Analysis

Any company that’s not on LIFO that is considering electing for this coming year end SHOULD ALWAYS perform a cost-benefit analysis in order to answer the following questions:

- What are the potential current year tax savings?

- What have the historical inflation trends been for our company’s product mix?

- Do the current year & historical results suggest that my company’s a good LIFO candidate?

- How volatile could being on LIFO be based on the analysis results?

- What are the costs of implementing LIFO & maintaining the calculation in-house?

- What are the costs of outsourcing all LIFO-related work in the year of implementation & on a recurring basis?

- What are the costs of obtaining LIFO software to manage the calculation in-house in periods subsequent to the election?

- Do the projected benefits outweigh the potential costs?

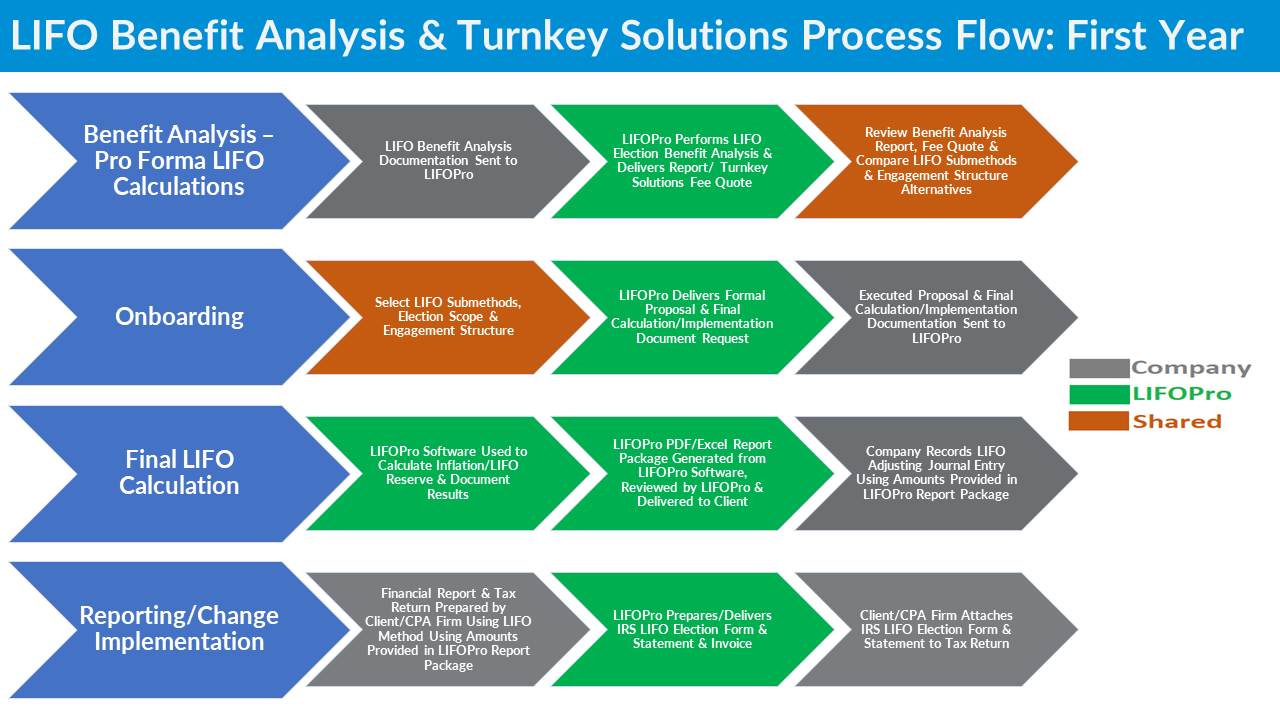

LIFOPro offers complimentary LIFO election benefit analysis for companies considering LIFO elections in order to answer many of the questions posed above. Here’s how LIFOPro’s benefit analysis process works:

- LIFOPro requests documentation to complete the benefit analysis – consists of the following documentation:

- Current & prior period’s item detail or stock status reports – aka inventory valuation/snapshot reports

- Combined federal & state tax rate – optional

- LIFOPro performs a LIFO election benefit analysis that includes the following:

- Current year pro forma LIFO calculation – to estimate the potential tax savings from electing LIFO this year

- 20 year pro forma LIFO calculation – to determine the following:

- Historical average annual inflation rate – should be at least 1% or greater to merit being a worthy LIFO candidate

- Inflation frequency – how many years was inflation calculated in the past 20 years (should be more than half to be a worthy LIFO candidate)?

- Historical average inflation rates for the most predominant items in product mix

- Good LIFO candidate & LIFO election recommendation – provides a straight yes or no answer regarding whether a company is 1. A good LIFO candidate 2. If a current year LIFO election is recommended based on the pro forma calculation results (must be a good LIFO candidate for a current year election to be recommended)

- LIFO submethods recommendations – one of the most overlooked, but important aspects of LIFO is choosing the best submethods! Let the LIFO experts provide our best practices feedback from our 30 years of experience of working with companies of all sizes, industries & product mixes!

- Turnkey outsourcing solutions fee quote: shows the following

- Estimated first year cost to outsource all efforts related to the adopting LIFO, including year end LIFO calculation, LIFOPro PDF report package delivery & IRS LIFO election forms preparation

- Estimated recurring cost to outsource the calculation on an annual basis

- Estimated LIFOPro software license cost if company desires to take the LIFO calculation in-house after the year of adoption (beginning in the second year)

- LIFOPro delivers LIFO Election Benefit Analysis Report & turnkey outsourcing solutions fee quote within one week of receipt of the documentation listed above

- LIFOPro follows up to schedule call with analysis recipient, discuss results &answer questions

- LIFOPro delivers formal proposal in the event that analysis recipient would like to move forward with LIFO implementation & turnkey outsourcing solution