The Inventory Price Index Computation (IPIC) method allows taxpayers to use published external indexes to calculate inflation for the purpose of valuing LIFO inventories. The IPIC method was first authorized by the IRS in 1982 in order to provide an approved method that would simplify LIFO calculations & make LIFO more accessible to smaller taxpayers.

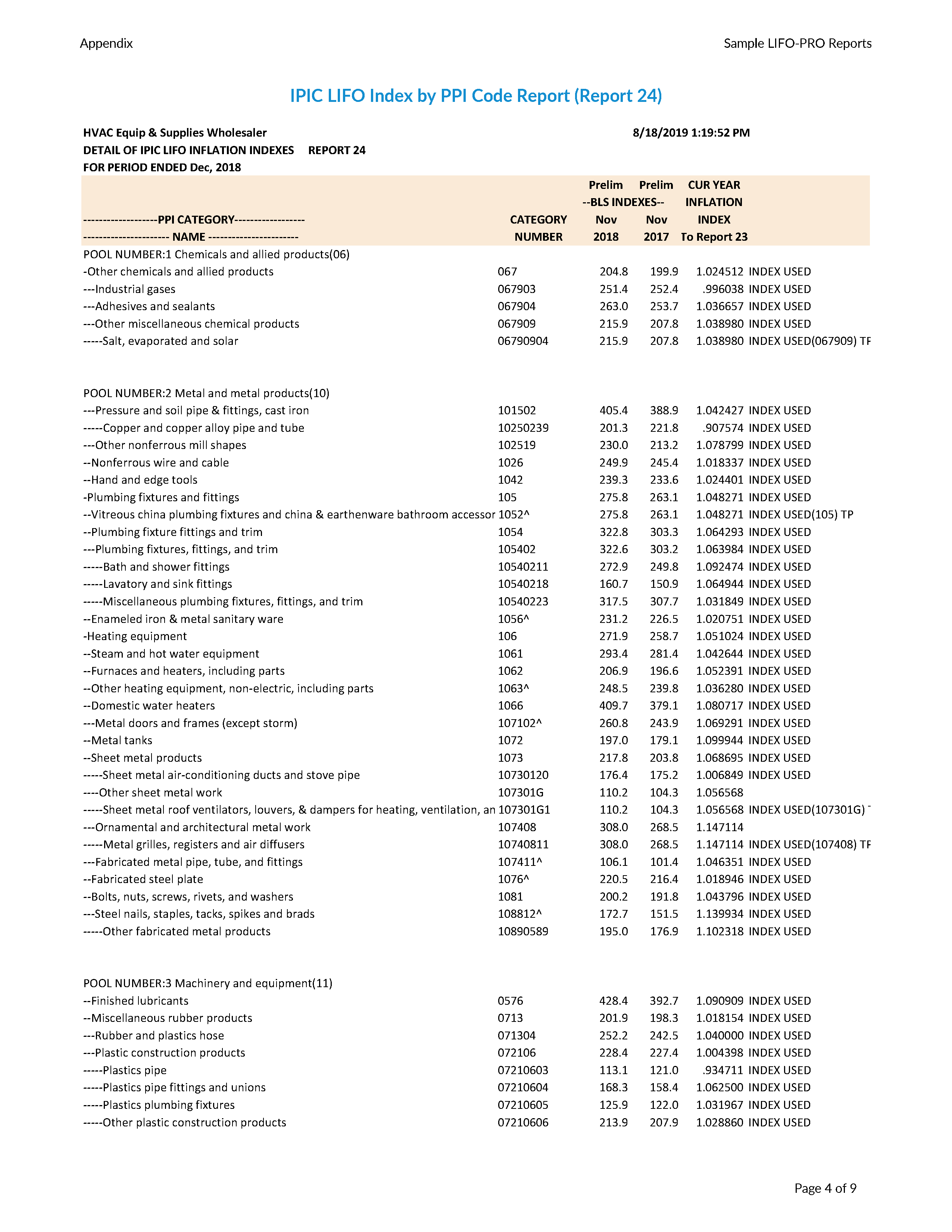

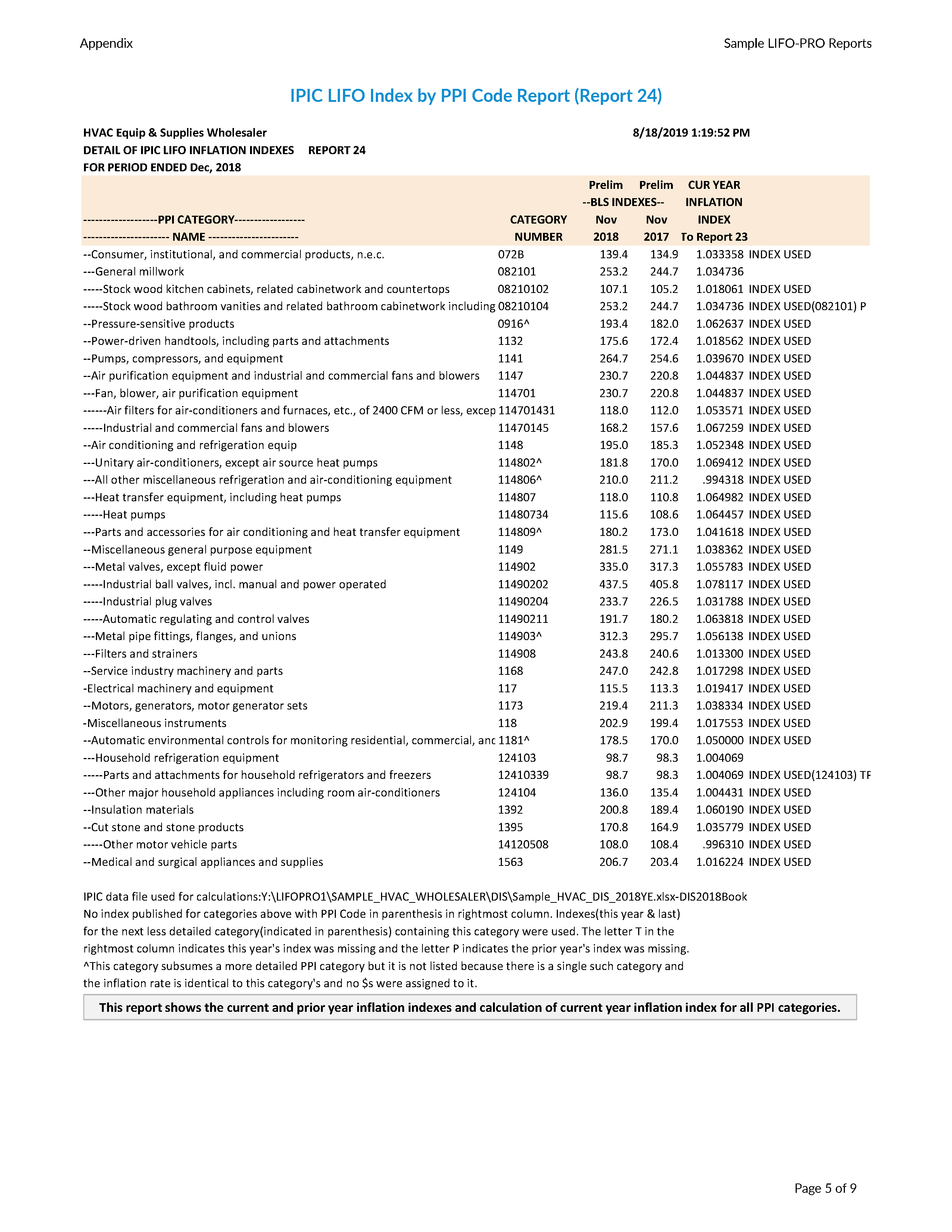

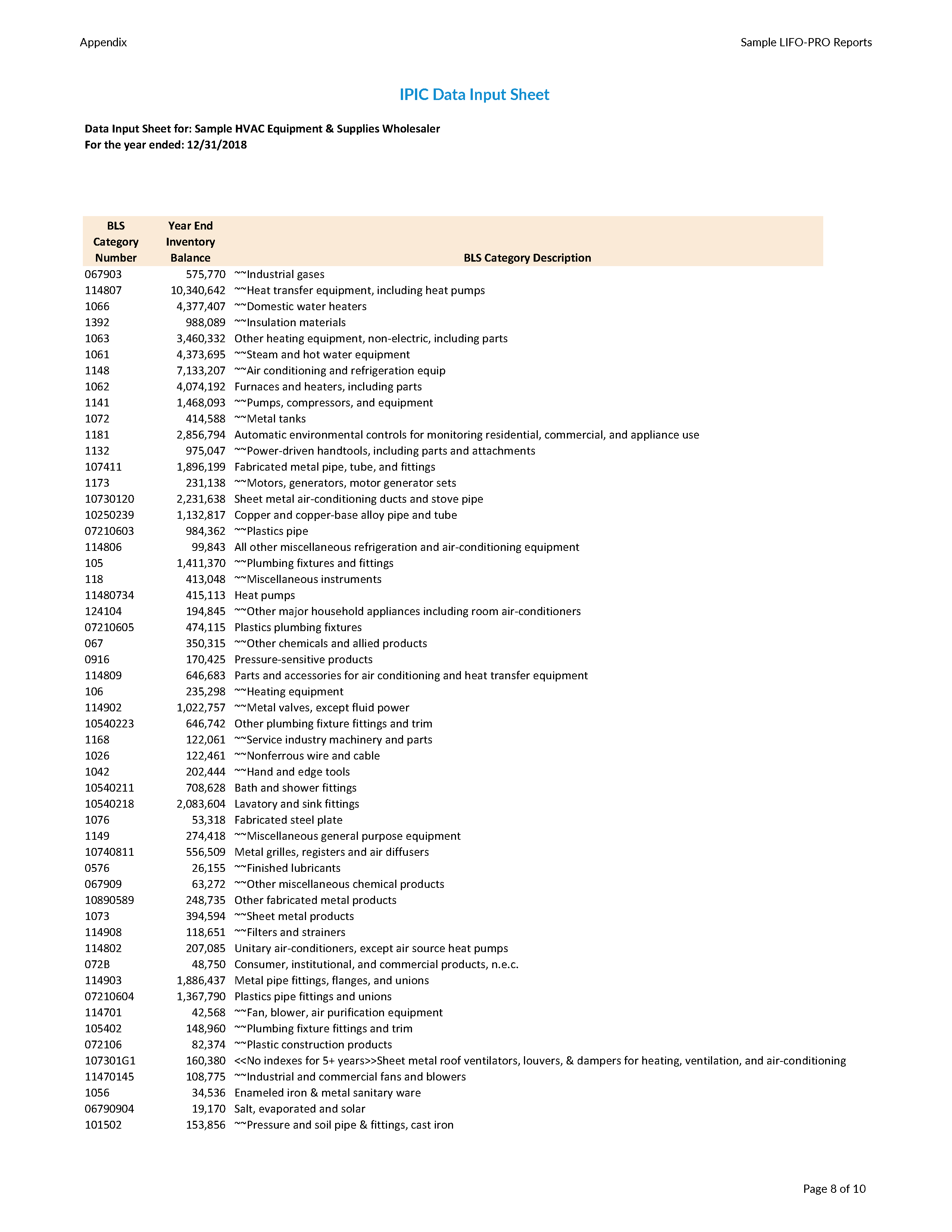

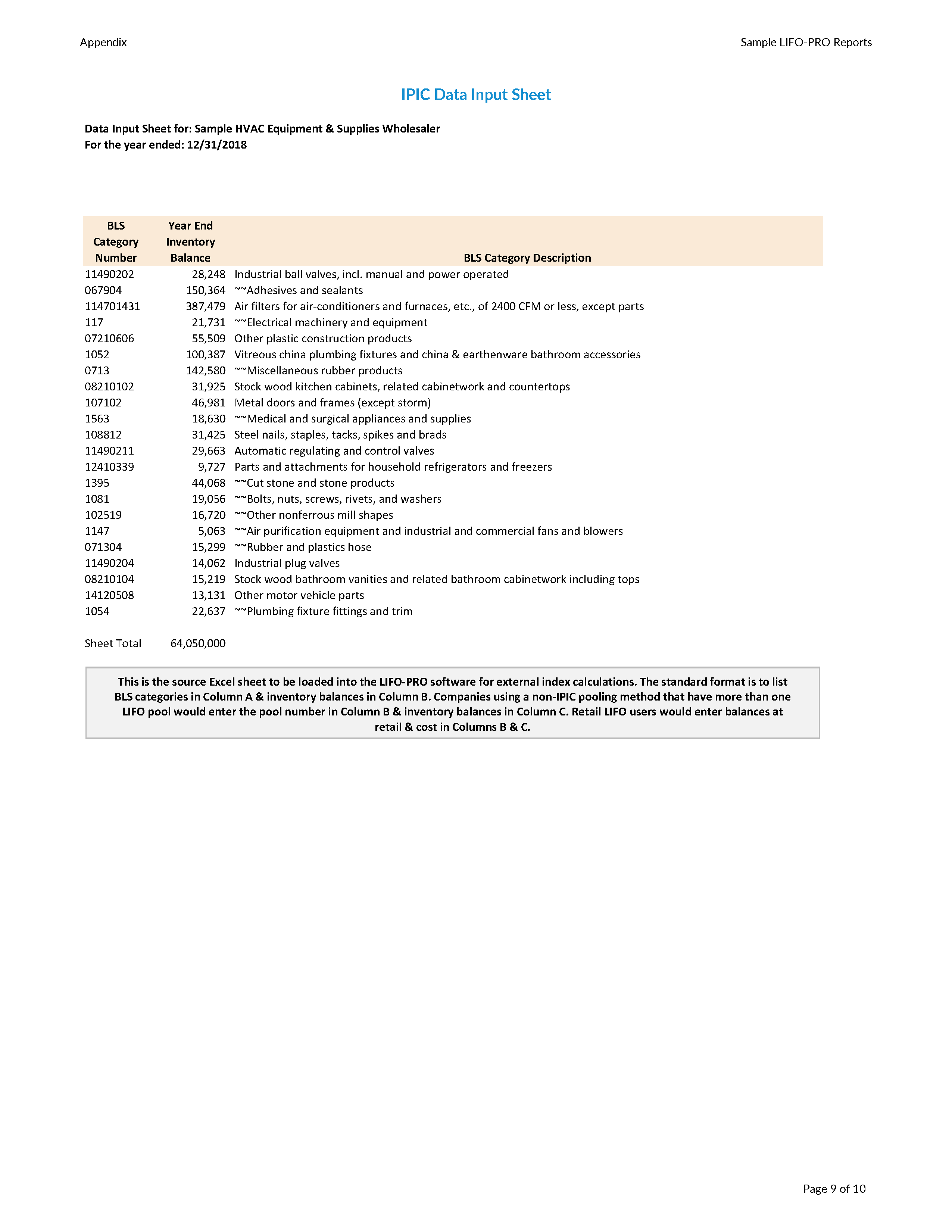

A taxpayer using the IPIC method must assign appropriate Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) or Producer Price Index (PPI) categories to inventory items in order to measure the amount of inflation used for LIFO calculations. Manufacturers & wholesalers are required to use PPI while retailers are allowed to use either CPI or PPI. These indexes are used to calculate category inflation indexes. Category inflation indexes are then weighted by inventory dollars (taxpayers using the optional 10% Method must also use BLS weights) to compute a current year inflation index for each pool. Taxpayers using the IPIC method can use the IPIC pooling method for which pools are created using broad CPI or PPI major groups (and not the individual categories). Use of the IPIC pooling method is not mandatory & other authorized pooing methods may be used. The pool cumulative indexes are used to deflate the inventory current-year cost (FIFO or average cost) to base period prices, which is then compared to the prior year’s inventory valued at base period prices. If the current year’s inventory at base is greater than the previous year’s inventory at base, the increment is multiplied by the pool cumulative inflation index to price the LIFO layer. If the current year’s inventory at base is less than the previous year’s inventory at base, the decrement erodes a previous layer (or multiple layers) & is priced using the index(es) originally used to price the layer(s).

On March 16, 1982 the Department of Treasury published IRS Reg. § 1.472-8(e)(3) as Treasury Decision 7814 regarding the IPIC method. This IPIC method is commonly referred to as “Simplified LIFO”. The Simplified LIFO term was first used by the IRS to refer to a method of using published indexes authorized by IRS Code §474 that could be used by very small businesses, originally defined as companies with three-year average annual gross receipts of $2 million (later revised to $5 million) or less. Very few taxpayers ever used this method & now the Simplified LIFO term is used by CPAs to describe the IPIC method. The purpose of the IPIC method is to simplify the use of LIFO accounting by allowing companies to use published indexes.

Since the 1940s the IRS has allowed broad line retailers (i.e., department stores & discount chains) to use published government indexes. The National Retail Federation contracted with the BLS to compile a special set of Department Store Indexes (DSI) as a subset of the Consumer Price Indexes (CPI). Broad line retailers could then use pools corresponding to the DSI categories & utilize one index per pool, which greatly simplified their LIFO calculations.

The prospect of using published indexes was very appealing to food retailers. In 1975 the Food Merchandisers LIFO Advisory Committee of the Food Marketing Institute (FMI) began to work towards the goal of gaining IRS approval for their members to use published indexes. The concept of using published indexes was appealing to food retailers for the same reasons it was to the broad lines retailers, i.e., because of the great difficulty in calculating internal inflation indexes. The cost to develop indexes specifically for food retailers was deemed to be too great & the use of a single Food at Home CPI for all goods would not have provided sufficient accuracy, so the committee devised what resulted in the IPIC Method regulations using existing published indexes & establishing rules to provide a good balance between precision & simplicity. In January 1983, the FMI published a booklet entitled Handbook for LIFO Tax Valuations Inventory Price Index Computation Method (IPIC) which was a guide for use of the IPIC Method for supermarket chains. Use of the IPIC method has allowed companies to avoid the onerous task of calculating internal indexes which is particularly difficult for smaller firms. The IPIC Method is not without its drawbacks. The 10 Percent method, which was mandatory in the original 1982 IPIC Regs., requires a complicated two-tiered weighting calculation in which multiple indexes for each pool were first weighted by BLS Weights of Relative Importance & then by actual inventory dollars. While small taxpayers were allowed to use 100% of the inflation calculated with the IPIC method, all other taxpayers were allowed to use only 80% for tax purposes.

On May 19, 2000 the IRS published proposed changes to the IPIC LIFO Regulations under Treasury Regulations Section 1.472-8(e)(3) & solicited comments regarding the proposed regulations. A public hearing was held in Washington, D.C. on September 15, 2000 on the proposed regulations.

On January 8, 2002 the IRS issued final Regulations § 1.472-8(e)(3) in Treasury Decision 8976. The following is a synopsis of most important changes encompassed in the new Regs:

Advantages

Disadvantages

LIFO Reserve Calculation – computation of increments/decrements, LIFO inventory, reserve & expense (income) values (detailed steps shown in LIFO Inventory Training Basics & Audit Guide

The Regs. permit retailers to choose either Consumer Price Indexes (CPI) or Producer Price Indexes (PPI). All other taxpayers must use PPI. The Table 2 CPI for All Urban Consumers (CPI-U): U. S. city average, by detailed expenditure category is used for CPI. The Table 9 PPIs for commodity and service groupings and individual items or Table 11. PPIs for the net output of industries and their products can be used for PPI. Use of PPI Table 11 indexes rather than Table 9 PPI is extremely rare because the main difference between these tables is in the organization (Table 9 is by commodity type & Table 11 is by industry) & there are Table 9 index categories corresponding to almost every Table 11 index category. The references in the Regs. to the PPI Detailed Report tables are Table 6 for commodities & Table 5 for industries. The BLS changed the numbers of these tables in 2014 so that Table 9 is now the commodities table & Table 11 is now the industries table.

Use of the IPIC pooling method is not mandatory for companies using the IPIC method. The following are alternative pooling methods provided by the IRS:

To maximize tax savings, companies should use as few pools as possible because this will reduce the likelihood of decrements because decreases in inventory values will be offset by increases in others for groupings of inventory items included in the same pool. Decrements result in lower-cost goods being included in cost of goods sold which increases taxable income.

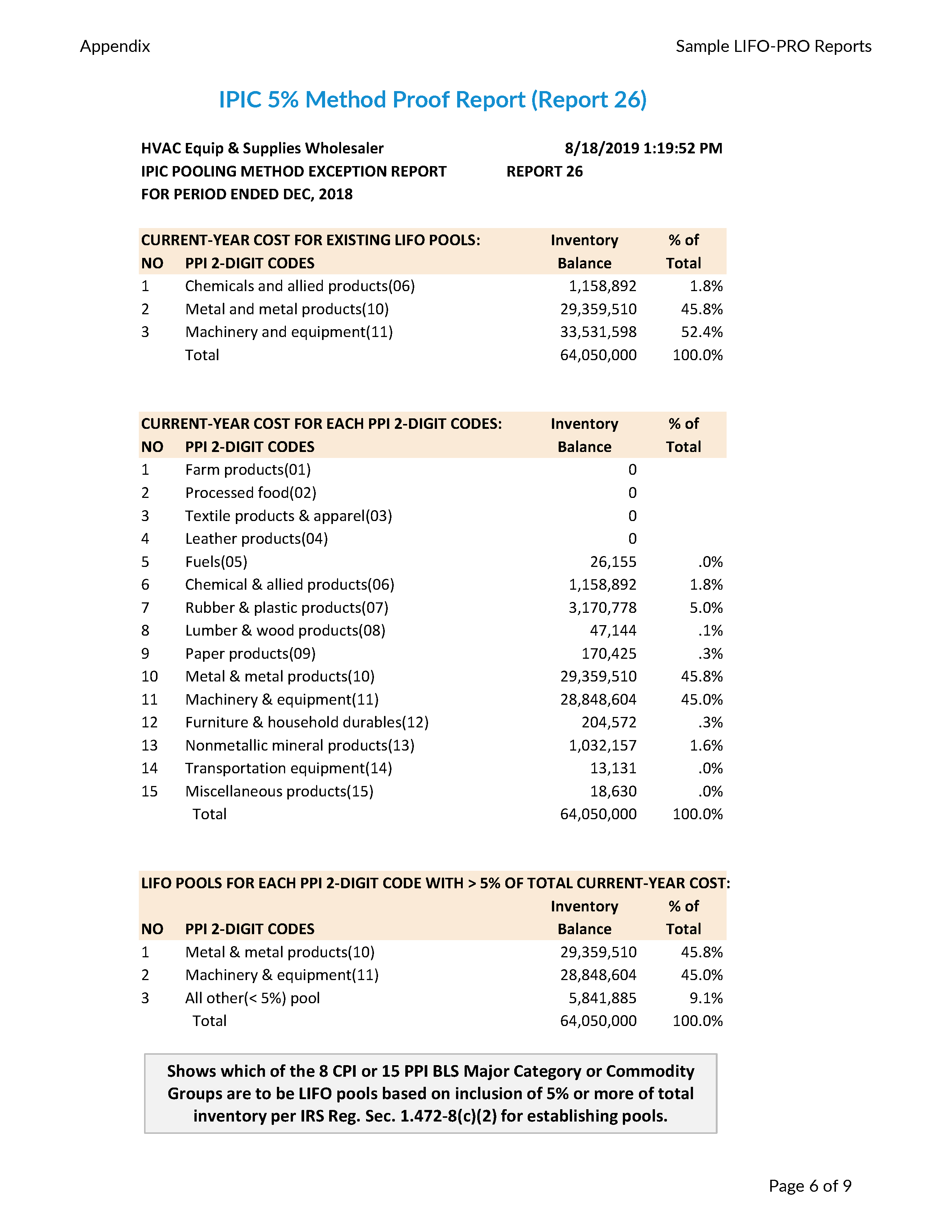

The IPIC method Regs. allow for IPIC LIFO taxpayers to optionally elect to use the IPIC LIFO pooling method. This method is referred to as the IPIC 5% pooling method. Under this method, pools are established for each PPI Table 9 2-digit category or CPI Major Group which includes 5% or greater of the taxpayer’s total FIFO inventory balances on LIFO. A single de minimis or all other pool will include the inventory balances represented by the less than 5% 2-digit PPI codes or CPI Major Group. If the total FIFO inventory balances for this all other pool is less than 5%, these 2-digit PPI codes or CPI Major Groups may be included in the largest pool. This determination is made upon election of the IPIC method & the Regs. provide for review of the pools used every other year in which case more or less pools may be required as determined by the same 5% rule.

Unlike for the PPI, the BLS does not introduce new CPI categories & discontinue old ones every three months. The BLS restructured the entire CPI series beginning in January 1998, though & similar restructurings may occur in the future.

The 2002 New Regs specified that LIFO taxpayers using Consumer Price Indexes & the IPIC Pooling Method should use the CPI major expenditure categories (i.e., major groups) as their IPIC pools. These Major Groups are not defined in the Regs. but appear to be these:

|

Pool # |

CPI Code | CPI Major Expenditure Group |

Pool Name |

| 1 | SAF | Food & Beverages | Food & Beverages |

| 2 | SEHE | Fuel Oil & Other Fuel | Housing |

| 2 | SAH3 | Household Furnishings & Operations | Housing |

| 3 | SAA | Apparel | Apparel |

| 4 | SAT1 | Private transportation (Inc. gasoline) | Transportation |

| 5 | SAM1 | Medical Care Commodities | Medical Care |

| 6 | SAR | Recreation | Recreation |

| 7 | SEEA | Educational Books & Supplies | Education & Communication |

| 7 | SEEE | Information & Information Processing | Education & Communication |

| 8 | SAG | Other Goods & Services | Other Goods & Services |

| 8 | SEGA | Tobacco & Smoking Products | Other Goods & Services |

| 8 | SEGB | Personal Care Products | Other Goods & Services |

| 8 | SEGE | Miscellaneous Personal Goods | Other Goods & Services |

Similar to IRS CPI Regs., taxpayers using Producer Price Indexes & the IPIC pooling Method should use the PPI major commodity groups as their IPIC LIFO pools, and are as follows:

| Pool # PPI Code | BLS PPI Major Commodity Group & Pool Name |

| 01 | Farm Products |

| 02 | Processed Foods & Feeds |

| 03 | Textile Products & Apparel |

| 04 | Hides, Skins, Leather & Related Products |

| 05 | Fuels & Related Products & Power |

| 06 | Chemicals & Allied Products |

| 07 | Rubber & Plastic Products |

| 08 | Lumber & Wood Products |

| 09 | Pulp, Paper, & Allied Products |

| 10 | Metal & Metal Products |

| 11 | Machinery & Equipment |

| 12 | Furniture & Household Durables |

| 13 | Nonmetallic Mineral Products |

| 14 | Transportation Equipment |

| 15 | Miscellaneous Products |

Each two-digit General Category is comprised of successively more-detailed three-digit, four-digit, six-digit, & eight-digit categories. For example, the 02 – Processed foods & feeds PPI category includes 9 three-digit categories:

Three-digit 02 – Processed foods & feeds categories

| PPI Code | PPI Commodity Name |

| 021 | Cereal & bakery products |

| 022 | Meats, poultry, & fish |

| 023 | Dairy products |

| 024 | Processed fruits & vegetables |

| 025 | Sugar & confectionery |

| 026 | Beverages & beverage materials |

| 027 | Fats & oils |

| 028 | Miscellaneous processed foods |

| 029 | Prepared animal feeds |

Four-digit 021 – Cereal & bakery product categories

| PPI Code | PPI Commodity Name |

| 0211 | Bakery products |

| 0212 | Flour & flour base mixes & doughs |

| 0213 | Milled rice |

| 0214 | Other cereals |

Six-digit 0211 – Bakery product categories

| PPI Code | PPI Commodity Name |

| 021101 | White pan bread |

| 021104 | Other bread |

| 021105 | Bread type rolls |

| 021107 | Sweet yeast goods |

| 021108 | Soft cakes |

| 021109 | Pies |

| 021121 | Cookies, crackers, & related products |

Eight-digit 021104 – Other bread categories

| PPI Code | PPI Commodity Name |

| 02110401 | White hearth bread |

| 02110402 | Dark wheat bread |

| 02110404 | Other variety bread |

There are changes made every three months in the PPI codes published by the BLS. Some of the PPI codes shown in this section have been discontinued since this guide was first written but they are used here to illustrate how the hierarchy of PPI codes is organized.

PPI Most-Detailed Categories

A most-detailed category is one that does not include any other categories. Eight-digit categories are always most-detailed categories. There are numerous most-detailed categories, however, that have fewer than eight digits. 021101 White pan bread is a six-digit category that does not include any eight-digit categories, hence it is a most-detailed category. 0232 Butter & 0234 Ice cream & frozen desserts are each examples of four-digit categories that are most-detailed categories because they do not include any six-digit categories. Sometimes three-digit categories are considered most-detailed categories because they include only four-digit & six-digit categories with the same category name (e.g., 138 Glass containers consists entirely of 1381 Glass containers & 138101 Glass containers); in these cases, the three, four, & six-digit categories will have identical indexes & BLS weights. Because of this, which categories are most-detailed categories cannot be determined based simply on the number of digits in the commodity code.

The IRS Regs. describe an optional method that taxpayers may use for assigning inventory items to BLS categories & for determining category inflation indexes called the 10 Percent method. The 10 Percent method is intended to simplify the use of the IPIC method by allowing taxpayers to sort their inventories into fewer, less-detailed categories than are required for the alternative Most-Detailed Categories method. While the 10 Percent method makes the task of assigning inventory to BLS categories less burdensome, there is a trade-off involved because the math required to calculate category inflation indexes is more complex. The Regs. require taxpayers electing to use the 10 Percent method to first weight inflation indexes with BLS weights, then with inventory dollars. Taxpayers using the Most-Detailed Categories method only use inventory dollars to weight inflation indexes.

Taxpayers are allowed to select either the 10 Percent method or the Most-Detailed Categories method for assigning BLS categories to their inventory dollars & calculating pool indexes. Many retailers still use the retail inventory method & do not have inventory systems that allow them to track the actual costs of specific goods at their stores. Requiring taxpayers to sort inventory into most-detailed categories, therefore, would have been a formidable burden for most retailers. The real value of the 10 Percent method is that it allows taxpayers carrying many different inventory items to reduce the burden of assigning all of their IPIC LIFO inventories to BLS categories.

LIFO-PRO, Inc. has performed numerous pro-forma calculations comparing the results of the two methods & over time there is little difference. As a practical matter, taxpayers should consider the following when deciding which index calculation method to use:

Regs. § 1.472-8(e)(3)(iii)(C)(1) states that taxpayers using the Most-Detailed Categories method “must assign each item in a dollar-value pool to the most-detailed BLS category of the selected BLS table that contains that item.” This simply means that all inventory items must be assigned to each most-detailed category of the BLS table selected by the taxpayer (CPI or PPI) for items that are present in inventory. To think of it more simplify, BLS category assignment under this method must be performed on an item by item basis.

| 10% Method | Most-Detailed | |||

| Consideration | Pro | Con | Pro | Con |

| BLS category assignment simplification | ✓ | |||

| BLS category assignment complexity | ✓ | |||

| Pool index calculation complexity | ✓ | |||

| Pool index calculation simplification | ✓ | |||

IPIC Regs. § 1.472-8(e)(3)(iii)(C)(2) describe a three-step process to assign inventory items to BLS categories when using the 10 Percent method:

In addition, Regs. § 1.472-8(e)(3)(iii)(D)(5) defines a less-detailed category (in the context of determining a category inflation index) as a BLS category that:

A) subsumes (i.e., includes, or incorporates in a more comprehensive category) two or more BLS categories;

B) does not have a single assigned item whose current-year cost is 10% or more of the current-year cost of all items in the dollar-value pool;

C) has at least one item in at least one of the subsumed BLS categories; and

D) has at least one subsumed BLS category that either does not have any assigned items or is a separate 10% BLS category.

Based on these Regs. sections, three types of index categories may be identified:

A taxpayer that uses the 10 Percent method does not need to break down their inventory dollars to the level of greatest detail but it is necessary to account for whether the most-detailed categories actually have items present in inventory. The reason for this is that only the indexes & BLS weights of categories actually present are used for pool index calculations. If category representation is not performed, the BLS weights for items present within a company’s product mix may not be included in the LIFO calculation. Similarly, failing to perform category representation may cause BLS the BLS weights for items not present within a company’s product mix to be included in the LIFO calculation. For this reason alone, it’s highly recommended to use software when using the 10 Percent method.

Assigning inventory dollars to BLS categories is a data-gathering process that precedes pool index calculations. The mechanics of the 10 Percent method pool index calculations determines the appropriate BLS category assignments when using the 10% method. This means that changes in the inventory mix or pooling may require assigning different BLS categories if using the 10% method.

Example 1 – CPI: This company uses CPI & does not have fuels on LIFO. The following CPI Major Groups each include at least 5% of the total FIFO inventory balances:

| Pool # | CPI Code | CPI Category Name | CPI Major Expenditure Group |

| 1 | SAF | Food & Beverages | Food & Beverages |

| 2 | SAG | Other Goods & Services | Other Goods & Services |

| 2 | SEGA | Tobacco & Smoking Products | Other Goods & Services |

| 2 | SEGB | Personal Care Products | Other Goods & Services |

| 2 | SEGE | Miscellaneous Personal Goods | Other Goods & Services |

| 3 | – | All Other Goods | All Other Goods* |

*The sum of the other six Major Groups’ FIFO inventory balances is greater than 5% of total inventory, so they will be combined in a third All other goods pool.

Pool 1 Food & Beverages BLS CPI 10% Categories

| CPI Code | CPI Category Name |

| SAF111 | Cereals & bakery products |

| SAF112 | Meats, poultry, fish & eggs |

| SEFJ | Dairy & related products |

| SAF113 | Fruits & vegetables |

| SAF114 | Nonalcoholic beverages & beverage materials |

| SEFN01 | Carbonated drinks |

| SAF115 | Other food at home |

| SEFR02 | Candy & chewing gum |

| SEFT03 | Snacks |

| SEFW | Alcoholic beverages at home |

Pool 2 Other Goods & Services BLS 10% Categories

| CPI Code | CPI Category Name |

| SEGA01 | Cigarettes |

| SEGA02 | Tobacco products other than cigarettes |

| SEGB | Personal care products |

| SEGE | Miscellaneous personal goods |

Pool 3 All Other Goods 10% Categories:

| CPI Code | CPI Category Name |

| SAH | Housing |

| SEHN01 | Household cleaning products |

| SEHN02 | Household paper products |

| SEHN03 | Miscellaneous household products |

| SAA | Apparel |

| SETC02 | Vehicle accessories other than tires |

| SAM | Medical care |

| SEMB01 | Internal & respiratory over-the-counter drugs |

| SAR | Recreation |

| SERG | Recreational reading materials |

| SAE | Education & communication |

This company uses PPI & has fuels on LIFO. The following PPI 2-digit codes each include at least 5% of the total FIFO inventory balances:

| Pool # | PPI Code | PPI Major Commodity Group/Name |

| 1 | 02 | Processed foods & feeds |

| 2 | 05 | Fuels & related products & power |

| 3 | 06 | Chemicals & allied products |

| 4 | 15 | Miscellaneous products |

The sum of the other 11 PPI 2-digit codes inventory balances is less than 5% of total inventory balances so they will be included with the largest pool.

Pool 1 Processed Foods & Feeds (02) & All Other 10% Categories

| PPI Code | PPI Commodity Name |

| 01 | Farm products |

| 02 | Processed foods & feeds |

| 025503 | Candy & nuts |

| 0261 | Alcoholic beverages |

| 02620609 | Noncarbonated soft drinks |

| 026207 | Bottled carbonated soft drinks |

| 02890172 | Chips (potato, corn, etc.) |

| 03 | Textile products & apparel |

| 04 | Hides, skins, leather & related products |

| 07 | Rubber & plastic products |

| 08 | Lumber & wood products |

| 09 | Pulp, paper & allied products |

| 10 | Metal & metal products |

| 11 | Machinery & equipment |

| 12 | Furniture & household durables |

| 13 | Nonmetallic mineral products |

| 14 | Transportation equipment |

025503 Candy & nuts, 02620609 Noncarbonated soft drinks, 026207 Bottled carbonated soft drinks, & 02890172 Chips (potato, corn, etc.) will each probably include at least 10% of Pool 1’s inventory balances. 0261 Alcoholic beverages includes canned & bottled beer & other malt beverages, wine, & distilled spirits. If any of those categories of alcoholic beverages is likely to include 10% of the pool total, then more detailed categories should be used for BLS category assignment to inventory items. 02 Processed foods & feeds can be used for BLS category assignment to inventory items that are all other food & beverage categories because the pool’s 10% threshold is not likely to be met by aggregating (“rolling up”) inventory balances at any four-digit or three-digit level included in the 02 PPI 2-digit code. Similarly, all other inventory in Pool 1 can be sorted at the 2-digit level because no other PPI 2-digit code will likely include 10% or more of the pool total. In fact, some of these PPI 2-digit codes will probably not have any inventory balances—10 Metal & metal products & 13 Nonmetallic mineral products, for example.

Pool 2 Fuels & Related Products & Power (05) 10% Categories

| PPI Code | PPI Commodity Name |

| 057103 | Unleaded premium gasoline |

| 057104 | Unleaded regular gasoline |

| 057105 | Unleaded mid-premium gasoline |

| 057303 | #2 diesel fuel |

| 057604 | Lubricating & similar oils |

Each of these are likely to include 10% of the pool total.

Pool 3 Chemicals & Allied Products (06) 10% Categories

| PPI Code | PPI Commodity Name |

| 06 | Chemicals & allied products |

| 0638 | Pharmaceutical preparations |

| 0675 | Cosmetics & other toilet preparations |

It may be necessary to use one or more 8-digit category included in 0638 for BLS category assignment to inventory items. For example, if 063802 Central nervous system, 063805 Respiratory system, & 063807 Vitamins, nutrients & hematinic preparations were each more than 10% of the pool total then those would be used as BLS categories & all other pharmaceutical preparations would be assigned into 0638.

Pool 4 Miscellaneous Products (15) 10% Categories

| PPI Code | PPI Commodity Name |

| 15 | Miscellaneous products |

| 152101 | Cigarettes |

| 15250101 | Other tobacco products |

152101 Cigarettes & 15250101 Other tobacco products are most detailed categories that are likely to include 10% of the pool total. All other goods in this pool can be can be assigned 2-digit BLS PPI codes.

The math involved in the pool index calculations is simpler with this method because it is not necessary to use BLS Weights & perform 10% roll-ups. A typical retail grocer using this method would need to sort their inventory by approximately 80 CPI categories. Pool index calculations can be summarized by these three steps:

Example 1 – CPI

A Convenience Store chain using CPI & the Most Detailed Categories method sorted their Other goods & services pool’s inventory into the following categories:

| (1) | ||

| CPI Code | Category Name |

Y/E FIFO $s |

| SAG | OTHER GOODS & SERVICES | |

| SEGA | Tobacco & smoking products | |

| SEGA01 | Cigarettes | 9,875,000 |

| SEGA02 | Tob. products other than cigarettes | 1,500,000 |

| SEGB | Personal care products | |

| SEGB01 | Hair, dental, shaving & misc. | 325,000 |

| SEGB02 | Cosmetics, perfume, bath, nail prep. | 300,000 |

| SEGE | Misc. personal goods | 500,000 |

| Current-Year Cost Pool Total | $12,500,000 |

The current year indexes are then divided by the previous year indexes for each category, which produces the December 2004-to-December 2005 inflation index expressed as a decimal.

|

|

(2) | (3) | (4) |

|

= (2) ÷ (3) |

|||

|

CPI |

CPI |

Category | |

| Code | Dec-05 | Dec-04 |

Inflation |

| SEGA01 | 207.6 | 196 | 1.059184 |

| SEGA02 | 154.6 | 147.1 | 1.050986 |

| SEGB01 | 102.1 | 101.7 | 1.003933 |

| SEGB02 | 173.1 | 169.2 | 1.02305 |

| SEGE | 86.4 | 86.6 | 0.997691 |

The FIFO inventory amounts for each category are then divided by category inflation to calculate harmonic dollar-weighted extensions.

| (1) | (4) | (5) | |

| = (1) ÷ (4) | |||

| Harmonic | |||

| CPI | Category | $ – Wtd. | |

| Code | Y/E FIFO $s | Inflation | Extension |

| SEGA01 | 9,875,000 | 1.059184 | 9,323,218 |

| SEGA02 | 1,500,000 | 1.050986 | 1,427,232 |

| SEGB01 | 325,000 | 1.003933 | 323,727 |

| SEGB02 | 300,000 | 1.02305 | 293,241 |

| SEGE | 500,000 | 0.997691 | 501,157 |

| CYC Total | $12,500,000 | $11,868,574 | |

The last step is to divide the total pool FIFO balances by the sum of the harmonic dollar-weighted extensions.

| Y/E FIFO $s (CYC) | ÷ Sum of Extensions | = Pool Inflation Index |

| $12,500,000 | $11,868,574 | 1.053201 |

This pool index will then be multiplied times the previous year’s cumulative deflator index to produce the current year’s cumulative deflator index for this pool.

| (1) | ||

| PPI Code | Category Name | Y/E FIFO $s |

| 15 | MISC. PRODUCTS | |

| 15110154 | Toys, excl. games & hobbies | 40,000 |

| 15110156 | Dolls & stuffed toy animals | 60,000 |

| 152101 | Cigarettes | 9,875,000 |

| 15250101 | Other tobacco products | 1,500,000 |

| 1542 | Photographic supplies | 150,000 |

| 159404 | Costume jewelry & novelties | 50,000 |

| 15950201 | Ball point pens, incl. roller pens | 75,000 |

| 15950208 | Markers, fn. pnt. & brd. tipped | 5,000 |

| 15960313 | Watches, clocks, cases, & parts | 20,000 |

| 159A0901 | Other misc. products, n.e.c. | 50,000 |

| 159C0101 | Reproduction of audio discs & video | 50,000 |

| Current-year Cost Pool Total | $11,875,000 |

Using a December “appropriate month”, the current & prior period indexes are divided for each category, which produces the December 2004 to December 2005 inflation index as a decimal. This example includes two instances of missing indexes, which are common when using PPI. A preliminary index for December 2005 was not published for15110154 Toys, etc. so the current year & previous year indexes for the next less detailed category, 151101 Toys, games, & children’s vehicles were used. 15250101, 152501 & 1525 were introduced in December 2005, so there are no previous year indexes for those categories. The current year & previous year indexes for 152 Tobacco products, incl. stemmed & redried were used instead.

| (2) | (3) | (4) | |

| = (2) ÷ (3) | |||

| PPI | PPI | Category | |

| Code | Dec-05 | Dec-04 | Inflation |

| 15110154 | 127 | 125.9 | 1.008737 |

| 15110156 | 127.7 | 124.4 | 1.026527 |

| 152101 | 548.5 | 516.3 | 1.062367 |

| 15250101 | 460.8 | 435.2 | 1.058824 |

| 1542 | 120.9 | 114.8 | 1.053136 |

| 159404 | 153.5 | 147.8 | 1.038566 |

| 15950201 | 163.2 | 157.5 | 1.03619 |

| 15950208 | 127.1 | 122.2 | 1.040098 |

| 15960313 | 131.4 | 130.4 | 1.007669 |

| 159A0901 | 140.2 | 139.3 | 1.006461 |

| 159C0101 | 98.7 | 98.2 | 1.005092 |

The FIFO balances for each category are then divided by the category inflation indexes to calculate harmonic dollar-weighted extensions or current year inventory balances deflated to balances expressed in prior year prices.

| (1) | (4) | (5) | |

| = (1) ÷ (4) | |||

| Harmonic | |||

| PPI | Category | $ – Wtd. | |

| Code | Y/E FIFO $s | Inflation | Extension |

| 15110154 | 40,000 | 1.008737 | 39,654 |

| 15110156 | 60,000 | 1.026527 | 58,449 |

| 152101 | 9,875,000 | 1.062367 | 9,295,283 |

| 15250101 | 1,500,000 | 1.058824 | 1,416,667 |

| 1542 | 150,000 | 1.053136 | 142,432 |

| 159404 | $50,000 | 1.038566 | 48,143 |

| 15950201 | 75,000 | 1.03619 | 72,381 |

| 15950208 | 5,000 | 1.040098 | 4,807 |

| 15960313 | 20,000 | 1.007669 | 19,848 |

| 159A0901 | 50,000 | 1.006461 | 49,679 |

| 159C0101 | 50,000 | 1.005092 | 49,747 |

| CYC Total | $11,875,000 | $11,197,089 | |

The last step is to divide the total pool FIFO dollars by the sum of the harmonic dollar-weighted extensions.

| Y/E FIFO $s (CYC) | ÷ Sum of Extensions | = Pool Inflation Index |

| $11,875,000 | $11,197,089 | 1.060544 |

This pool index will then be multiplied times the previous year’s cumulative deflator index to produce the current year’s cumulative deflator index for this pool.

The 10 Percent method was devised to provide a happy medium between pool index calculation simplicity & the effort required to sort inventories by CPI & PPI categories. Pool Inventory Price Index (IPI) calculations can be summarized by these four steps:

The PPI categories in Table 9 represent a market basket of goods & BLS weights are a measure of each categories’ relative weight, of price data sampled by the BLS, in proportion to the entire market basket. As an example, the BLS weight of 02 PROCESSED FOODS & FEEDS is equal to the sum of the BLS weights for the 9 three-digit categories that are included in that General Category.

| PPI Code | PPI Commodity Name | 2003 BLS Weight | % of Total |

| 02 | PROCESSED FOODS & FEEDS | 9.911 | |

| 021 | Cereal & bakery products | 1.143 | 11.53% |

| 022 | Meats, poultry, & fish | 2.575 | 25.98% |

| 023 | Dairy products | 1.144 | 11.54% |

| 024 | Processed fruits & vegetables | 0.575 | 5.80% |

| 025 | Sugar & confectionery | 0.651 | 6.57% |

| 026 | Beverages & beverage materials | 1.539 | 15.53% |

| 027 | Fats & oils | 0.265 | 2.67% |

| 028 | Miscellaneous processed foods | 1.26 | 12.71% |

| 029 | Prepared animal feeds | 0.759 | 7.66% |

| Sum of 3-digit 02 categories BLS Weights | 9.911 | 100% | |

To illustrate the practical implications of the use of BLS weights for IPIC calculations using the 10 Percent method, consider the following example in which the inflation index (current-year appropriate month price index divided by previous-year appropriate month price index) for 021104 Other bread is equal to the sum of the BLS-weighted inflation indexes for the 3 eight-digit categories included in 021104.

| (1) | (2) | (3) | (4) | (5) | (6) | ||

| = (1) ÷ ∑ (1) | = (3) ÷ (4) | = (2) x (5) | |||||

| PPI Code | PPI Commodity Name | 2003 BLS Weight | Relative Weight (% of Total) | July ’04 PPI | July ’03 PPI | Inflation Index | BLS Weighted Extension |

| 021104 | Other bread | 0.08 | 202.4 | 203.2 | 0.99606 | ||

| 02110401 | White hearth bread | 0.03 | 37.50% | 216.2 | 220.6 | 0.98005 | 0.36752 |

| 02110402 | Dark wheat bread | 0.03 | 37.50% | 190.1 | 194.5 | 0.97738 | 0.36652 |

| 02110404 | Other variety bread | 0.02 | 25.00% | 202.7 | 193.4 | 1.04809 | 0.26202 |

| BLS Weights Sum = | 0.08 | 0.99606 |

The preceding example is mathematically identical to the following computation in which the percent-to-totals (a.k.a., relative weighting) in Column (2) are eliminated, the BLS weights are multiplied times the inflation indexes to produce BLS weighted extensions, & the sum of the BLS weights is divided by the sum of the BLS weighted extensions.

| (1) | (2) | (3) | (4) | (5) | ||

| = (2) ÷ (3) | = (1) x (4) | |||||

| PPI Code | PPI Commodity Name | 2003 BLS Weight | July ’04 PPI | July ’03 PPI | Inflation Index | BLS Weighted Extension |

| 021104 | Other bread | 0.08 | 202.4 | 203.2 | 0.99606 | |

| 02110401 | White hearth bread | 0.03 | 216.2 | 220.6 | 0.98005 | 0.02940 |

| 02110402 | Dark wheat bread | 0.03 | 190.1 | 194.5 | 0.97738 | 0.02932 |

| 02110404 | Other variety bread | 0.02 | 202.7 | 193.4 | 1.04809 | 0.02096 |

| BLS Weights Sum = | 0.08 | 0.07968 | ||||

| BLS Weighted Extensions Sum ÷ BLS Weights Sum = | 0.99606 | |||||

These examples demonstrate that the inflation indexes of less-detailed categories are derived from the BLS weights & inflation indexes of the more-detailed categories they include. This means that if the 10 Percent method is used, rather than weighting the inflation indexes of 02110401, 02110402, & 02110404 with their respective BLS weights, then dividing the sum of the BLS weighted extensions by the sum of the BLS weights, the inflation index of 021104 can be used if each of the categories 021104 includes are present in inventory. If any of the three 8-digit categories included in 021104 is not present in the ending inventory (a single item, in this case a loaf of bread, is sufficient for the category to be considered present in inventory), then the inflation index for 021104 must be calculated using the inflation indexes & BLS weights of the more-detailed categories which are actually present in inventory.

BLS weighting is only used for categories which represent less than 10% of the pool’s total FIFO dollars. For categories representing an amount greater than 10% of the pool total, their inflation indexes are weighted only by the inventory dollars assigned to them.

Example 1- CPI

This example shows a pool index calculation using CPI & the Ten Percent method. The pool’s total FIFO inventory balance is $23,500,000 so the 10% threshold is $2,350,000. For inventory balances assigned to a 10% category, an “X” indicates that a category has items present in inventory & an “*” (asterisk) indicates that a category has no items present in inventory:

| (1) | ||

| CPI Code | Category Name | Y/E FIFO $s |

| SAF | FOOD & BEVERAGES: | |

| SAF11 | -Food at home: | |

| SAF111 | –Cereals & bakery products: | 1,880,000 |

| SEFA | —Cereals & cereal products: | |

| SEFA01 | —-Flour & prepared flour mix | X |

| SEFA02 | —-Breakfast cereal | X |

| SEFA03 | —-Rice, pasta, cornmeal | X |

| SEFB | —Bakery products: | |

| SEFB01 | —-Bread | X |

| SEFB02 | —-Fresh biscuits, rolls, muff. | X |

| SEFB03 | —-Cakes, cupcakes & cook. | X |

| SEFB04 | —-Other bakery products | X |

| SAF112 | –Meats, poultry, fish & eggs: | 1,645,000 |

| SAF1121 | —Meats, poultry & fish: | |

| SAF11211 | —-Meats: | |

| SEFC | —–Beef & veal: | |

| SEFC01 | ——Uncooked ground beef | * |

| SEFC02 | ——Uncooked beef roasts | * |

| SEFC03 | ——Uncooked beef steaks | * |

| SEFC04 | ——Uncooked other beef & veal | * |

| SEFD | —–Pork: | |

| SEFD01 | ——Bacon, brkfst. saus. & rel. | X |

| SEFD02 | ——Ham | * |

| SEFD03 | ——Pork chops | * |

| SEFD04 | ——Other pork, incl. roasts | * |

| SEFE | —–Other meats | X |

| SEFF | —-Poultry: | |

| SEFF01 | —–Chicken | * |

| SEFF02 | —–other poultry incl. turkey | * |

| SEFG | —-Fish & seafood: | |

| SEFG01 | —–Fresh fish & seafood | * |

| SEFG02 | —–Processed fish & seafood | X |

| SEFH | —Eggs | X |

| SEFJ | –Dairy & related products: | 1,410,000 |

| SEFJ01 | —Milk | X |

| SEFJ02 | —Cheese & related products | X |

| SEFJ03 | —Ice cream & related products | X |

| SEFJ04 | —Other dairy & related | X |

| SAF113 | –Fruits & vegetables: | 705,000 |

| SAF1131 | —Fresh fruits & vegetables: | |

| SEFK | —-Fresh fruits: | |

| SEFK03 | —–Citrus fruits | * |

| SEFK04 | —–Other fresh fruits | * |

| SEFL | —-Fresh vegetables: | |

| SEFL01 | —–Potatoes | * |

| SEFL02 | —–Lettuce | * |

| SEFL03 | —–Tomatoes | * |

| SEFL04 | —–Other fresh vegetables | * |

| SEFM | —Processed fruits & veg. | |

| SEFM01 | —-Canned fruits & veg. | X |

| SEFM02 | —-Frozen fruits & veg. | X |

| SEFM03 | —-other proc. fruits & veg. | X |

| SAF114 | –Nonalc. bev. & bev. mat. | 3,055,000 |

| SEFN | —Juices & nonalc. drinks: | |

| SEFN01 | —-Carbonated drinks | 3,525,000 |

| SEFN02 | —-Frozen noncarb. juic. & dr. | X |

| SEFN03 | —-Nonfr. Noncarb. juic. & dr. | X |

| SEFP | —Bev. mat. Incl. coffee & tea | |

| SEFP01 | —-Coffee | X |

| SEFP02 | —-Other bev. mat. incl. tea | X |

| SAF115 | –Other food at home: | 2,115,000 |

| SEFR | —Sugar & sweets: | |

| SEFR01 | —-Sugar & artific. sweeteners | X |

| SEFR02 | —-Candy & chewing gum | 3,760,000 |

| SEFR03 | —-Other sweets | X |

| SEFS | —Fats & oils: | |

| SEFS01 | —-Butter & margarine | X |

| SEFS02 | —-Salad dressing | X |

| SEFS03 | —-Other fats & oils incl. p.b. | X |

| SEFT | —Other foods: | |

| SEFT01 | —-Soups | X |

| SEFT02 | —-Frozen & freeze dried prep. | X |

| SEFT03 | —-Snacks | 2,820,000 |

| SEFT04 | —-Spices, etc. | X |

| SEFT05 | —-Baby food | X |

| SEFT06 | —-Other miscellaneous foods | X |

| SEFW | -Alcoholic beverages at home: | 2,585,000 |

| SEFW01 | –Beer, ale & other malt bev. | X |

| SEFW02 | –Distilled spirits at home | X |

| SEFW03 | –Wine at home | X |

| Pool Current-Year Cost Total | $23,500,000 |

X = item present; * = not present (BLS weights are included in index computation for items present & are excluded for items not present)

Four category inflation index calculations will not require the use of BLS weights. Three most-detailed categories: EFN01 Carbonated drinks, SEFR02 Candy & chewing gum & SEFT03 Snacks exceed the 10% threshold so category inflation & harmonic dollar-weighted extensions are calculated for these categories without using BLS weights. The inventory balances aggregated at SEFW exceed 10% of the pool total & all categories included in it (SEFW01, SEFW02 & SEFW03) are present in inventory so SEFW’s category inflation index is also calculated without using BLS weights. The calculations for these category inflation indexes are shown below.

| (2) | (3) | (4) | |

| = (2) ÷ (3) | |||

| CPI | CPI | Category | |

| Code | Dec-05 | Dec-04 | Inflation |

| SEFN01 | 133.1 | 127.5 | 1.043922 |

| SEFR02 | 111.4 | 107.5 | 1.036279 |

| SEFT03 | 181.3 | 171.4 | 1.05776 |

| SEFW | 171.5 | 170.9 | 1.003511 |

The inventory balances sorted at SAF114 exceed 10% of the pool total but not all categories included in it have their balances aggregated at that level. The SEFN01 balances are excluded because the 10% threshold was met at the most-detailed category level. BLS weights will be used to calculate the category inflation index at the SAF114 level. The calculations for these category inflation indexes are shown below.

| (2) | (3) | (4) | (5) | (6) | |

| = (2) ÷ (3) | = (4) x (5) | ||||

| CPI Code | July ’04 PPI | July ’03 PPI | Inflation Index | BLS Weights | BLS Weighted Extension |

| SEFN02 | 111.7 | 111.5 | 1.00179 | 0.025 | 0.025045 |

| SEFN03 | 107.4 | 105.7 | 1.01608 | 0.269 | 0.273326 |

| SEFP01 | 162.3 | 145.5 | 1.11546 | 0.1 | 0.111546 |

| SEFP02 | 115.9 | 115.4 | 1.00433 | 0.174 | 0.174754 |

| Sum = | 0.568 | 0.584672 |

| Sum of Weighted Extensions | ÷ Sum of BLS Weights | = Category Index |

| 0.584672 | 0.568 | 1.029351 |

Similarly, the balances sorted using all other categories will be “rolled up” to SAF11 where the total aggregated balances will exceed 10% but BLS weighting will be required because not all categories included in SAF11 are present (some are missing due to category inflation index calculations at more-detailed levels & others because they are not present in inventory). The calculations for these category inflation indexes are shown below.

| (2) | (3) | (4) | (5) | (6) | |

| = (2) ÷ (3) | = (4) x (5) | ||||

| CPI Code | July ’04 PPI | July ’03 PPI | Inflation Index | BLS Weights | BLS Weighted Extension |

| SEFA01 | 171.6 | 165.4 | 1.03749 | 0.05 | 0.051874 |

| SEFA02 | 201.3 | 205.7 | 0.97861 | 0.221 | 0.216273 |

| SEFA03 | 167.1 | 165 | 1.01273 | 0.128 | 0.129629 |

| SEFB01 | 126.9 | 123.3 | 1.0292 | 0.225 | 0.231569 |

| SEFB02 | 126.1 | 123.1 | 1.02437 | 0.109 | 0.111656 |

| SEFB03 | 213.9 | 209.4 | 1.02149 | 0.22 | 0.224728 |

| SEFB04 | 205.9 | 206.9 | 0.99517 | 0.23 | 0.228888 |

| SEFD01 | 120.3 | 124.8 | 0.96394 | 0.147 | 0.141700 |

| SEFE | 180.4 | 178.9 | 1.00839 | 0.282 | 0.284364 |

| SEFG02 | 108.2 | 106.9 | 1.01216 | 0.127 | 0.128544 |

| SEFH | 154.7 | 152.6 | 1.01376 | 0.094 | 0.095294 |

| SEFJ01 | 128.7 | 124.4 | 1.03457 | 0.324 | 0.335199 |

| SEFJ02 | 182.3 | 181.4 | 1.00496 | 0.252 | 0.253250 |

| SEFJ03 | 179.1 | 178.4 | 1.00392 | 0.147 | 0.147577 |

| SEFJ04 | 121.9 | 120.1 | 1.01499 | 0.126 | 0.127888 |

| SEFM01 | 119.1 | 112.6 | 1.05773 | 0.133 | 0.140678 |

| SEFM02 | 122.6 | 117 | 1.04786 | 0.076 | 0.079638 |

| SEFR01 | 154.3 | 142.7 | 1.08129 | 0.051 | 0.055146 |

| SEFR03 | 118.6 | 116.6 | 1.01715 | 0.055 | 0.055943 |

| SEFS01 | 131.2 | 135.6 | 0.96755 | 0.083 | 0.080307 |

| SEFS02 | 105.6 | 110.3 | 0.95739 | 0.07 | 0.067017 |

| SEFS03 | 116.3 | 113.8 | 1.02197 | 0.104 | 0.106285 |

| SEFT01 | 211.4 | 207.4 | 1.01929 | 0.092 | 0.093774 |

| SEFT02 | 154.3 | 152.9 | 1.00916 | 0.241 | 0.243207 |

| SEFT04 | 185.2 | 178.4 | 1.03812 | 0.208 | 0.215928 |

| SEFT05 | 127.4 | 123.2 | 1.03409 | 0.072 | 0.074455 |

| SEFT06 | 112.4 | 110.8 | 1.01444 | 0.301 | 0.305347 |

| Sum = | 4.168 | 4.226158 |

| Sum of Weighted Extensions | ÷ Sum of BLS Weights | = Category Index |

| 4.226158 | 4.168 | 1.013953 |

The FIFO inventory balances can now be divided by category inflation indexes to compute the harmonic dollar-weighted extensions.

| (1) | (4) | (5) | |

| = (2) ÷ (3) | = (1) x (4) | ||

| CPI Code | Y/E FIFO $s | Inflation Index | BLS Weighted Extension |

| SAF11 | 7,755,000 | 1.013954 | 7,648,280 |

| SAF114 | 3,055,000 | 1.029351 | 2,967,889 |

| SEFN01 | 3,525,000 | 1.043922 | 3,376,690 |

| SEFR02 | 3,760,000 | 1.036279 | 3,628,366 |

| SEFT03 | 2,820,000 | 1.05776 | 2,666,012 |

| SEFW | 2,585,000 | 1.003511 | 2,575,956 |

| CYC Total | $23,500,000 | $22,863,193 |

The last step is to divide the total pool FIFO inventory balance by the sum of the harmonic dollar-weighted extensions.

| Y/E FIFO $s (CYC) | ÷ Sum of Extensions | = Pool Inflation Index |

| $2,585,000 | $2,575,956 | 1.003511 |

This pool index will then be multiplied times the previous year’s cumulative deflator index to produce the current year’s cumulative deflator index for this pool.

Example 2 – PPI: The pool’s total FIFO inventory balance is $11,875,000 so the 10% threshold is $1,187,500. Two most-detailed categories—152101 Cigarettes & 15250101 Other tobacco products —exceed the 10% threshold so category inflation & harmonic dollar-weighted extensions are calculated for these categories without using BLS weights. The FIFO inventory balances for all of the other categories are aggregated at successively less-detailed levels. These “roll-ups” continue until all balances are aggregated at the two-digit level. The BLS weights of each category present in inventory is then multiplied times their respective category inflation (the quotient of current-year PPI divided by previous-year PPI) to produce BLS weighted extensions.

| (1) | (2) | (3) | |

| = (1) x (2) | |||

| PPI Code | BLS Weights | Inflation Index | BLS Weighted Extension |

| 15110154 | 0.031 | 1.00874 | 0.031271 |

| 15110156 | 0.006 | 1.02653 | 0.006159 |

| 1542 | 0.178 | 1.05314 | 0.187458 |

| 159404 | 0.023 | 1.03857 | 0.023887 |

| 15950201 | 0.017 | 1.03619 | 0.017615 |

| 15950208 | 0.01 | 1.0401 | 0.010401 |

| 15960313 | 0.017 | 1.00767 | 0.01713 |

| 159A0901 | 0.044 | 1.00646 | 0.044284 |

| 159C0101 | 0.03 | 1.00509 | 0.030153 |

| Total | 0.356 | 0.368359 |

The sum of the BLS weighted extensions is divided by the sum of the BLS weights.

| Sum of Weighted Extensions | ÷ Sum of BLS Weights | = Category Index |

| 0.368359 | 0.356 | 1.034716 |

Each category index—for 152101 Cigarettes, 15250101 Other tobacco products, & for the categories aggregated at the 2-digit level—is divided into the respective FIFO balances to calculate harmonic dollar-weighted extensions.

| (1) | (4) | (6) | |

| = (4) ÷ (5) | |||

| PPI Code | Y/E FIFO $s | Inflation Index | Harmonic $ Weighted Extension |

| 15-Remaining | 500,000 | 1.034716 | 483,224 |

| 152101 | 9,875,000 | 1.062367 | 9,295,283 |

| 15250101 | 1,500,000 | 1.058824 | 1,416,667 |

| Totals | $11,875,000 | $11,195,174 |

The last step is to divide the total pool FIFO balances by the sum of the harmonic dollar-weighted extensions.

| YE FIFO $s (CYC) | ÷ Sum of Extensions | = Pool Index |

| 11,875,000 | 11,195,174 | 1.060725 |

This pool index will then be multiplied times the previous year’s cumulative deflator index to produce the current year’s cumulative deflator index for this pool.

The double-extension method is the term used to describe calculation of cumulative indexes by dividing current year prices by base year prices for individual inventory items. The link-chain method is the term used to describe calculation of current year indexes by dividing current year prices by prior year prices, which is then multiplied by the prior year cumulative index to calculate the current year cumulative index. The prior year link-chain cumulative indexes would have been determined in a similar fashion. Either the double-extension or link-chain methods may be used by IPIC taxpayers. Use of the double-extension method by non-IPIC method retailers is very rare because this method is not practical for companies with rapid turnover of inventory items. In our opinion, the double-extension method should never be elected for IPIC taxpayers because discontinuation of CPI or PPI categories will require complicated index calculations that are avoided if the link-chain method is used. Use of the double-extension method can also cause greatly distorted inflation or deflation rates when there are substantial inventory mix changes from one year to the next solely as a result of the change in mix.

The Regs. provide options to certain taxpayers regarding the selection of CPI or PPI months. Determination of appropriate index months for both IPIC & non-IPIC method taxpayers can be somewhat confusing because past IRS Regs. & other guidance in this area have been neither clear nor consistent. One item of confusion has been the definition of “current-year costs”. This could mean the valuation method (FIFO or average cost) used to determine general ledger inventory balances(gross of the LIFO reserve) or the method used to value LIFO increments. Many taxpayers & CPAs in the past have assumed current-year costs was only the method of valuing LIFO increments because of the pre-December 2005 Form 970 line 6a caption which reads “Method used to figure the cost of goods in the closing inventory over those in the opening inventory”. Such thinking led to the use of “dual indexes” whereby separate indexes were used to: 1) convert year end inventory balances to base year costs (deflator index), & 2) value the current year increment (inflator index). While it is still not clear what the intent of the IRS terminology & rules in this area really were in the past, the new Regs. published in 2002, the new Form 970(as of December 2005) & the Dual Index Methods Proposed Coordinated Issue Paper issued in April 2003 by the IRS Inventory Technical Advisor make it clear that:

Since there are PPI & CPI inflation indexes compiled & published for each month, IPIC taxpayers must decide which month’s indexes are to be used for pool index calculations. These are referred to as the “appropriate month” in the Regs.

The Regs. provide options to taxpayers regarding the selection of CPI or PPI months depending on their current year cost method & their history of inventory production or purchases throughout the year. These index months are referred to as the appropriate month in the Regs. The Regs. allow retailers using the retail method to only use the month of their year end as their appropriate month. The IRS definition of “retail method” is LIFO calculations for which retail inventory balances are converted to base year retail indexes using retail selling price inflation indexes. This definition differs from the commonly used retail industry term Retail Inventory Method (RIM) which is the method commonly used to reduce retail inventory balances to a cost balance using departmental purchase & price change data. Other taxpayers (other than retailers using the retail method) have the option of electing one of the following two appropriate month selection options:

If the latest acquisitions current-year cost method is selected, the appropriate month will either be the year end month or a month or two earlier than the year end month. If the earliest acquisitions current-year cost method is selected, the appropriate month will be one of the first months of the year.

Reg. § 1.472-8(e)(3)(iii)(B)(3) provides examples of months deemed to be appropriate months for various current-year cost & taxpayer’s history of inventory production or purchases throughout the year combinations.

Although various CPAs have touted the ability to use different appropriate months for different pools & different months for different years as an improvement in the New Regs., doing so almost always creates additional complications in the annual index calculations without any compensating tax savings benefit. This is because the cumulative amount of inflation will be the same over time once the IPIC method is adopted & changing the appropriate month from year to year or using different appropriate months for different pools only complicates the calculations by requiring index calculations using either more than or less than 12 months’ inflation.

Most companies have historically used the most recent purchases current-year cost method. A fairly common practice for these IPIC taxpayers not required to use the last month of the year as the appropriate month (by virtue of being a retailer using the retail method), is to use an appropriate month earlier than the last month of the year to facilitate quicker LIFO calculations. Before the advent of the BLS Web site which makes PPI & CPI available within about 15 days after month end, this was a useful technique but is not really necessary now. Another planning idea was to elect the earliest acquisitions current-year cost method so that the first month of the year can be used as the appropriate month. This is an option no longer available based on the IRS’s clarification of the definition of current-year cost in their 2000 Dual Index Issues Paper.

The BLS publishes Preliminary indexes around the 15th of the following month (e.g., Preliminary August indexes are made available around September 15). All indexes are subject to revision four months after their original publication—these are Final indexes. Taxpayers may choose to use either Preliminary or Final indexes, but they must be consistent in their use (i.e., both Current Year indexes & Previous Year indexes must be Preliminary, or both must be Final). As a practical matter, taxpayers should use Preliminary indexes in order to perform IPIC calculations in a timely manner.

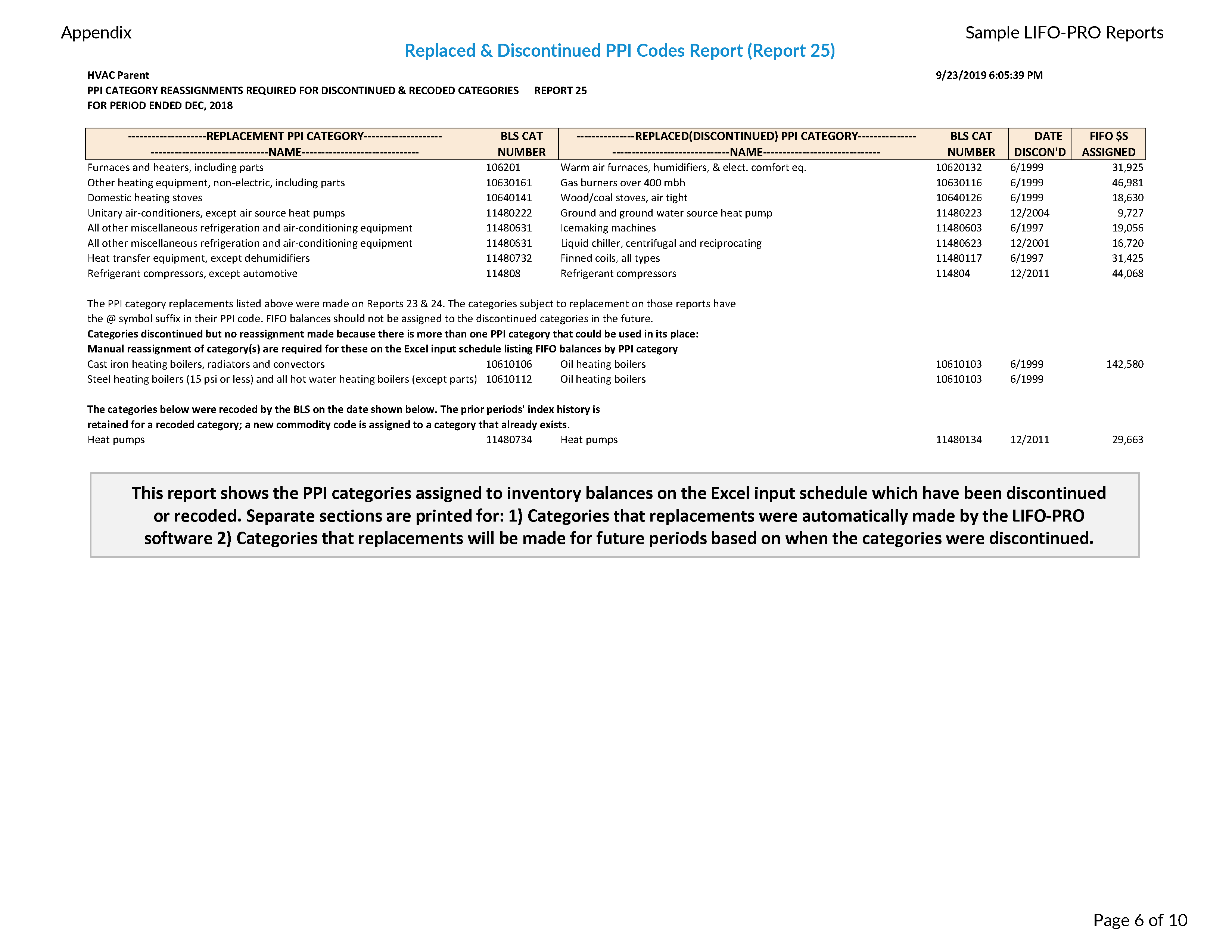

Companies using PPI must be aware of the issue of missing indexes. The PPI categories in Table 9 are not a static list because new categories are added & others discontinued on a regular basis. In July & January of each year the BLS publishes an Appendix in the PPI Detailed Report identifying which new categories have been added & which categories have been discontinued. It is not uncommon for the BLS to stop publishing indexes for some categories months before they are officially discontinued. Also, there are categories for which the BLS publishes indexes only sporadically, such as for seasonal produce (e.g., 01110203 Cherries).

Retailers adopting LIFO for the first time will need to decide whether to use retail or cost LIFO. Historically, those companies with warehouse inventories used cost LIFO because of the difficultly of converting warehouse cost inventory balances to retail values. Companies without warehouse inventories using the IPIC method typically used retail LIFO because this did not require conversion of retail basis CPI to a cost basis using cost complements as required by the old (pre-2002) IPIC LIFO Regs. We believe most retailers would be better off using cost LIFO regardless of whether they have warehouse inventories. The reason for this is that the annual LIFO expense using retail LIFO is affected by margin changes from the prior year (this is not the case for cost LIFO) & this makes the planning for the amount of LIFO expense less predictable.

Most retailers use the 10 Percent method because this allows them to reduce time spent assigning BLS categories to their inventory items & use fewer less detailed CPI or PPI codes. Supermarkets using CPI, for example, must make BLS category assignments to their inventories by 33 less-detailed CPI categories rather than about 100 most-detailed categories as required by use of the Most-Detailed Categories method. Supermarkets using PPI that use the 10 Percent method must sort their inventories by about 55 less-detailed PPI categories rather than about 200 most-detailed categories as required by use of the Most-Detailed Categories method

The 10 Percent method entails more complicated pool index calculations but this is not an issue if the LIFO-PRO software is used because the necessary BLS weighting & dollar weighting is completely automated.

Most retailers that maintain warehouse inventories have warehouse inventory accounting systems that produce sufficient detail to allow breakdown of these balances by the required CPI or PPI categories. This is because these systems typically keep track of cost per item. Some companies’ store inventory accounting systems also include sufficient cost per item data to allow breakdown of these balances by the required CPI or PPI categories but at this point, the majority of retailers don’t have this luxury. For store inventories, the traditional inventory accounting method for at least some departments has been some variation of the Retail Inventory Method for which retail balances are known by department & cost by department balances are calculated by use of standard gross profit margins for these departments.

The inventory service should be provided the list of CPI or PPI categories required for IPIC method calculations. These are referred to as “LIFO counts”. While a few of the CPI or PPI categories may correspond to the regular physical count breakdowns, this will be a special LIFO count listing. The inventory service may or may not be instructed to make the normal count breakdowns in addition to the LIFO counts. An inventory service should be able to provide both the normal & LIFO breakdowns from the same physical count. This is accomplished by making different store layout maps (what shelf space belongs in the various breakout categories). Making LIFO counts in addition to normal counts often entails an additional fee from the inventory service & a 40% premium to do this is not unusual.

Sample size – For companies having only a few stores, they may well make LIFO counts for all stores. For companies with numerous stores, LIFO counts are made for a sample of stores & the sample stores’ CPI or PPI category distribution is used for the total of all stores’ inventory balances. The IRS provides no guidelines for this type of sampling. The IPIC LIFO Regs. make no mention of whether sampling is an appropriate means of obtaining the CPI or PPI category breakdowns, but this type of sampling has been used by retail grocers for 20 years without substantial IRS challenge of this practice. The sampling plan should take into account different store size, formats & location or other factors that could cause one store to have a significantly different inventory mix than another store. It is not uncommon for the same LIFO count stores for one year to be LIFO count stores in succeeding years because this eliminates the need for the inventory service to make LIFO count layouts for more stores.

Once the physical counts have been taken & the LIFO count sheets are available, there are several things that need to be taken into consideration including:

Missing PPI Treatment Options

The IRS IPIC LIFO Regulations issued in January, 2002 specify that what we call the “Substitute Index Method” be used for categories for which indexes are missing (for either the current or prior year for the applicable index month) but for which the categories have not been discontinued (what we refer to as “sporadic index categories”). We believe the use of the Substitute Index Method is also the most practical way to handle missing indexes for categories discontinued for which a replacement category is not added by the BLS until the same month.

Regulations § 1.472-8(e)(3)(iii)(D)(4) states that “…If the BLS has revised the applicable BLS table for a taxable year, a taxpayer must compute the category inflation index for each BLS category for which the taxpayer cannot compute a category inflation index in accordance with paragraph (e)(3)(iii)(D)(3) of this section (affected BLS category) using a reasonable method, provided the method is used consistently for all affected BLS categories within a particular taxable year.” This Reg. paragraph goes on to say “The compound category inflation index described in paragraph (e)(3)(iii)(D)(4)(ii) of this section is a reasonable method of computing the category inflation index for an affected BLS category.”

The Compound Inflation method entails the multiplication of partial year inflation rates for both the discontinued & replacement categories. We believe this method is not as practical as the Substitute Index Method & the use of the Substitute Index Method will generally produce indexes not significantly different from those calculated using the Compound Category Inflation Index method.

It is important to use a current list of PPI categories in order to minimize the problems associated with missing indexes. LIFO-PRO, Inc. performs extensive research on an ongoing basis to identify discontinued categories & their likely replacements.

A 1982 AICPA LIFO Issues Paper titled Simplified LIFO for Financial Reporting Purposes stated that the IPIC method was an acceptable method for financial reporting unless “it is apparent that the external index structure & its application do not reflect a company’s experience.” The other GAAP issue when switching from non-IPIC LIFO (internal index) to IPIC LIFO is whether this is a change to a preferable method. In a perfect world, this change should seldom be a preferable method because one would normally assume that internal indexes are a better measure of a company’s inflation than government price indexes. The reason the IPIC method may be preferable for some companies is that most companies use shortcuts in their internal index calculation method that may render those indexes less accurate than external indexes.

It has been our experience that auditors are less likely to object to changes to the IPIC method for financial reporting purposes for private companies but these objections are common for publicly traded companies. We have seen several cases of companies being allowed to make the change to the IPIC method if the historical comparison of pro-forma IPIC method calculations to the actual internal indexes shows the IPIC method producing a similar amount of inflation over the past two or three years as internal index inflation.

While the LIFO conformity rules included in the Regs. Sec. 1.472-2(e) require the use of the LIFO method for financial reporting if it is used for tax purposes, it does not require that the LIFO methods be the same. Most U.S. based publicly traded supermarket chains use internal indexes for financial reporting LIFO & the IPIC method for tax. An often-overlooked aspect of the conformity rule is that while taxpayers cannot have goods on LIFO for tax but not book, there is no reason why taxpayers cannot have more goods on LIFO for book than for tax. A company could reduce their book LIFO expense by having consistently deflationary goods on LIFO for book but not for tax subject to the limitations of Lower-of-Cost-or-Market accounting.

With the issuance of the New IPIC LIFO Regs. in 2002, all taxpayers are eligible to use the IPIC method. A Form 3115 Application for Change in Accounting Method is required to be filed to change from a non-IPIC LIFO method to the IPIC method. This type of change is normally an automatic approval change for which the Form 3115 due date is the same as for the Form 1120 including extension. A Form 970 Application to Use LIFO Inventory Method is required to be filed for changes to the IPIC method even for companies already using a non-IPIC LIFO method. No Form 3115 filing fee is required for automatic approval accounting method changes. Taxpayers not already using the LIFO method need only to file a Form 970 to adopt LIFO (IPIC or otherwise) & the Form 970 due date is the same as for the Form 1120 including extension.

The IRS allows a number of automatic approval changes to and within the IPIC method, for these automatic changes, the following applies:

A fairly common practice among retail grocers historically has been to exclude certain departments from LIFO. Perhaps 40% or so of these companies have excluded fresh meats & produce. Many also excluded bakery, deli, floral & pharmacy departments. One of the reasons these departments were not on LIFO was that meat & produce are commodity goods whose prices & inflation indexes can fluctuate greatly which results in unpredictable LIFO expense amounts. Another reason for these departments’ exclusion from LIFO is that internal indexes are difficult to calculate for commodity items. Using the IPIC LIFO method precludes the need to calculate internal inflation indexes using a company’s actual costs.

Our recommendation with respect to the LIFO election scope for grocery retailers is that all food & beverage goods be on LIFO because over time all food & beverage categories prices have risen. Meats & produce are typically not a large enough portion of total inventories that their volatile price indexes will greatly affect the total LIFO expense. Use of the IPIC method makes calculation of indexes for commodity items simple, so this reason for excluding departments from LIFO is not applicable for LIFO taxpayers.

If the makeup of pools changes as a result of switching to the IPIC method, reconfiguration of pools, or “repooling” is required. To do this, inventory must be sorted by the categories required (using either the Most-Detailed Categories method or the 10 Percent method) by the new pooling configuration as well as those categories required by the old pooling scheme. The result of this is that portions of individual old pools are allocated to different new pools. A repooling matrix illustrates this below:

| New Pools % of Old Pools | ||||||

| Old Pool | 1 | 2 | 3 | 4 | 5 | Total |

| A | 20% | 25% | 30% | 15% | 10% | 100% |

| B | 10% | – | 85% | – | 5% | 100% |

| C | 55% | 33% | – | – | 12% | 100% |

| D | 20% | 25% | 30% | 15% | 10% | 100% |

| E | 10% | 35% | 40% | 7% | 8% | 100% |

| F | 5% | 40% | 10% | 10% | 35% | 100% |

| G | – | 15% | 10% | 45% | 30% | 100% |

| H | 2% | – | 30% | 40% | 28% | 100% |

Old pools B & C are each split into three pieces as shown above, pools G & H are each split into four pieces & the other pools are each split into five pieces. The seven pieces coming from the old pools that now belong in new pool 1 are combined. The same combination procedure is then applied to the other pools. Pool splitting & combination procedures are described in Regs. §1.472-8. The measurement date for the allocation is the year end before the new pooling method is implemented. The repooling matrix percentages are calculated using the FIFO balances as of the year end of the pooling method change despite the fact that the LIFO layer histories being repooled are as of the year end prior to the method change.

The IRS Regs. require separate sets of LIFO pools to be maintained for each separate corporation regardless of whether consolidated federal tax returns are filed. Qualified Subchapter S subsidiary corporations (Q-Subs) & certain other legal entities may be “disregarded entities” in the eyes of the IRS & separate LIFO pools need not be maintained for disregarded entities for tax purposes.

No such separate set of LIFO pools for different corporations requirement exists for GAAP & book LIFO calculations for a “consolidated” set of pools are not uncommon.

Companies that change from “C” corporations to Subchapter S corporations are required by the IRS Regs. to recapture their LIFO reserve. This is required for tax purposed only because there is no corresponding GAAP requirement.

It is not uncommon for smaller companies to use certain IPIC Regs. provisions but not others. One of the most commonly-used shortcut is what we call “Simplified Simplified LIFO”. An example of this is in the grocery industry whose pools are the traditional grocery retail pools such as grocery, meat, produce, HABA (Health and beauty aids), pharmacy, tobacco & alcoholic beverages. This shortcut entails using a single CPI category for each pool. Use of this shortcut allows for the use of a “less-detailed” CPI category which is the best match for that pool, thereby significantly reducing the time otherwise spent assigning the appropriate BLS categories to inventories on an item by item basis (i.e. For example, the SAF11 Food at home index is normally used for the grocery pool & the SAF1121 Meats, poultry & fish index is used for the meat pool).

Use of this shortcut method will probably not produce substantially higher or lower inflation, in the long run, compared to the proper application of the IPIC method. This is probably why some companies use this, i.e. they think that if the results are about the same as for using the proper methods, there is little chance of IRS adjustment. While this may be true, the IRS could terminate a company’s LIFO elections if it does not retain the books & records necessary to recalculate past years’ LIFO inventories using the proper methodology. “Inadequate books & records” is a reason specifically listed in the Regs. warranting LIFO termination.

Trial the software for 90 days. Get a complimentary analysis for companies considering using LIFO. Get a complimentary review for companies on LIFO. Request a cost estimate. Use our simple form to submit your request.

Sign up today to receive industry news & promotional offers from LIFO-PRO