The costing method used to value inventory is considered an accounting method or principle. Since there are multiple inventory valuation methods available, preferability must be established when changing to the LIFO method from a non-LIFO method. Because of this, companies issuing GAAP financial statements must establish that LIFO is preferable to the existing method.

No authoritative body has established criteria for determining the preferability among alternative inventory valuation methods, but the Securities & Exchange Commission’s Staff Accounting Bulletin Topic 6.G.2b states the following:

Furthermore, most companies use LIFO in perpetuity, and because of this, the LIFO reserve will often grow and become a materially large amount. For these reasons, companies and CPA firms should obtain or perform meticulous analysis prior to adopting LIFO for the following reasons:

Such analysis should include historical calculations, current period estimates, exploring all available submethods & preparing comparisons amongst the available submethods (such as valuing all or only certain goods using LIFO, using an internal vs. external inflation measurement source, pooling methods & determining whether the same or different book & tax LIFO submethods will be used). Additional considerations should include comparing the administrative burden and risks, outsourcing costs, and considering licensing software to automate the calculation if managed in-house.

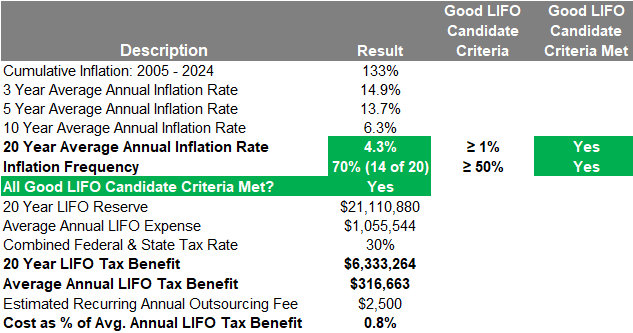

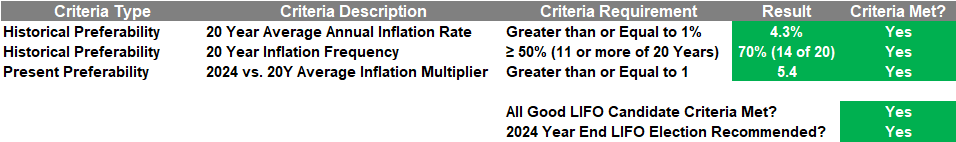

LIFOPro uses proprietary inflation metrics and a standard grading system to establish whether or not LIFO is a preferable method for a company or given industry. From this grading system, a determination can be made regarding if a company is a good LIFO candidate, and subsequent recommendations are also provided regarding the proper timing of when to elect LIFO. Our grading system & scoring criteria is organized as follows:

Although LIFO can create meaningful short and long term tax benefits, there are many considerations that should be made prior to and during the implementation process. Most importantly, the timing of adopting LIFO is key for the following reasons:

Preferability Statement

Upon our evaluation of Sample Company’s current and historical inventory costs as of the 2024 year end and the past twenty years, it is our opinion that the LIFO method of inventory costing is preferable over Sample Company’s present method and other alternatives available because it allows for better matching of costs and revenues, as historical inflationary inventory acquisition prices are expected to continue in the future and the LIFO method uses the current acquisition prices to value the cost of goods sold. Accordingly, LIFOPro recommends for Sample Company to elect the LIFO method beginning with the 2024 year end using the submethods listed below.

Want to learn more about LIFO, obtaining a free LIFO election benefit analysis & LIFOPro’s turnkey outsourcing solutions prior to obtaining your complimentary LIFO Election Benefit Analysis? Schedule a free LIFO discovery call or Teams meeting with LIFOPro by calling 402-330-8573, emailing lifopro@lifopro.com or using our online scheduling tool

Schedule Free LIFO Discovery Call LIFO Discovery Call Presentation Slide Deck Sample LIFO Election Benefit Analysis Report LIFOPro's Offerings CPA Firm OfferingsRequest your complimentary benefit analysis report by completing & submitting the form below. You’ll receive your complimentary analysis PDF report & fee quote within one week of submitting this form.

Instructions:

The green-colored cells will automatically update as soon as all values have been entered into the blue-colored input cells

Output notes:

LIFO is adopted on a prospective basis & LIFO tax savings accrue beginning in the year of the change. Prior period benefits can NOT be retrospectively recaptured. 20 year cumulative taxable income reduction & after-tax cash savings shown in calculator are for analysis purposes only & is provided to forecast the long-term or future tax savings from LIFO.

BLS PPI Inflation Rate Averages Table for Selected Commodities through April 2025

| PPI Code | BLS PPI Category Description | 1M 4/25 | YTD 4/25 | 1YR 4/25 | 3YR 4/25 | 5Y 4/25 | 10YR 4/25 | 20Y 4/25 |

|---|---|---|---|---|---|---|---|---|

| 01 | FARM PRODUCTS | -2.3% | 0.5% | 4.6% | -3.2% | 10.4% | 3.0% | 3.4% |

| 011 | Fruits & melons, fresh/dry vegs. & nuts | 0.3% | -19.3% | -6.0% | -1.6% | 3.5% | 2.1% | 2.5% |

| 012 | Grains | 3.2% | 5.3% | 6.3% | -16.6% | 6.6% | 1.8% | 4.1% |

| 013 | Slaughter livestock | 1.5% | 11.4% | 11.5% | 14.7% | 17.3% | 4.2% | 4.5% |

| 014 | Slaughter poultry | 2.1% | 4.2% | 3.3% | -6.7% | 21.5% | 2.7% | 3.8% |

| 015 | Raw cotton | -1.1% | -6.2% | -20.1% | -22.0% | 5.3% | -0.4% | 1.1% |

| 016 | Raw milk | -2.6% | -11.0% | -3.0% | -5.6% | 4.3% | 2.8% | 1.5% |

| 017 | Chicken eggs | -39.4% | -11.4% | 50.0% | 6.3% | 23.7% | 12.7% | 10.6% |

| 018 | Hay, hayseeds and oilseeds | 7.0% | 5.3% | -8.8% | -13.5% | 3.8% | 0.7% | 2.7% |

| 02 | PROCESSED FOODS AND FEEDS | 0.2% | 1.5% | 3.2% | 2.0% | 5.3% | 2.7% | 2.9% |

| 021 | Cereal and bakery products | -0.1% | 0.4% | 0.0% | 2.8% | 4.9% | 2.8% | 3.2% |

| 022 | Meats, poultry, and fish | 2.9% | 3.2% | 4.0% | 1.2% | 6.1% | 2.3% | 2.7% |

| 023 | Dairy products | -1.3% | -1.5% | 2.8% | -1.5% | 4.0% | 2.1% | 2.1% |

| 024 | Processed fruits and vegetables | -0.7% | 0.1% | 1.5% | 8.0% | 7.0% | 4.1% | 3.8% |

| 025 | Sugar and confectionery | 3.1% | 1.2% | 8.8% | 9.1% | 6.8% | 3.7% | 3.4% |

| 026 | Beverages and beverage materials | -0.1% | 0.8% | 2.2% | 4.5% | 4.4% | 2.9% | 2.6% |

| 027 | Fats and oils | 0.6% | -4.1% | -4.2% | -11.3% | 5.6% | 2.3% | 2.9% |

| 028 | Miscellaneous processed foods | -2.7% | 5.0% | 6.3% | 4.6% | 6.2% | 3.5% | 3.1% |

| 029 | Prepared animal feeds | -0.7% | 0.1% | -0.1% | -2.8% | 3.7% | 1.7% | 3.5% |

| 03 | TEXTILE PRODUCTS AND APPAREL | 0.6% | 0.7% | 0.1% | 1.1% | 4.6% | 2.6% | 2.1% |

| 031 | Synthetic fibers | 1.9% | -1.2% | -1.3% | 1.4% | 5.1% | 3.0% | 1.9% |

| 032 | Processed yarns and threads | -0.2% | 0.0% | -0.3% | -4.2% | 5.0% | 2.6% | 2.3% |

| 033 | Greige fabrics | 0.8% | 0.5% | 0.0% | 0.9% | 4.2% | 1.9% | 2.0% |

| 034 | Finished fabrics | 0.6% | 1.9% | 1.7% | 1.7% | 5.2% | 3.0% | 2.6% |

| 038 | Apparel & other fabricated textile prods | 0.2% | 0.7% | 1.3% | 3.1% | 3.4% | 2.2% | 1.9% |

| 039 | Miscellaneous textile products/services | 0.5% | 1.4% | -8.8% | -0.8% | 7.0% | 2.3% | 1.8% |

| 04 | HIDES, SKINS, LEATHER, AND RELATED PRODUCTS | 0.1% | -1.4% | -1.8% | -0.2% | 2.8% | -2.4% | 0.3% |

| 041 | Hides and skins, incl. cattle | -2.6% | -13.1% | -16.8% | -14.4% | -3.2% | -12.3% | -4.2% |

| 042 | Leather | 1.9% | -0.2% | -1.9% | -0.1% | 4.7% | -3.7% | -0.5% |

| 043 | Footwear | 0.0% | 1.2% | 1.7% | 4.4% | 4.3% | 3.0% | 2.9% |

| 044 | Other leather and related products | 0.0% | 0.6% | 1.8% | 3.1% | 3.1% | 2.1% | 2.1% |

| 05 | FUELS AND RELATED PRODUCTS AND POWER | -0.7% | 2.7% | -7.2% | -6.9% | 13.2% | 3.1% | 2.0% |

| 051 | Coal | 1.9% | 4.1% | 10.4% | 3.0% | 9.6% | 4.3% | 4.8% |

| 053 | Gas fuels | -10.6% | 0.3% | 52.6% | -16.5% | 21.7% | 1.6% | -3.4% |

| 055 | Utility natural gas | 0.9% | 5.6% | 12.7% | 2.3% | 10.9% | 4.7% | 1.6% |

| 056 | Crude petroleum (domestic production) | -4.5% | -5.3% | -23.8% | -14.5% | 32.3% | 2.3% | 1.4% |

| 057 | Petroleum products, refined | 0.3% | 2.8% | -21.0% | -13.7% | 20.7% | 3.1% | 2.2% |

| 058 | Asphalt and other petroleum and coal products, n.e.c. | 2.5% | 25.0% | 28.7% | -9.5% | 10.1% | 2.7% | 7.5% |

| 06 | CHEMICALS AND ALLIED PRODUCTS | -0.7% | 1.5% | 0.1% | -1.7% | 5.0% | 2.8% | 3.1% |

| 061 | Industrial chemicals | -2.7% | 0.5% | -3.2% | -5.9% | 7.1% | 2.3% | 2.3% |

| 062 | Paints and allied products | -0.3% | 0.0% | 0.8% | 1.8% | 6.3% | 4.0% | 3.8% |

| 063 | Drugs and pharmaceuticals | 0.1% | 0.2% | 1.0% | 1.9% | 2.0% | 3.4% | 4.3% |

| 064 | Fats and oils, inedible | -2.0% | 1.3% | 0.4% | -5.5% | 12.4% | 4.7% | 4.5% |

| 065 | Agricultural chemicals and chemical products | 0.9% | 3.9% | 2.3% | -7.3% | 7.6% | 2.2% | 3.4% |

| 066 | Plastic resins and materials | -0.6% | 4.2% | 1.0% | -4.8% | 5.5% | 1.7% | 1.8% |

| 067 | Other chemicals and allied products | 0.9% | 2.8% | 2.7% | 4.0% | 5.1% | 3.2% | 2.9% |

| 07 | RUBBER AND PLASTIC PRODUCTS | 0.2% | 0.1% | 0.3% | 0.8% | 5.5% | 3.1% | 3.0% |

| 071 | Rubber and rubber products | -0.3% | 0.6% | 0.9% | 1.8% | 4.8% | 2.7% | 2.9% |

| 072 | Plastic products | 0.3% | 0.0% | 0.1% | 0.5% | 5.7% | 3.2% | 3.0% |

| 08 | LUMBER AND WOOD PRODUCTS | 0.0% | 1.1% | 1.2% | -5.4% | 5.1% | 3.1% | 2.1% |

| 081 | Lumber | -1.6% | 3.2% | 6.7% | -10.9% | 5.9% | 3.0% | 1.4% |

| 082 | Millwork | 0.2% | 0.1% | -0.1% | -1.4% | 5.8% | 4.1% | 3.0% |

| 083 | Plywood | 0.6% | 1.7% | -3.5% | -11.0% | 6.4% | 3.0% | 2.0% |

| 084 | Other wood products | 1.0% | 1.7% | 0.6% | -4.1% | 3.7% | 2.7% | 2.2% |

| 085 | Logs, bolts, timber, pulpwood, woodchips and other roundwood products | -0.1% | 1.0% | -0.5% | -1.4% | 1.8% | 0.9% | 1.3% |

| 086 | Prefabricated wood buildings & components | 1.1% | 6.6% | 6.8% | 1.4% | 8.5% | 5.5% | 3.5% |

| 087 | Treated wood and contract wood preserving | 0.8% | -5.1% | -4.5% | -2.5% | 4.9% | 2.6% | 2.0% |

| 09 | PULP,PAPER, AND ALLIED PRODUCTS | 0.2% | 0.7% | 1.7% | 1.5% | 5.7% | 3.2% | 2.7% |

| 091 | Pulp, paper, and prod., ex. bldg. paper | 0.6% | 0.9% | 2.4% | 1.6% | 5.6% | 3.0% | 2.8% |

| 092 | Building paper & building board mill prods. | -5.4% | -10.3% | -21.7% | -20.2% | 5.8% | 4.3% | 2.0% |

| 094 | Publications, printed matter & printing material | -0.2% | 1.2% | 2.7% | 4.6% | 6.2% | 3.7% | |

| 10 | METALS AND METAL PRODUCTS | 0.9% | 5.7% | 4.8% | -1.7% | 8.5% | 4.7% | 3.6% |

| 101 | Iron and steel | 2.3% | 10.1% | 1.9% | -7.3% | 9.4% | 4.8% | 3.0% |

| 102 | Nonferrous metals | 0.7% | 7.6% | 12.8% | 0.1% | 9.0% | 5.1% | 4.3% |

| 103 | Metal containers | 0.8% | 2.5% | 2.3% | -0.6% | 7.2% | 4.3% | 3.2% |

| 104 | Hardware | 0.2% | 1.7% | 2.6% | 2.1% | 5.2% | 3.4% | 2.8% |

| 105 | Plumbing fixtures and fittings | 2.2% | 3.9% | 4.2% | 3.1% | 4.2% | 3.3% | 2.9% |

| 106 | Heating equipment | 1.5% | 2.1% | 2.6% | 4.4% | 7.6% | 5.2% | 4.2% |

| 107 | Fabricated structural metal products | 0.2% | 3.1% | 1.8% | 1.0% | 9.6% | 5.7% | 3.9% |

| 108 | Miscellaneous metal products | 0.0% | 1.0% | 2.8% | 2.9% | 5.7% | 3.3% | 2.6% |

| 11 | MACHINERY AND EQUIPMENT | 0.9% | 2.1% | 3.1% | 4.2% | 5.0% | 3.0% | 2.0% |

| 111 | Agricultural machinery and equipment | 0.1% | 0.4% | 0.6% | 2.9% | 5.9% | 3.8% | 3.1% |

| 112 | Construction machinery and equipment | 1.1% | 1.8% | 1.3% | 5.4% | 5.7% | 3.7% | 3.2% |

| 113 | Metalworking machinery and equipment | 0.3% | 1.7% | 2.9% | 4.7% | 5.2% | 3.2% | 2.5% |

| 114 | General purpose machinery and equipment | 1.7% | 3.1% | 4.3% | 5.8% | 7.1% | 4.6% | 3.8% |

| 115 | Electronic computers and computer equipment | 1.8% | 1.8% | 1.1% | 54.4% | 31.5% | 13.1% | 3.3% |

| 116 | Special industry machinery and equipment | 0.6% | 1.2% | 2.2% | 3.9% | 6.2% | 3.8% | 2.6% |

| 117 | Electrical machinery and equipment | 0.7% | 1.5% | 2.7% | 3.2% | 3.7% | 2.2% | 1.1% |

| 118 | Miscellaneous instruments | 0.8% | 4.3% | 6.2% | 5.8% | 5.3% | 3.5% | 2.6% |

| 119 | Miscellaneous machinery | 0.4% | 1.7% | 2.6% | 3.8% | 3.9% | 2.3% | 2.3% |

| 12 | FURNITURE AND HOUSEHOLD DURABLES | 0.4% | 1.8% | 2.5% | 2.8% | 4.8% | 3.2% | 2.4% |

| 121 | Household furniture | -0.4% | 0.6% | 2.0% | 1.8% | 4.5% | 3.1% | 2.6% |

| 122 | Commercial furniture | 1.0% | 2.9% | 4.8% | 4.8% | 6.7% | 4.5% | 3.3% |

| 123 | Floor coverings | -0.2% | 0.6% | 0.2% | 2.1% | 1.6% | 1.5% | 2.0% |

| 124 | Household appliances | 0.4% | 2.2% | 0.2% | 1.7% | 3.8% | 2.6% | 1.9% |

| 125 | Home electronic equipment | 0.3% | 0.3% | -0.2% | 2.0% | 3.8% | 2.1% | 0.0% |

| 126 | Other household durable goods | 1.0% | 1.9% | 4.0% | 2.8% | 4.9% | 3.0% | 2.3% |

| 13 | NONMETALIC MINERAL PRODUCTS | -0.9% | 1.7% | 2.6% | 5.7% | 6.3% | 4.3% | 3.9% |

| 131 | Glass | -1.5% | -0.9% | 0.1% | 2.9% | 4.1% | 3.3% | 2.1% |

| 132 | Concrete ingredients and related products | -0.1% | 3.9% | 5.9% | 8.4% | 7.2% | 5.5% | 4.7% |

| 133 | Concrete products | 0.5% | 1.4% | 1.8% | 7.0% | 7.0% | 5.1% | 4.1% |

| 134 | Clay construction products ex. refractories | 0.0% | 1.2% | 1.9% | 4.1% | 4.4% | 2.7% | 1.9% |

| 135 | Refractories | -0.3% | 0.8% | 0.8% | 3.2% | 4.4% | 3.6% | 3.7% |

| 136 | Asphalt felts and coatings | -0.7% | -1.8% | 0.2% | 2.2% | 6.4% | 3.9% | 5.2% |

| 137 | Gypsum products | 1.0% | 1.2% | 3.4% | 4.7% | 8.7% | 5.1% | 4.1% |

| 138 | Glass containers | 0.2% | 1.7% | 5.8% | 6.2% | 7.0% | 4.3% | 3.6% |

| 139 | Other nonmetallic minerals | -3.2% | 2.7% | 2.6% | 5.1% | 5.7% | 3.3% | 3.9% |

| 14 | TRANSPORTATION EQUIPMENT | 0.2% | 0.8% | 1.7% | 2.3% | 2.8% | 1.8% | 1.7% |

| 141 | Motor vehicles and equipment | 0.2% | 0.5% | 1.5% | 1.9% | 2.7% | 1.6% | 1.4% |

| 142 | Aircraft and aircraft equipment | 0.3% | 1.3% | 2.4% | 3.6% | 3.0% | 2.1% | 2.3% |

| 143 | Ships and boats | 0.3% | 1.4% | 2.5% | 2.9% | 3.5% | 2.5% | 2.5% |

| 144 | Railroad equipment | 0.1% | -0.1% | -0.3% | 0.8% | 1.1% | 0.8% | 1.6% |

| 149 | Transportation equipment, n.e.c. | 0.4% | 0.1% | 0.1% | 0.0% | 3.1% | 2.4% | 1.7% |

| 15 | MISCELLANEOUS PRODUCTS | 0.8% | 2.3% | 5.5% | 5.7% | 6.0% | 4.3% | 3.4% |

| 151 | Toys, sporting goods, small arms, etc. | 0.1% | -0.1% | -1.0% | 5.0% | 5.8% | 3.4% | 2.5% |

| 152 | Tobacco products, incl. stemmed & redried | 1.8% | 4.2% | 12.7% | 11.4% | 10.0% | 7.8% | 6.2% |

| 153 | Notions | 0.0% | 4.1% | 4.1% | 4.4% | 5.7% | 3.5% | 3.8% |

| 154 | Photographic equipment and supplies | 2.9% | 5.3% | 3.7% | 3.9% | 5.0% | 3.5% | 2.7% |

| 155 | Mobile homes | 0.6% | 1.3% | 2.2% | -0.9% | 8.2% | 6.2% | 4.6% |

| 156 | Medical, surgical & personal aid devices | 0.1% | 1.3% | 2.1% | 2.5% | 2.3% | 1.7% | 1.4% |

| 157 | Other industrial safety equipment | 1.2% | 2.4% | 3.9% | 6.5% | 5.9% | 3.3% | 2.5% |

| 159 | Other miscellaneous products | 0.6% | 2.0% | 5.2% | 4.8% | 6.8% | 4.5% | 3.1% |

BLS CPI Historical Annual Inflation Rate Averages For Selected Categories through April 2025

| BLS CPI Code | BLS CPI Category Description | 1M 4/25 | 1Y 4/25 | 3Y 4/25 | 5Y 4/25 | 10Y 4/25 | 20Y 4/25 | |

|---|---|---|---|---|---|---|---|---|

| SAF | FOOD & BEVERAGES | 0.0% | 1.2% | 3.0% | 4.1% | 4.7% | 3.1% | |

| SAF11 | Food at home | -0.3% | 1.1% | 2.1% | 3.4% | 4.4% | 2.6% | |

| SAF114 | Nonalcoholic beverages & beverage materials | 0.4% | 3.2% | 3.1% | 4.9% | 4.9% | 3.1% | |

| SEFN | Juices & nonalcoholic drinks | -0.3% | 2.6% | 1.9% | 5.1% | 4.9% | 3.4% | |

| SEFN01 | Carbonated drinks | -0.4% | 4.2% | 1.5% | 5.5% | 5.2% | 3.9% | |

| SEFN03 | Nonfrozen noncarbonated juices & drinks | 0.0% | 0.8% | 1.5% | 4.4% | 4.5% | 3.0% | |

| SEFP | Beverage materials including coffee & tea | 1.9% | 4.4% | 6.0% | 4.5% | 4.9% | 2.2% | |

| SEFP01 | Coffee | 2.0% | 6.4% | 9.0% | 4.6% | 5.4% | 2.0% | |

| SEFP02 | Other beverage materials including tea | 1.9% | 2.3% | 2.5% | 4.8% | 4.2% | 2.6% | |

| SAF115 | Other food at home | 0.0% | 1.1% | 0.9% | 4.1% | 4.7% | 2.8% | |

| SEFT06 | Other miscellaneous foods | 0.4% | 0.3% | 0.9% | 3.9% | 4.4% | 2.7% | |

| SEFW | Alcoholic beverages at home | -0.1% | 1.0% | 0.6% | 2.0% | 2.0% | 1.6% | |

| SEFW01 | Beer, ale & other malt beverages at home | 0.1% | 0.7% | 1.7% | 3.5% | 3.0% | 2.7% | |

| SEFW02 | Distilled spirits at home | 0.6% | 1.8% | 0.7% | 1.4% | 1.7% | 1.0% | |

| SEFW03 | Wine at home | -0.7% | 0.8% | -0.5% | 1.0% | 1.2% | 0.8% | |

| SEHE | FUEL OIL & OTHER FUELS | -5.3% | -1.9% | -9.7% | -7.8% | 9.8% | 2.7% | |

| SAH3 | HOUSEHOLD FURNISHINGS & OPERATIONS | 0.7% | 2.0% | 1.7% | 1.9% | 3.8% | 2.0% | |

| SAA | APPAREL | -1.1% | 4.1% | 0.4% | 1.4% | 2.3% | 0.3% | |

| SAM1 | MEDICAL CARE COMMODITIES | 0.4% | 0.6% | 1.6% | 2.5% | 1.6% | 1.6% | |

| SEMF | Medicinal drugs | 0.4% | 0.7% | 1.8% | 2.4% | 1.5% | 1.6% | |

| SEMF01 | Prescription drugs | 0.4% | 0.8% | 2.8% | 1.9% | 1.1% | 1.7% | |

| SEMF02 | Nonprescription drugs | 0.5% | 0.4% | -0.3% | 3.9% | 2.8% | 1.2% | |

| SEMG | Medical equipment and supplies | 0.4% | -0.4% | -0.2% | 3.5% | 1.7% | 0.9% | |

| SAR | RECREATION | -0.1% | 1.7% | 1.7% | 2.7% | 2.9% | 1.9% | |

| SEEA | EDUCATIONAL BOOKS & SUPPLIES | -0.2% | 2.5% | 11.1% | 3.1% | 2.6% | 1.8% | |

| SEGA | TOBACCO & SMOKING PRODUCTS | 0.3% | 1.9% | 7.6% | 6.8% | 6.9% | 5.8% | |

| SEGB | PERSONAL CARE PRODUCTS | 0.1% | 1.4% | 0.4% | 3.2% | 2.3% | 1.0% | |

| SEGE | MISCELLANEOUS PERSONAL GOODS | 1.3% | 3.4% | 0.7% | 2.1% | 2.6% | 0.7% | |

| SAG | OTHER GOODS AND SERVICES | 0.3% | 2.1% | 4.6% | 4.8% | 4.6% | 3.4% | |

| SERE | Other recreational goods | 0.1% | 1.1% | -2.6% | -1.8% | -0.6% | -3.7% | |

| SERG | Recreational reading materials | -1.0% | 3.3% | 3.2% | 1.4% | 2.3% | 2.1% |

Make the decision to elect LIFO with the utmost confidence, fully understand the risks/rewards of LIFO, and simplify the LIFO due diligence process with our complimentary LIFO Election Benefit Analysis Report. This comprehensive case study uses proprietary inflation metrics to forecast your client’s election year and long-term tax benefits of LIFO and includes recommendations regarding whether a LIFO election should be made or deferred, and recommendations on the most practical and beneficial methods to use.

Sign up today to receive industry news & promotional offers from LIFO-PRO