Two options are available for determining the LIFO inventory value, which are the dollar-value & specific goods methods. The differences between the two methods and pros/cons are explained below.

Specific Goods Method

The specific goods method is commonly referred to as the unit LIFO method because each item’s inventory value must be tracked on a LIFO basis. This method is also most commonly illustrated in college courses and accounting reference materials (although it’s used far less than the dollar-value LIFO method, which is explained further below). Under this method, the accounting information system must maintain records of all purchases and sales for each item to support determining each item’s unit costs using a last-in, first-out cost flow assumption. Said another way, the unit LIFO method assumes that the most recently purchased goods are the ones sold first, and the unit cost values of the inventory on hand at the end of the year is determined in reverse chronological order from the date that an item’s inventories were first on hand. An illustrative example and comparison to the FIFO method is shown below.

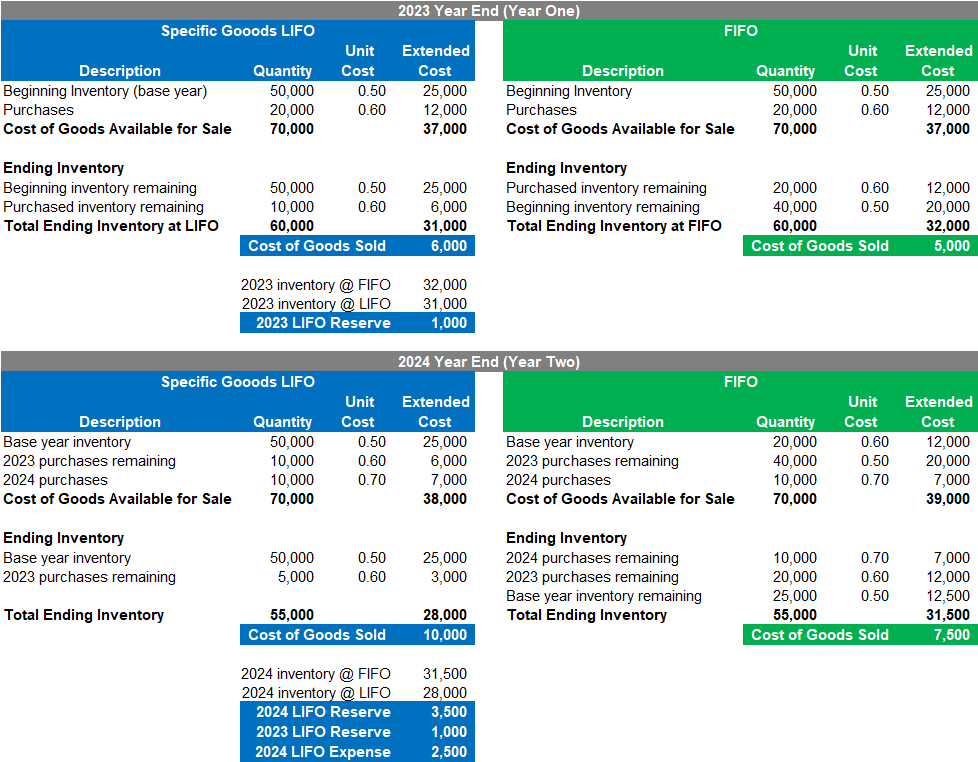

Figure 1. Specific Goods (Unit LIFO) Illustrative Example

The above illustration assumes the calculation of the specific goods cost of a single item. The same concept must be applied for each item unless multiple goods were combined into a single item grouping.

When there’s a year over year increase in the quantity of goods on hand for a given item, a new increment or layer will be created for that item, and it will be set equal to the purchase price as determined using the LIFO cost flow assumption. When there’s a year over year decrease in the quantity of goods on hand for a given item, a decrement or erosion/liquidation of that item’s most recently created increment/layer will occur.

The specific goods LIFO method becomes less practical the longer it’s used because the inventory accounting systems must keep track of an ever-increasing number of items and unit cost values for many years. Accordingly, companies using the specific goods method are motivated to use broad item definition where multiple goods are placed into a single group in order to minimize the administrative burden required to maintain each item’s historical LIFO unit costs, and to avoid the LIFO recapture that occurs when a preexisting item is discontinued or replaced by a new item.

IRS Regs. require for users of the specific goods LIFO method to define their items based on character, quality or price, and for each type of good in the opening inventory to be compared with a similar type in the closing inventory. Accordingly, employing an overly broad item definition approach where multiple goods are considered a single item creates risk upon audit, and taking shortcuts to minimalize the amount of items maintained for LIFO purposes has been frequently challenged upon examination by the IRS.

Dollar-value Method

In practice, the dollar-value method is employed by the overwhelming majority of LIFO users. Under this method, changes in inventory are measured in terms of equivalent base-year dollars (value) rather than changes in quantities (units). The key to this method is that the starting point of the calculation is the year end inventory value at its current cost (aka Current-year cost), which is most commonly determined using FIFO or average cost (or any non-LIFO method).

Under the dollar-value method, the LIFO value of inventory is determined outside of the accounting system & a top-side accounting entry is recorded to adjust ending inventory from cost to LIFO & accrue the change in the LIFO reserve. Under dollar-value LIFO, item costs remain being tracked the same way they did prior to electing LIFO & requires no changes to the accounting system other than adding a contra-inventory subledger account called the LIFO reserve. Said another way, the accounting system continues tracking inventory costs the same way before and after LIFO is adopted. The only change made is that a LIFO reserve contra inventory account is added to the subledger to enable a top-level adjustment to be annually recorded to account for the difference between the Current-year cost inventory value as determined in the accounting system (FIFO, average cost etc.) & the inventory value at LIFO. The calculation of inflation & the LIFO inventory value is made outside of accounting system following the close of the year end, and once this is done, a single journal entry is recorded to record the change in the CY vs. PY LIFO reserve (equal offsetting entries are made to account for the change in the LIFO reserve & cost of goods sold. For example, if the CY LIFO reserve is $10 and the PY LIFO reserve is $7, a journal entry will be made to debit cost of goods sold for $3 & credit the LIFO reserve contra inventory account for $3).

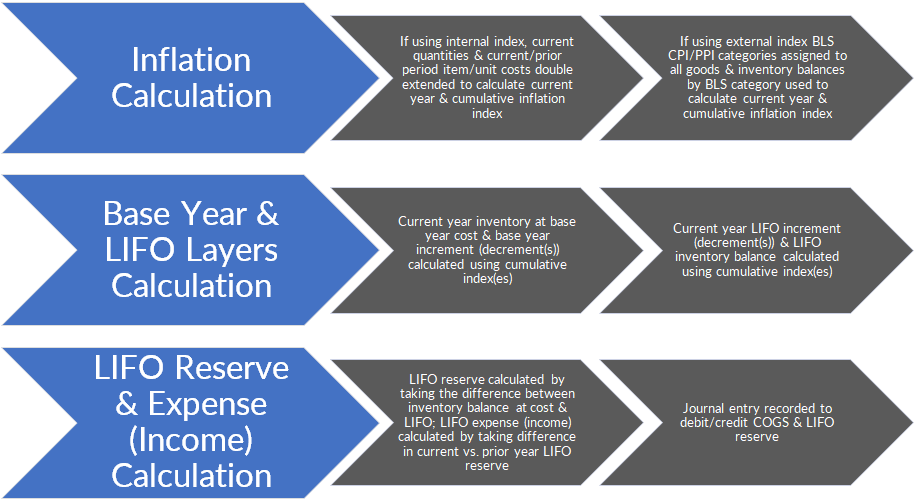

The process flow of the dollar-value LIFO method is provided below.

Figure 2. Dollar-value LIFO Overview

The dollar-value method is utilized by the vast majority of LIFO taxpayers because the after-tax cash savings achieved when compared to the specific goods LIFO method is far greater. Using the specific goods method will result in substantially less tax benefits than the dollar-value method for the following reasons:

- New items entering into inventory will have a higher value than preexisting items whose value is determined using prior period unit costs (thereby reducing LIFO tax benefits)

- LIFO reserve attributable to a good is completely recaptured when it’s discontinued or out of stock at year end (similar to how obsolete or LCM reserves attributable to an item is recaptured as soon as the good is sold/disposed of)

- layer erosions (causing reduction of previous years’ LIFO tax benefits) occur for every item each year in which there are fewer units on hand at year end than at the prior year end because there is essentially a LIFO pool for each item.

A comparison of the specific goods LIFO reserve amount as a percentage compared to the dollar-value LIFO method is provided below based on three different new item turnover ratios.

Table 1. Comparison of Specific Goods Method LIFO Reserve as a Percentage to the Dollar-Value Method LIFO Reserve

| Years on LIFO | 10% New Item Turnover Rate | 20% New Item Turnover Rate | 30% New Item Turnover Rate |

|---|---|---|---|

| 5 | 82% | 68% | 56% |

| 10 | 66% | 46% | 34% |

| 15 | 55% | 34% | 24% |

| 20 | 47% | 28% | 19% |

| 25 | 41% | 23% | 16% |

| 30 | 36% | 20% | 14% |

| 35 | 33% | 18% | 13% |

| 40 | 30% | 17% | 11% |

| 45 | 28% | 15% | 11% |

| 50 | 27% | 15% | 11% |

The LIFOPro software automates all aspects of dollar-value LIFO calculations, and our turnkey solutions allows companies to outsource all aspects of their LIFO calculation to us, and be provided a LIFO report package containing comprehensive calculation that includes all information required to record the annual LIFO journal entry, tax return entries & substantiate the reasonableness/accuracy of the LIFO calculation for purposes of financial statement audits/reviews (and IRS examinations). When partnering with us, we maximize your LIFO tax benefits & make LIFO as simple as possible. Learn more about LIFOPro’s complete range of offerings here!

LIFOPro's Offerings