The more frequently you make LIFO calculations, the more likely you would want to use the software. For example, if you make midyear calculations quarterly for financial reporting or for tax provision or quarterly payments estimates, you may be a good candidate to use the LIFO-PRO software. Corporations that have separate LIFO pools for a number of different legal entities are more likely to want to use the software.

Companies that possess these attributes are good candidates to use the LIFO method:

Significant LIFO reserves can be generated without having huge amounts of inventory if there is more than a nominal amount of annual inflation. A reliable predictor of the amount of annual income tax deferral from use of LIFO is beginning of year FIFO inventory balance times the current year inflation rate. As an example, a company with $2 million in FIFO inventory and 2% annual inflation would increase their year-end LIFO reserve by approximately $40,000 per year.

Companies with consistent deflation should not use LIFO. We believe the companies with very volatile prices for significant portions of their inventory are not good LIFO candidates. High inflation during the year can cause a big increase the LIFO reserve but big decreases in inflation are likely in subsequent years and using LIFO can be real roller coaster. Companies with commodities inventories should only adopt LIFO if they are prepared to terminate their LIFO election if there is enough deflation such years to create negative LIFO reserves (LIFO inventory greater than FIFO inventory). If a company wants to terminate their LIFO election before they have used the LIFO method for five years, this is an advance approval tax accounting method change for which the IRS user’s fee is about $12,000. The IRS rules allow companies to use the LIFO inventory method selectively, that is for some inventories but not others. For example, many convenience store chains that have gasoline inventories do not use the LIFO method for gasoline but use LIFO for merchandise sold in their stores (cigarettes, food and beverages, etc.) which has a good history of inflation over the years.

This was the only LIFO method allowed by the IRS until 1947 but this method should never be used because of the burdensome record keeping requirements and the fact that the taxable income deferral using this method is only a fraction of the deferral achieved using a dollar-value LIFO method. This is a link to our blog article addressing this question:

Beware of Specific Goods LIFO Calculations

The double-extension LIFO method should never be used. We recently wrote a 27 page article describing in detail why this method is completely unreliable for purposes of measuring LIFO inflation and why this method should not be considered a permissible method by either the IRS or GAAP. This is a link to Lee Richardson’s article addressing this question:

Why double extension is a bad LIFO Method

Advantages of using the IPIC LIFO method include:

A disadvantage of using the IPIC method is that once the method is used, it is not an automatic approval change to switch back to an internal index method if an internal index method had been used before the company change to IPIC method. What can be a disadvantage for some manufacturers is the fact that the different index categories published for their products is not granular enough. For example, we have had client that had to use a nonferrous metals PPI code because there is no indexes published for their specific metal for that particular stage of production.

Yes, the “LIFO conformity rule” which is contained in Reg. § 1.472–2(e) were amended in 1981 to specifically permit the use of book LIFO methods that are different from IRS Regs. methods. The most common book v. tax LIFO methods difference is companies using the IPIC method for tax purposes and an internal index method for financial reporting purposes.

Over time, for retailers and wholesalers, the IPIC method PPI inflation is usually higher than internal index inflation. For some companies, the actual price comparison may be very close to being the same between the two methods but there is an internal index inflation dilution factor that results from setting the prior year item cost equal to the current year cost for new items (the method used by most companies using an internal index method).

For manufacturing companies, there can be a substantial difference annual inflation between internal indexes and PPI indexes. Below is a link to a blog article which describes the reason for this and why using the IPIC method usually results in much less volatile LIFO inflation than for manufacturers using an internal index method:

Why internal index LIFO inflation is often more volatile than PPI inflation for manufacturers

While there may be a few items for which CPI inflation has consistently been higher than PPI inflation, for most retailers, there is a long history of there being greater (and sometimes significantly greater) PPI inflation than CPI inflation. For example, for the dozen or so years ended in 2014, PPI inflation for supermarkets outperformed CPI inflation during that period.

We serve numerous companies with less than $10 million in inventory value. Our extensive experience enables us to be as efficient as possible and charge the lowest possible fees.

There are two vendors that sell auto dealer LIFO calculation software. Other LIFO service providers have attempted to develop non-auto dealer LIFO calculation software in the past but they were not successful. Some companies may want to outsource their LIFO calculations but many corporations want to use software to make their LIFO calculations in-house. LIFO-PRO has over 30 clients that were once clients of another LIFO service provider that now use our services. LIFO-PRO’s clientele do not switch from using our services to that of a multinational company.

LIFO-PRO is the only non-auto dealer LIFO calculation software with a menu-driven user interface. There are a number of LIFO calculation Excel templates in use but it is a real stretch to call this software because:

The most common service we provide to CPA firms is what we call our Service Bureau for which we are provided a LIFO layer history in the first year in an Excel file listing the year and inventory balances by PPI or CPI category in the first year and succeeding years.

Other services we provide CPA firms include:

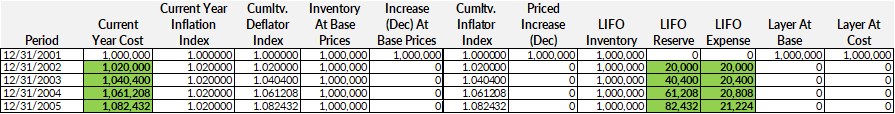

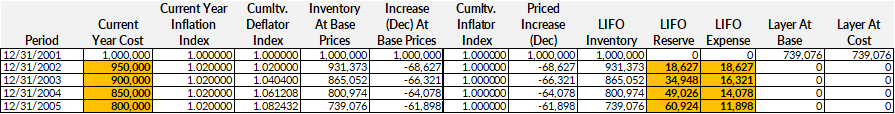

Example 1: Assumption – Current-year cost increases at the same rate as inflation starting at $1,000,000 in the base year | Result – 2002 – 2005 LIFO reserve increases by $20K – $21K per year

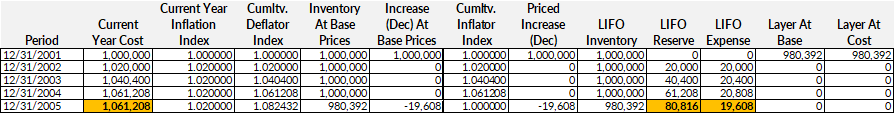

Example 2: Assumption – 2005 & 2004 CYC are equal (2005 CYC = $20K less than Example 1) | Result – 2005 LIFO reserve increases by just under $20K

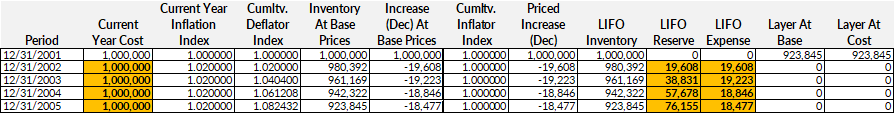

Example 3: Assumption – CYC is the same for all years | Result – 2002 – 2005 LIFO reserve increases by $18K – $20K per year ($76K total)

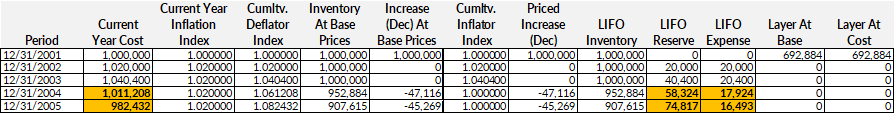

Example 4: Assumption – 2004 & 2005 CYC are $50 & $100K less than Example 1 | Result – 2004 & 2005 LIFO reserve increases by $18K & $16K

Example 5: Assumption – CYC decreases by $50K/year ($200K total) | Result – 2002 – 2005 LIFO reserve increases by $12K – $19K per year ($61K total)

LIFO Examples of Correlation Between FIFO Balance Changes and LIFO Expense/Income Amount

=IF(F46>0,F46*D46,IF(-F46<C57,F46<C57,F46*D57,IF(F46<C58,F57+((F46+C57*D58),IF(-F46<C59,F58+((F46+C58)*D59, IF (F46<C60, F59+((F46+C59)*D60),IF(F46<C61,F60+((F46+C60)*D61),IF(-F46<C62,F61+((F46+C61)*D62),IF(-F46<C63,F62+((F46+C62)*(D63),IF(F46 <IF(F46<C64,F63+((F46+C63)*D64),IF(-F46<C65,F64+((F46+C64)*D65),IF(-F46<C66,F65+ ((F46+C65+ ((F46+C65)*D66),IF(F46<C67+ ((F46+C66)*D67),IF(F46<C68,F67+((F46+C67)*D68),IF(-F46<C69,F68+(( F46+C68)*D69),IF(-F46<C70,F69+((F46+C69)*D70),ERR)))))

This is an example spreadsheet formula that calculates LIFO inventory balances & all possible layer liquidation possibilities for a company with 15 LIFO layers. These types of formulas are convoluted & require updating when used in subsequent years/pools. The high probability for errors to occur causes manual spreadsheet LIFO calculations to be unreliable.

| Error Type | Error Description | Error Example | Audit/Error Detection Step | Preventative Control | LP Rpt. Ref. | IRS GAAP Ref. | Comments |

|---|---|---|---|---|---|---|---|

| Current-Year Cost (CYC) & LIFO Election Scope | CYC improperly includes (is net of) valuation reserves | CYC is net of reserve for obsolescence but should not be or item cost recorded is estimated market value rather than cost | Agree LIFO calc. schedule CYC to sum of inv. g/l balances that are gross of valuation reserves | Review step | n/a | § 1.472–2(b) | |

| Current-Year Cost (CYC) & LIFO Election Scope | CYC dollars not consistent with LIFO election scope | All inventories are on LIFO per Form 970 election & financial statement disclosure but in-transit inventories are excluded | Review Form 970 LIFO election scope & agree CYC to sum of inv. g/l balances that are supposed to be on LIFO. Compare election scope to financial statements note for book LIFO. | Review step | n/a | § 1.472–2(a) | |

| Current-Year Cost (CYC) & LIFO Election Scope | CYC method not consistent with LIFO method elected | FIFO is the CYC method shown on the Form 970 & or the financial statement notes but the specific identification cost method is used | Review Form 970 for tax & financial statements note for book | Review step | n/a | § 1.472–8(e)(2)(ii) | |

| LIFO Reserve or LIFO Layer History Schedule Calculations | Link-chain C/Y cum. index <> P/Y cum. index x C/Y inflation index | C/Y inflation index is multiplied times cum. Index from 2 years ago | Recalculate C/Y cum. index | Prepare & review schedule using LIFO-PRO Rpt 18a format | 18a row 10 | § 1.472–8(a) | |

| LIFO Reserve or LIFO Layer History Schedule Calculations | C/Y inventory at base <> CYC/cumulative Index | Inventory at base = CYC divided by C/Y index | Recalculate C/Y inventory at base | Prepare & review schedule using LIFO-PRO Rpt 18a format | 18a row 11 | § 1.472–8(a) | |

| LIFO Reserve or LIFO Layer History Schedule Calculations | C/Y increment or decrement at base <> C/Y inv. at base minus P/Y inv. at base | Recalculate C/Y increment or decrement | Prepare & review schedule using LIFO-PRO Rpt 18a format | 18a row 13 | § 1.472–8(a) | ||

| LIFO Reserve or LIFO Layer History Schedule Calculations | C/Y increment calculation error; increment at LIFO cost <> increment at base x C/Y cum. Index | Recalculate C/Y increment calculation error | Prepare & review schedule using LIFO-PRO Rpt 18a format | 18a row 15 | § 1.472–8(a) | ||

| LIFO Reserve or LIFO Layer History Schedule Calculations | Layer history balances do not tie to reserve calculation schedule | P/Y inv. at base does not tie to that balance per layer history | Compare the balances between the 2 schedules | Prepare & review schedule using LIFO-PRO Rpt 18a format | 18a | § 1.472–8(a) | |

| Decrement Calculation | Decrement incorrectly priced using the current year cumulative index | Decrements must be priced using the indexes used to price the layers in the year the layers were created | Recalculate decrement | Prepare & review schedule that is in the format of LIFO-PRO Report 16a | 16a & 18a | § 1.472–8(a) | |

| Decrement Calculation | Incorrect multiple layer decrement calculation | Multiple layer decrements should be calculated using Report 16a steps | Recalculate decrement | Prepare & review schedule that is in the format of LIFO-PRO Report 16a | 16a & 18a | § 1.472–8(a) | |

| Decrement Calculation | Use of different index precision for decrements than was used for increments | Unlimited precision is used for an increment but four decimal places are used to price the decrement | Recalculate decrement | Prepare & review schedule that is in the format of LIFO-PRO Report 16a | 16a & 18a | § 1.472–8(a) | The dollar amount of this type of error will not be large but it will cause an imbalance between the LIFO inventory balance and the sum of the extended LIFO layers |

| Internal Index Calculation | Improper sampling method used | Sample of items chosen is not a representative sample | Review by person with substantial LIFO experience | Sampling plan designed and updated by person with substantial LIFO experience | n/a | IRS LIFO Training Guide | |

| Internal Index Calculation | Improper exclusion of new items | Wholesaler carries wine for the first time but this & other new items (none present in P/Y inventory) are excluded from the internal index calculation | Review by person with substantial LIFO experience | Design of internal index calculation steps made by someone with substantial LIFO experience | n/a | § 1.472–8(e)(2)(iii) & 1984 AICPA LIFO Issues Paper paragraph 4-27 | Both GAAP & IRS Regs. require that new items be priced at p/y or base year cost or at reconstructed p/y (link-chain) or base year cost (double-extension) |

| Internal Index Calculation | Error in setting P/Y cost = C/Y cost for new item | C/Y item cost for a different item is used as P/Y item cost | Review to determine that P/Y costs are priced properly as per policy | Review by person with substantial LIFO experience | n/a | § 1.472–8(e)(2)(iii) | |

| Internal Index Calculation | Improper item definition | Comparison of avg. cost/lb. from P/Y to C/Y is used for all steel nails instead of comparison at SKU level | Review by person with substantial LIFO experience | Design of internal index calculation steps made by someone with substantial LIFO experience | n/a | IRS Ltr. Rul. 9632001 & several other related rulings | |

| Internal Index Calculation | Vendor price list used to measure LIFO inflation | Equipment manufacturer price list used to calculate LIFO inflation | Review by person with substantial LIFO experience | Design of internal index calculation steps made by someone with substantial LIFO experience | n/a | § 1.472–8(e)(1) | IRS Regs. require that internal indexes measure taxpayer’s actual inventory cost & not external price indexes. |

| Internal Index Calculation | Improper math used to calculate internal index | Sum of C/Y extensions divided by sum of P/Y extensions which is the opposite of the correct math | Recalculate internal index | Review by person with substantial LIFO experience | n/a | § 1.472–8(e)(1) | |

| IPIC Method C/Y Index Calculation | PPI index per pool index calculation schedule does not tie to PPI detailed report | Index used was for the 02890175 code but it should have been the 02890174 code | Tie P/Y & C/Y indexes used to PPI Detailed Reports at http://www.bls.gov/ppi/ppi_dr.htm | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | § 1.472–8(e)(3)(iii)(D)(2)) | |

| IPIC Method C/Y Index Calculation | Wrong month index used | The representative appropriate month that should be used every year is December but November is used instead | Determine the proper month to use by reference to P/Y calculation, Form 970 or LIFO policy document & tie index to PPI Detailed Report | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | § 1.472–8(e)(3)(iii)(B)(3) | |

| IPIC Method C/Y Index Calculation | Improper appropriate month used | The annually selected appropriate month (not a representative appropriate month) selected is not allowable per reference to IRS Regs. | Determine the range of possible appropriate months from schedule of purchases & based on CYC method & ascertain whether the month selected is consistent with annual selection method | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | § 1.472–8(e)(3)(iii)(B)(3) | |

| IPIC Method C/Y Index Calculation | Index calculation P/Y numerator is not the C/Y denominator | May 2014 is the numerator for the June 2014 y/e calculation, so it should be the denominator for the June 2015 y/e calculation but is not | Tie P/Y denominator used in C/Y pool index calculation schedule to numerator used in P/Y index calculation schedule | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 c/y & p/y | § 1.472–8(e)(3)(iii)(E)(2) | |

| IPIC Method C/Y Index Calculation | Final index used but preliminary should be used (method chosen) or vice versa | Final indexes are elected on the Form 970 or by prior years usage but preliminary indexes are used | Determine whether final or preliminary index method was chosen & tie to the appropriate PPI detailed report | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | § 1.472–8(e)(3)(iii)(D)(2)) | |

| IPIC Method C/Y Index Calculation | Inconsistent use of preliminary v. final indexes | Final indexes were used for the P/Y but preliminary indexes are used for the C/Y | Determine whether final or preliminary index method was chosen & tie to the appropriate PPI detailed report | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | § 1.472–8(e)(3)(iii)(D)(2)) | |

| IPIC Method C/Y Index Calculation | Index not published & improper substitute index used | Nov. index used because the Dec. index normally used was unpublished when IRS Regs. require that the C/Y and P/Y indexes of the next less detailed code be used | Tie P/Y & C/Y indexes used to PPI Detailed Reports at http://www.bls.gov/ppi/ppi_dr.htm | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | § 1.472–8(e)(3)(iii)(D)(4)(i) | |

| IPIC Method C/Y Index Calculation | Commodity code publishing is discontinued by BLS & appropriate replacement code is not used | 02840101 Canned baby foods used but this code was discontinued after 6/2008. 028401 Specialty canning has been used since then but 02840105 Canned baby foods & other canned specialties… first published 11/2007 s/b used | Review pool index calculation documentation to determine that appropriate PPI codes are being used | Review by person with substantial IPIC LIFO experience | n/a | § 1.472–8(e)(3)(iii)(D)(4)(i) | |

| IPIC Method C/Y Index Calculation | Don't mix final & preliminary indexes | Preliminary indexes used for C/Y but final indexes used for P/Y | Determine whether final or preliminary index method was chosen & tie to the appropriate PPI detailed report | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | § 1.472–8(e)(3)(iii)(D)(2)) | |

| IPIC Method C/Y Index Calculation | Must use PPI Detailed Report indexes published in 2 separate reports (C/Y & P/Y), not annual % change | For a March appropriate month, the percentage change from the P/Y March index to the C/Y March index in the PPI Detailed Report (2nd column from the right) is used as the C/Y LIFO inflation | Tie P/Y & C/Y indexes used to PPI Detailed Reports at http://www.bls.gov/ppi/ppi_dr.htm | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | § 1.472–8(e)(3)(iii)(D)(2)) | The percentage change from the P/Y same month shown in the PPI Detailed Report is the current year preliminary index divided by the prior year final index, so this % change cannot be used |

| IPIC Method C/Y Index Calculation | Incorrect index calculation math | Category indexes calculated by dividing P/Y indexes by C/Y indexes | Recalculate using proper steps from IRS Regs. or LIFO-PRO Training Basics Guide | Prepare & review schedule that is in the format of LIFO-PRO Reports 23 & 24 | 23 & 24 | § 1.472–8(e)(3)(iii)(E)(2) | |

| IPIC Method C/Y Index Calculation | Incorrect index category weighted harmonic mean calculation math | Arithmetic mean math is used rather than Harmonic mean | Recalculate pool index using Regs. steps | Prepare & review schedule that is in the format of LIFO-PRO Report 23 | 23 | § 1.472–8(e)(3)(iii)(D)(2)) | |

| IPIC Method C/Y Index Calculation | PPI Table 11 code is used when a Table 9 code should have been | Table 11 325412-1111 Cancer therapy products indexes are used instead of 06380105 Cancer therapy products Table 9 code | Review PPI Detailed Reports to ascertain that the Table 11 code is more appropriate for the inventory item | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | § 1.472–8(e)(3)(iii)(B)(2)) | The IRS Regs. require that PPI Table 9 indexes be used unless a more appropriate code is found in another PPI table |

| IPIC Method C/Y Index Calculation | Use of dual index method | The cumulative inflator index used to price an increment is different than the cumulative deflator index | Review by person with substantial LIFO experience | n/a | § 1.472–8(e)(3)(i) | There is no GAAP prohibition for using a dual index method & some companies use a dual index for an internal index book LIFO method. We have yet to see a company use a dual index for book LIFO when the IPIC method is used. | |

| IPIC Method C/Y Index Calculation | Old IPIC LIFO Regs. (before 2002) methods used | 80% rather than 100% of PPI inflation is used | Recalculate pool index calculation | Prepare & review schedule that is in the format of LIFO-PRO Report 24 | 24 | 1982 AICPA LIFO Issues Paper for book LIFO & § 1.472–8(e)(3) for tax LIFO | GAAP does not address old v. new Regs. methods which may imply that using old IPIC Regs. okay for book but not for tax except that 80% limitation has never been permissible under GAAP |

| IPIC 10% Method Index Calculation | Improper BLS Weight used or double counted in 10% category index calculation | Inventory balances are assigned to both the 10170602 & 101706 codes, so the weight of 10170602 is used twice. The 101706 weight cannot be used unless all 8 digit codes it subsumes are present in inventory. | Recalculate using proper steps from IRS Regs. or LIFO-PRO Training Basics Guide | Review by person with substantial IPIC LIFO experience | 23 | § 1.472–8(e)(3)(iii)(D)(5) | |

| IPIC 10% Method Index Calculation | Arithmetic mean math not used for calculation of a 10% category index | Harmonic mean math was used for the 10% category index calculation but arithmetic mean math should have been used | Recalculate using proper steps from IRS Regs. or LIFO-PRO Training Basics Guide | Review by person with substantial IPIC LIFO experience | 23 | § 1.472–8(e)(3)(iii)(D)(5)(2) | Harmonic mean math is used to calculate the pool indexes but arithmetic mean math should be used to calculate 10% category indexes |

| IPIC 10% Method Index Calculation | Incorrect 10% category determination | 024 Processed fruits & vegetables was a 10% index category last year but is not this year however it was treated as a 10% category this year | Recalculate using proper steps from IRS Regs. or LIFO-PRO Training Basics Guide | Review by person with substantial IPIC LIFO experience | 23 | § 1.472–8(e)(3)(iii)(D)(5) | |

| IPIC 10% Method Index Calculation | Wrong year's BLS Weight used | 2014 BLS weights were used for a 3/31/2015 y/e calculation but the 2013 weights should have been used | Review to determine that the proper year weight is used | Review by person with substantial IPIC LIFO experience | 23 | § 1.472–8(e)(3)(iii)(D)(5)(2) | The Regs. specify that the most recent year BLS weights are used only for July through December appropriate months |

| Bureau of Labor Statistics (BLS) Producer Price Index (PPI) or Consumer Price Index (CPI) Category Assignment (IPIC method only) | Inappropriate PPI commodity code selected | The 02440102 Canned vegetable PPI code was used for tomato paste but 02440127 Canned catsup and other tomato based sauces should have been used | Review pool index calculation documentation to determine that appropriate PPI codes are being used | Review by person with substantial IPIC LIFO experience | n/a | § 1.472–8(e)(3)(iii)(C)(1) | |

| Bureau of Labor Statistics (BLS) Producer Price Index (PPI) or Consumer Price Index (CPI) Category Assignment (IPIC method only) | PPI or CPI services code used rather than PPI or CPI commodity code | 33110101 Sale of textbooks used instead of 094401141 Textbook printing & binding | Review pool index calculation documentation to determine that appropriate PPI codes are being used | Review by person with substantial IPIC LIFO experience | n/a | § 1.472–8(e)(3)(iii)(C)(1) | This is not specifically addressed in the Regs. because the publishing of the PPI services codes (those with a 2-digit Table 9 code > 15) |

| Bureau of Labor Statistics (BLS) Producer Price Index (PPI) or Consumer Price Index (CPI) Category Assignment (IPIC method only) | CPI substratum code used rather than CPI commodity code | SS06011 Fresh whole chicken CPI Table 3 substratum code used instead of SEFF01 Chicken | Review pool index calculation documentation to determine that appropriate CPI codes are being used | Review by person with substantial IPIC LIFO experience | n/a | § 1.472–8(e)(3)(iii)(C)(1) | This is not addressed in the Regs. but substratum CPI codes are not part of the normal CPI sampling, are assigned no BLS weights & should not be used for LIFO calculations |

| Bureau of Labor Statistics (BLS) Producer Price Index (PPI) or Consumer Price Index (CPI) Category Assignment (IPIC method only) | Less detailed PPI codes assigned than permitted by the Regs. rules | 024401 Canned vegetables and juices PPI code was used for tomato paste but 02440127 Canned catsup and other tomato based sauces should have been used when the 10% method is not used & 024401 subsumes multiple 8-digit codes | Review pool index calculation documentation to determine that appropriate PPI codes are being used | Review by person with substantial IPIC LIFO experience | n/a | § 1.472–8(e)(3)(iii)(C)(1) | |

| Bureau of Labor Statistics (BLS) Producer Price Index (PPI) or Consumer Price Index (CPI) Category Assignment (IPIC method only) | Improper replacement PPI code assigned for discontinued code | 02890153 Miscellaneous flavoring powders and tablets was discontinued after 12/2000 & 028901 Other misc. processed foods used as replacement instead of 02890154 Other flavoring agents, except chocolate syrup first published on 12/2000 | Review pool index calculation documentation to determine that appropriate PPI codes are being used | Review by person with substantial IPIC LIFO experience | n/a | § 1.472–8(e)(3)(iii)(C)(1) | |

| Bureau of Labor Statistics (BLS) Producer Price Index (PPI) or Consumer Price Index (CPI) Category Assignment (IPIC method only) | Finished goods PPI code not used for WIP inventory | Raw material PPI code used for material value of WIP instead of the finished good PPI code as per the Regs. rules | Review pool index calculation documentation to determine that appropriate PPI codes are being used | Review by person with substantial IPIC LIFO experience | n/a | § 1.472–8(e)(3)(iii)(C)(1) | |

| Improper Financial Statement LIFO Disclosure | Footnote does not disclose the fact that not all inventories are valued using LIFO | Review notes to financial statements | Review by person with substantial LIFO experience | n/a | 1984 AICPA LIFO Issues Paper paragraph 3-16 | ||

| Improper Financial Statement LIFO Disclosure | Layer erosion effect not disclosed (if material) in financial statement notes | Review notes to financial statements | Review by person with substantial LIFO experience | n/a | 1984 AICPA LIFO Issues Paper paragraph 5-28 | ||

| Improper Financial Statement LIFO Disclosure | LIFO reserve balance is not disclosed | Review financial statements & notes | Review by person with substantial LIFO experience | n/a | 1984 AICPA LIFO Issues Paper paragraph 2-24 | ||

| LIFO Conformity Rule Violations | More inventories are on LIFO for tax than for book | All inventories except produce is on LIFO for tax but both produce & meat is excluded from the LIFO election scope for book | Review reconciliation of book to tax LIFO current-year cost | Reconcile LIFO CYC used for book v. that used for tax | n/a | § 1.472–2(e)(2)(iii) | |

| LIFO Conformity Rule Violations | Financial statement presented to the bank are FIFO basis for a LIFO taxpayer | Review financial statements & notes | Review by person with substantial LIFO experience | n/a | § 1.472–2(e)(2)(iii) | ||

| LIFO Conformity Rule Violations | The FIFO basis pre-tax income is shown on the Income Statement | Review financial statements & notes | Review by person with substantial LIFO experience | n/a | § 1.472–2(e)(2)(iii) | The LIFO reserve may be shown on the balance sheet and/or notes but the FIFO basis income cannot be shown on the Income Statement | |

| Other LIFO Calculation Errors | Improper population of pool number field | Some inventory balances are allocated to the wrong pool | Compare CYC balances C/Y to P/Y and investigate large differences. Compare C/Y to P/Y CYC balances for each PPI code. | n/a | Understatement of the C/YC for a pool can cause "artificial layer erosion" & income & this error is not self-correcting if the C/YC is allocated properly in the subsequent year | ||

| Other LIFO Calculation Errors | Improper LIFO pool combination | Post-combination inventory at base balances equal sum of pre-combination inventory at base balances for the y/e prior to the combination | Make a comparison to determine that the post-combination inventory at base balances are equal to the cumulative sum of the layers at base for each pre-combination year | Make this comparison after the pool combination has been made. Someone with substantial LIFO pool combination experience should review this. | 16 | The error rate for pool combinations is very high if made by someone lacking substantial LIFO pool combination experience. There is no guidance that exists for the proper pool combination steps and examples provided in the Regs. is very simplistic. This type of error will cause an imbalance in LIFO-PRO Report 16 between the LIFO inventory field and the sum of the layers at cost remaining in the rightmost column. If the manual layer history spreadsheet calculation does not include both the year to year LIFO calculation steps and the remaining layers section proof, this error may not be detected. | |

| Other LIFO Calculation Errors | Improper LIFO pooling method used | A single pool is used by a multi-line retailer or wholesaler | Review internal documentation justifying the pooling method used | Review by person with substantial LIFO experience | n/a | § 1.472–8(b) & 1.472–8(c) & 1984 AICPA LIFO Issues Paper section 4 | Refer to the LIFO Training Basics Guide pooling method section |

| Other LIFO Calculation Errors | Improper adjustment of LIFO layer history when the LIFO election scope is changed | The y/e before expansion of scope inventory balances must be added to the CYC, inventory at base and LIFO inventory balance fields for the layer history used for the first y/e following the scope expansion. The LIFO expense for the first post-scope expansion year will be understated (if there is inflation) if the layer history is not adjusted for the scope expansion. | Review layer history schedule for year following LIFO election scope expansion | Review by someone with substantial LIFO experience | n/a | No AICPA or IRS guidance is provided on this subject, so it is important that the LIFO calculation for the period in which the LIFO election scope is expanded be prepared or reviewed by someone with substantial LIFO experience | |

| Other LIFO Calculation Errors | The raw materials LIFO index is used for labor & overhead dollars for a manufacturer not using a standard cost system | No separate LIFO index is calculated for the labor & overhead dollars | Review pool index calculation documentation | Review | n/a | § 1.472 | The difficulty of calculating LIFO indexes for manufacturing labor & overhead is the reason that some companies use a raw material & raw material content of WIP and finished goods LIFO election scope so that L and OH costs are not on LIFO. The IRS has long maintained a position that the use of the components-of-cost method whereby separate LIFO pools are established for L & OH is not authorized in the Regs. |

| Other LIFO Calculation Errors | Improper extension & summing of § 263A ratios times the LIFO layers that remain as of the current y/e | The sum of the § 263A ratio times the remaining LIFO layers' extensions does not tie to the § 263A cost balance used for the tax return Sched. M-1 | Recalculate § 263A cost calculation once the C/Y § 263A absorption ratio has been calculated | Review by person with substantial LIFO experience | Report 16 version including § 263A costs | § 1.263A | Generally only applicable for tax LIFO. Not applicable if burden rate method or other non-simplified method used. |

Have a phone call or WebEx with the LIFO-PRO team to get started today or learn more about our offerings. Schedule online using our easy-to use booking tool.

Sign up today to receive industry news & promotional offers from LIFO-PRO