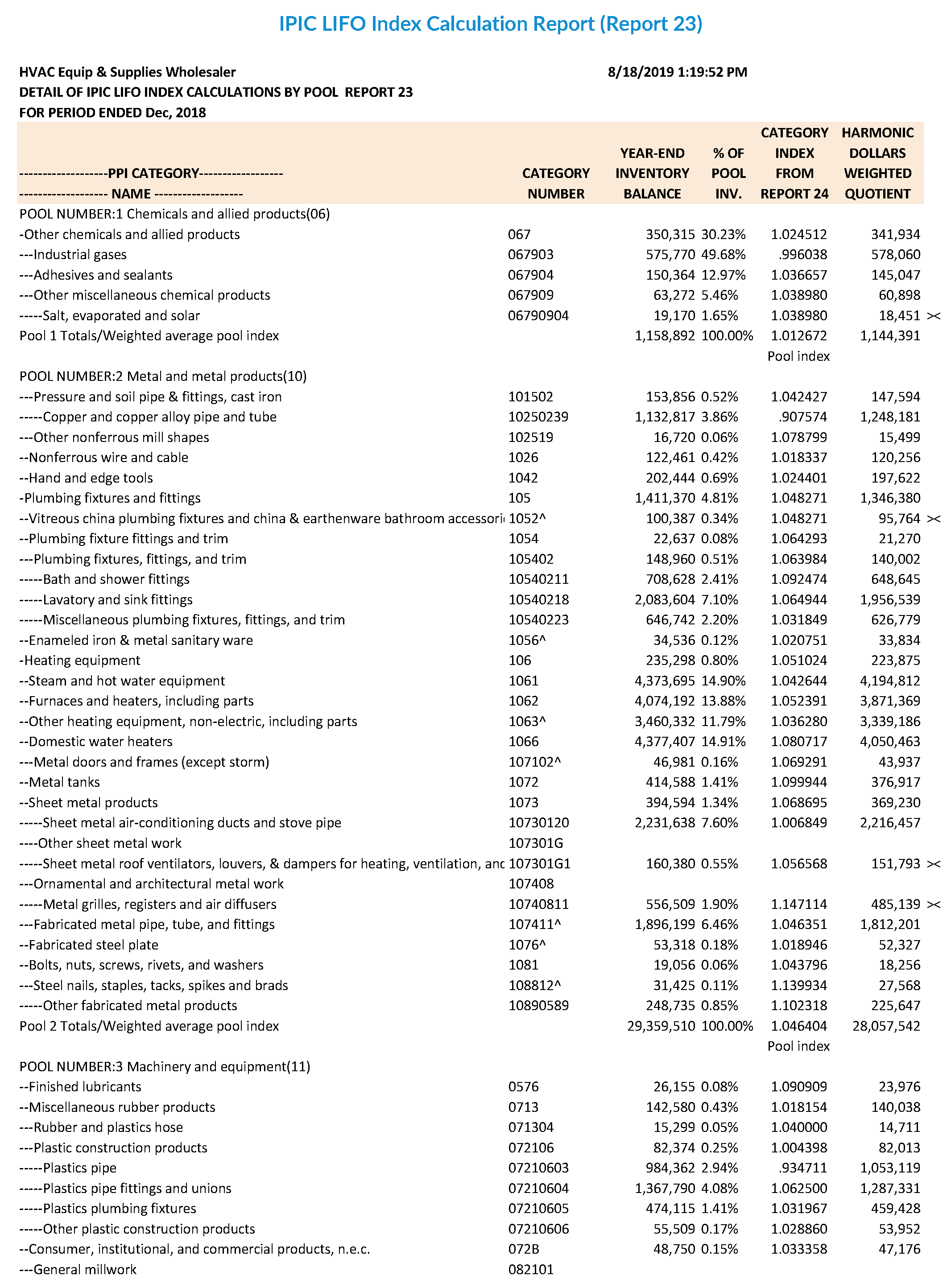

Companies using published government indexes assign their year end current-year cost inventory dollars to categories defined by the Bureau of Labor Statistics (BLS) and then use either PPI or CPI indexes published by the BLS to calculate a weighted average inflation index for each pool. Companies must choose either the most-detailed categories method or the 10 percent method.

The following two examples show link-chain IPIC method pool index calculations using the most-detailed categories and the 10 percent methods. Both examples use link-chain method because the use of the double-extension method is very rare for IPIC method taxpayers. The value of inventory at LIFO cost can be calculated after a cumulative inflation index has been computed and the current-year cost balance determined for each pool. Each pools’ current-year cost (FIFO or average cost) is divided (or “deflated”) by the cumulative index to determine the value of current inventory quantities at base-period prices, which is then compared to the prior year’s inventory valued at base-period prices. If the current year’s inventory at base is greater than the previous year’s inventory at base, this increment is multiplied times the cumulative index to price the LIFO layer. If the current year’s inventory at base is less than the previous year’s inventory at base, this decrement erodes a previous layer (or multiple layers, in reverse chronological order) and is priced using the cumulative index(es) originally used to price the layer(s).

Calculation Steps

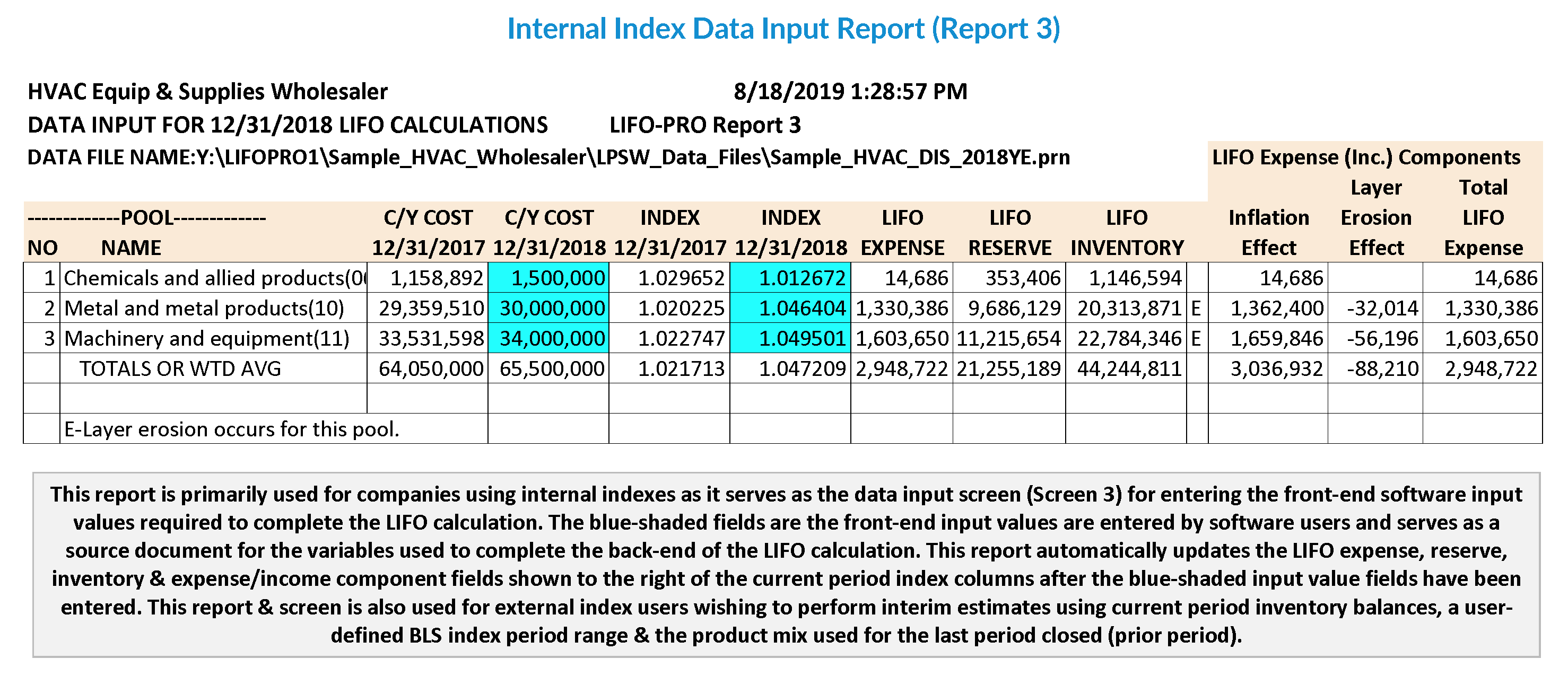

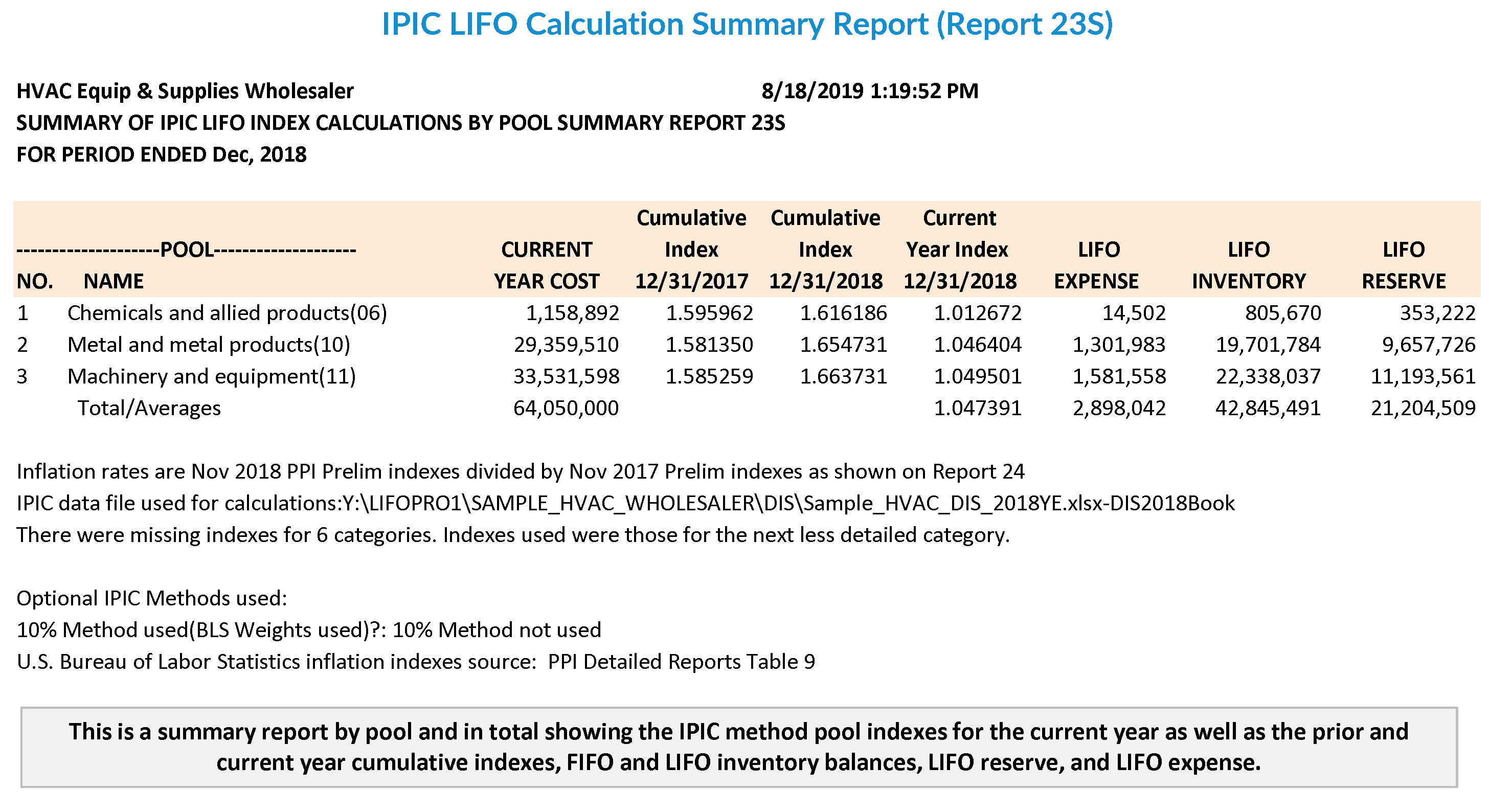

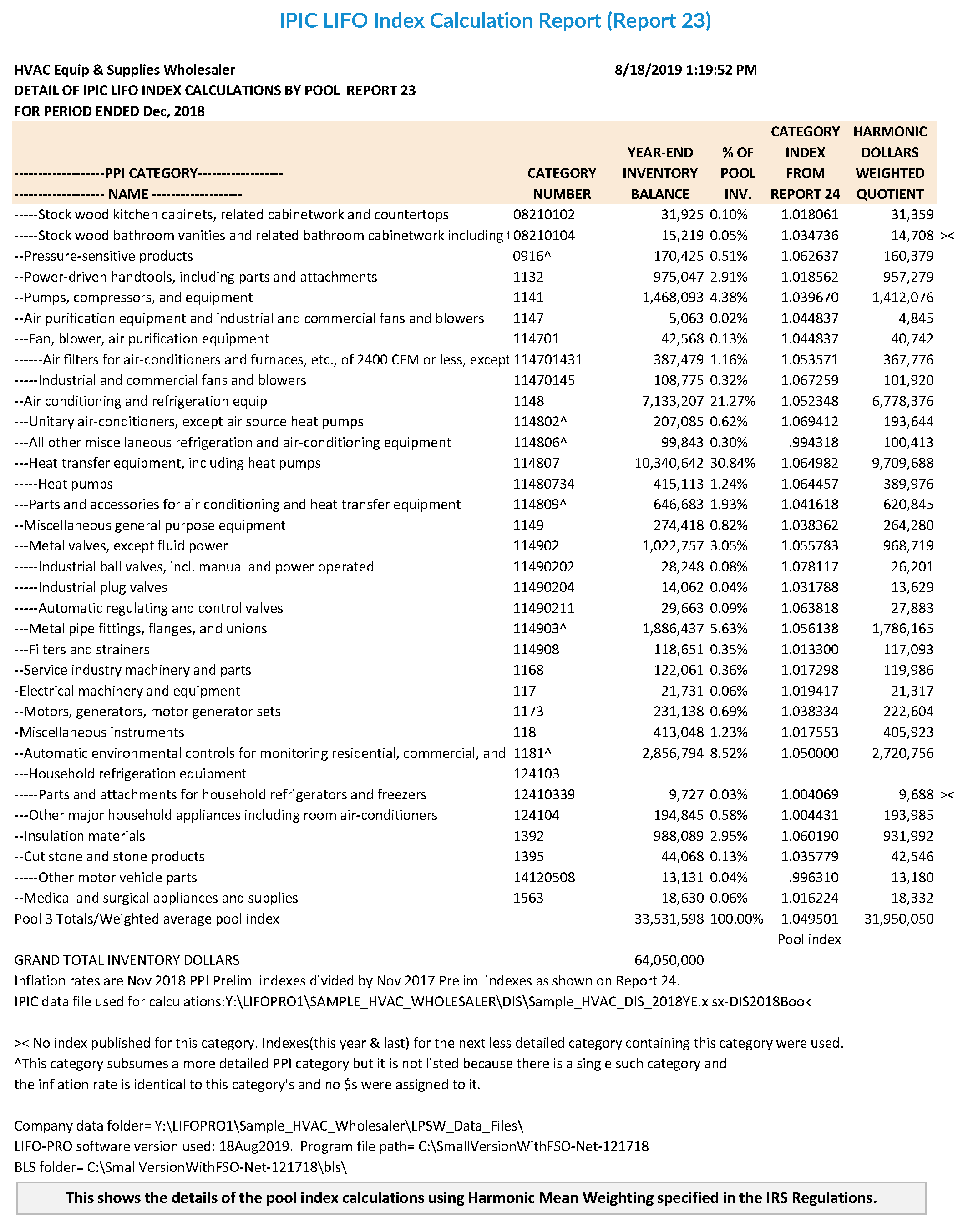

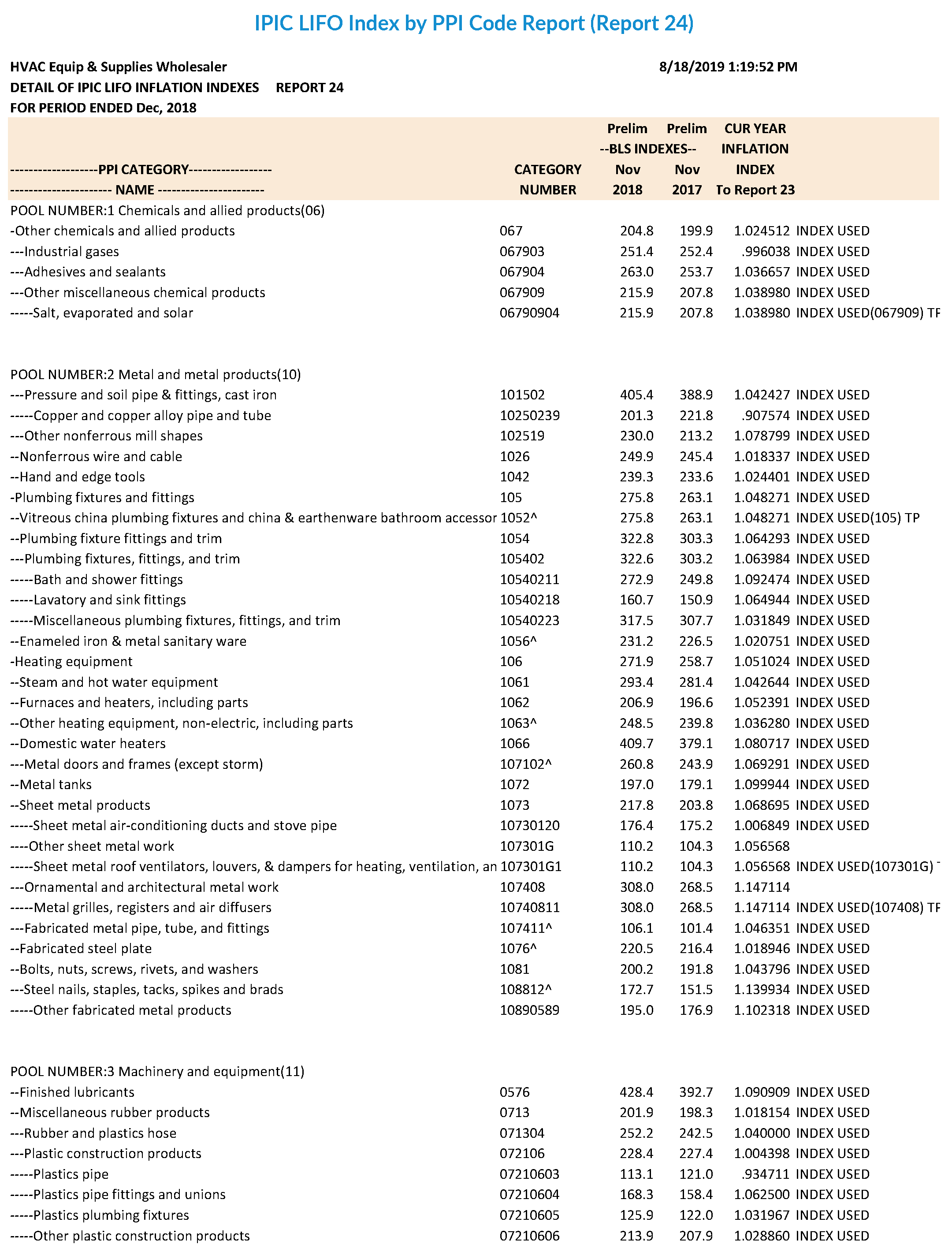

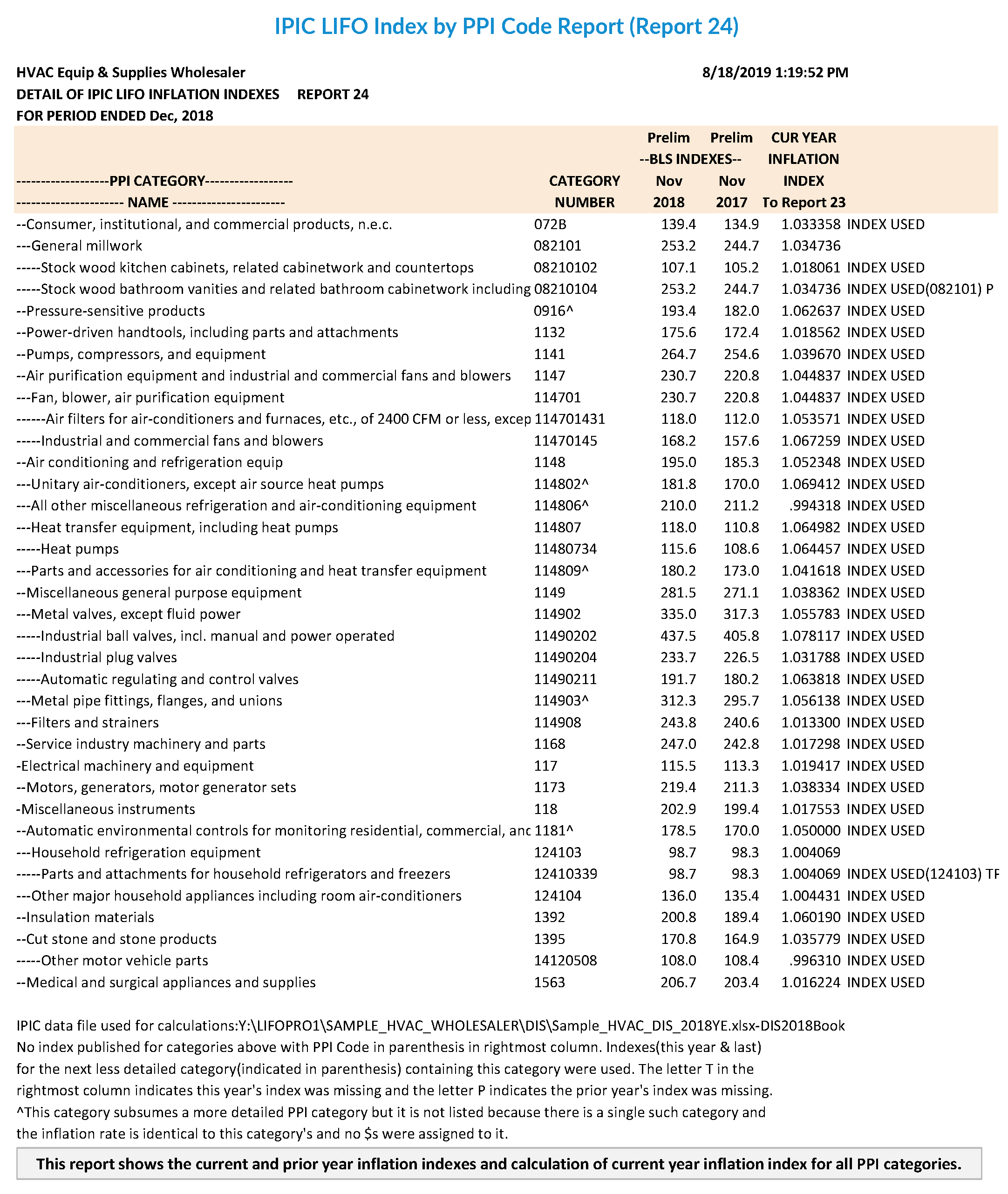

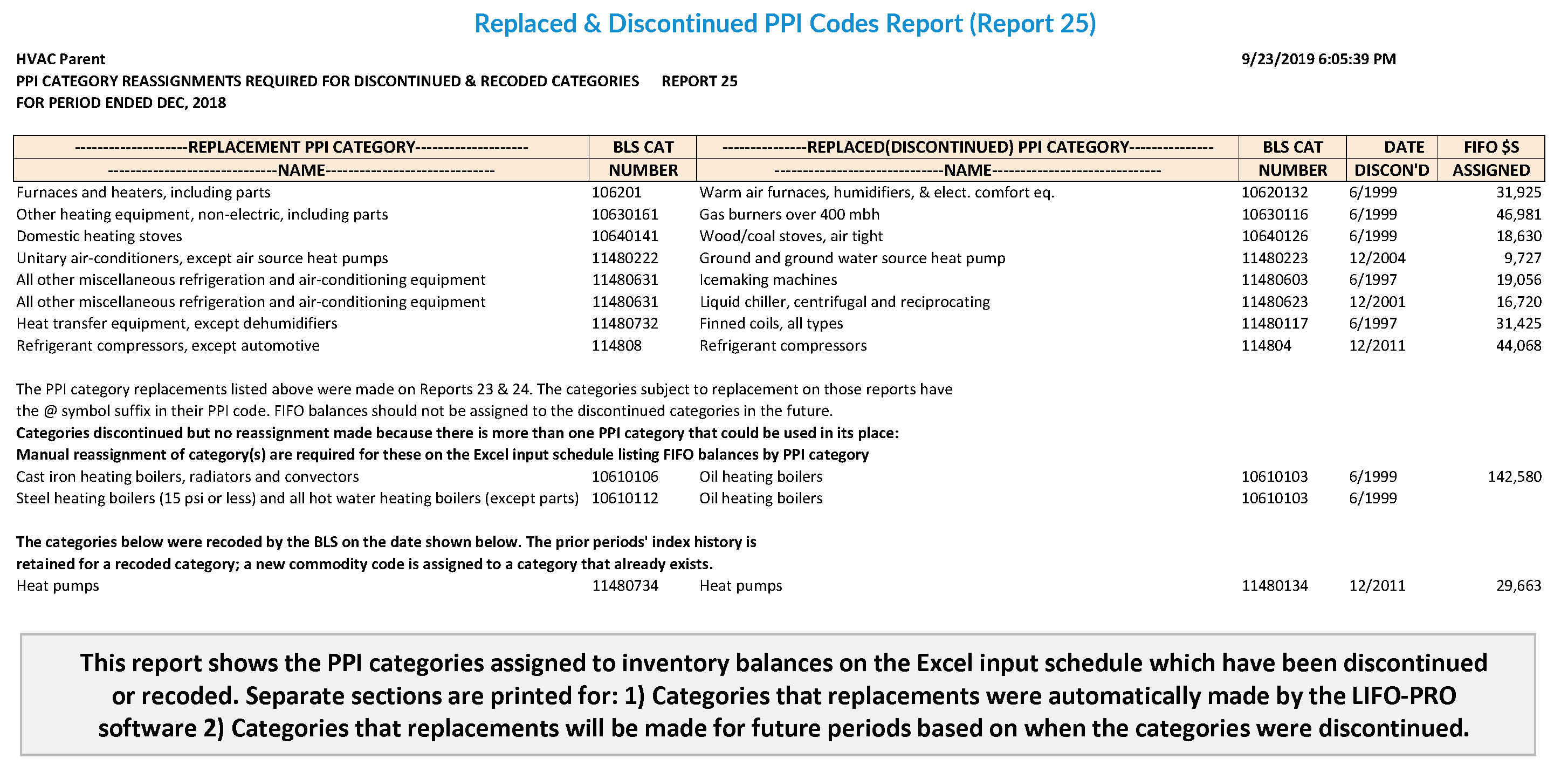

The steps below utilize a LIFO-PRO software report to illustrate the front end IPIC LIFO calculation mechanics.

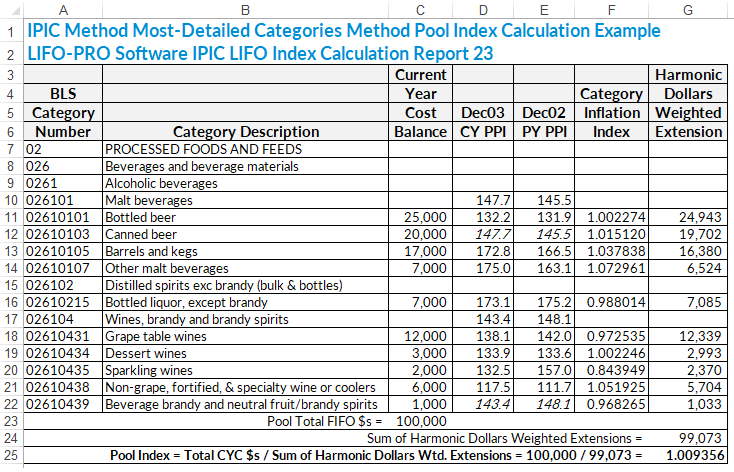

Example 1 – Sample Beer & Wine Distributor: Using Producer Price Indexes & Most-detailed Category Method

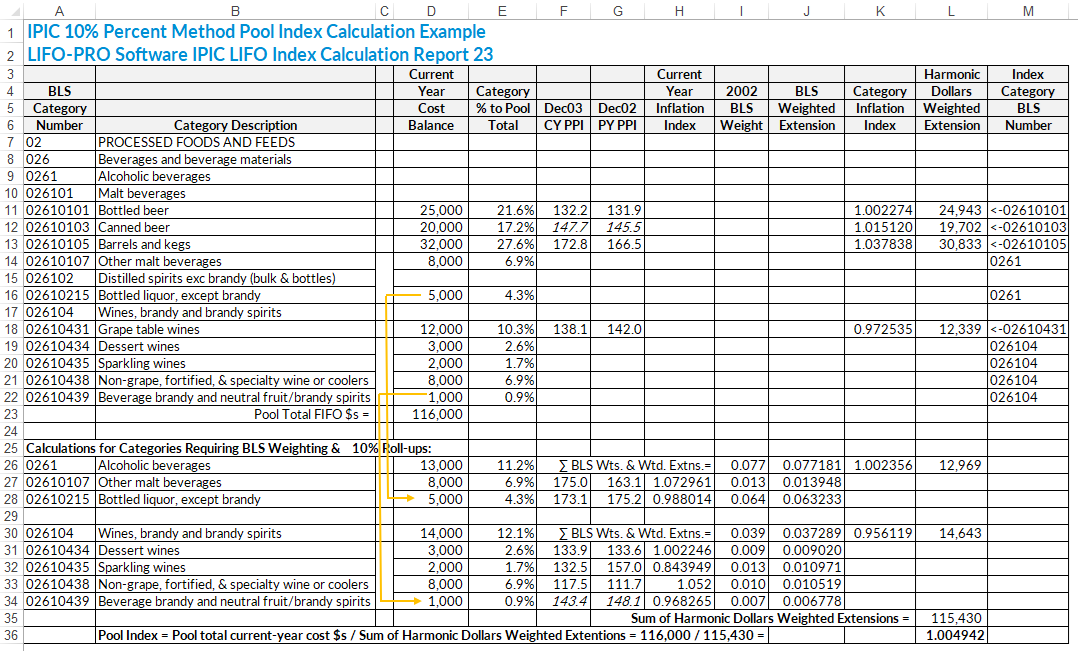

The LIFO-PRO software’s IPIC LIFO Index Calculation Report 23 is shown below for a sample beer and wine distributor using a single dollar-value LIFO pool, December Producer Price Indexes (PPI) & the most detailed categories method. The front-end IPIC LIFO index calculation steps for companies using these submethods are as follows:

LIFO-PRO, Inc. refers to the IPIC method steps that are not using the optional 10 percent method as the Most-Detailed Categories method. The IRS has not given the use of the alternative to the 10 percent method a name.

There were missing indexes for two most-detailed categories. Reg. § 1.472-8(e)(3)(iii)(D)(2) specify that the indexes for the next less-detailed category should be used when the most-detailed category indexes are not published for a given month. A December 2003 PPI is not available for 02610103 because no indexes were published by the BLS for this category for 2003, so the current-year and previous-year indexes for 026101 are used (cells D12 & E12). The index were first published for 02610439 in September 2003 (this is a new category added by the BLS) so no December 2002 PPI is available for this category and the current-year and previous-year indexes for 026104 are used (cells D22 & E22) for this calculation. The Regs. permit the use of a reasonable method when BLS categories are added or discontinued & this is a reasonable method.

There are changes made every six months in the PPI codes published by the BLS. Some of the PPI codes shown in this example have been discontinued since this example was first written but the use of these codes is still valid to illustrate the index calculation steps.

The IRS rules for the IPIC method steps not using the 10% method are contained in Reg. § 1.472-8(e)(3)(iii)(C)(1).

Example 2 – Sample Beer & Wine Distributor: Using Producer Price Indexes & Ten Percent Method

The LIFO-PRO software’s IPIC LIFO Index Calculation Report 23 is shown below for a sample beer and wine distributor using a single dollar-value LIFO pool, December Producer Price Indexes (PPI) & the ten percent method. The front-end IPIC LIFO index calculation steps for companies using these submethods are as follows:

In practice, a company using the 10 Percent method would assign inventory dollars only to those categories that 1) were not likely to exceed 10% of the pool total, and 2) were not likely to include any more-detailed categories that themselves exceeded 10% of the pool total.

There were missing indexes for two most-detailed categories. Reg. § 1.472-8(e)(3)(iii)(D)(2) specify that the indexes for the next less-detailed category should be used when the most-detailed category indexes are not published for a given month. A December 2003 PPI is not available for 02610103 because no indexes were published by the BLS for this category for 2003, so the current-year and previous-year indexes for 026101 are used (cells F12 & G12). The index were first published for 02610439 in September 2003 (this is a new category added by the BLS) so no December 2002 PPI is available for this category and the current-year and previous-year indexes for 026104 are used (cells F34 & G34) for this calculation. The Regs. permit the use of a reasonable method when BLS categories are added or discontinued & this is a reasonable method. No 2002 BLS Weight is available for 02610439 so the 2003 BLS Weight for that category is used (cell I34).

There are changes made every six months in the PPI codes published by the BLS. Some of the PPI codes shown in this example have been discontinued since this example was first written but the use of these codes is still valid to illustrate the index calculation steps.

The IRS rules for the 10% method steps are contained in Reg. § 1.472-8(e)(3)(iii)(C)(2).

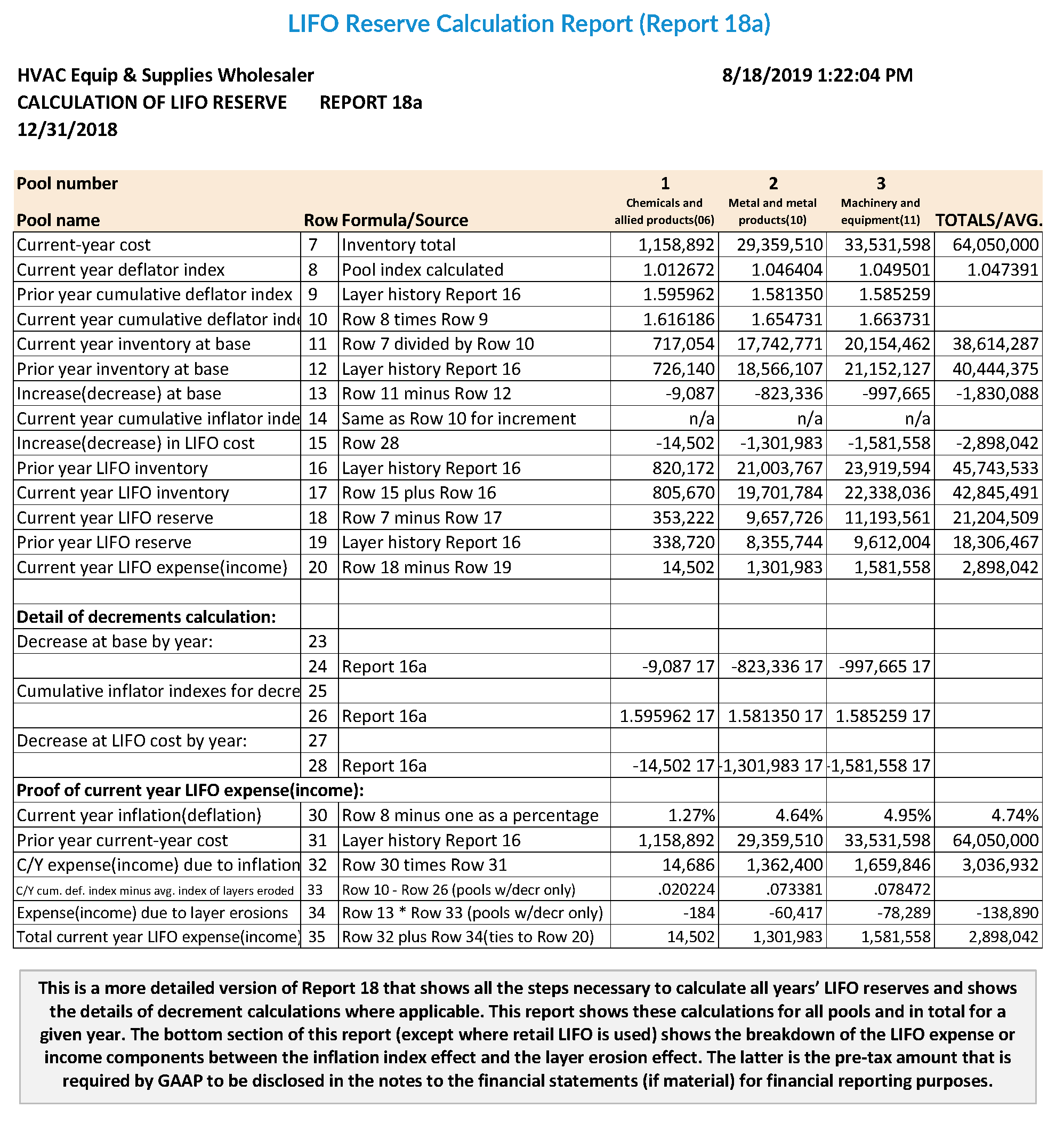

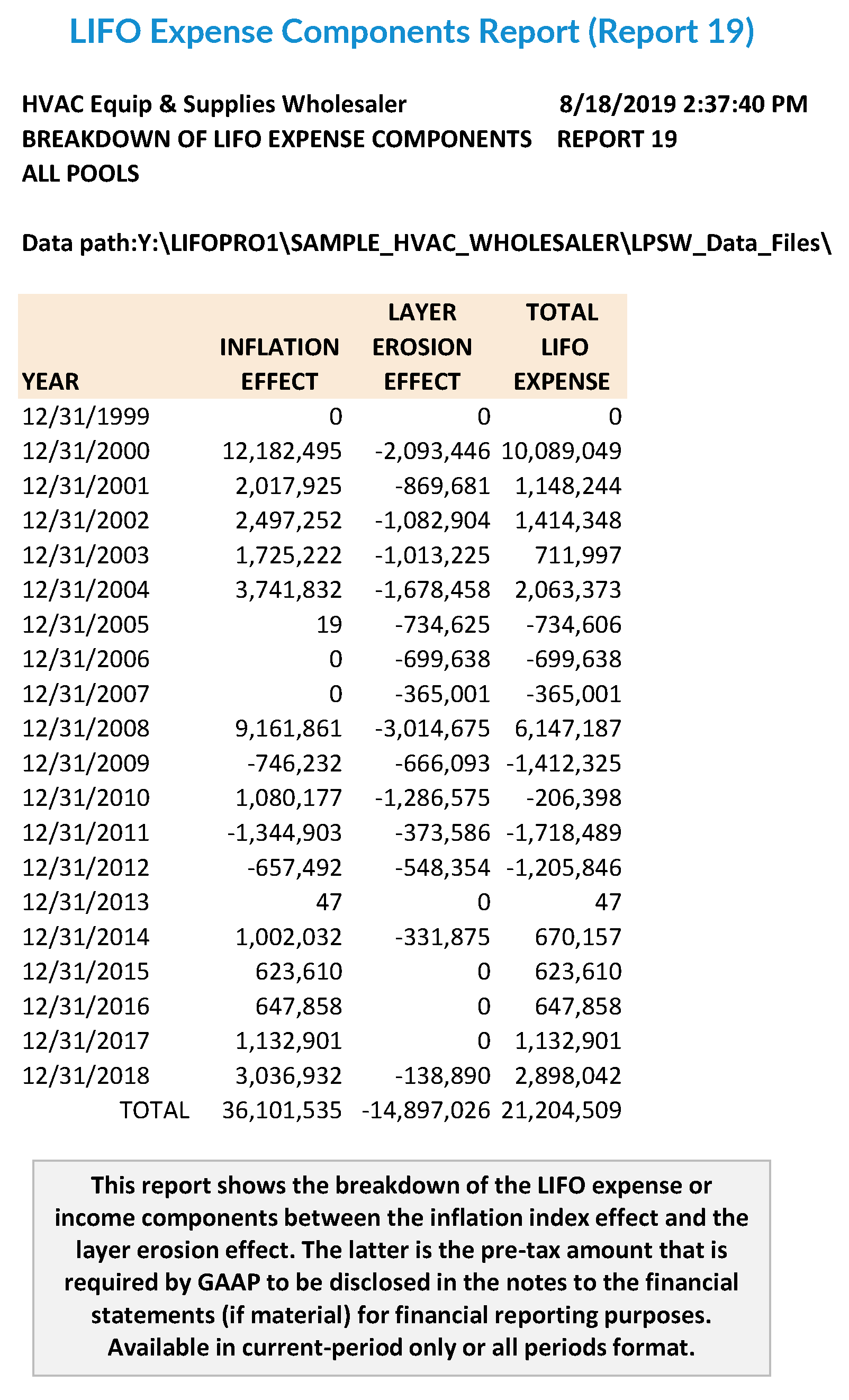

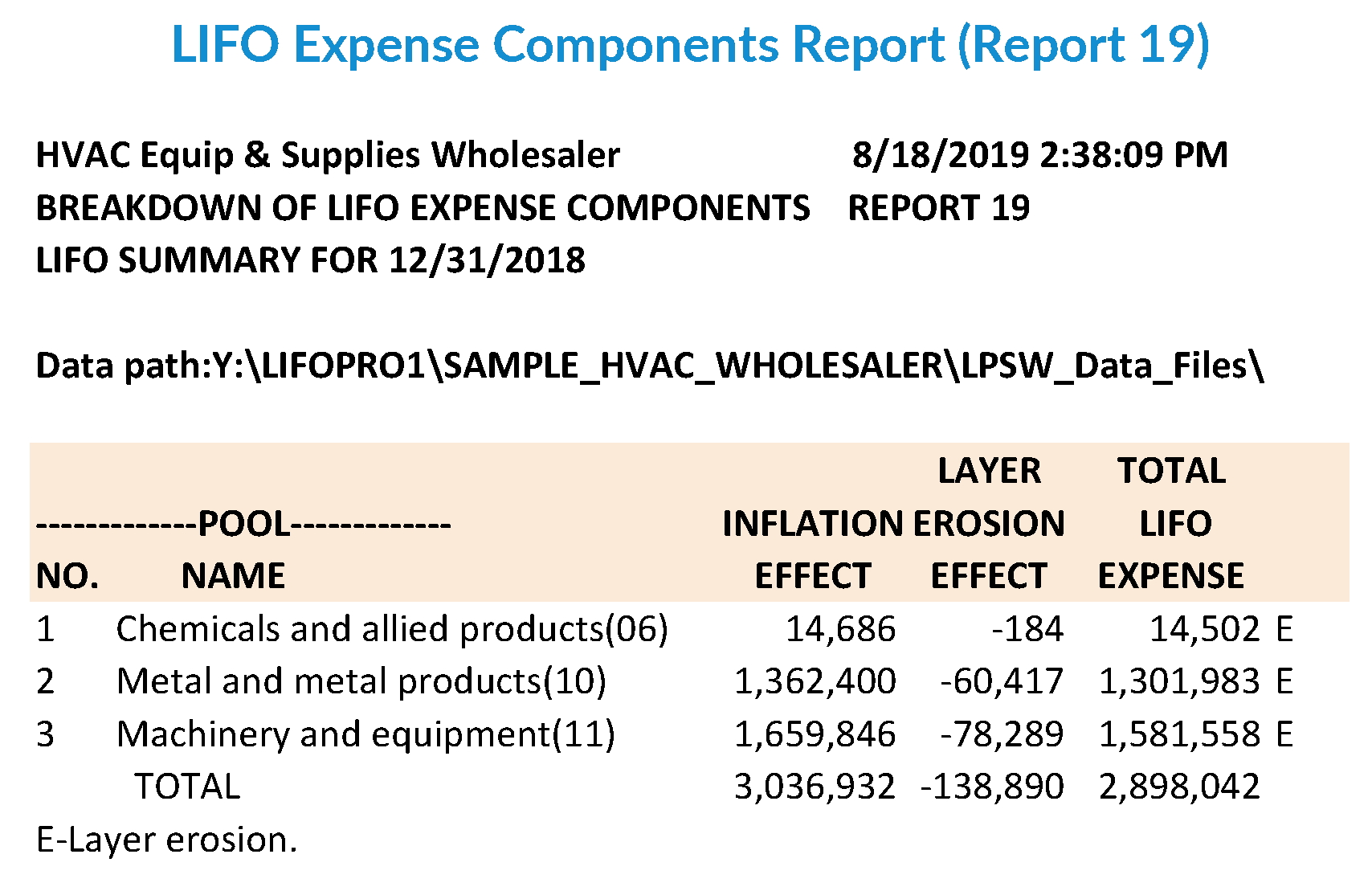

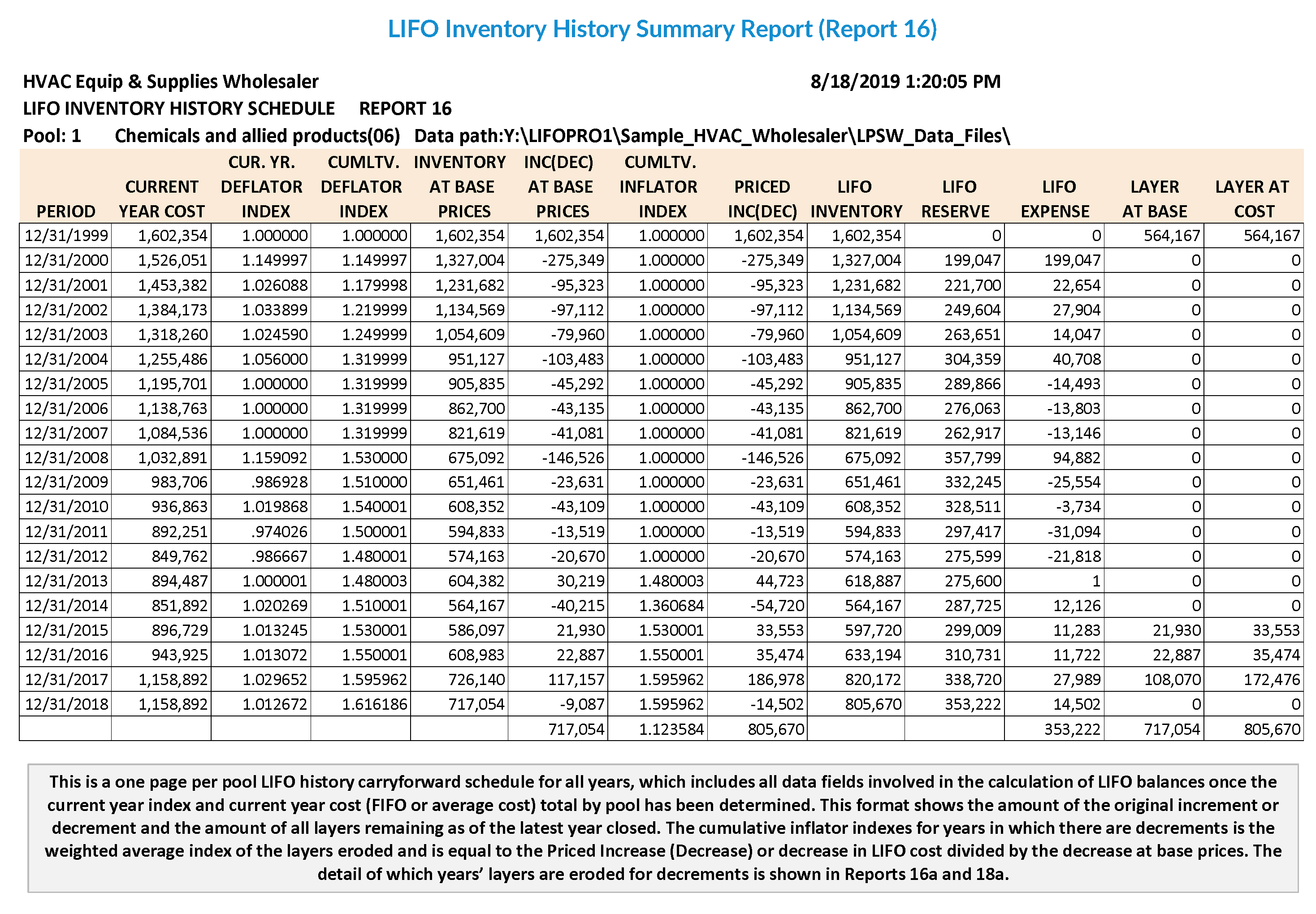

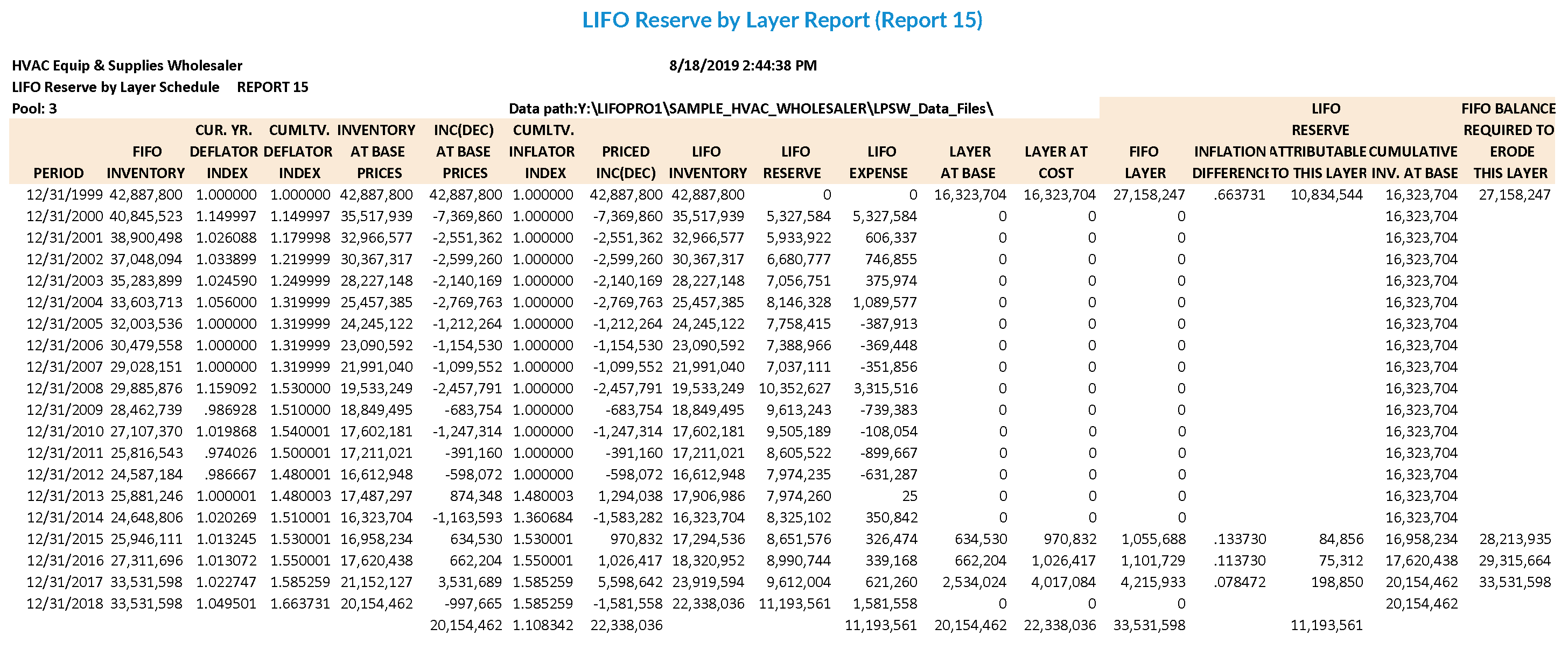

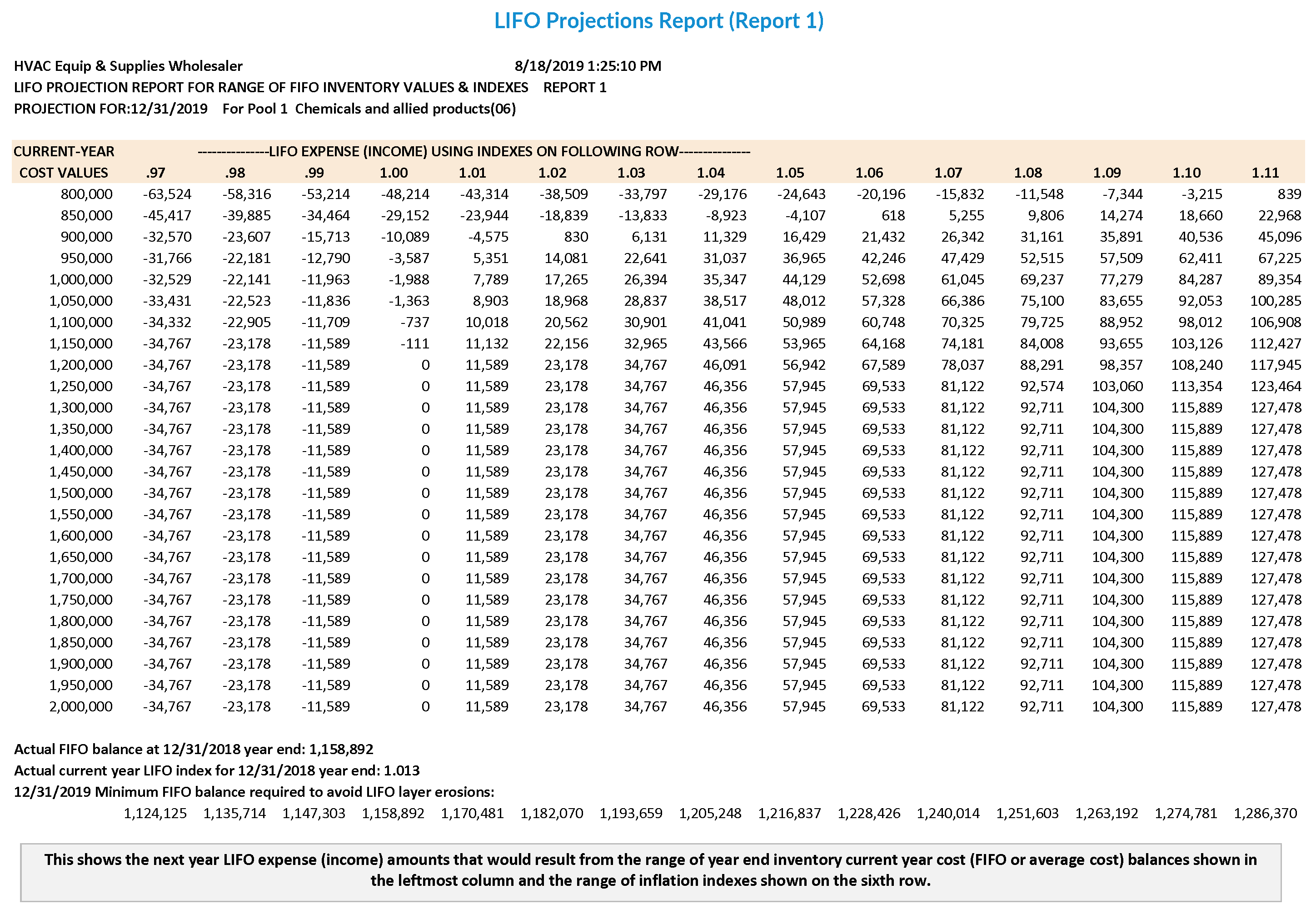

The steps below utilize the following LIFO-PRO software reports to illustrate the back end LIFO calculation mechanics:

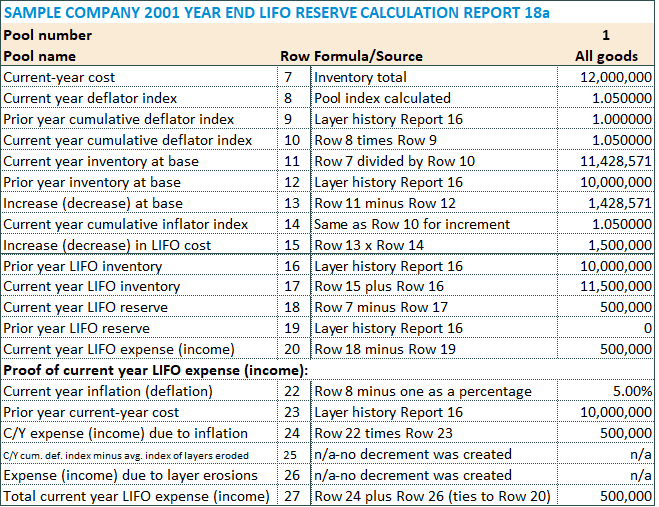

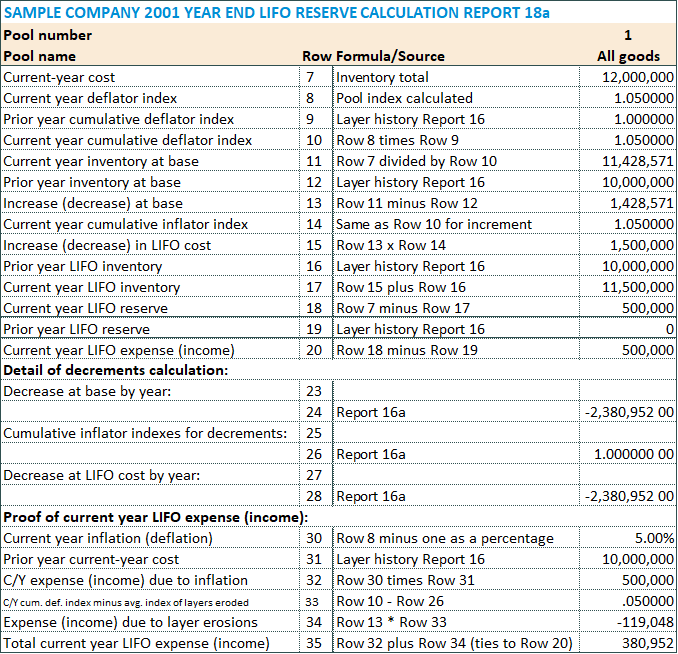

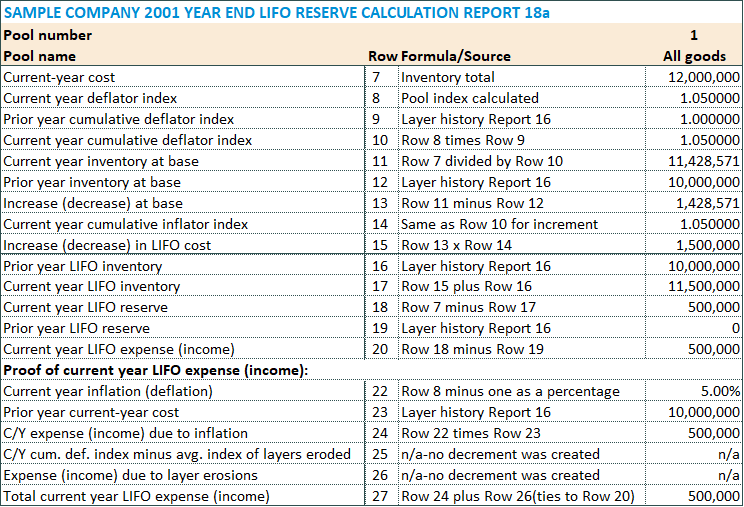

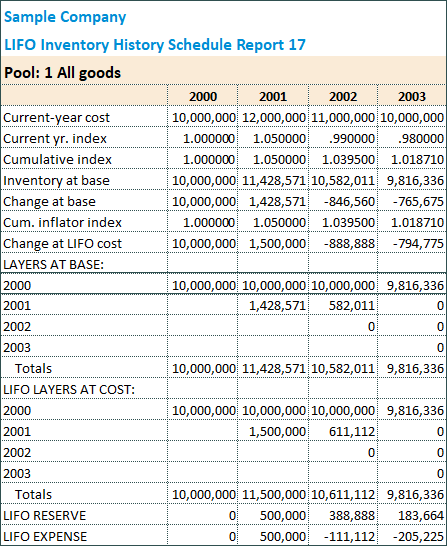

The first example of a LIFO inventory calculation shows data for a company’s first year using the LIFO method. Current-year cost inventory increased from 10 million dollars at the 2000 base year end to 12 million dollars for the 2001 year end and there was 5% inflation that resulted in an increment (i.e. layer was created).

Rows 7-20 of the above report show all the steps necessary to calculate the LIFO reserve for this year. Rows 22-27 show the proof to verify the accuracy of the Row 14 balance. The 2001 Increase at LIFO cost (LIFO increment) is calculated as follows: 2001 Increase at Base x 2001 Inflator Index = 1,428,571 x 1.050 = 1,500,000.

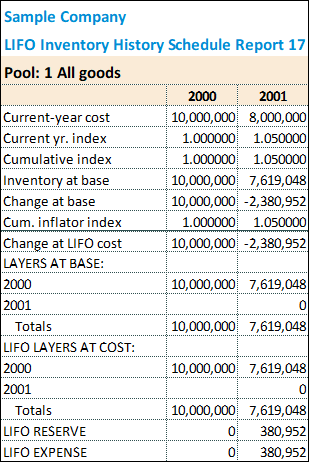

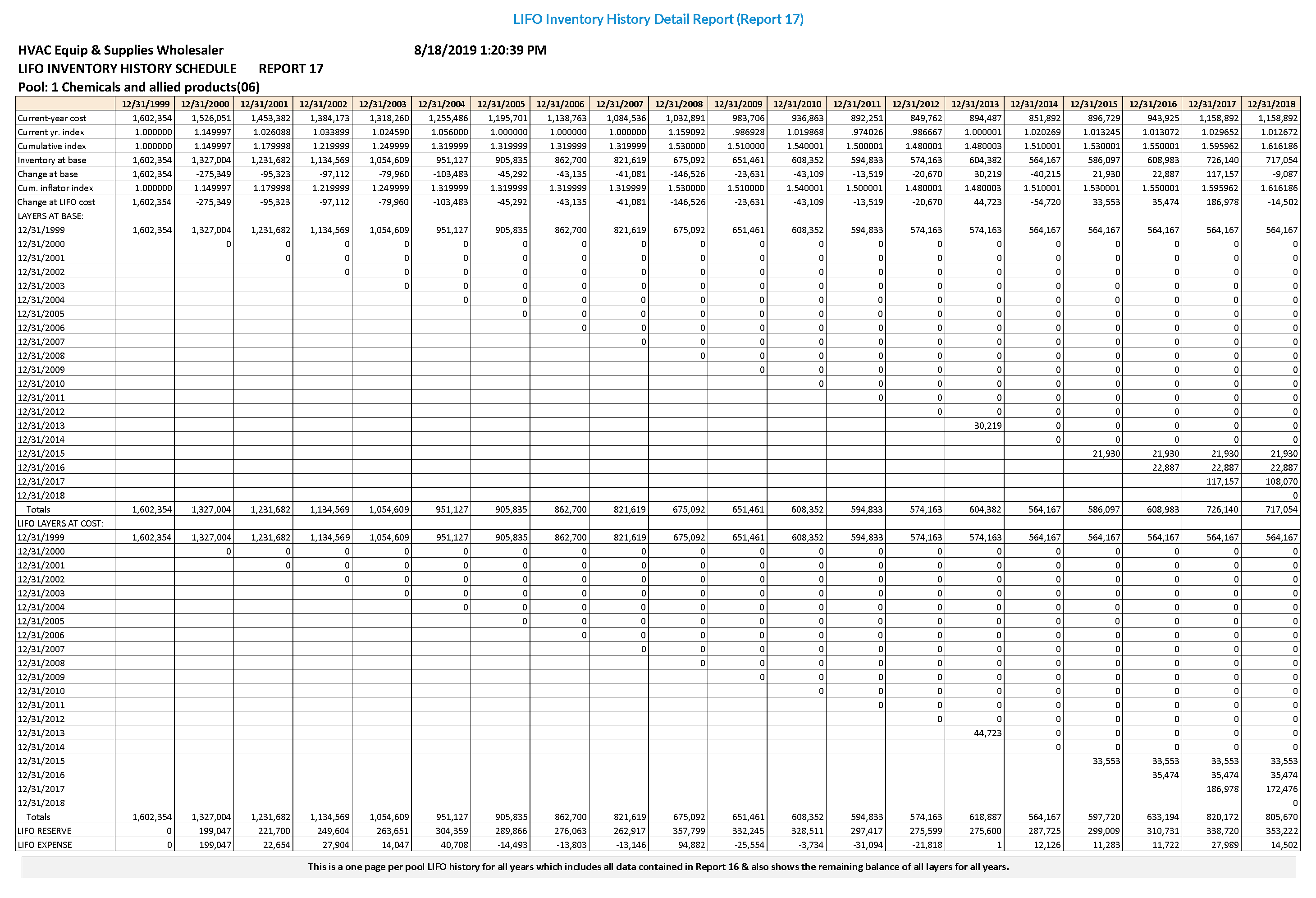

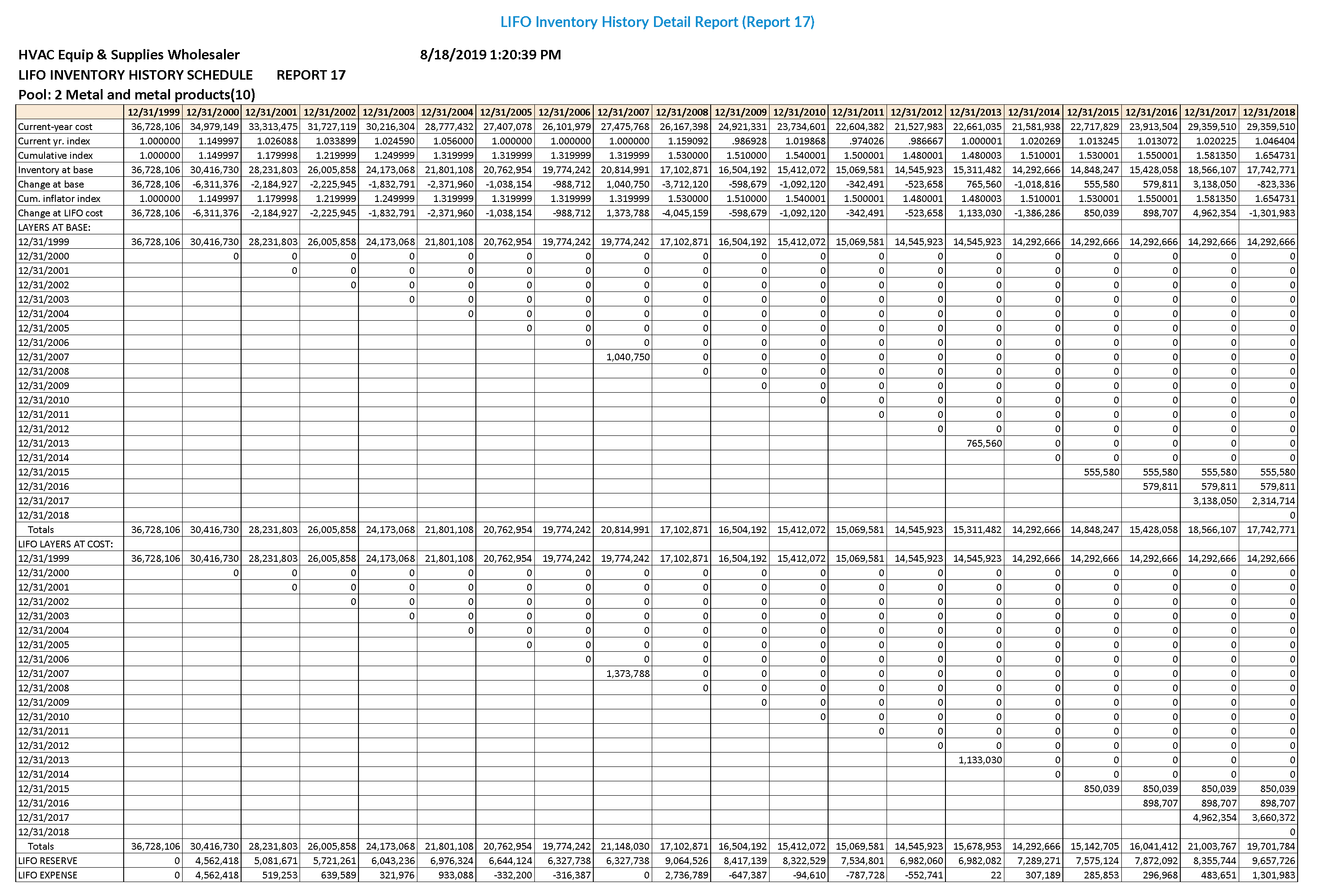

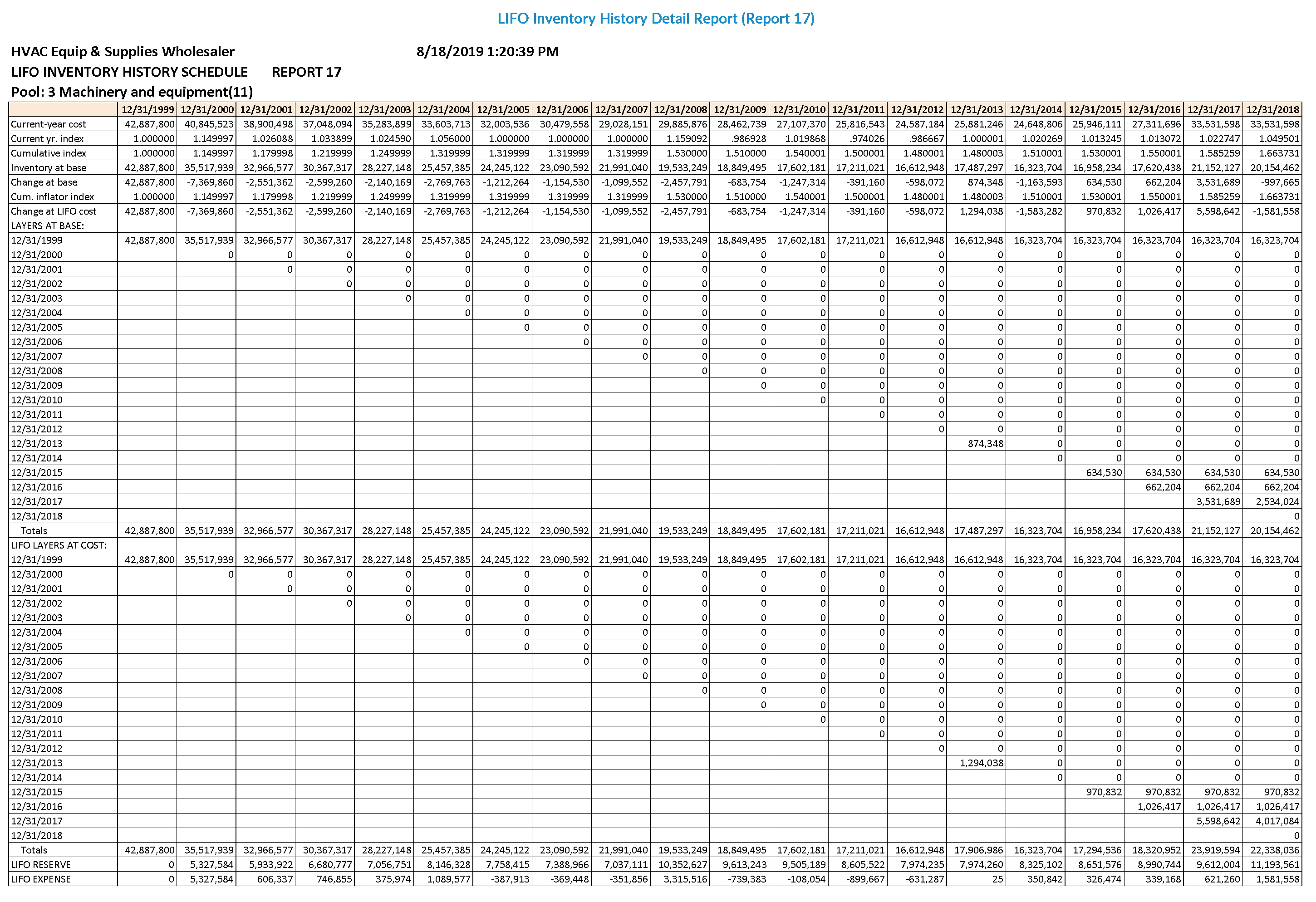

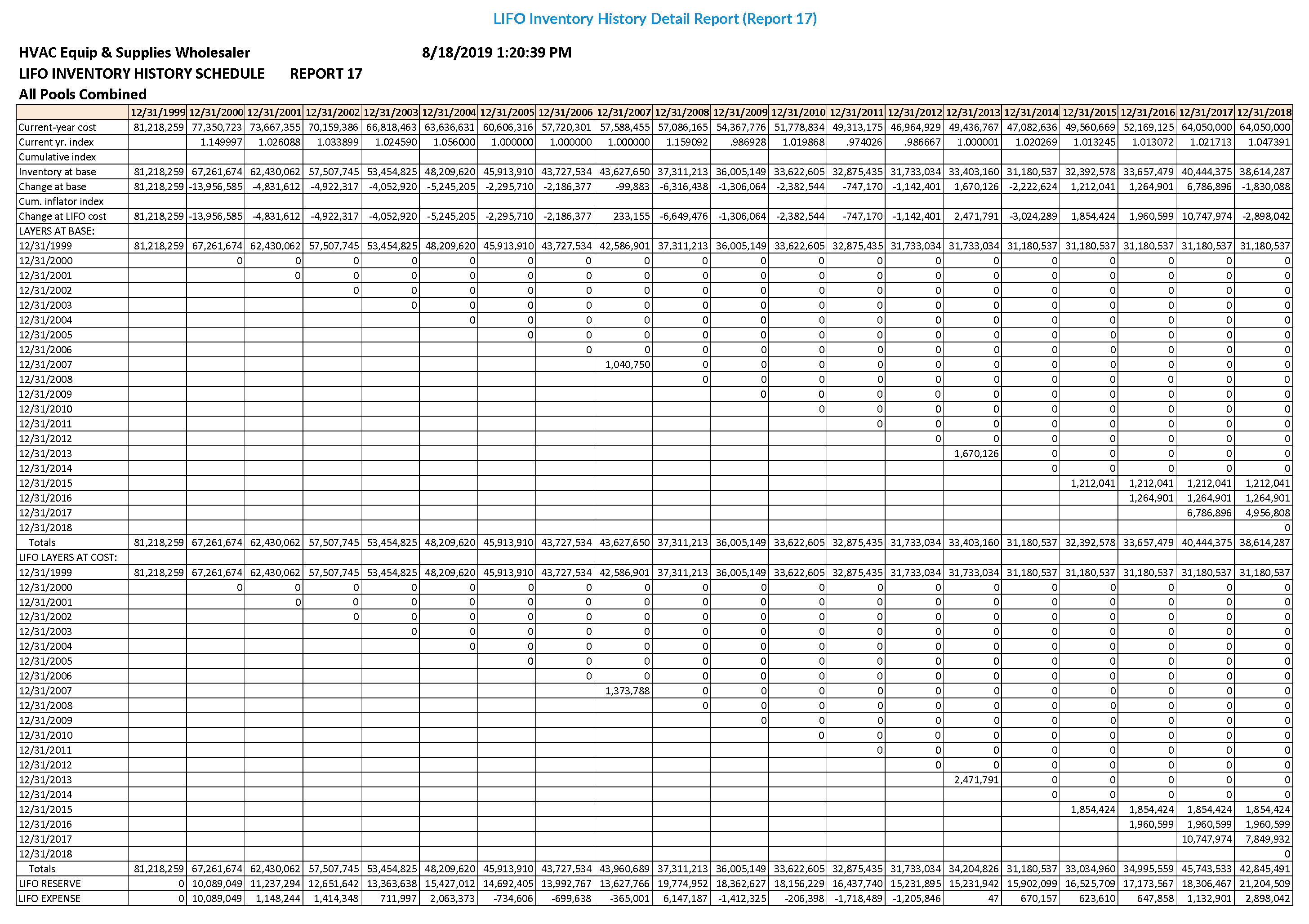

Shown below is the LIFO-PRO software Report 17 that is a LIFO layer history schedule which includes all data fields involved in the LIFO calculation. This carryforward report format shows the amount of all years’ layers that existed for all years including the leftmost column base year (year end prior to LIFO election).

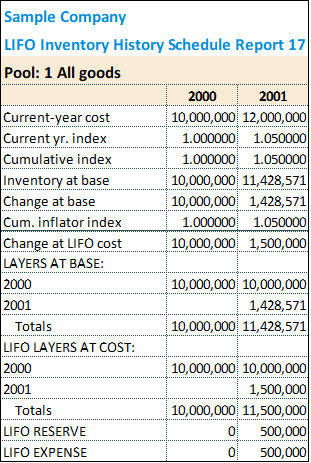

The second example of a LIFO inventory calculation shows data for a company’s first year using the LIFO method. Current-year cost inventory decreased from 10 million dollars at the 2000 base year end to 8 million dollars for the 2001 year end and there was 5% inflation in 2001 resulting in a decrement.

Rows 24-28 show a proof of the 2001 LIFO expense amount. The row 24 layer erosions effect amount is required by GAAP to be disclosed in the notes to the financial statements (if material). The 2001 Decrease at LIFO cost (LIFO decrement) is calculated as follows: 2002 Decrease at Base x 2001 Inflator Index = -2,380,952 x 1.000 = -2,380,952.

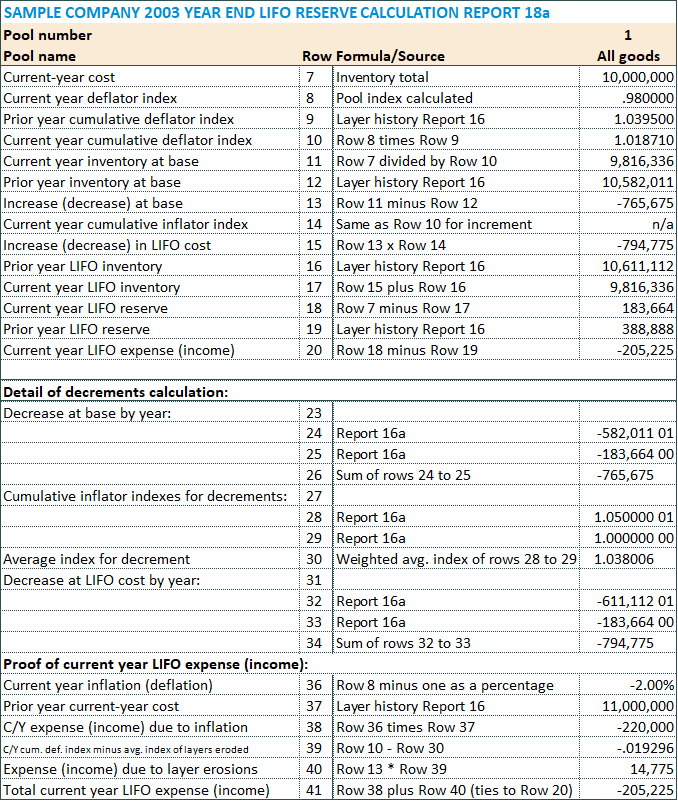

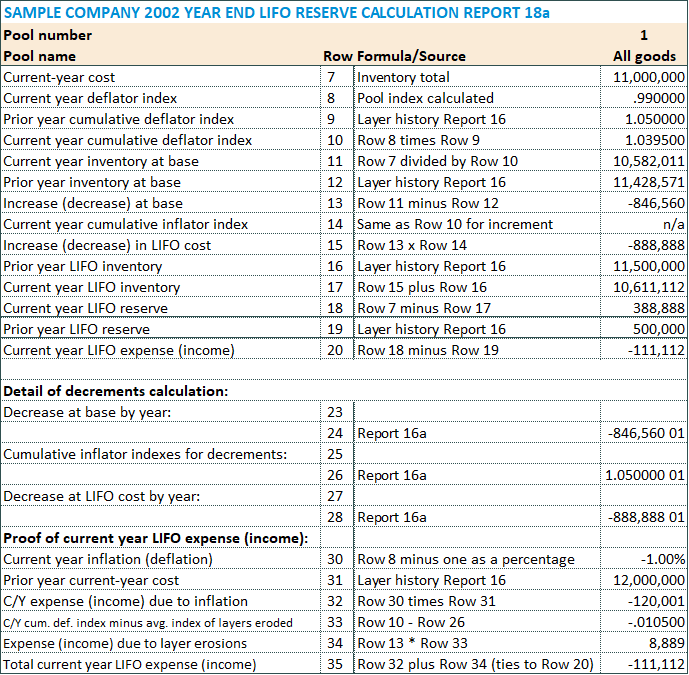

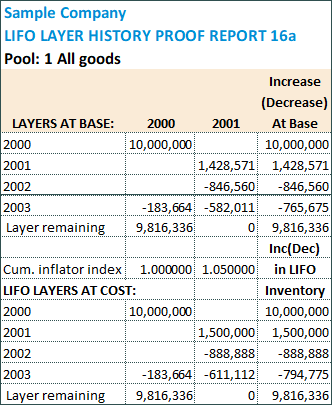

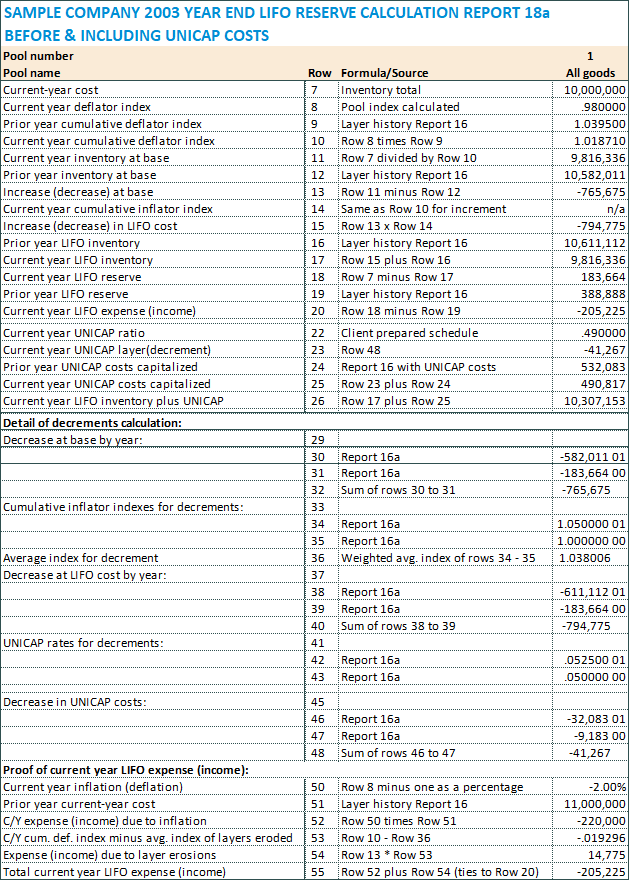

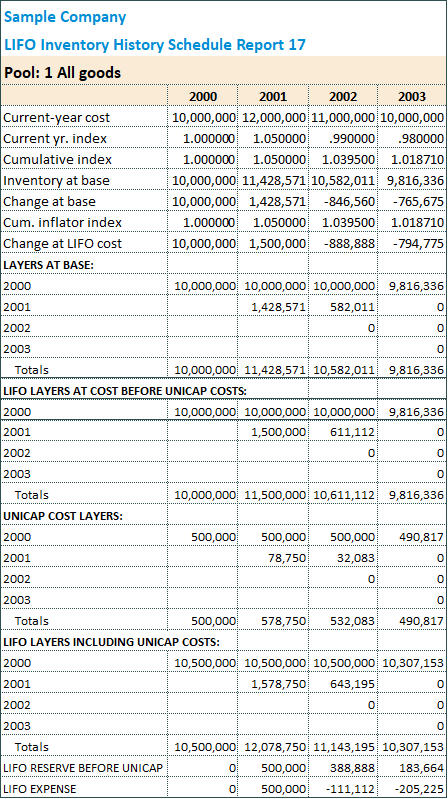

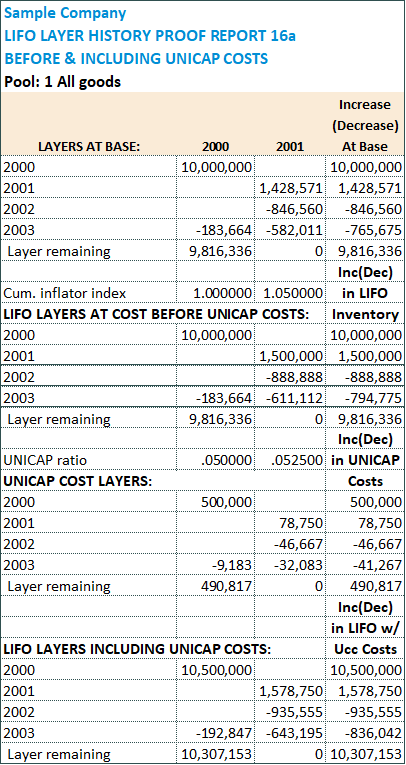

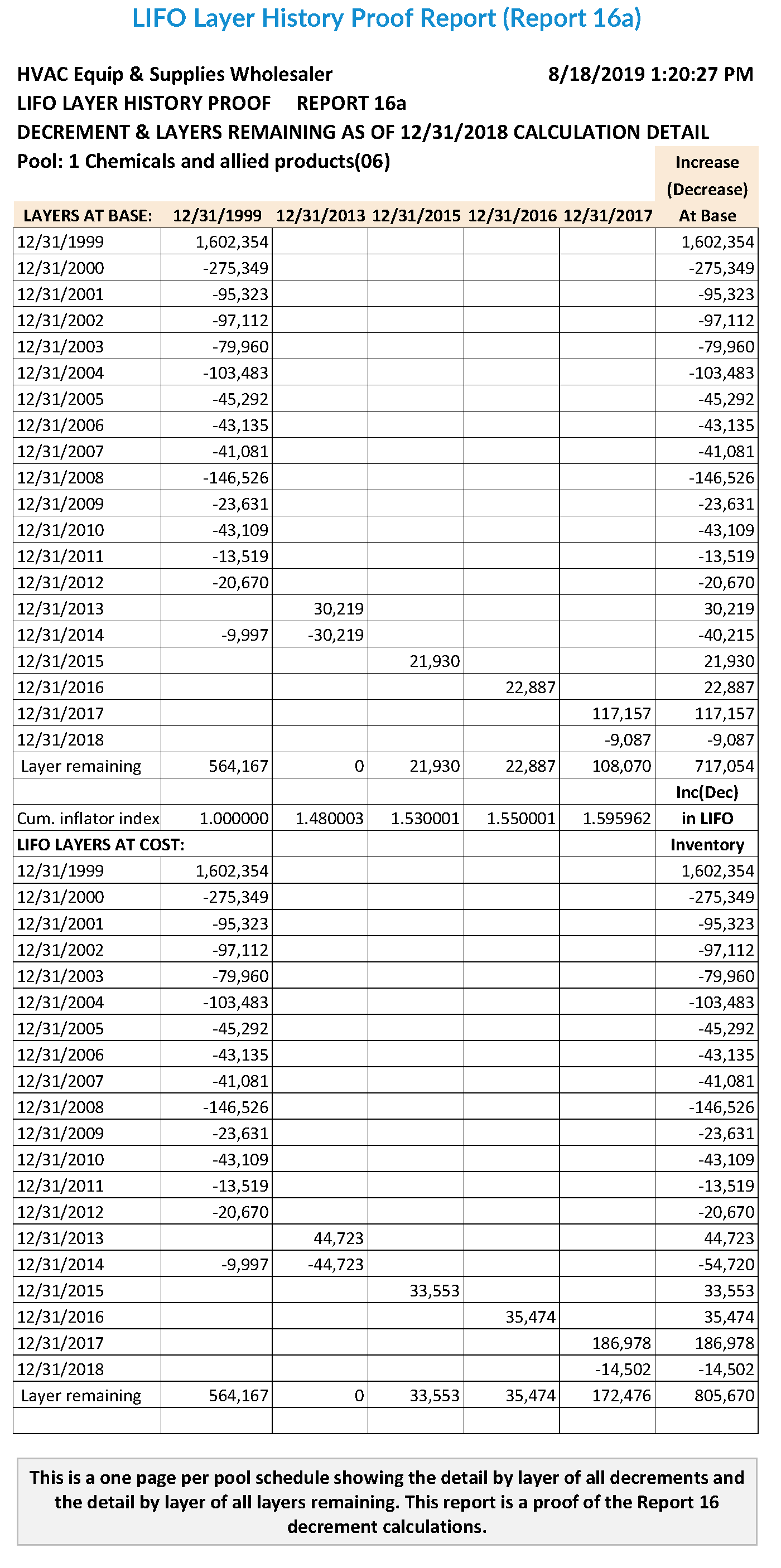

The third example of a LIFO inventory calculation shows data for a company that has been on LIFO for three years beginning in 2001. Current-year cost increased from 10 million to 12 million dollars during the first year and there was 5% inflation (which would have been calculated on another schedule) resulting in an increment. Current-year cost decreased from 12 million to 11 million dollars during the second year and there was 1% deflation resulting in a decrement which partially eroded the first year’s layer. Current-year cost decreased from 11 million to 10 million dollars during the third year and there was 2% deflation resulting in a decrement that completely eroded the first year’s layer and partially eroded the base layer. Five reports are shown for this example; one Report 18a for each year, one Report 16a for all years & one Report 17 for all years.

In the example above, the 2002 decrease at base erodes only the 2001 layer. The 2002 decrease at LIFO cost is calculated by multiplying the 2002 decrease at base times the inflator index used to create the 2001 layer & is as follows: 2002 Decrease at Base x 2001 Inflator Index = 2002 Decrease at LIFO Cost -846,560 x 1.050 = -888,888

In the example above, the 2003 decrease at base eliminates the portion of the 2001 layer remaining after the 2002 decrement and partially erodes the 2000 (base-year) layer. The 2003 decrease at LIFO cost is calculated by 1) multiplying a negative amount equal to the 2001 layer at base remaining after the 2002 decrement times the 2001 inflator index, and 2) multiplying the additional 2003 decrease at base times the 2000 inflator index, and 3) adding the products of Steps 1 & 2.

2003 Decrease at LIFO Cost Formula = (-2001 layer at base remaining after 2002 decrement x 2001 inflator index) + ((2003 decrease at base – 2001 layer at base remaining after 2002 decrement) x 2000 inflator index)

2003 Decrease at LIFO Cost Calculation = (-582,011 x 1.050) + (-765,675 – 582,011) x 1.000) = -611,112 + (-183,664 x 1.000) = -611,112 – 183,664 = -794,775

This report shows the detail by layer of all decrements & the detail by layer of all layers remaining after 2003.

LIFO taxpayers using a simplified Sec. 263A (a.k.a. UNICAP) method can apply their Section 263A costs by multiplying the appropriate UNICAP rate times the layer at tax LIFO cost. The following example of a LIFO inventory calculation including UNICAP costs uses the same data as Example 3 above, but applies the following UNICAP rates by year:

2000 – 5.0%

2001 – 5.25%

2002 – 4.8%

2003 – 4.9%

Decrements of UNICAP layers are calculated similarly to decrements of layers at LIFO cost—the same UNICAP rates used when layers are created are used in reverse chronological order to calculate decreases in UNICAP costs.

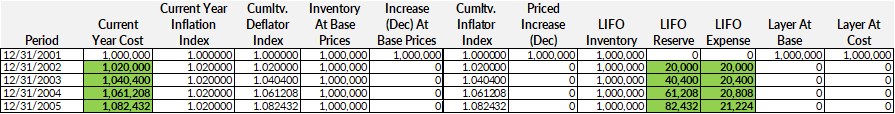

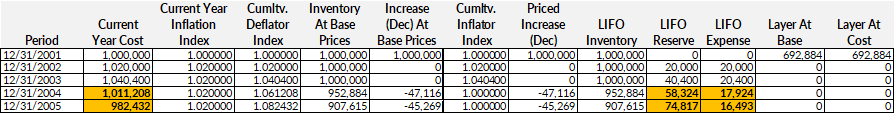

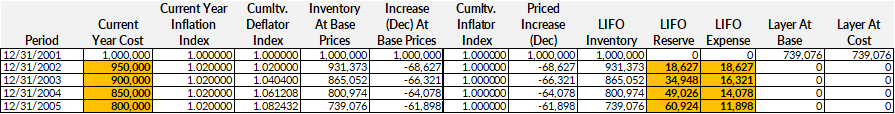

Example 1: Assumption – Current-year cost increases at the same rate as inflation starting at $1,000,000 in the base year | Result – 2002 – 2005 LIFO reserve increases by $20K – $21K per year

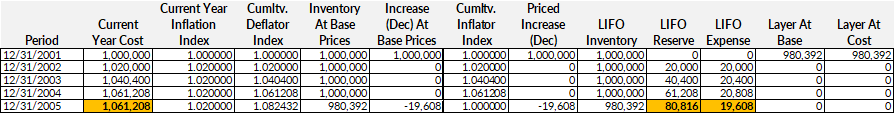

Example 2: Assumption – 2005 & 2004 CYC are equal (2005 CYC = $20K less than Example 1) | Result – 2005 LIFO reserve increases by just under $20K

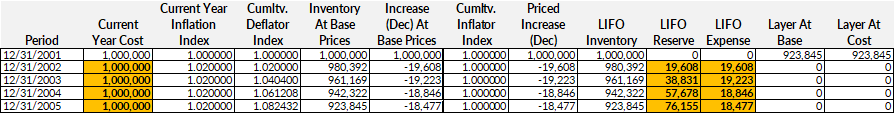

Example 3: Assumption – CYC is the same for all years | Result – 2002 – 2005 LIFO reserve increases by $18K – $20K per year ($76K total)

Example 4: Assumption – 2004 & 2005 CYC are $50 & $100K less than Example 1 | Result – 2004 & 2005 LIFO reserve increases by $18K & $16K

Example 5: Assumption – CYC decreases by $50K/year ($200K total) | Result – 2002 – 2005 LIFO reserve increases by $12K – $19K per year ($61K total)

It is permissible to use financial reporting LIFO (referred to as book LIFO) methods that differ from those used for preparation of the annual tax return (referred to as tax LIFO). Most large companies use different book and tax methods while most of the smaller companies use the same methods for book and tax LIFO. This guide can be used to audit both book and tax LIFO calculations because steps are included that are applicable to both book and tax LIFO methods.

The convoluted nature of LIFO has caused accounting professionals to believe that companies must use uniform Book (Financial Reporting) & Tax LIFO methods. That misconception is incorrect. Both IRS Regs. & GAAP allow for companies to have differing Book & Tax LIFO methods. Aside from International Financial Reporting Standards (IFRS), the only true Book & Tax LIFO conformity requirements are as follows:

The 1981 LIFO Conformity Requirement published within IRS Reg. §1.472-2(e)8 of Treasury Decision #7756 is the authoritative literature reference regarding the acceptability of differing Book and Tax LIFO methods; the IRS’ list of acceptable Book & Tax LIFO method differences read as follows:

The following are examples of costing methods and accounting methods that are neither inconsistent with the inventory method referred to in §1.472-1 nor at variance with the requirement of §1.472-2(c) and which, under paragraph (e)(1)(vi) of this section, may be used to ascertain income, profit, or loss for credit purposes or for purposes of financial reports regardless of whether such method is also used by the taxpayer for Federal income tax purposes:

(i) Any method relating to the determination of which costs are includible in the computation of the cost of inventory under the full absorption inventory method.

(ii) Any method of establishing pools for inventory under the dollar-value LIFO inventory method.

(iii) Any method of determining the LIFO value of a dollar-value inventory pool, such as the double-extension method, the index method, and the link chain method.

(iv) Any method of determining or selecting a price index to be used with the index or link chain method of valuing inventory pools under the dollar-value LIFO inventory method.

(v) Any method permitted under §1.472-8 for determining the current-year cost of closing inventory for purposes of using the dollar-value LIFO inventory method.

(vi) Any method permitted under §1.472-2(d) for determining the cost of goods in excess of goods on hand at the beginning of the year for purposes of using a LIFO method other than the dollar-value LIFO method.

(vii) Any method relating to the classification of an item as inventory or a capital asset.

(viii) The use of an accounting period other than the period used for Federal income tax purposes.

(ix) The use of cost estimates.

(x) The use of actual cost of cut timber or the cost determined under section 631(a).

(xi) The use of inventory costs unreduced by any adjustment required by the application of section 108 and section 1017, relating to discharge of indebtedness.

(xii) The determination of the time when sales or purchases are accrued.

(xiii) The use of a method to allocate basis in the case of a business combination other than the method used for Federal income tax purposes.

(xiv) The treatment of transfers of inventory between affiliated corporations in a manner different from that required by §1.1502-13.

Shown below is a simplified listing of acceptable Book-Tax LIFO method differences:

IPIC LIFO Guide – The advantages and disadvantages of this method are discussed. The cryptic IRS IPIC method regulations including those for the 10% method are explained with examples of calculations. This guide describes ways in which companies have dealt with the challenges of sorting inventory balances by the required PPI or CPI category breakdowns and other planning ideas that we have seen in practice over the years. In addition to a generic guide, we also have written guides specifically for these retailers which address the unique challenges companies in these industries face with the IPIC method:

CPA Firm LIFO Opportunities & Training Guide – This was written for CPAs in public accounting to describe ways they can help their clients best address their LIFO needs including whether their clients would benefit from a different LIFO method and whether they have clients not using LIFO that could reduce their taxes by adopting LIFO.

Other LIFO Resources

LIFO Inventory: Tax and Accounting Issues is a good general LIFO training guide authored by a practicing CPA named John Purtill. The coverage of the IPIC method is brief but it covers non-IPIC LIFO issues in greater detail. Information on this booklet is available at www.purtill.com. This publication is used for an 8 hour CPA CPE course.

Federal Income Taxation of Inventories is a 3 volume, loose leaf treatise published by LexisNexis and authored by Leslie Schneider, a partner in the Ivins, Phillips & Barker law firm. This definitive work analyzes every aspect of inventory taxation, including valuation of goods, UNICAP rules and LIFO inventories. This is a valuable tax inventory accounting reference resource that can be found in the tax libraries of most companies with significant inventories.

Inventory Tax Accounting and Uniform Capitalization is part of the Tax Practice Series published by Thomson Reuters and authored by W. Eugene Seago who is an accounting professor at Virginia Tech University. It provides analysis of various aspects of tax accounting related to inventories.

LIFO for Retailers, a Business, Financial and Tax Guide authored by Ernst & Whinney partners Paul W. Wilson and Kenneth E. Christensen and published by John Wiley & Sons, Inc. The last edition of this book was published in 1985.

The likelihood of making errors in spreadsheet-assisted manual LIFO calculations is substantial and it is usually just a matter of time before errors are made. The reason for this is that there are numerous potential errors that can be made and since the calculations are not made on a monthly basis, it is more difficult for persons with LIFO calculation responsibilities to develop expertise. The best way to prevent manual LIFO calculation errors is for the LIFO calculation schedules to be designed and created by a person with substantial LIFO methods and calculation experience. There are very few CPAs who spend more than a few hours of time each year updating their LIFO training or making LIFO calculations and even if a company or the company’s CPA employs a person with substantial LIFO experience, that person will not always be employed by the company.

What are listed as errors above may be considered by the IRS to be impermissible LIFO methods instead of errors. It is evident from historical IRS guidance that the IRS considers the application of a method of tax accounting to be a method of accounting. For example, while it is apparent that current-year cost multiplied times (rather than divided by) the cumulative deflator index to calculate the inventory at base balance is an error, the IRS would likely consider this to be an impermissible LIFO method.

It is common for companies to gain false assurance and be of the opinion that their company uses permissible LIFO methods and that their LIFO calculations are accurate when:

There are people at the Big 4 CPA firms that have substantial LIFO methods and calculation experience but this experience is concentrated among a relatively small number of people and offices. If the design of the LIFO calculation process is made by these firms’ LIFO experts as well as annual review by these experts, the likelihood of errors is much less.

Because LIFO expertise is in short supply within companies, CPA firms and the IRS, it is very common for impermissible book or tax LIFO methods and application of the methods to be used for many years without detection. For tax purposes, the fact that there were no prior years’ LIFO related IRS audit adjustments proposed by an examining agent does not mean the LIFO methods that are used are permissible and are immune to subsequent years’ adjustment. IRS Reg. § 1.472-3(d) clearly states that the IRS retains ongoing authority to approve a taxpayer’s LIFO methods. This allows the IRS to propose adjustments in cases when the impermissible method has been used for many years.

The IRS Reg. § 1.472 and various IRS Revenue Procedures (Rev. Proc.), letter rulings and other guidance provide the rules to be used for tax LIFO calculations. A separate comprehensive source of rules addressing book LIFO methods does not exist. The primary book LIFO rules guidance comes in the form of two different AICPA Accounting Standards Division Issues Papers. The first of these is entitled The Acceptability of Simplified LIFO for Financial Reporting Purposes and is dated October 14, 1982. The second of these is entitled Identification and Discussion of Certain Financial Accounting and Reporting Issues Concerning LIFO Inventories and is dated November 30, 1984.

The 1982 Issue Paper is limited in scope addressing only whether the IPIC method (referred to also as the “simplified LIFO” method) can be used for book LIFO. The conclusion was that the IPIC method can be used for book LIFO unless the IPIC method LIFO inflation does “not reflect a company’s experience” as long as 100% of the CPI or PPI inflation was used rather than the 80% limitation the IRS Regs. prescribed until the 2002 revision.

The IRS Regs. addressing LIFO have evolved over the years. The LIFO Regs. permitted only the specific goods LIFO method until 1947 when the dollar-value method that is almost universally used now was first permitted. The IRS Regs. for the IPIC LIFO method were written in 1982 and significant changes were made in 2002 to the IPIC LIFO Regs.

There was no need for book LIFO rules different from the IRS Regs. LIFO rules until 1981 when the IRS LIFO conformity rules contained in Reg. § 1.472–2(e) were amended to specifically permit the use of book LIFO methods that are different from IRS Regs. methods. Before this time, only the tax LIFO methods permitted by the IRS Regs. could be used for book LIFO. This is why the two AICPA LIFO Issues Papers were not written until after 1981.

While there is book LIFO guidance contained in the two AICPA Issues Papers, these are not a comprehensive set of book LIFO method rules which means that the IRS Regs. are considered to be also the book LIFO rules for issues not addressed in the two AICPA LIFO Issues Papers. For example, there are no book LIFO rules for the IPIC method in the AICPA Issues Papers other than the 1982 Issues Paper specifying that the IPIC method could be used for book LIFO and because of this, the IRS Regs. rules for tax LIFO are also considered to be the IPIC method book LIFO rules.

Book LIFO methods and internal controls for the annual book LIFO calculations must be evaluated annually to ensure the accurate calculation of the book LIFO reserve that is disclosed in the financial statements. Tax LIFO methods and internal controls for the annual tax LIFO calculations must be evaluated annually to ensure compliance with ASC 740-10. (formerly FIN 48). ASC 740-10 requires annual evaluation of tax positions taken to determine whether income tax deferrals can be recognized in the financial statements and whether disclosure of tax positions taken require financial statement disclosure. Tax positions taken include use of tax LIFO methods and application of methods that are not permissible by the IRS.

For tax purposes, corrections of errors entail either filing amended tax returns or filing a Form 3115, Application for Change in Accounting Method and could possibly require a § 481(a) adjustment (cumulative effect of correction of the error is made). For financial reporting, material errors may require a retrospective accounting adjustment. The scope of this guide does not include discussion of steps required to properly account for corrections of LIFO errors that are required. A LIFO-PRO team member or LIFO inventory accounting expert should be consulted to properly account for correction of LIFO errors.

The purpose of the LIFO Audit Guide section of this publication is to describe:

LIFO calculation errors are much less likely to occur when a company’s LIFO calculation process includes the elements described below:

By far, the best way to prevent and detect LIFO calculation errors is to have persons within or outside the company with substantial LIFO experience design the steps for the calculations and perform or review the calculations. If a company has sufficient in-house LIFO experience, it is necessary also for the existence of a plan for LIFO training to ensure sufficient LIFO experience when and if others with LIFO experience move to other positions or leave the company. LIFO knowledge is more difficult to develop than other areas of accounting because LIFO calculations are usually not made monthly and this slows the pace of LIFO on-the-job-training. If a company using LIFO does not have substantial LIFO experience in-house, they should rely on their CPA firm to reduce the likelihood of LIFO calculation errors. If their CPA firm does not have substantial LIFO experience, they should rely on outside LIFO calculation experts.

There are various steps to take to prove the accuracy of the calculation of the LIFO reserve and properly designed LIFO calculation reports will include redundant calculations which prove the accuracy of values calculated in other reports. The standard reports generated by the LIFO-PRO software include redundant calculations. These are the redundancies included in the following LIFO-PRO reports:

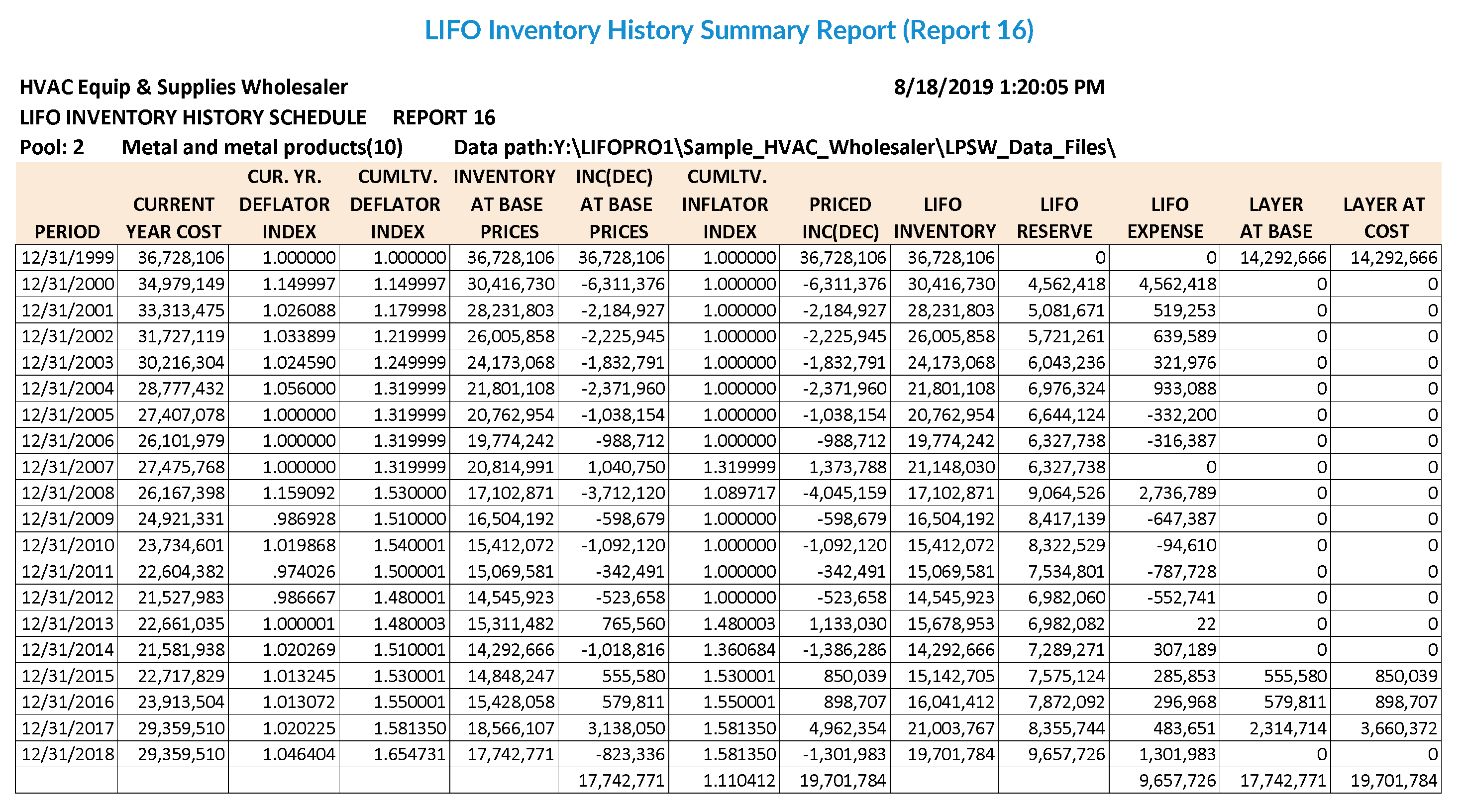

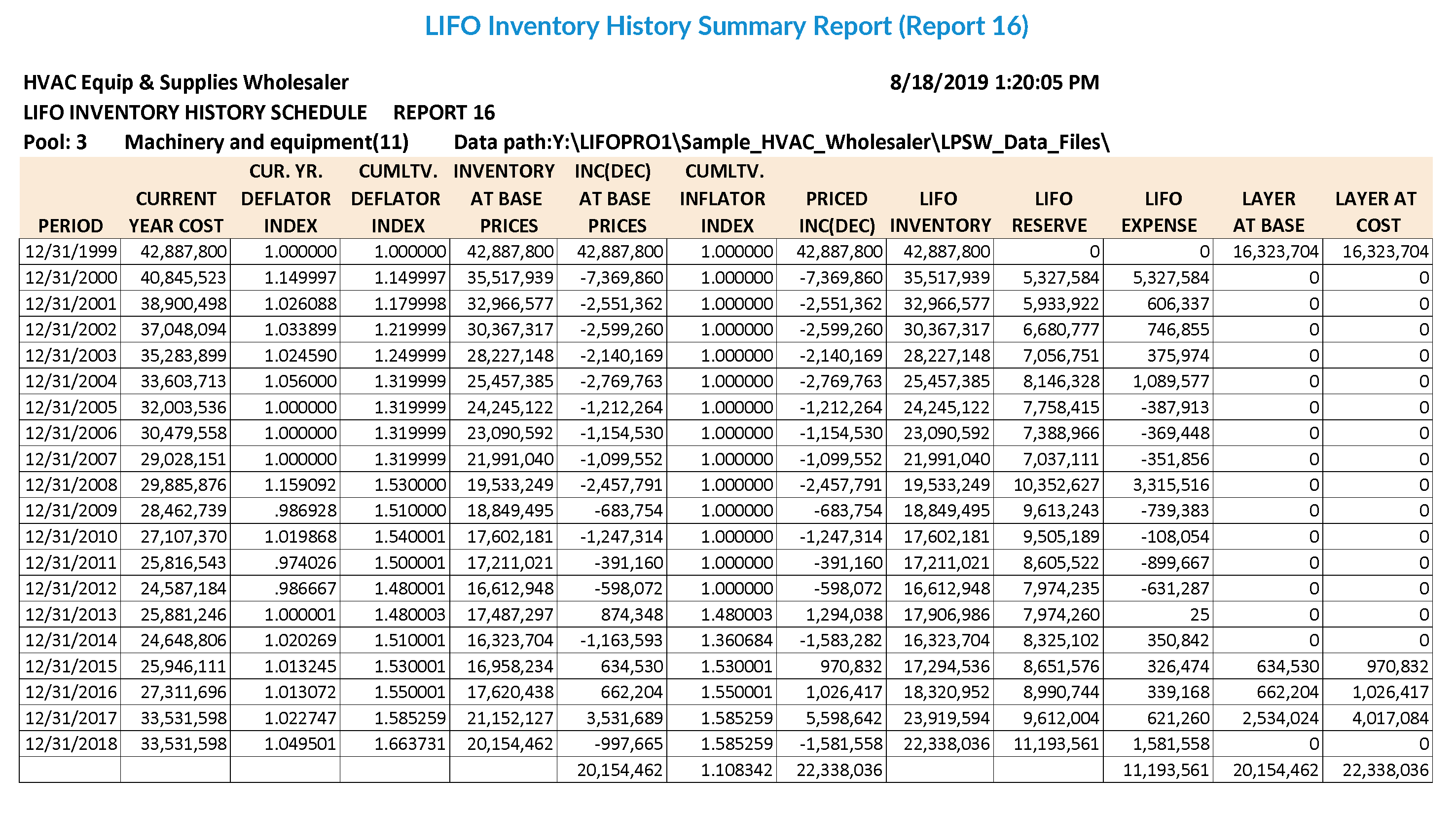

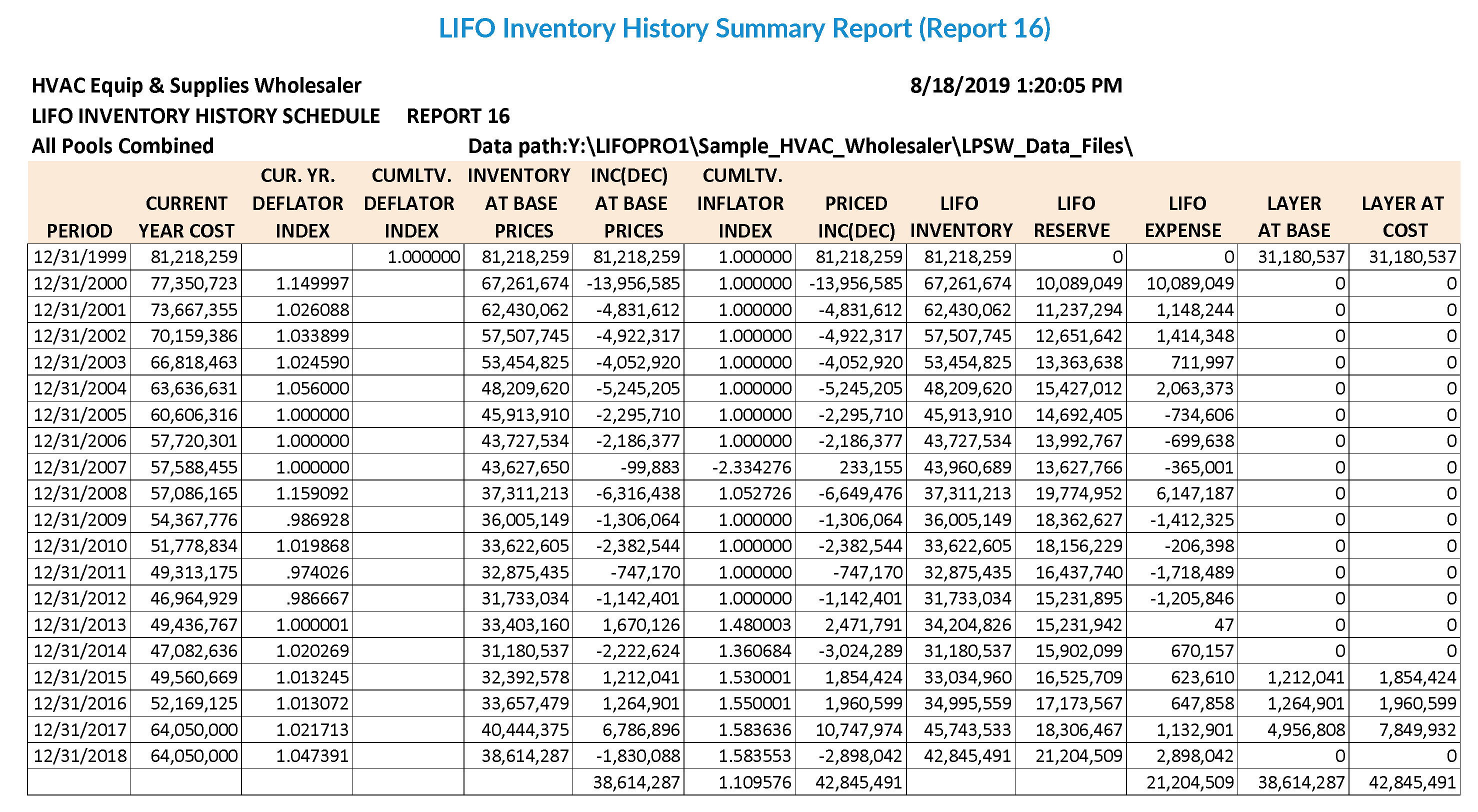

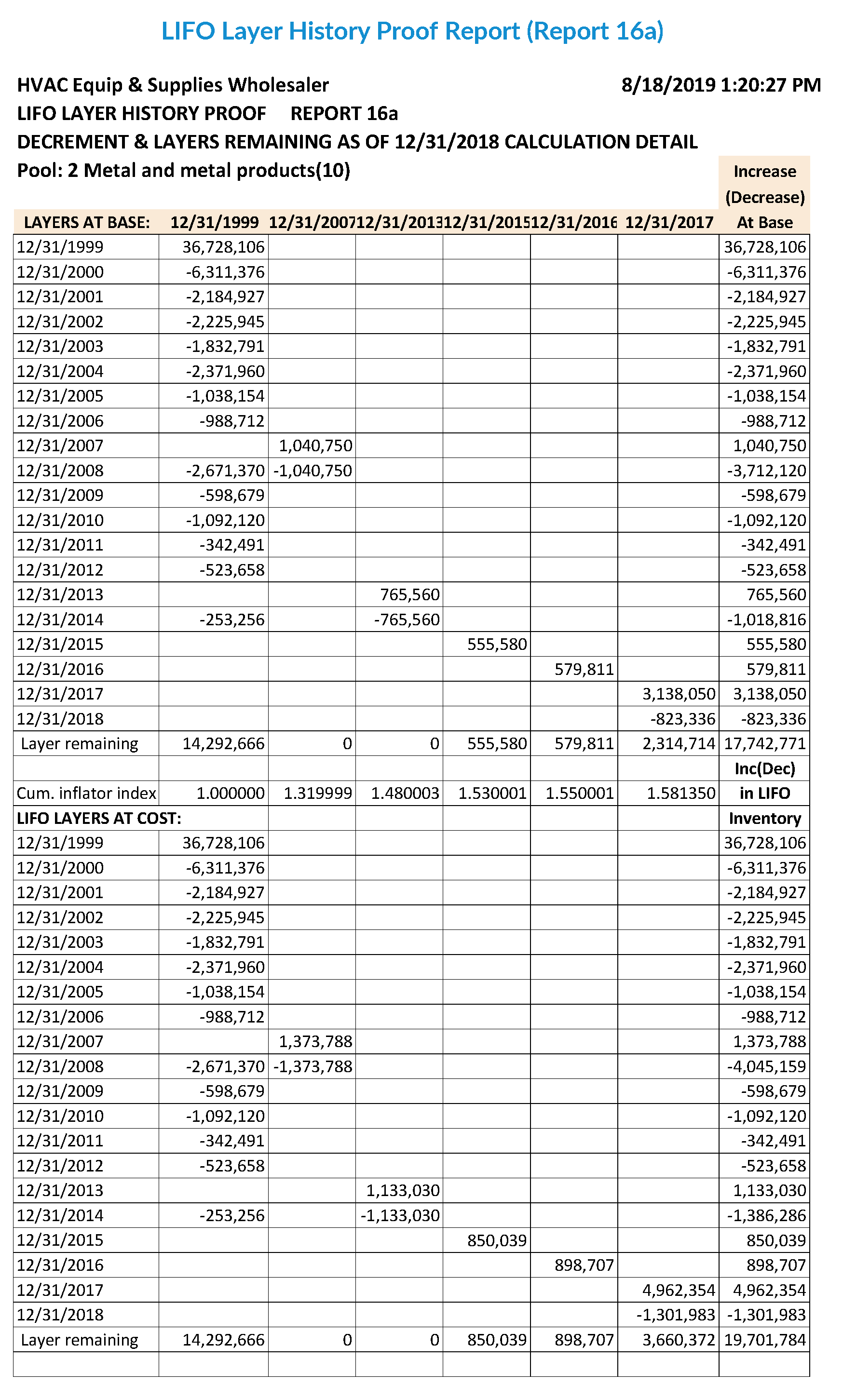

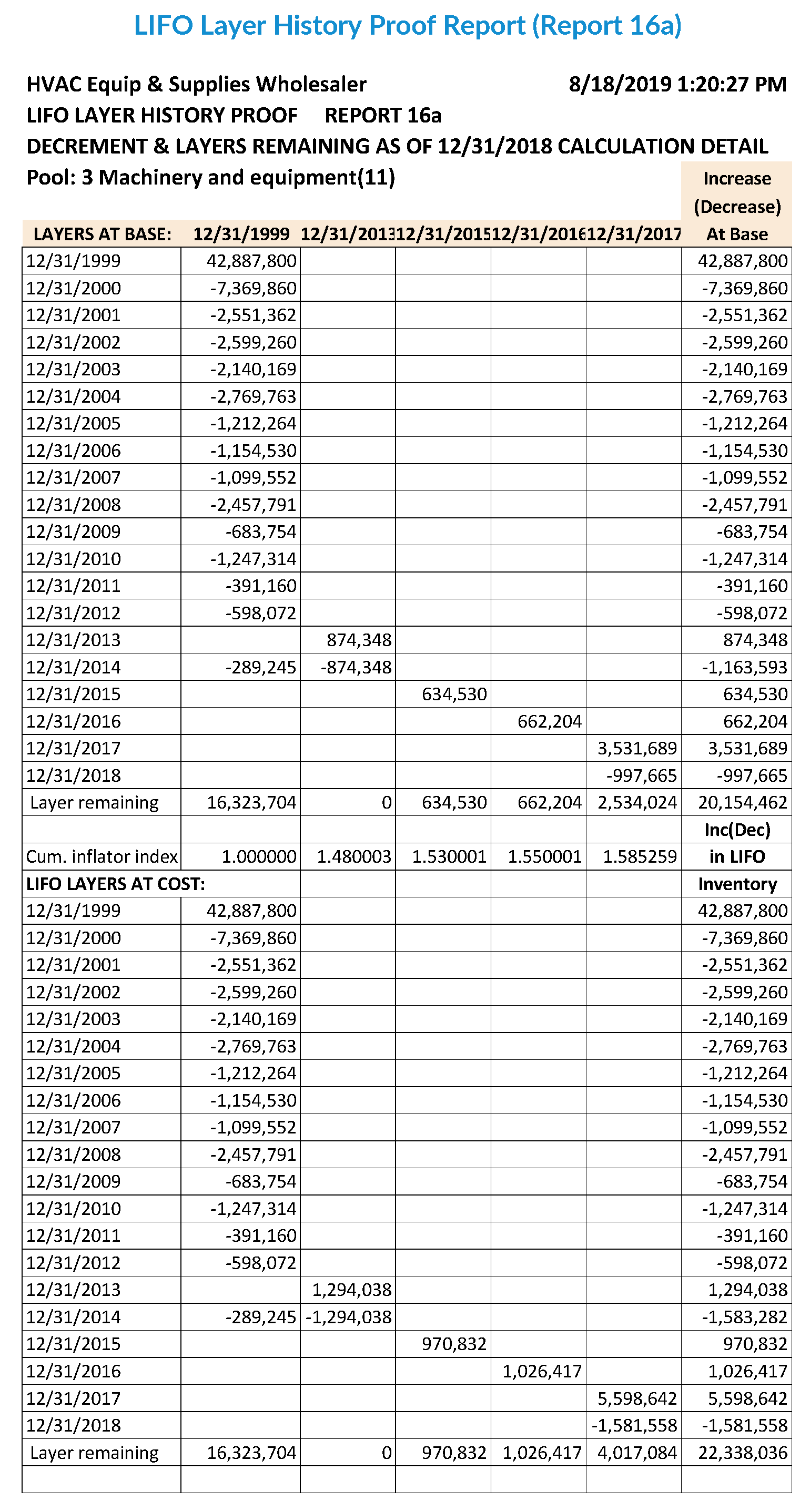

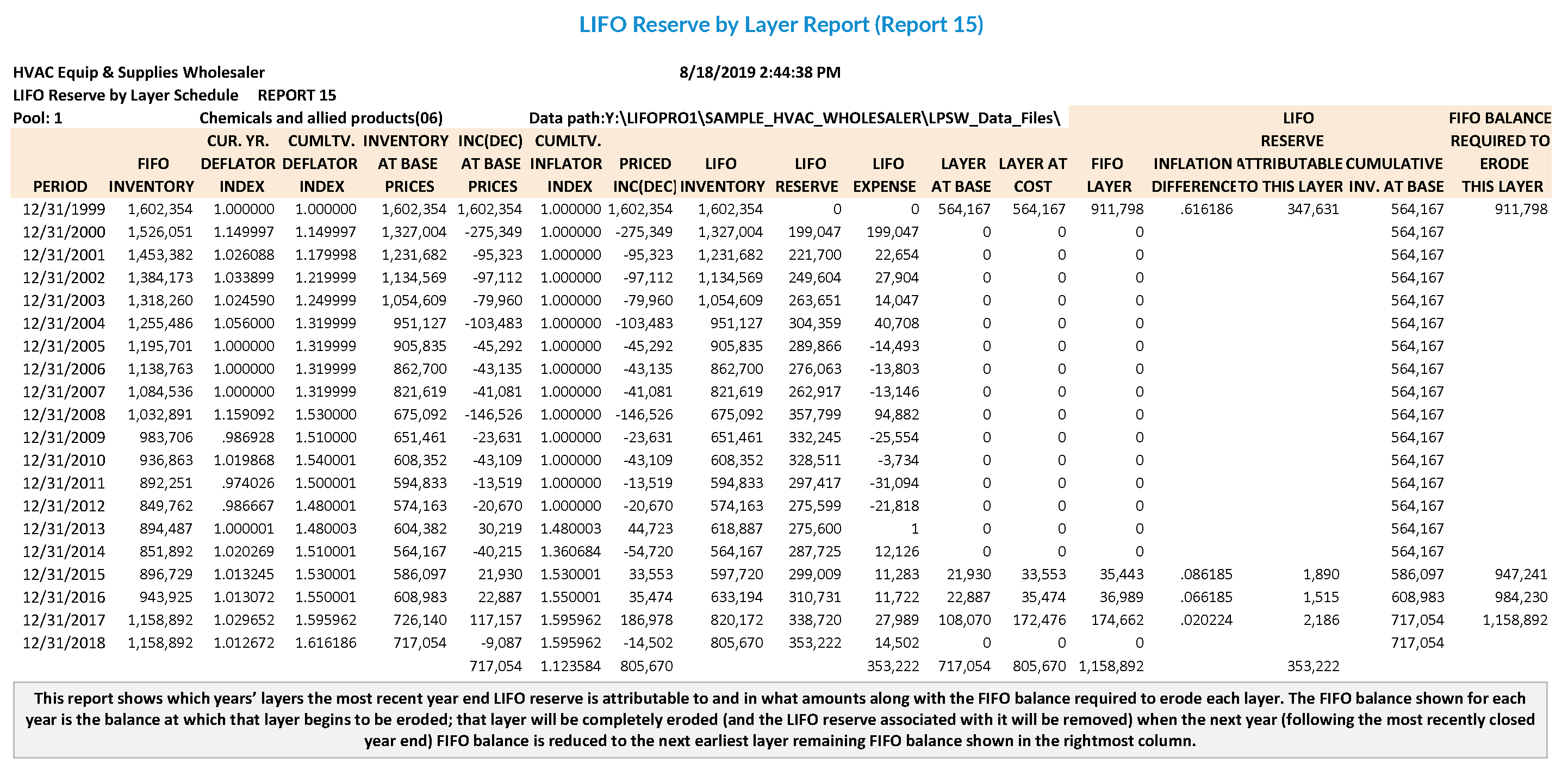

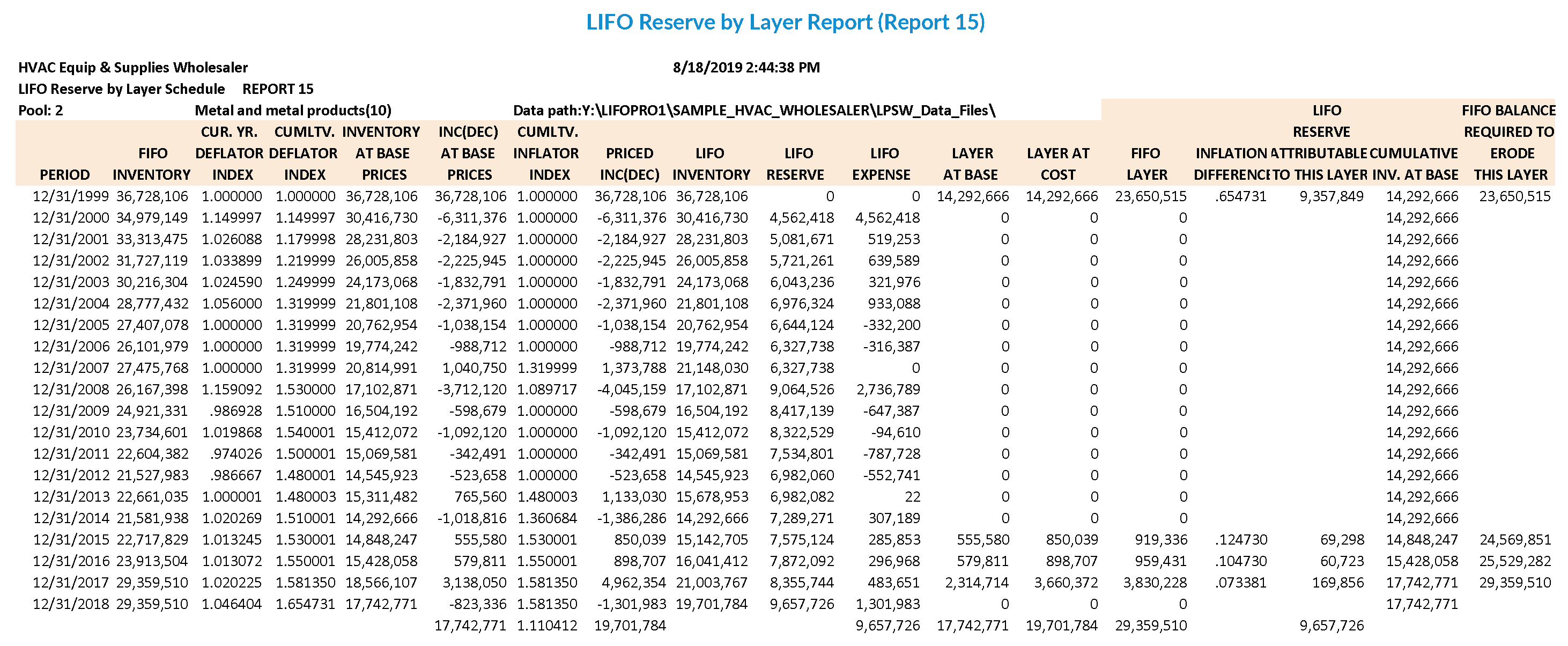

Properly designed schedules documenting LIFO calculations will include a LIFO layer history schedule in a carryforward format which shows current-year cost, indexes, inventory at base, change at base and LIFO cost, LIFO inventory and LIFO reserve balances for all years that LIFO has been used. Showing these values for all years makes it much less time consuming to perform recalculations or analytical review. A carryforward schedule format like this precludes the need and wasted time required to keep an archive of other schedules showing these fields for all preceding years. For example, if the LIFO layer history schedule used does not show the LIFO reserve balance history by year, a separate schedule must be prepared to view these balances. The LIFO-PRO Reports 16, 17 and 16a are all carryforward format LIFO schedules. The first two are LIFO layer history schedules and Report 16a shows the details of all years’ decrement calculations. Report 17 shows the LIFO layers that remain as of all years which the Report 16 shows the layers that remain as of the most recent year end. More data is included in Report 17 but printing this report become difficult for companies on LIFO for many years since both columns and rows are added for each year and only rows are added each year for Report 16.

Not only should the steps used for pool index calculations, the calculation of the LIFO reserve and updating of the LIFO layer histories be documented, the current-year cost and pool index calculation data sources should be documented. This document should be a carryforward, permanent file document which includes a description of the methods used for all years that LIFO has been used for both book and tax. A record of all IRS Form 970, Application to Use LIFO Inventory Method and Form 3115, Application for Change in Accounting Method that have been filed should be documented (with copies of these forms) as well as documentation of the results of any IRS audits for which LIFO was reviewed. This document should include a history of the LIFO election scope used for all years. Chapter 4 of this guide shows suggested content of this document. Appendix 3 of this Guide entitled “Sample LIFO Methods and Procedures Policy History Carryforward Document” includes an example of this type of comprehensive document.

Spreadsheet assisted manual calculations are prone to error and should be avoided if possible. If manual calculations are made, far greater efforts are required to make sure the proper controls are in place to prevent and detect LIFO errors.

Every company should maintain a permanent file document that addresses all aspects of the LIFO election and methods and steps used. This document should include each of these separate sections addressing each of these topics:

A more-detailed version of this outline can be found within the LIFO Methods & Submethods chapter located in Section 1 of this guide. The LIFO methods for companies with multiple entities whom require separate LIFO calculations & also have differing LIFO methods should also be addressed. The LIFO methods used and the description of the changes in methods should be described for all years (in the same carryforward document) that LIFO has been used. The details of the changes in methods (IRS guidance permitting the change, the type of change, whether adjustments were required) should be included.

The description of the LIFO calculation steps should describe the different processes for the different departments, divisions and companies and for stores as well as warehouses. The steps required for the calculation of the LIFO current-year cost adjustments for vendor monies (cash, trade & other discounts and allowances) and shrink accrual should be included. For manufacturing companies, the steps applicable to for all different stages of production (raw materials, WIP and finished goods) and all components of cost (material, labor and overhead) should be documented.

Items have always been defined for LIFO purposes as each inventory SKU.

The link-chain method was elected in 1974 with the initial LIFO election and has been used continuously since then.

The current-year cost method used at the 1974 LIFO election was the FIFO cost method for perishable inventories and the retail inventory method (RIM) for non-perishable inventories. A change was made in 2003 to the item cost method for all inventories using the FIFO cost flow assumption. A Form 3115 was filed for this change for tax purposes. A dual index method has never been used for either book or tax LIFO.

Form 970s:

1974 – For initial LIFO election.

1995 – To expand the LIFO election scope to include the pharmacy department inventories.

1996 – For the change to the IPIC method as required by the Form 3115 filed for this change.

2002 – For the change to the new IPIC method Regs. as required by the Form 3115 filed for this change.

2006 – To expand the LIFO election scope to include produce.

Form 3115s:

1996 – For the change to the IPIC method & to the IPIC pooling method.

2002 – For the change to the new IPIC method Regs.

2003 – For the change from the RIM to the item cost method.

2006 – For the change in accounting method for volume-related trade discounts.

2010 – For the change to the retail safe harbor inventory shrink accrual method.

There was an IRS examination in 1978 for which there was an adjustment agreed to that was related to LIFO inventories that resulted in the LIFO reserve being decreased by $1,321,930. The adjustment was in the method used to calculate RIM method cost complements. The adjustment was spread over 4 years starting in 1978 in the form of a § 481(a) adjustment.